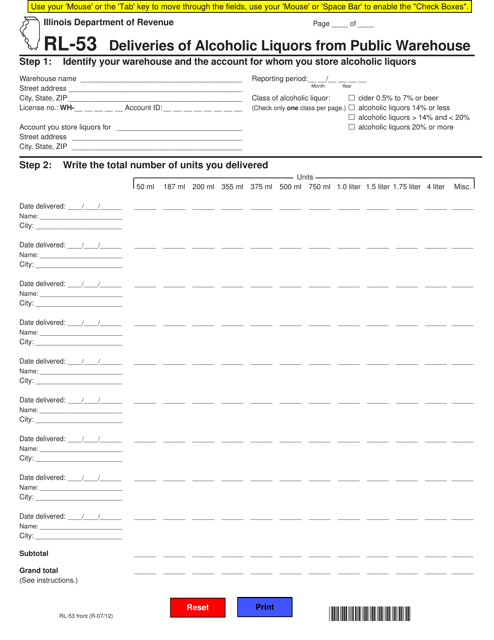

Form RL-53 Deliveries of Alcoholic Liquors From Public Warehouse - Illinois

What Is Form RL-53?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the form RL-53?

A: Form RL-53 is a form used in Illinois for reporting deliveries of alcoholic liquors from a public warehouse.

Q: Who uses form RL-53?

A: This form is used by businesses and individuals who deliver alcoholic liquors from a public warehouse in Illinois.

Q: What is the purpose of form RL-53?

A: The purpose of form RL-53 is to report deliveries of alcoholic liquors and ensure compliance with the relevant laws and regulations in Illinois.

Q: When should form RL-53 be filed?

A: Form RL-53 should be filed on a monthly basis, by the 10th day of the month following the reporting period.

Q: What information is required on form RL-53?

A: Form RL-53 requires information such as the name and address of the public warehouse, details of the deliveries made, and the total quantity of alcoholic liquors delivered.

Q: Are there any penalties for not filing form RL-53?

A: Yes, failure to file form RL-53 or filing it late may result in penalties, such as fines or other enforcement actions by the Illinois Department of Revenue.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-53 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.