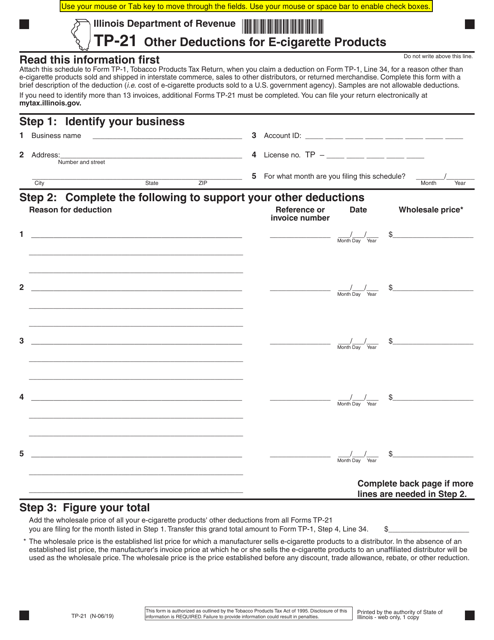

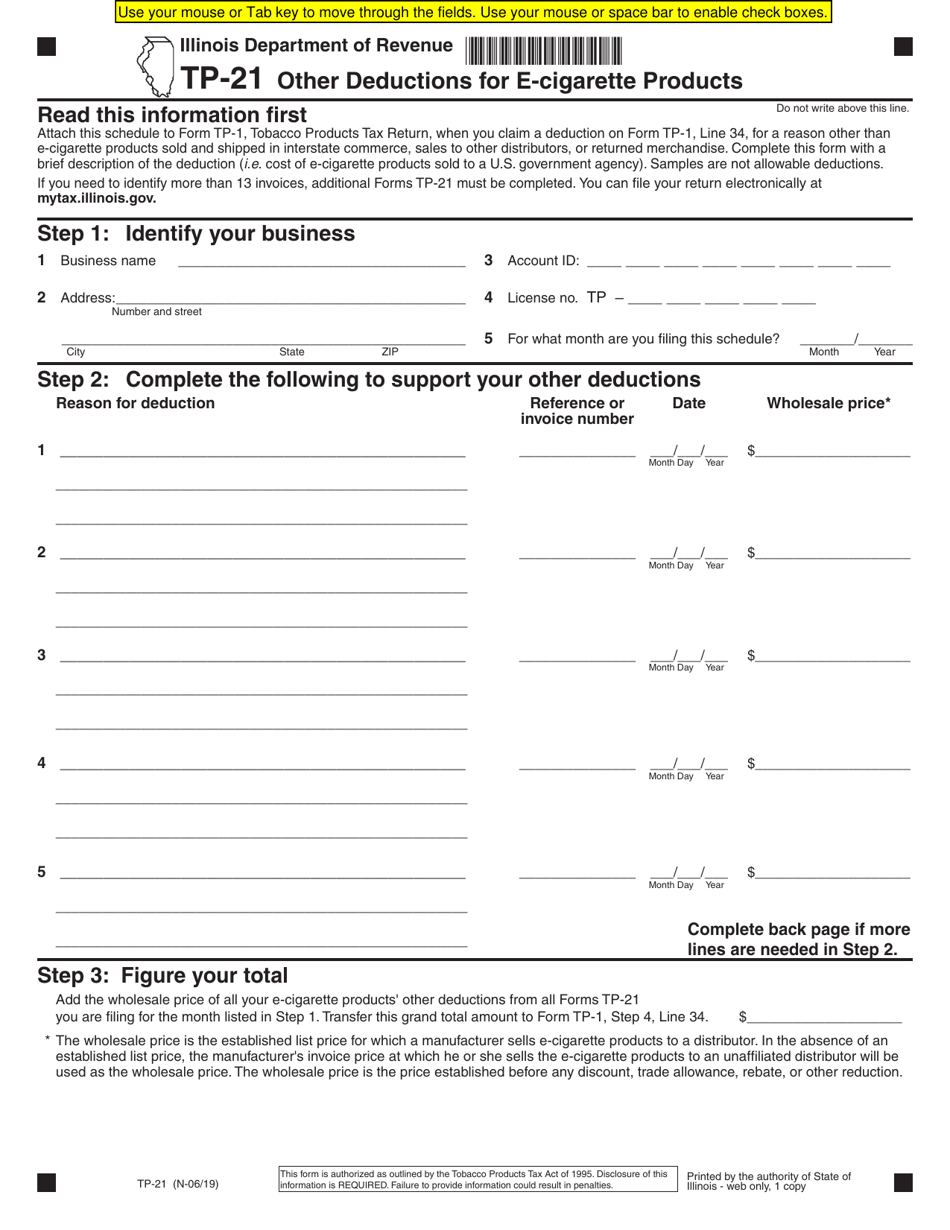

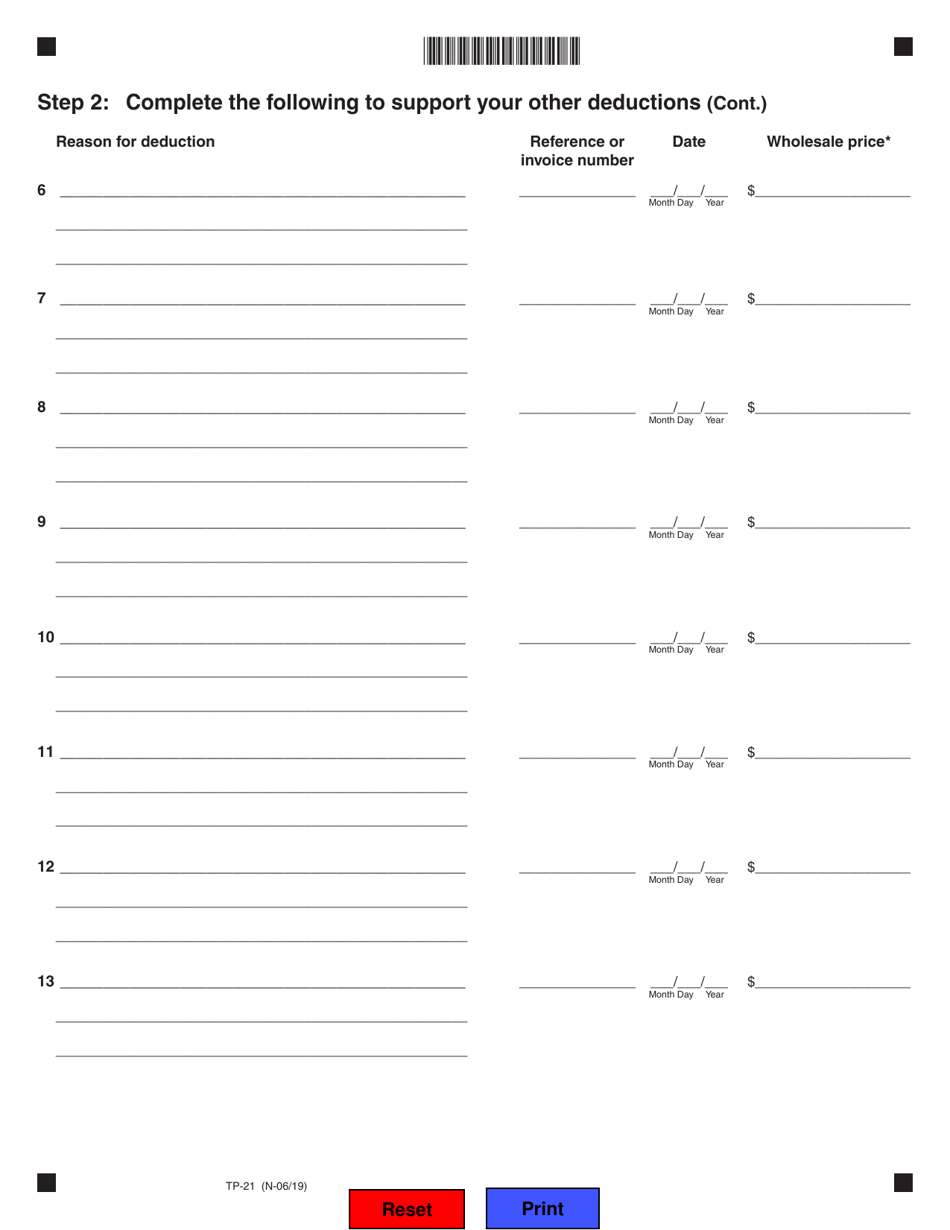

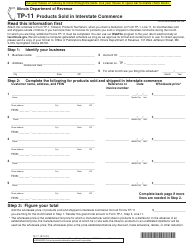

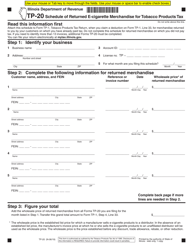

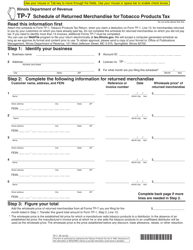

Form TP-21 Other Deductions for E-Cigarette Products - Illinois

What Is Form TP-21?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-21?

A: Form TP-21 is a tax form for reporting other deductions for e-cigarette products in Illinois.

Q: What are e-cigarette products?

A: E-cigarette products refer to electronic devices that heat and vaporize liquid nicotine or other substances to be inhaled.

Q: Why do I need to file Form TP-21?

A: You need to file Form TP-21 to claim deductions related to e-cigarette products in Illinois.

Q: What deductions can be claimed on Form TP-21?

A: Form TP-21 allows you to claim deductions for the wholesale cost of e-cigarette products purchased for resale.

Q: Is Form TP-21 specific to Illinois?

A: Yes, Form TP-21 is specific to Illinois and is used to report deductions for e-cigarette products purchased for resale in the state.

Q: When is Form TP-21 due?

A: The due date for filing Form TP-21 may vary each year, so it's important to check the instructions provided with the form or consult the Illinois Department of Revenue for the current year's due date.

Q: Who is required to file Form TP-21?

A: If you are engaged in the business of selling e-cigarette products in Illinois, you may be required to file Form TP-21 to claim deductions related to those products.

Q: What happens if I don't file Form TP-21?

A: If you are required to file Form TP-21 and fail to do so, you may face penalties and interest on any deductions that could have been claimed.

Q: Can I e-file Form TP-21?

A: As of now, electronic filing (e-filing) for Form TP-21 is not available. You will need to file a paper copy of the form with the Illinois Department of Revenue.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-21 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.