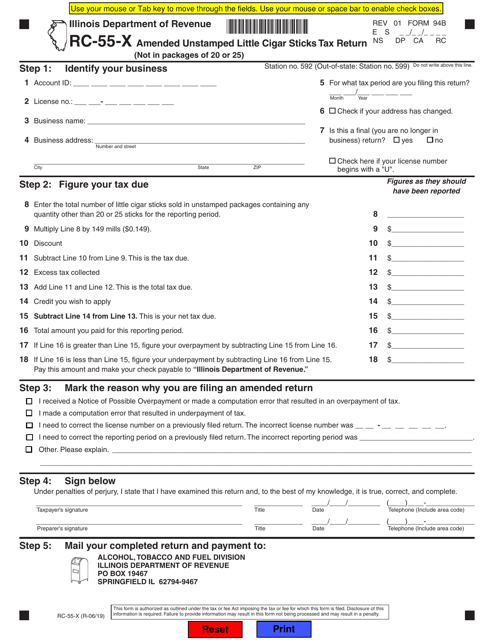

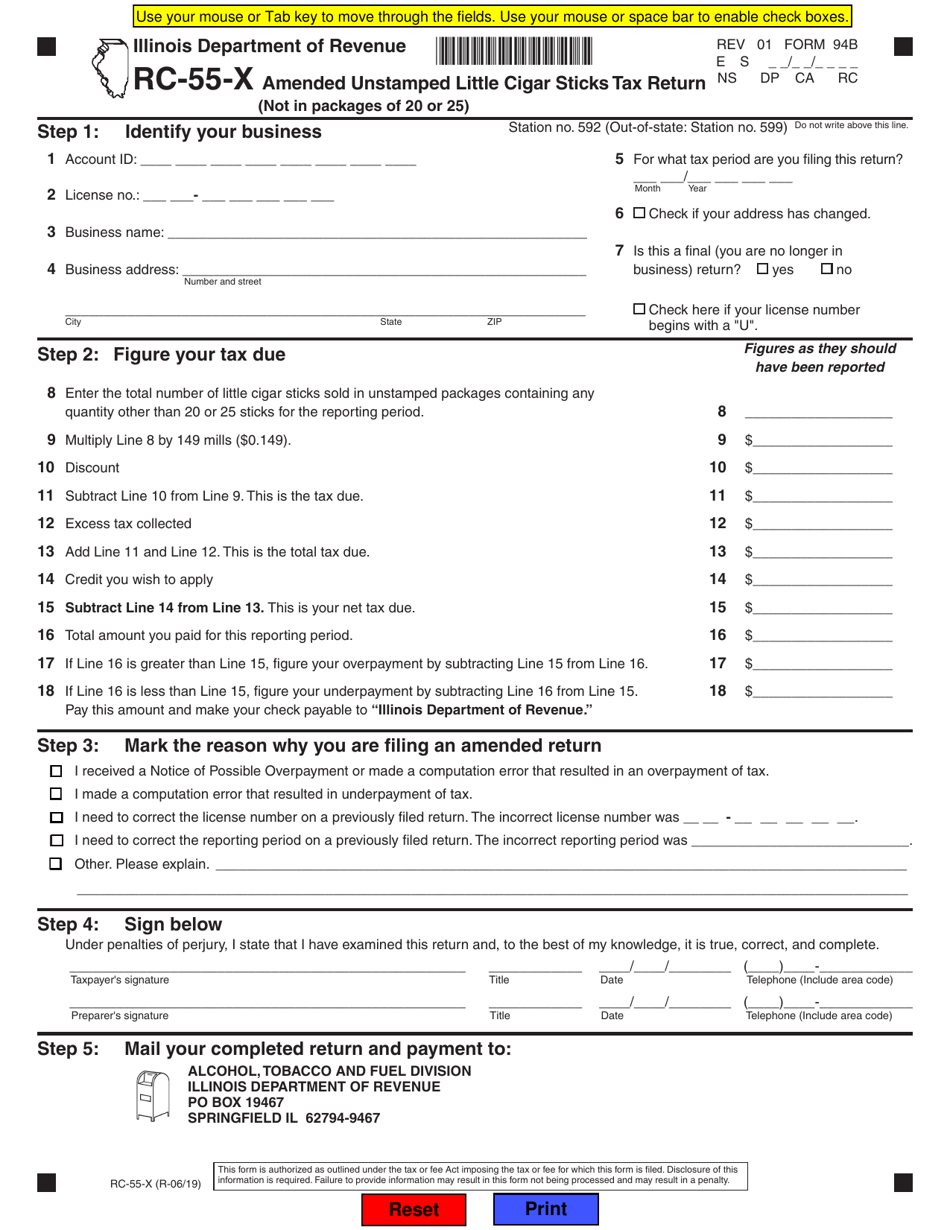

Form RC-55-X Amended Unstamped Little Cigar Sticks Tax Return - Illinois

What Is Form RC-55-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RC-55-X?

A: Form RC-55-X is a tax return form for reporting and paying the Amended Unstamped Little Cigar Sticks Tax in Illinois.

Q: Who needs to file Form RC-55-X?

A: Any individual or business that sells little cigar sticks in Illinois and needs to amend their previous tax return for those sales.

Q: What is the purpose of Form RC-55-X?

A: The purpose of Form RC-55-X is to report and pay the Amended Unstamped Little Cigar Sticks Tax in Illinois.

Q: What is the Amended Unstamped Little Cigar Sticks Tax?

A: The Amended Unstamped Little Cigar Sticks Tax is a tax imposed on the sale of little cigar sticks in Illinois.

Q: Is there a deadline for filing Form RC-55-X?

A: Yes, the deadline for filing Form RC-55-X is usually the same as the deadline for filing your regular Illinois sales tax return.

Q: Are there any penalties for late filing of Form RC-55-X?

A: Yes, if you fail to file Form RC-55-X by the deadline, you may be subject to penalties and interest charges.

Q: Are there any specific instructions for filling out Form RC-55-X?

A: Yes, there are instructions provided with the form that guide you through the process of filling it out correctly.

Q: Can I amend my Form RC-55-X if I make a mistake?

A: Yes, if you make a mistake on Form RC-55-X, you can file an amended version of the form to correct the error.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RC-55-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.