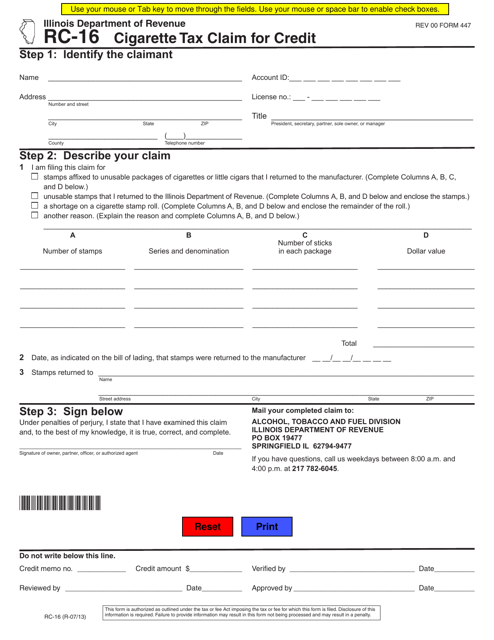

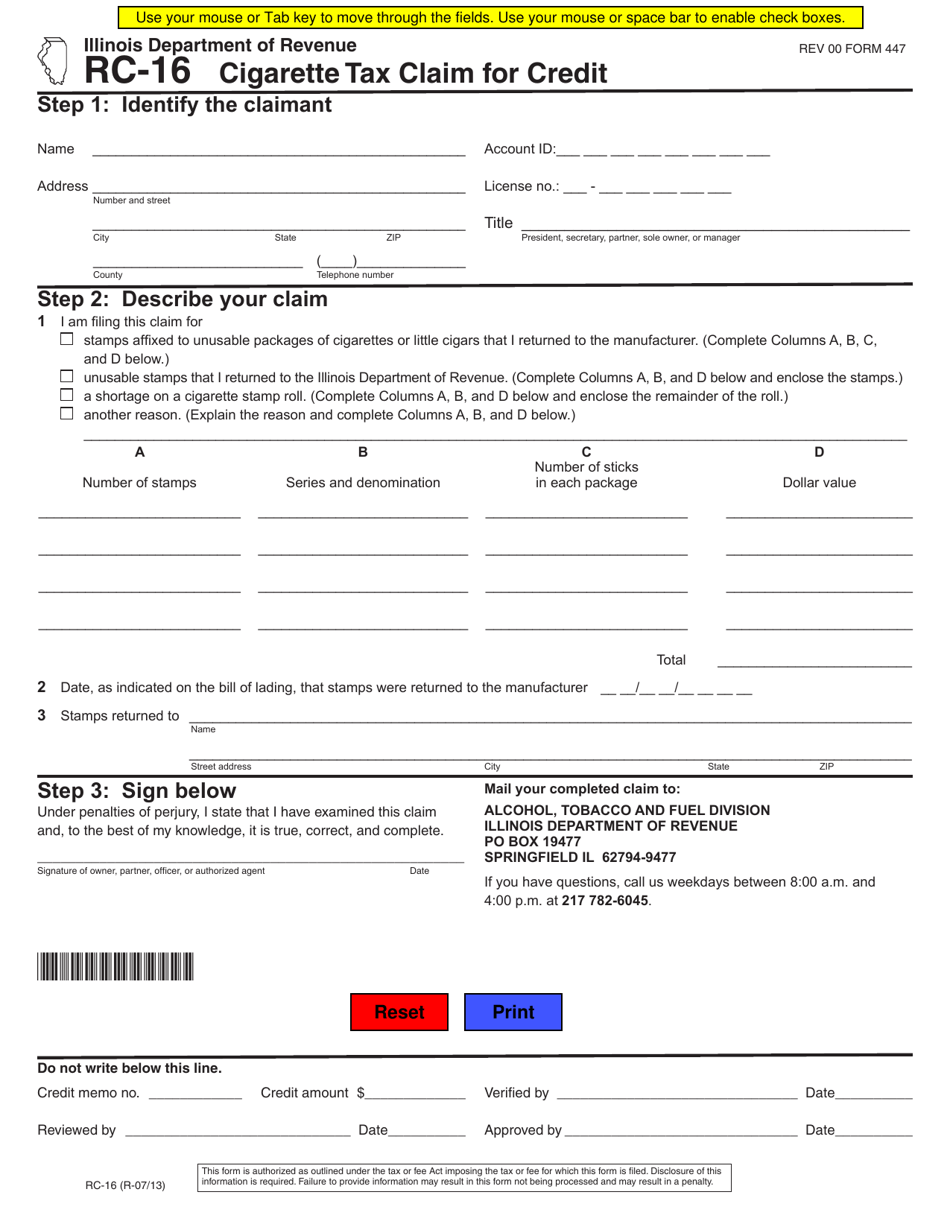

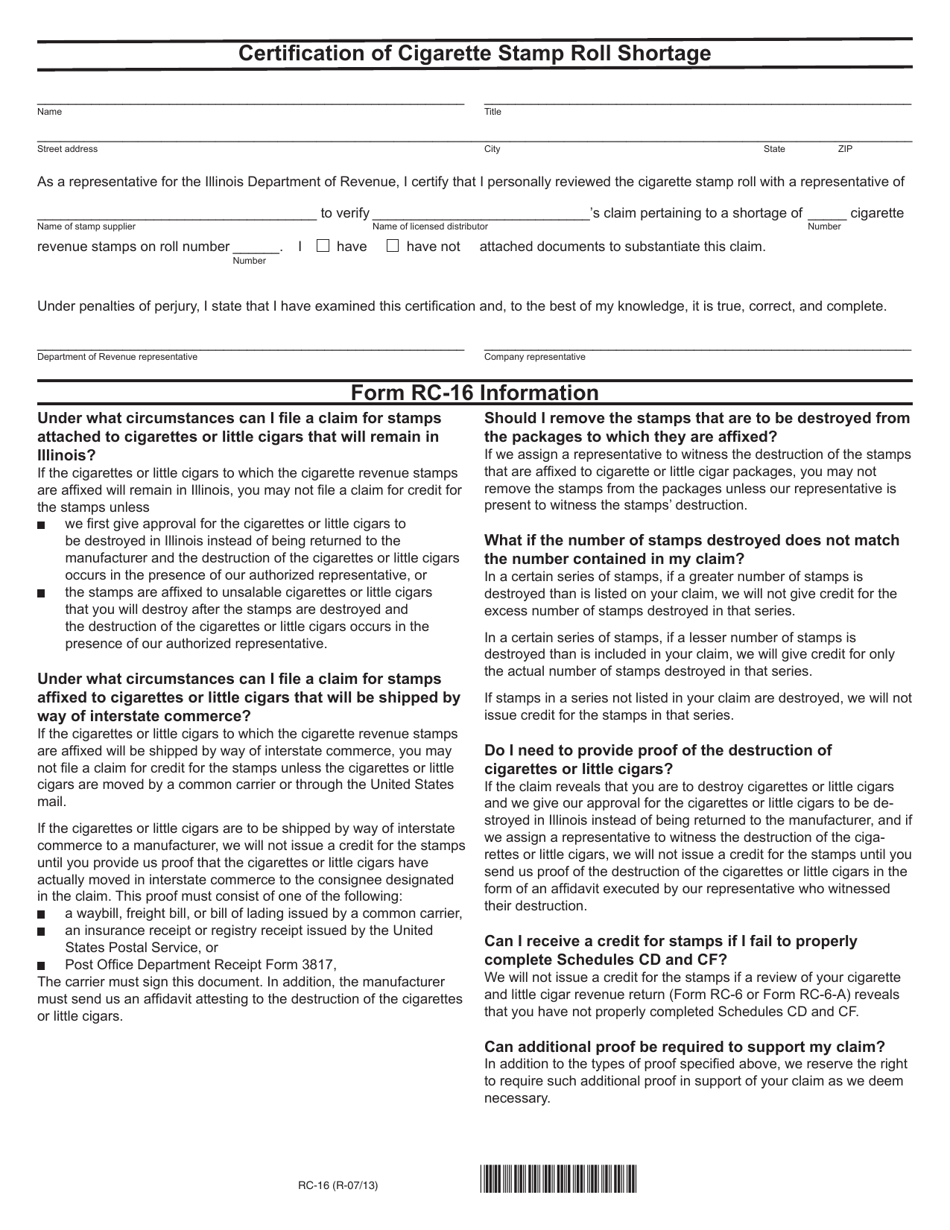

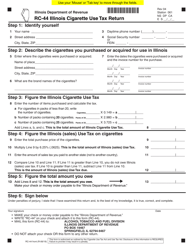

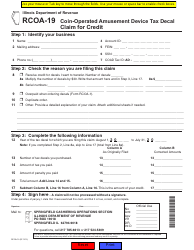

Form RC-16 (447) Cigarette Tax Claim for Credit - Illinois

What Is Form RC-16 (447)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RC-16 (447)?

A: Form RC-16 (447) is the Cigarette Tax Claim for Credit form used in Illinois.

Q: What is the purpose of Form RC-16 (447)?

A: The purpose of Form RC-16 (447) is to claim a credit for cigarette tax paid in Illinois.

Q: Who should use Form RC-16 (447)?

A: This form should be used by individuals or businesses who have paid cigarette tax in Illinois and want to claim a credit.

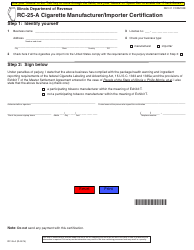

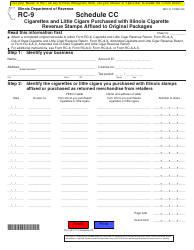

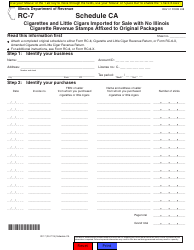

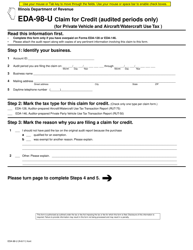

Q: What information is required on Form RC-16 (447)?

A: You will need to provide your contact information, details of the cigarettes purchased, and proof of payment.

Q: When is the deadline to file Form RC-16 (447)?

A: The deadline to file Form RC-16 (447) is typically the same as the deadline to file your Illinois income tax return.

Q: Can I claim a refund if I paid more in cigarette tax than I owed?

A: Yes, if you paid more in cigarette tax than you owed, you can claim a refund using Form RC-16 (447).

Q: Is there a limit on the amount of credit I can claim?

A: Yes, there is a limit on the amount of credit you can claim based on the number of cigarettes purchased.

Q: What supporting documents do I need to include with Form RC-16 (447)?

A: You will need to include documentation showing proof of purchase and payment for the cigarettes.

Q: What happens after I file Form RC-16 (447)?

A: After you file Form RC-16 (447), the Illinois Department of Revenue will review your claim and process your credit or refund.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RC-16 (447) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.