This version of the form is not currently in use and is provided for reference only. Download this version of

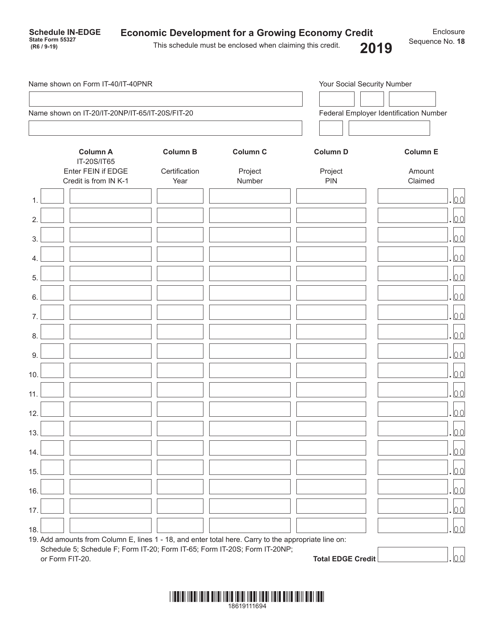

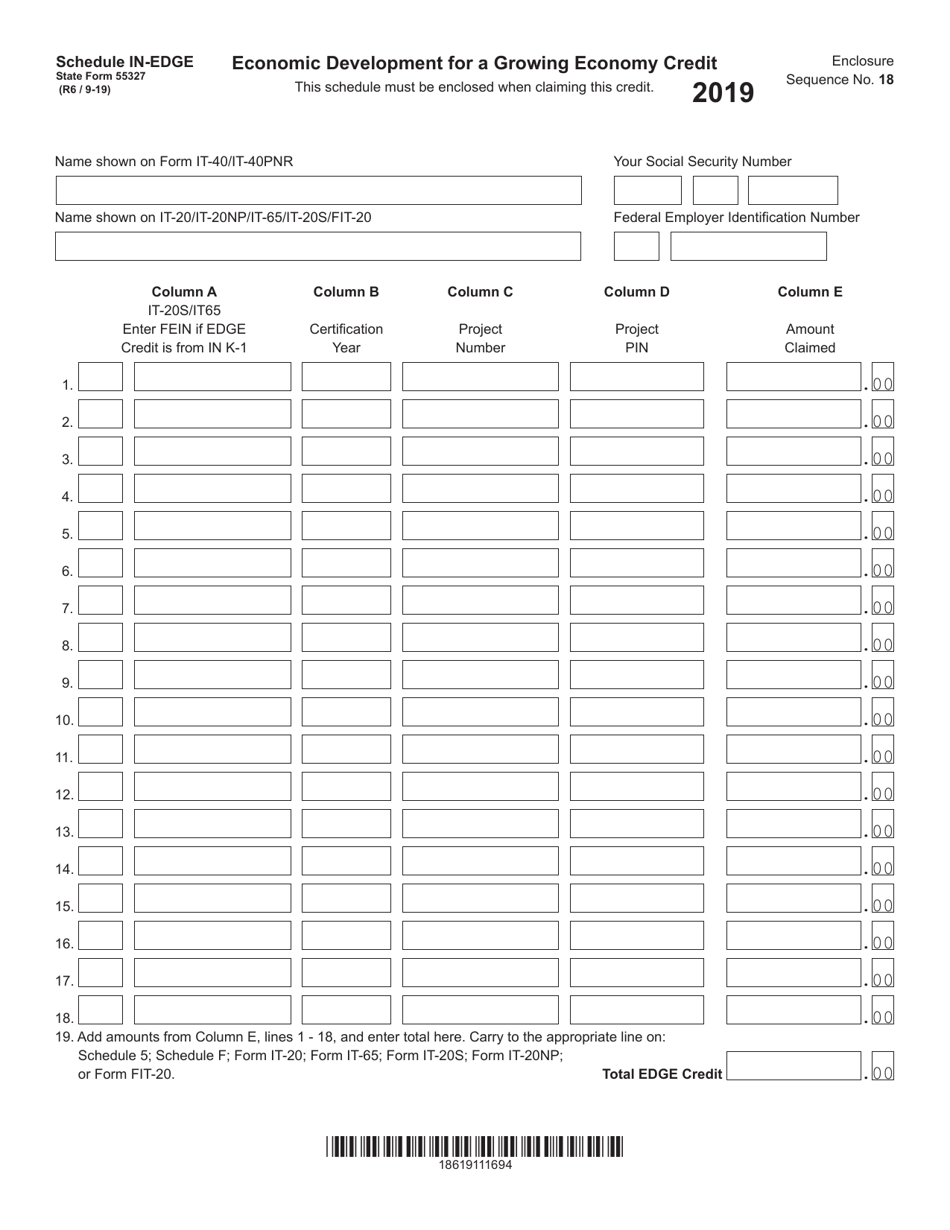

State Form 55327 Schedule IN-EDGE

for the current year.

State Form 55327 Schedule IN-EDGE Economic Development for a Growing Economy Credit - Indiana

What Is State Form 55327 Schedule IN-EDGE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55327?

A: Form 55327 is a specific tax form used in Indiana.

Q: What is Schedule IN-EDGE?

A: Schedule IN-EDGE is a part of Form 55327 that deals with the Economic Development for a Growing Economy Credit.

Q: What is the purpose of the Economic Development for a Growing Economy Credit?

A: The purpose of this credit is to encourage economic development in Indiana.

Q: Who can claim the Economic Development for a Growing Economy Credit?

A: Businesses operating in Indiana may be eligible to claim this credit.

Q: What expenses are eligible for the credit?

A: Expenses related to qualified investments and job creation may be eligible for the credit.

Q: How is the credit amount determined?

A: The credit amount is based on a percentage of the qualified investments and job creation expenses.

Q: Are there any limitations or requirements for claiming the credit?

A: Yes, there are certain limitations and requirements that businesses must meet to claim the credit.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55327 Schedule IN-EDGE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.