This version of the form is not currently in use and is provided for reference only. Download this version of

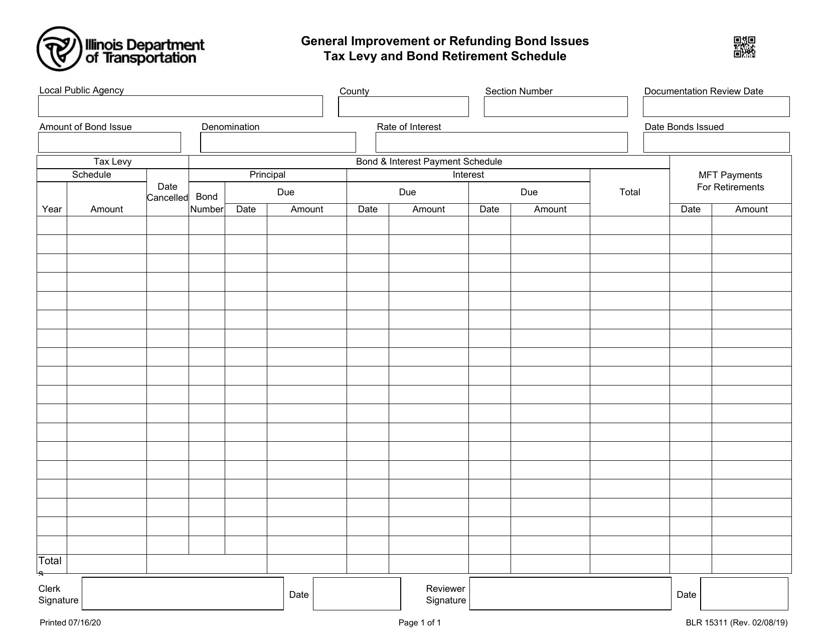

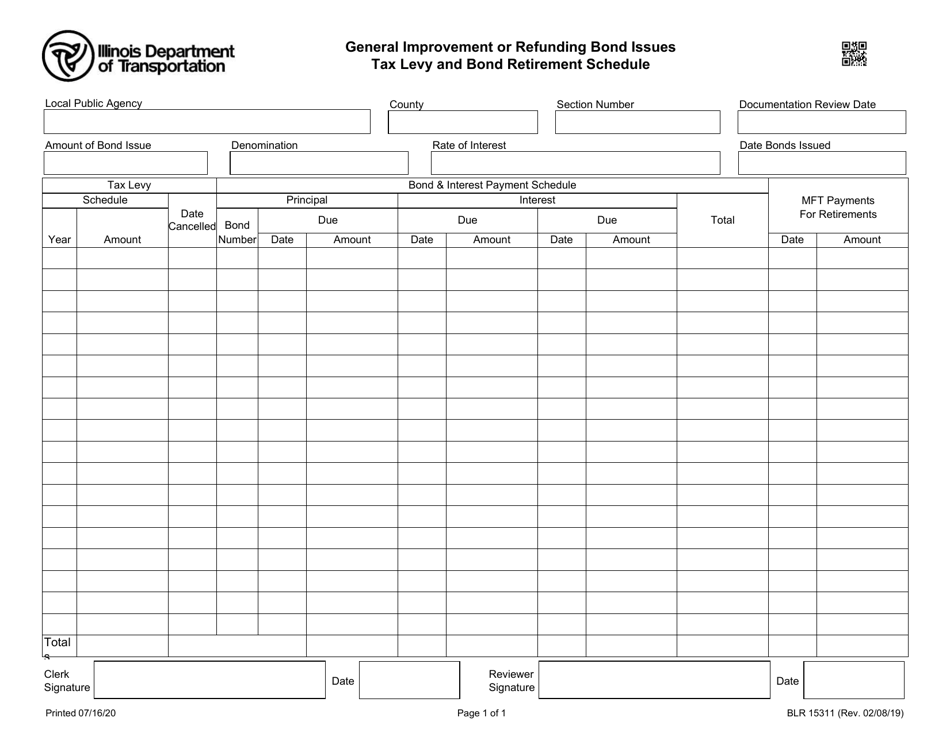

Form BLR15311

for the current year.

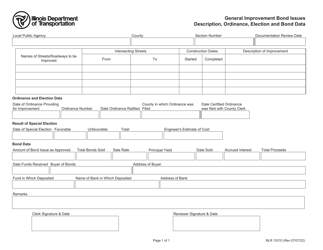

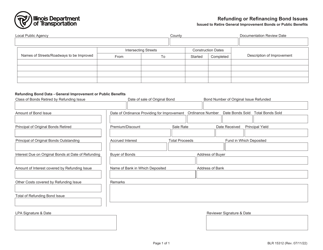

Form BLR15311 General Improvement or Refuding Bond Issues - Tax Levy and Bond Retirement Schedule - Illinois

What Is Form BLR15311?

