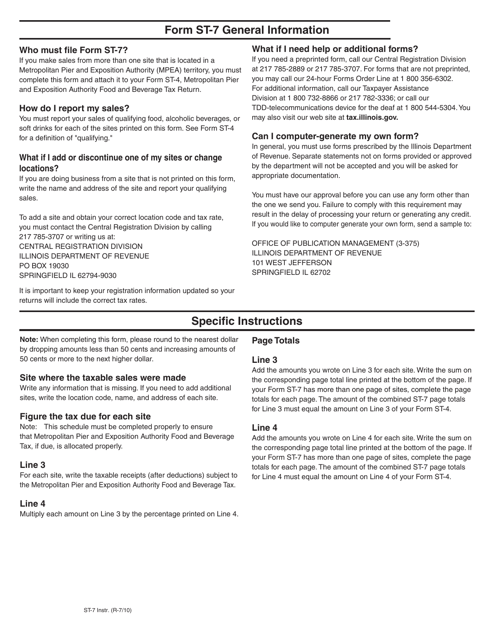

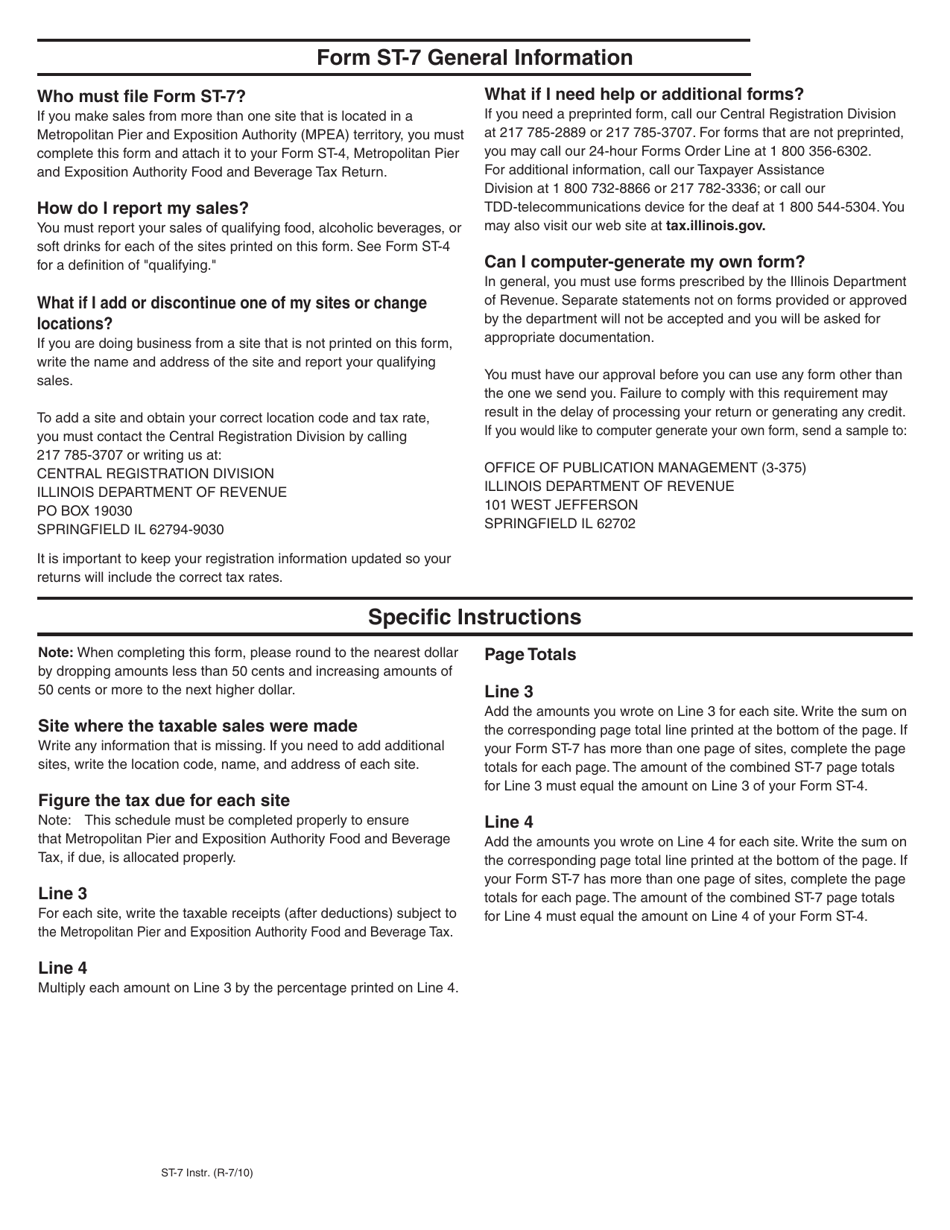

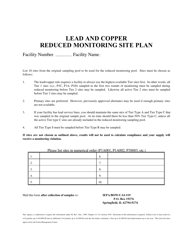

Instructions for Form ST-7 Multiple Site Form - Illinois

This document contains official instructions for Form ST-7 , Multiple Site Form - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form ST-7 is available for download through this link.

FAQ

Q: What is Form ST-7?

A: Form ST-7 is a Multiple Site Form for Illinois.

Q: What is the purpose of Form ST-7?

A: Form ST-7 is used to report sales and use tax liabilities for businesses with multiple locations in Illinois.

Q: Who needs to file Form ST-7?

A: Businesses with multiple locations in Illinois that owe sales and use tax.

Q: Is Form ST-7 for individuals or businesses?

A: Form ST-7 is for businesses.

Q: When is Form ST-7 due?

A: Form ST-7 is due on the 20th day of the month following the reporting period.

Q: Are there any filing fees for Form ST-7?

A: There are no filing fees for Form ST-7.

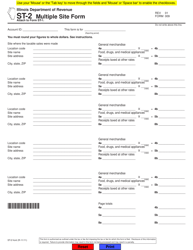

Q: What information is required on Form ST-7?

A: Form ST-7 requires information about each location, taxable sales, and use tax due.

Q: What happens if I don't file Form ST-7?

A: Failure to file Form ST-7 may result in penalties and interest charges.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.