This version of the form is not currently in use and is provided for reference only. Download this version of

Form BLR15413

for the current year.

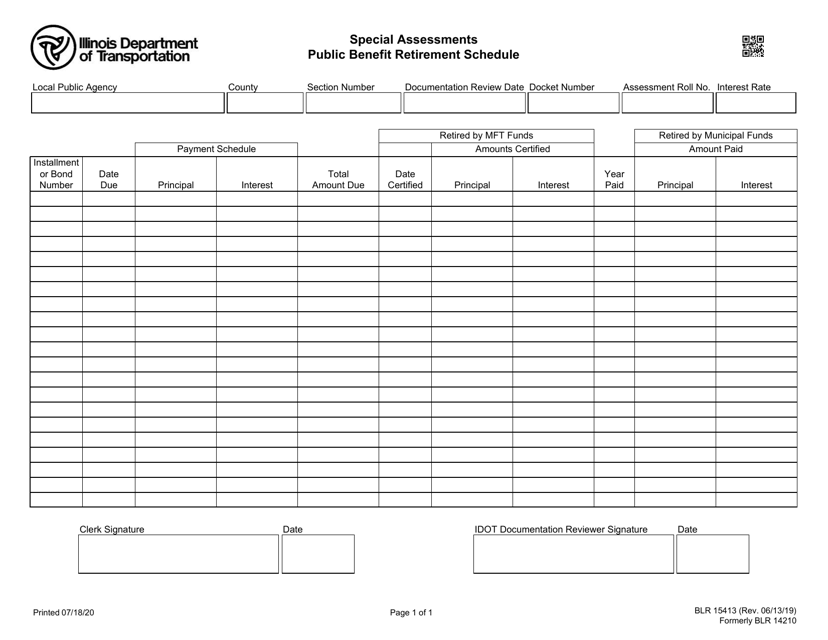

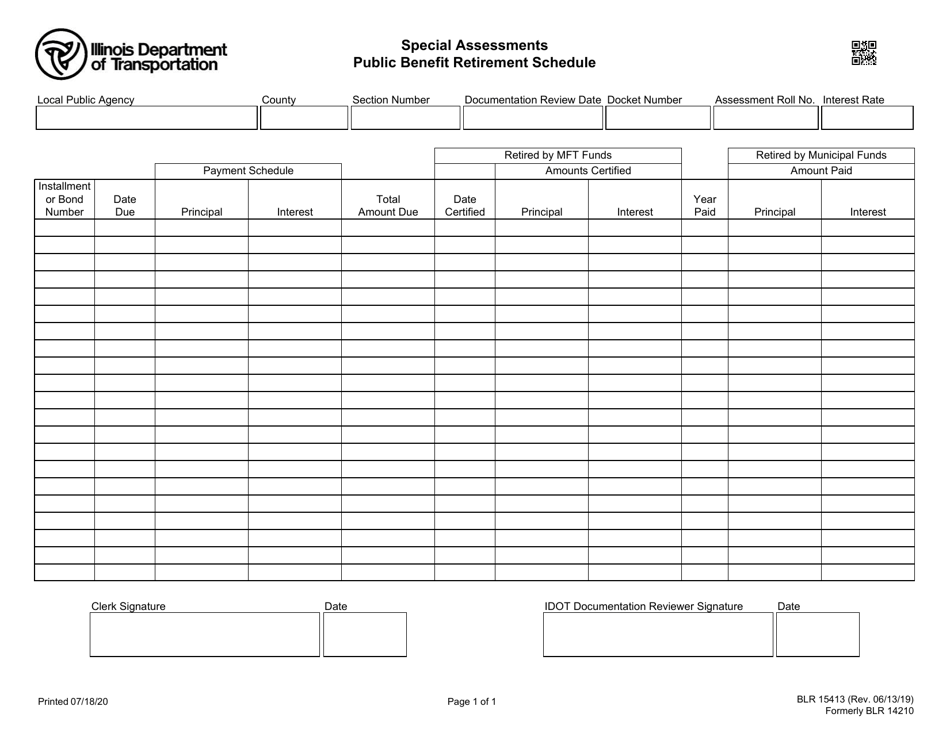

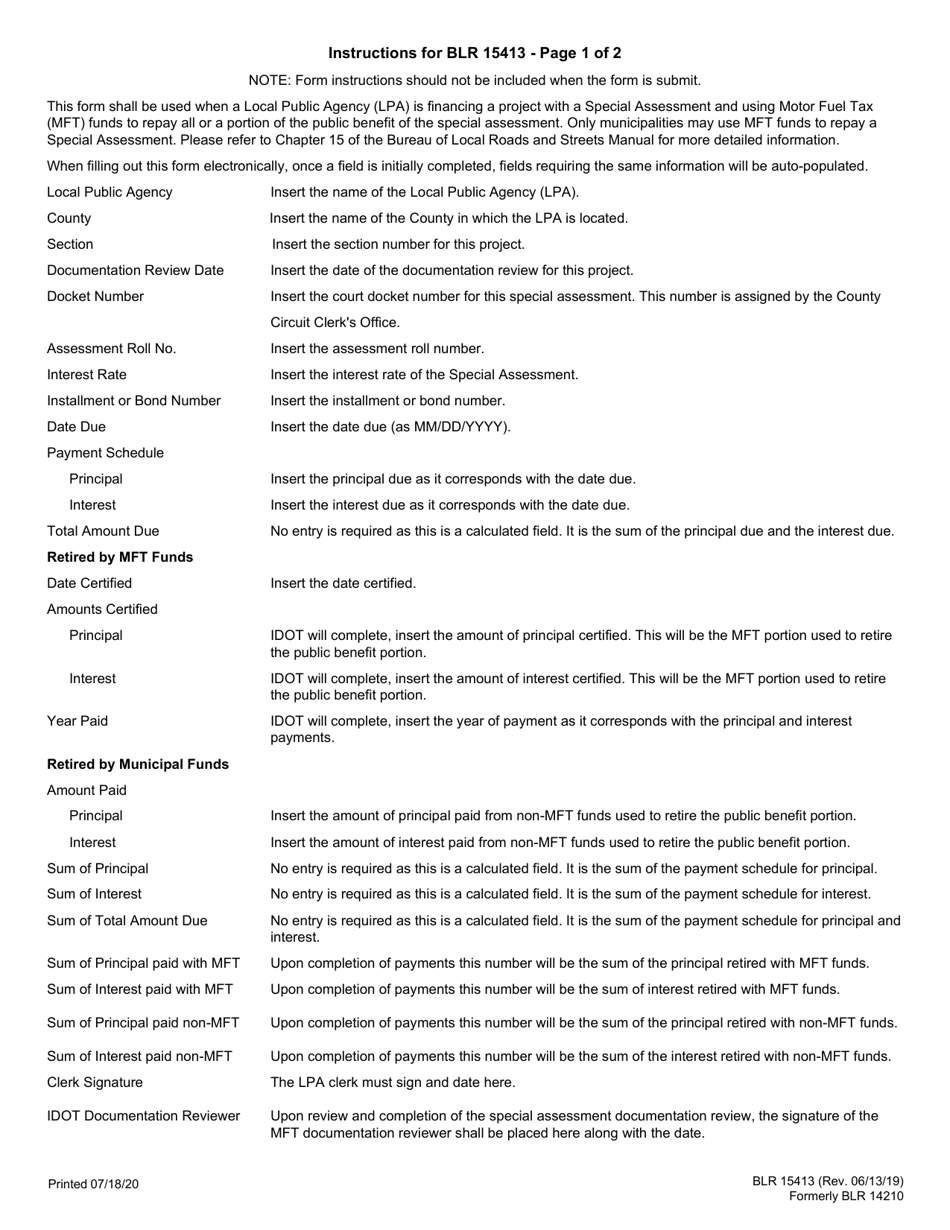

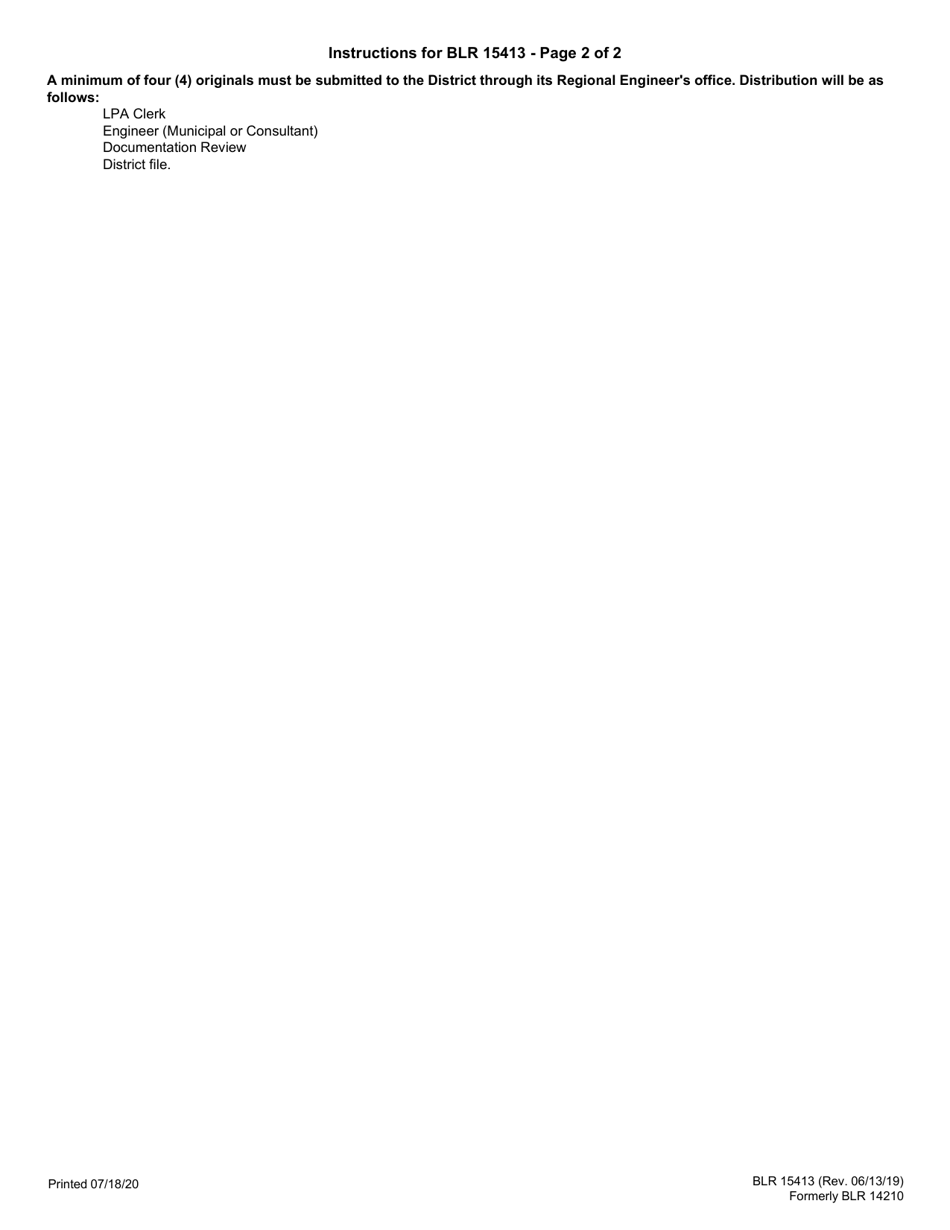

Form BLR15413 Special Assessments - Public Benefit Retirement Schedule - Illinois

What Is Form BLR15413?

This is a legal form that was released by the Illinois Department of Transportation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BLR15413?

A: Form BLR15413 is the Special Assessments - Public Benefit Retirement Schedule for Illinois.

Q: What is a Special Assessment?

A: A Special Assessment is a fee or tax levied on a property owner by a government agency to fund public infrastructure or improvements.

Q: What is a Public Benefit Retirement Schedule?

A: A Public Benefit Retirement Schedule is a document that outlines the timeline for retiring the debt incurred from special assessments in order to fund public benefit projects.

Q: Who is responsible for completing Form BLR15413?

A: The government agency or entity that levied the special assessments is responsible for completing Form BLR15413.

Q: What information is required on Form BLR15413?

A: Form BLR15413 requires information such as the name of the government agency, the amount and purpose of the special assessments, and the schedule for retiring the debt.

Q: Do I need to file Form BLR15413 as a property owner?

A: No, as a property owner, you are not required to file Form BLR15413. It is the responsibility of the government agency or entity that levied the special assessments.

Form Details:

- Released on June 13, 2019;

- The latest edition provided by the Illinois Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BLR15413 by clicking the link below or browse more documents and templates provided by the Illinois Department of Transportation.