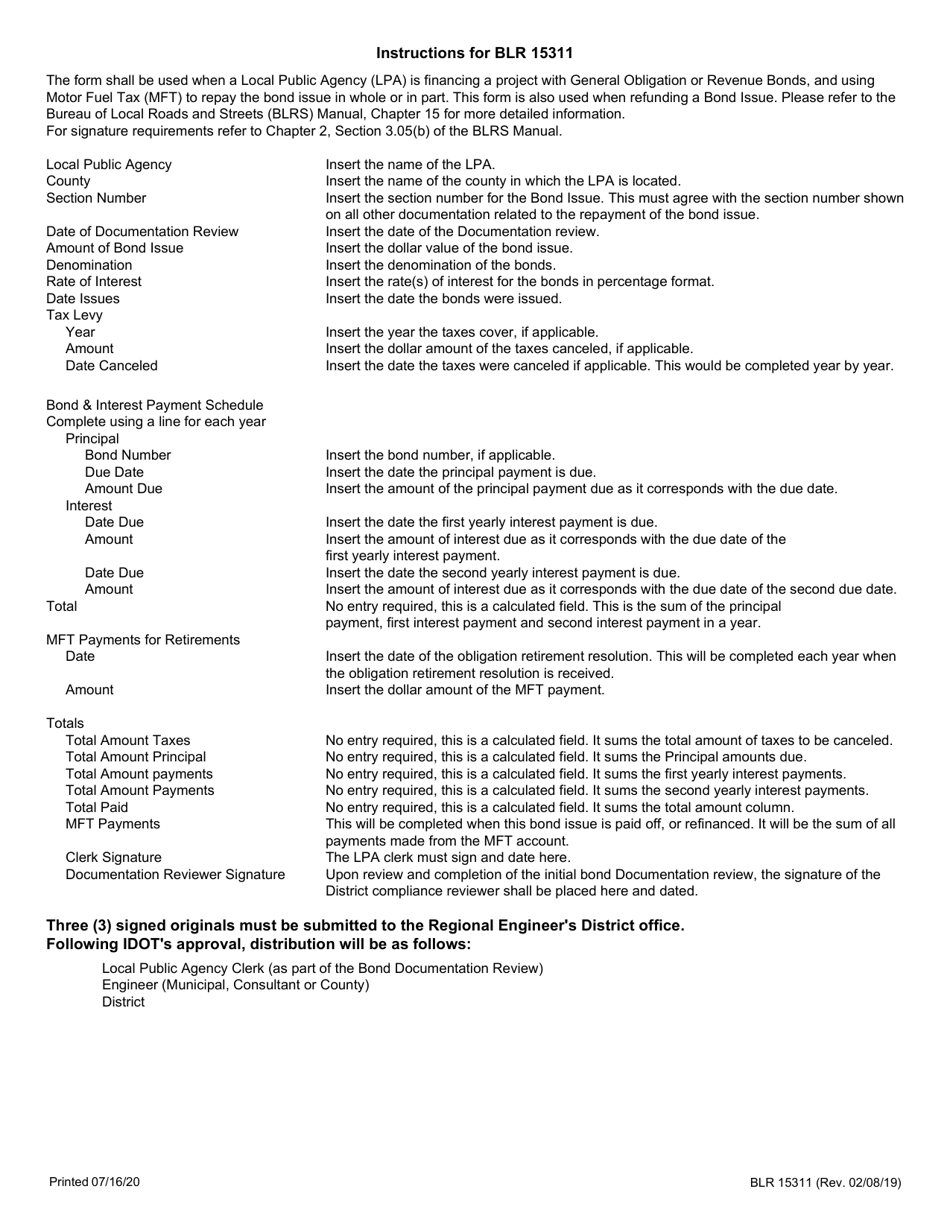

This is a legal form that was released by the Illinois Department of Transportation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BLR15311?

A: BLR15311 is a form for General Improvement or Refunding Bond Issues - Tax Levy and Bond Retirement Schedule in Illinois.

Q: What is a General Improvement Bond Issue?

A: A General Improvement Bond Issue is a type of bond issued by a government entity to fund various improvement projects, such as infrastructure upgrades or public facilities.

Q: What is a Refunding Bond Issue?

A: A Refunding Bond Issue is a type of bond issued by a government entity to replace existing bonds with new bonds at a lower interest rate, resulting in cost savings.

Q: What is a Tax Levy?

A: A Tax Levy is the amount of money imposed by a government entity on property owners to fund public expenses, such as bond payments.

Q: What is a Bond Retirement Schedule?

A: A Bond Retirement Schedule is a plan that outlines the maturity dates and payment schedule for bonds, including principal and interest payments.

Q: Who issues the BLR15311 form?

A: The BLR15311 form is typically issued by the government entity responsible for issuing the bonds, such as a local municipality or state government.

Q: Why is the BLR15311 form important?

A: The BLR15311 form provides important information about bond issues, tax levies, and bond retirement schedules, which are essential for transparency and accountability in public financing.

Form Details:

- Released on February 8, 2019;

- The latest edition provided by the Illinois Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BLR15311 by clicking the link below or browse more documents and templates provided by the Illinois Department of Transportation.