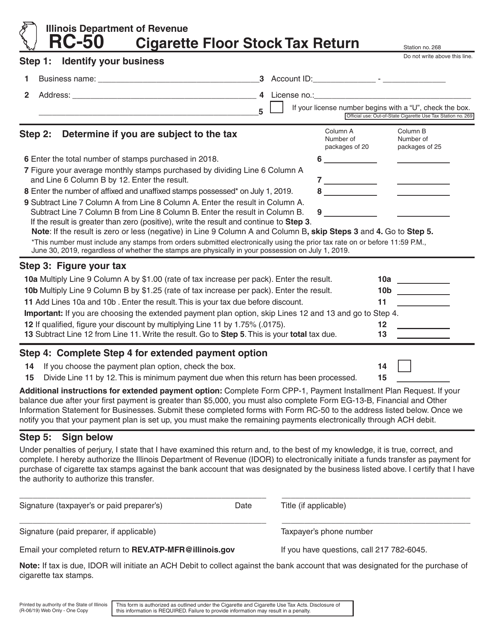

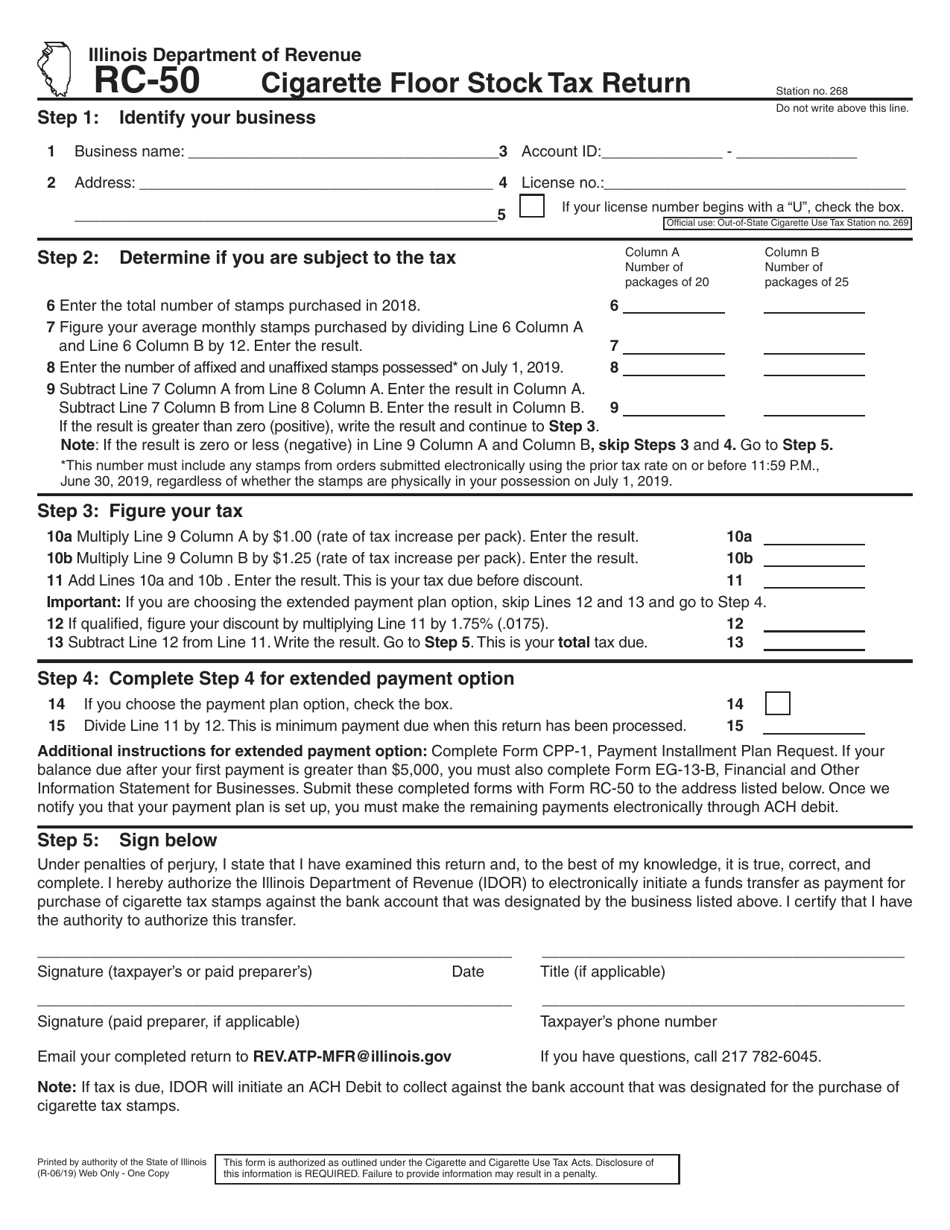

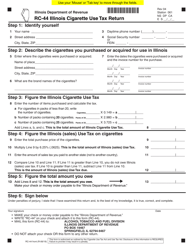

Form RC-50 Cigarette Floor Stock Tax Return - Illinois

What Is Form RC-50?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RC-50?

A: Form RC-50 is a Cigarette Floor Stock Tax Return in Illinois.

Q: What is the purpose of Form RC-50?

A: The purpose of Form RC-50 is to report and pay the floor stock tax on cigarettes in Illinois.

Q: Who needs to file Form RC-50?

A: Any person or entity that possesses cigarettes for sale or distribution in Illinois is required to file Form RC-50.

Q: When is Form RC-50 due?

A: Form RC-50 is due on the 20th day of each month.

Q: How do I file Form RC-50?

A: You can file Form RC-50 electronically through MyTax Illinois or by mail.

Q: Are there any penalties for late filing or non-filing of Form RC-50?

A: Yes, there are penalties for late filing or non-filing of Form RC-50, including interest charges and potential license suspension.

Q: Is there any tax relief available for small businesses?

A: Yes, small businesses that qualify may be eligible for a reduced floor stock tax rate.

Q: Are there any exemptions to the floor stock tax?

A: Yes, certain exemptions apply, such as transfers between licensed distributors and sales to the federal government.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RC-50 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.