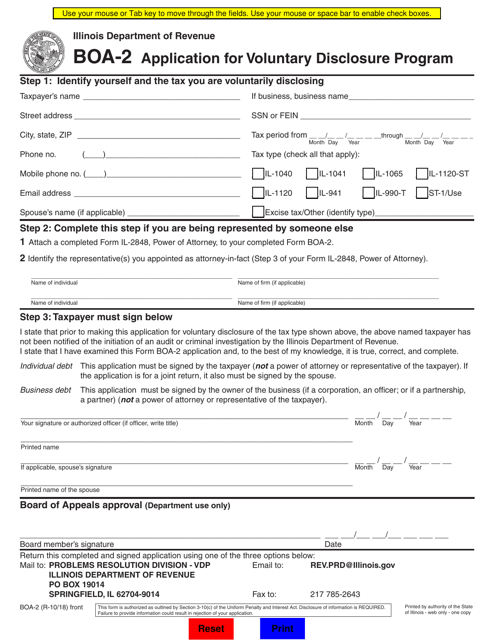

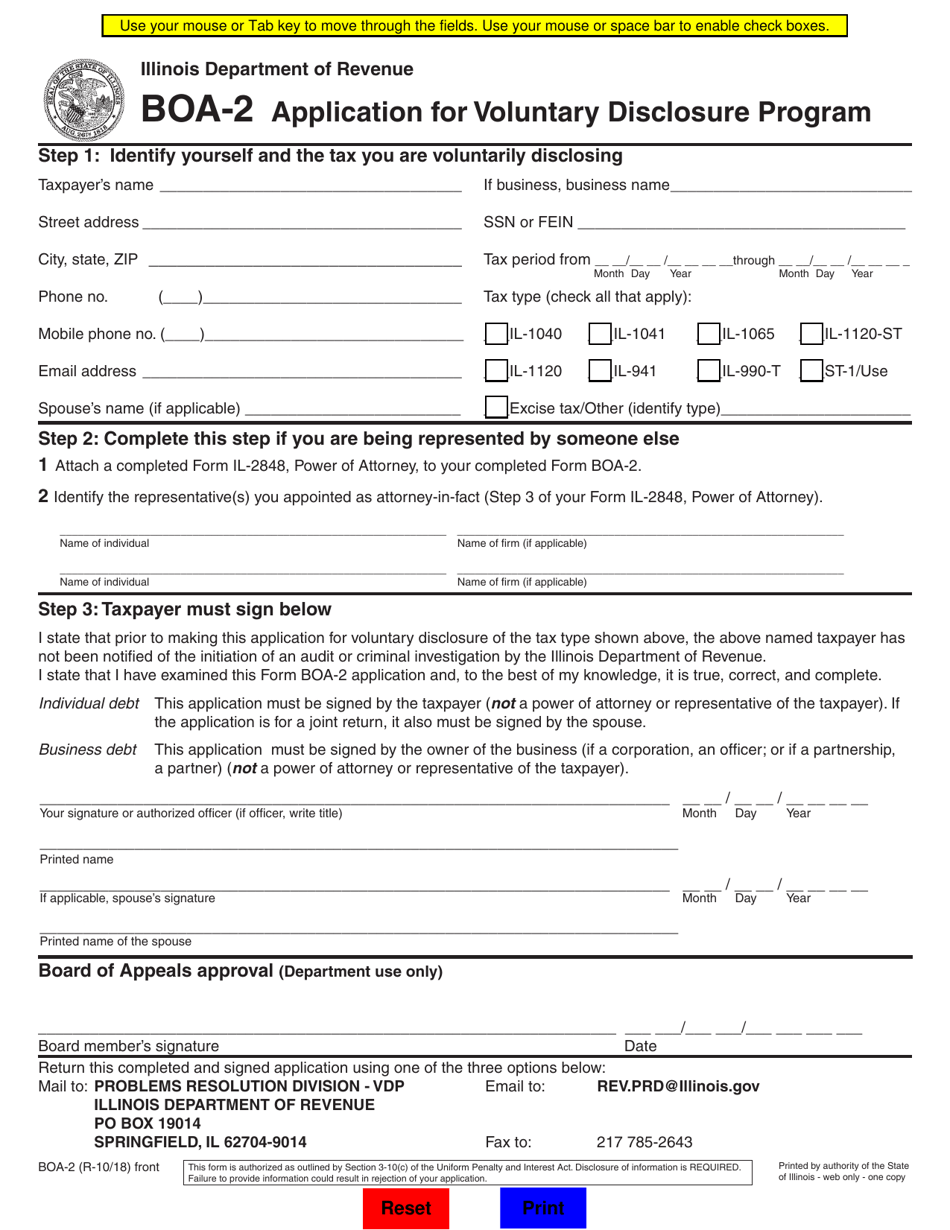

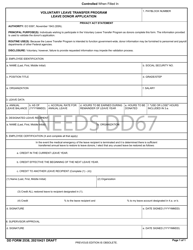

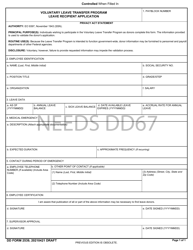

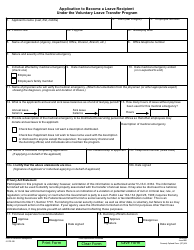

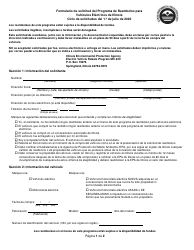

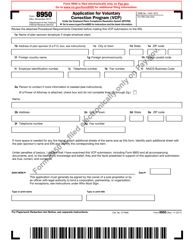

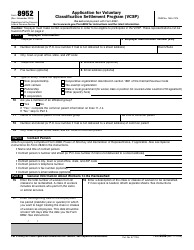

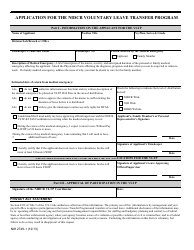

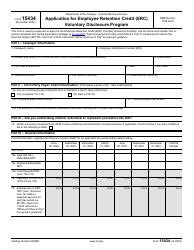

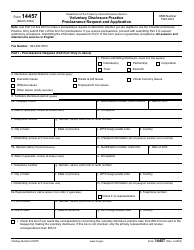

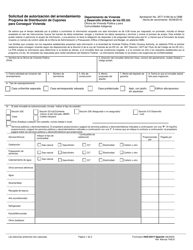

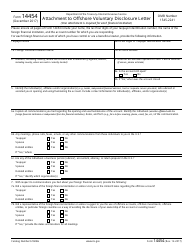

Form BOA-2 Application for Voluntary Disclosure Program - Illinois

What Is Form BOA-2?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOA-2?

A: Form BOA-2 is the Application for Voluntary Disclosure Program in Illinois.

