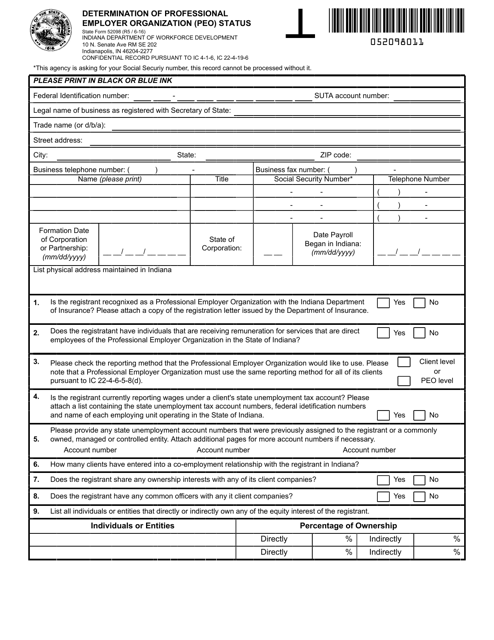

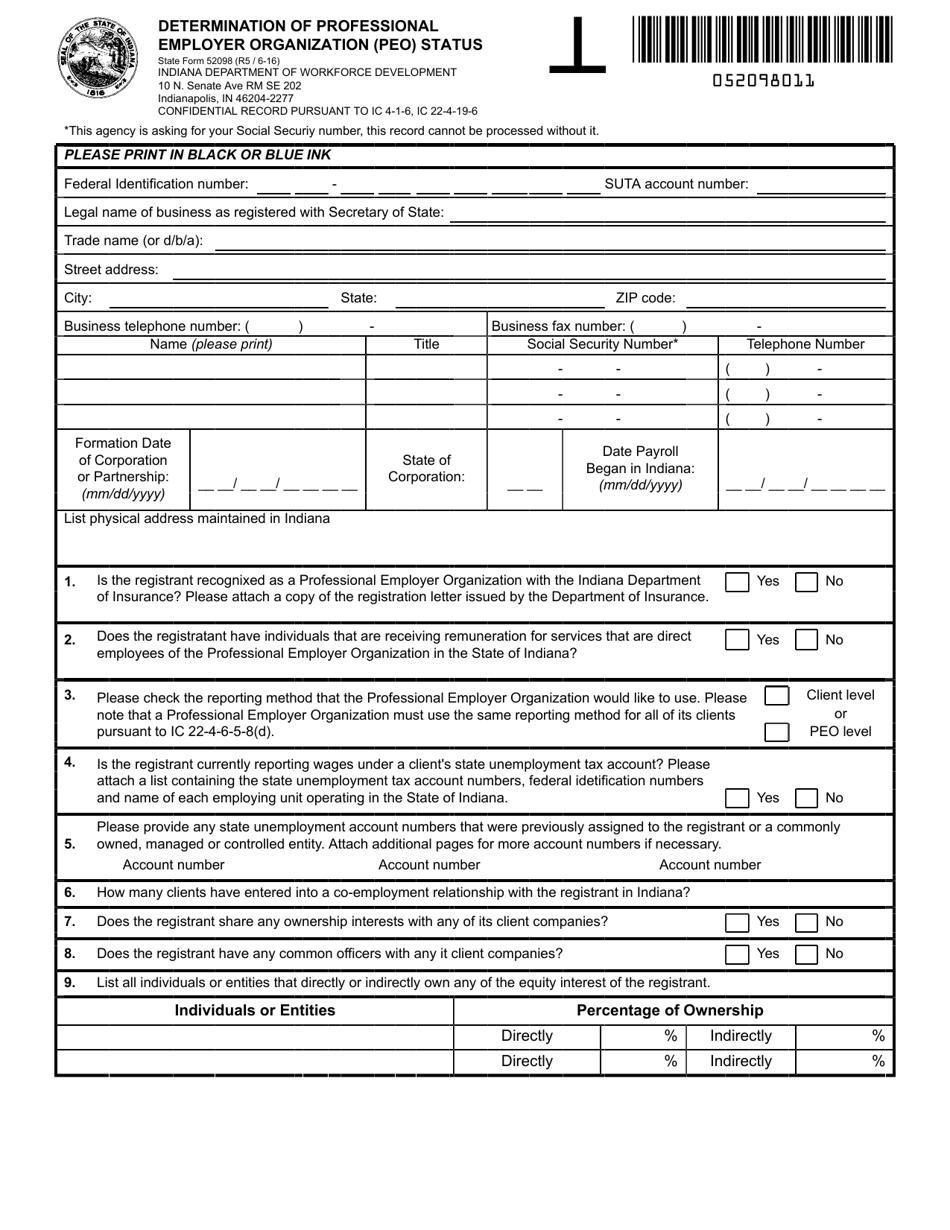

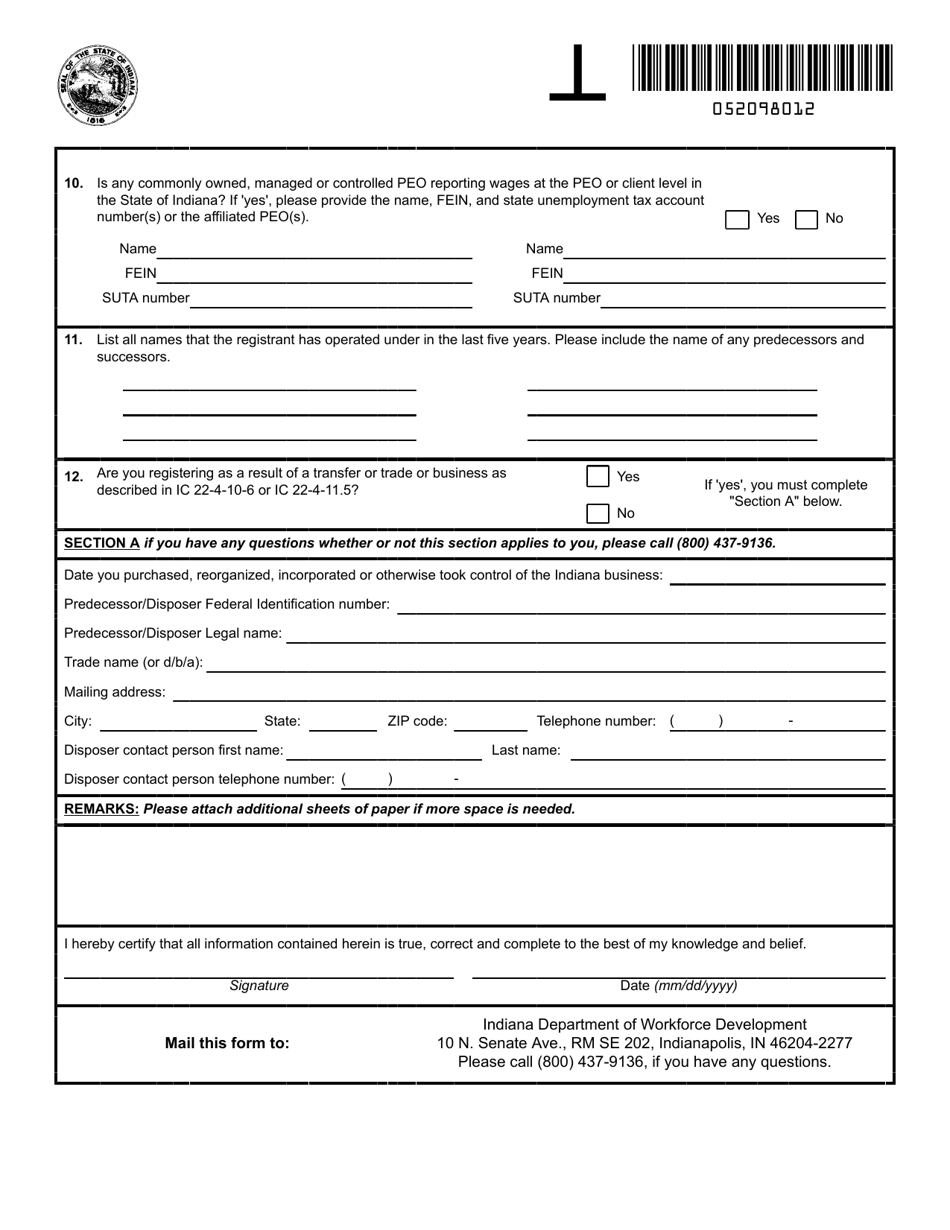

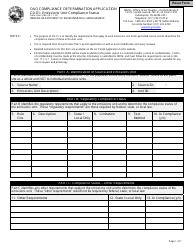

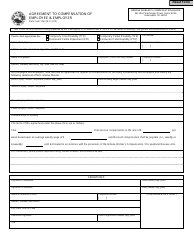

State Form 52098 Determination of Professional Employer Organization (Peo) Status - Indiana

What Is State Form 52098?

This is a legal form that was released by the Indiana Department of Workforce Development - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52098?

A: State Form 52098 is the Determination of Professional Employer Organization (PEO) Status form in Indiana.

Q: What is a Professional Employer Organization (PEO)?

A: A Professional Employer Organization (PEO) is a company that offers comprehensive HR solutions to small and medium-sized businesses, including payroll management, employee benefits, and risk management.

Q: Why is the Determination of PEO Status form necessary?

A: The Determination of PEO Status form is necessary to determine if a company meets the criteria to be recognized as a Professional Employer Organization in Indiana.

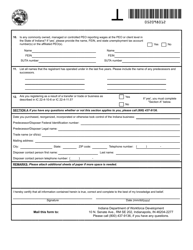

Q: Who needs to fill out State Form 52098?

A: Companies that want to become recognized as a Professional Employer Organization (PEO) in Indiana need to fill out State Form 52098.

Q: Are there any fees associated with filing State Form 52098?

A: Yes, there is a $250 fee for filing State Form 52098 in Indiana.

Q: Are there any specific requirements to qualify as a Professional Employer Organization (PEO) in Indiana?

A: Yes, there are several requirements that need to be met, including holding a valid certificate of authority from the Indiana Secretary of State and having a minimum of 50 client companies.

Q: What are the benefits of being recognized as a Professional Employer Organization (PEO) in Indiana?

A: Being recognized as a Professional Employer Organization (PEO) in Indiana allows companies to provide comprehensive HR solutions to their client companies, which can help them save time and resources.

Q: How long does it take to get a determination on PEO status in Indiana?

A: The Indiana Department of Revenue typically takes 30-60 days to process State Form 52098 and provide a determination on PEO status.

Q: What should I do if I have additional questions about State Form 52098?

A: If you have additional questions about State Form 52098 or the determination of PEO status in Indiana, you can contact the Indiana Department of Revenue for assistance.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Indiana Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of State Form 52098 by clicking the link below or browse more documents and templates provided by the Indiana Department of Workforce Development.