This version of the form is not currently in use and is provided for reference only. Download this version of

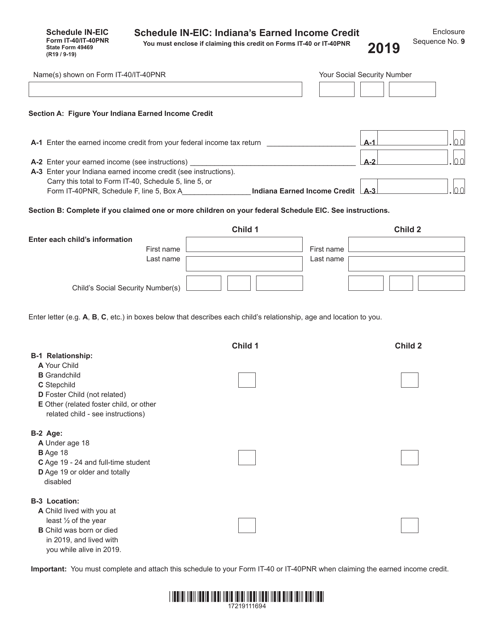

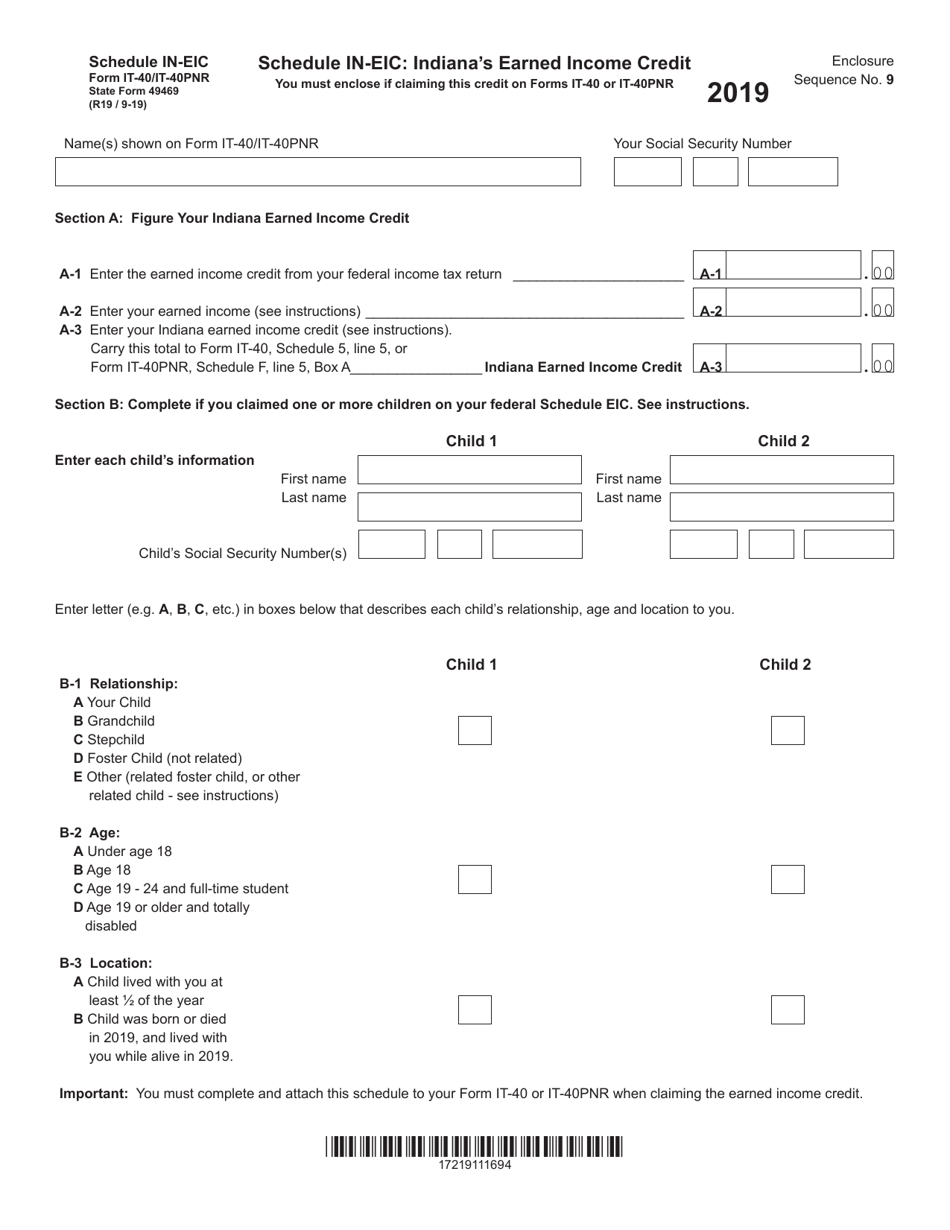

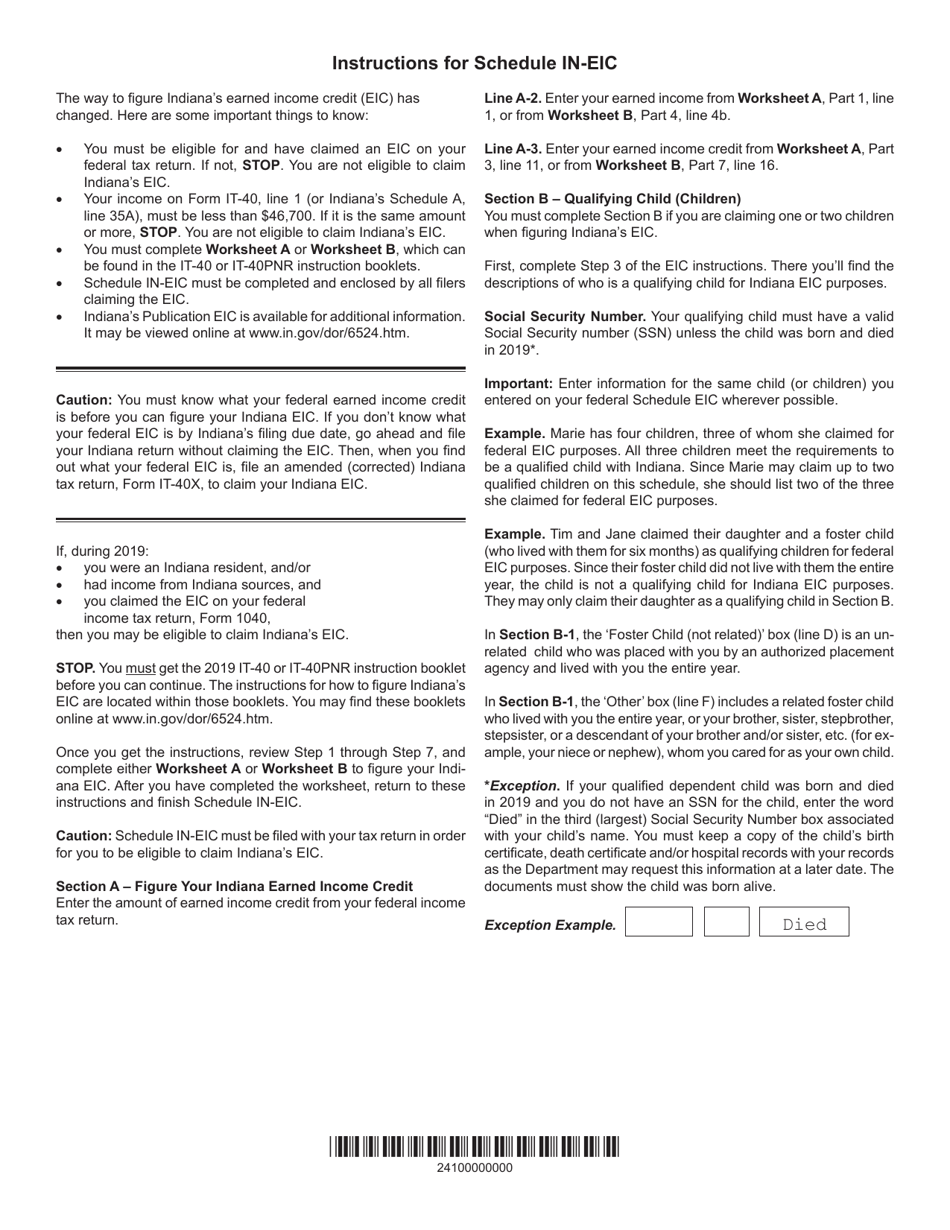

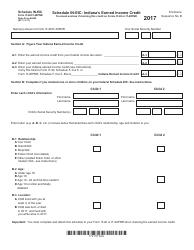

Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC

for the current year.

Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC Indiana's Earned Income Credit - Indiana

What Is Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC?

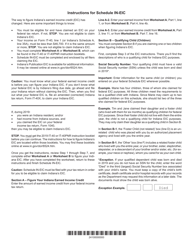

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by Indiana residents to file their individual income tax returns.

Q: What is IT-40PNR?

A: IT-40PNR is a specific version of Form IT-40 used by part-year or non-resident individuals to file their Indiana income tax returns.

Q: What is State Form 49469?

A: State Form 49469 is the specific form number for Schedule IN-EIC, which is used to claim Indiana's Earned Income Credit.

Q: What is Indiana's Earned Income Credit?

A: Indiana's Earned Income Credit is a tax credit that provides financial assistance to individuals and families with low to moderate incomes.

Q: What is the purpose of Schedule IN-EIC?

A: Schedule IN-EIC is used to calculate and claim Indiana's Earned Income Credit on your state income tax return.

Q: Who is eligible to claim Indiana's Earned Income Credit?

A: Eligibility for Indiana's Earned Income Credit is based on income and filing status. Individuals or families with low to moderate incomes may qualify.

Q: When is the deadline to file Form IT-40 and Schedule IN-EIC?

A: The deadline to file Form IT-40 and Schedule IN-EIC is typically April 15th, but it may vary depending on specific tax year or extensions.

Q: Can I e-file Form IT-40 and Schedule IN-EIC?

A: Yes, Indiana residents have the option to e-file their Form IT-40 and Schedule IN-EIC through the Indiana Department of Revenue's electronic filing system.

Q: Is the Earned Income Credit refundable?

A: Yes, Indiana's Earned Income Credit is refundable, meaning that if the credit exceeds the amount of tax owed, the taxpayer may receive the excess as a refund.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.