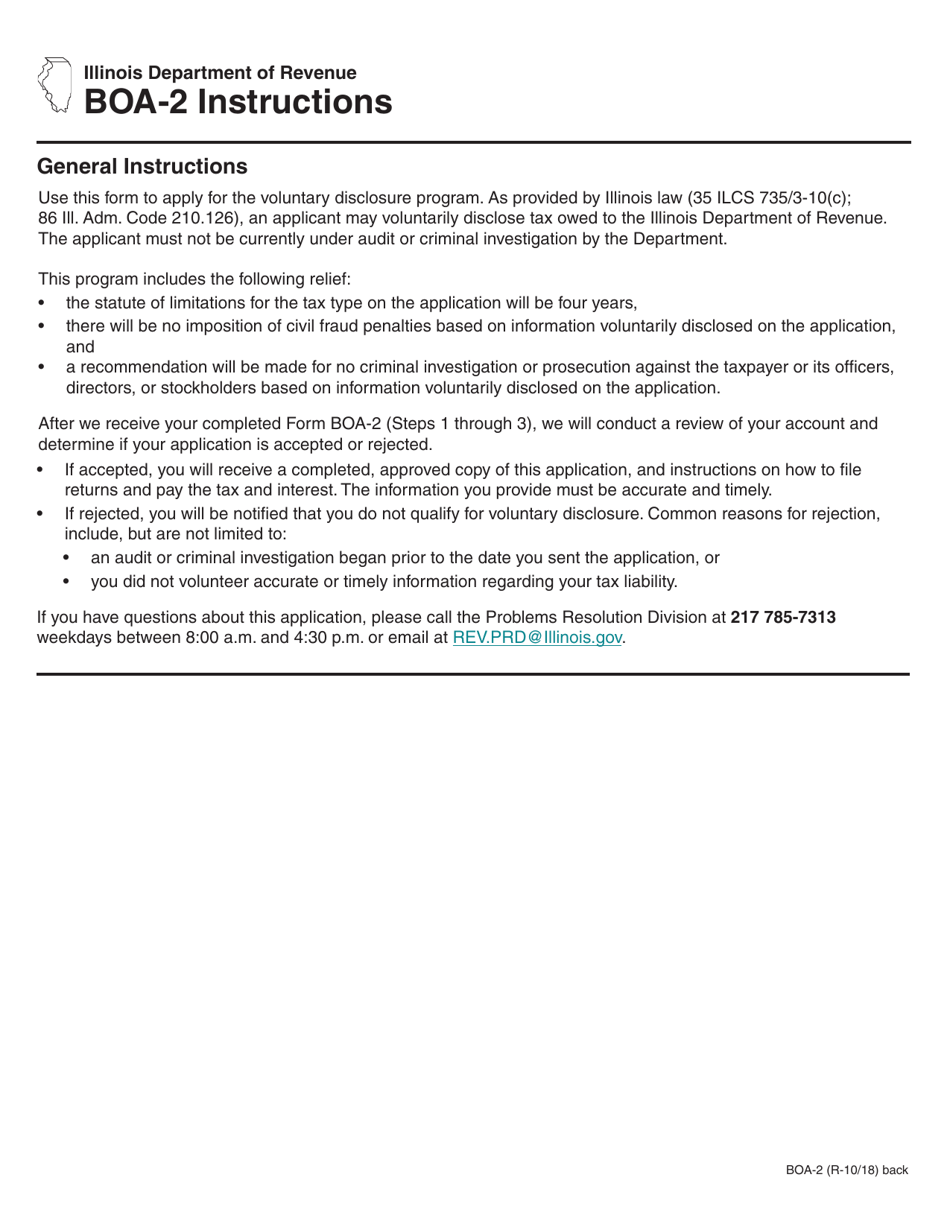

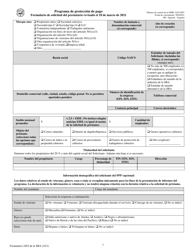

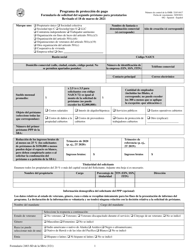

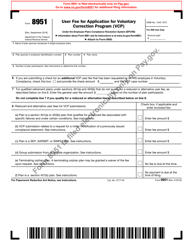

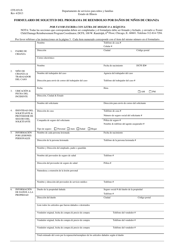

Q: What is the Voluntary Disclosure Program in Illinois?

A: The Voluntary Disclosure Program in Illinois allows taxpayers who have unpaid tax liabilities to voluntarily come forward and disclose those liabilities in order to resolve them.

Q: Who can use Form BOA-2?

A: Taxpayers who want to participate in the Voluntary Disclosure Program in Illinois can use Form BOA-2 to apply.

Q: What information is required on Form BOA-2?

A: Form BOA-2 requires taxpayers to provide detailed information about their tax liabilities and related financial records.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOA-2 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.