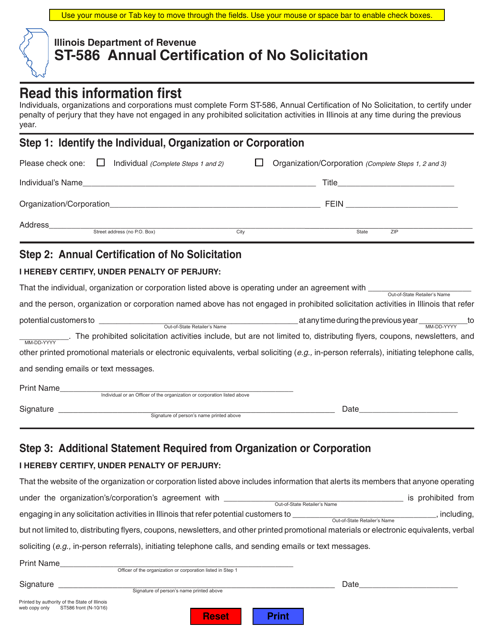

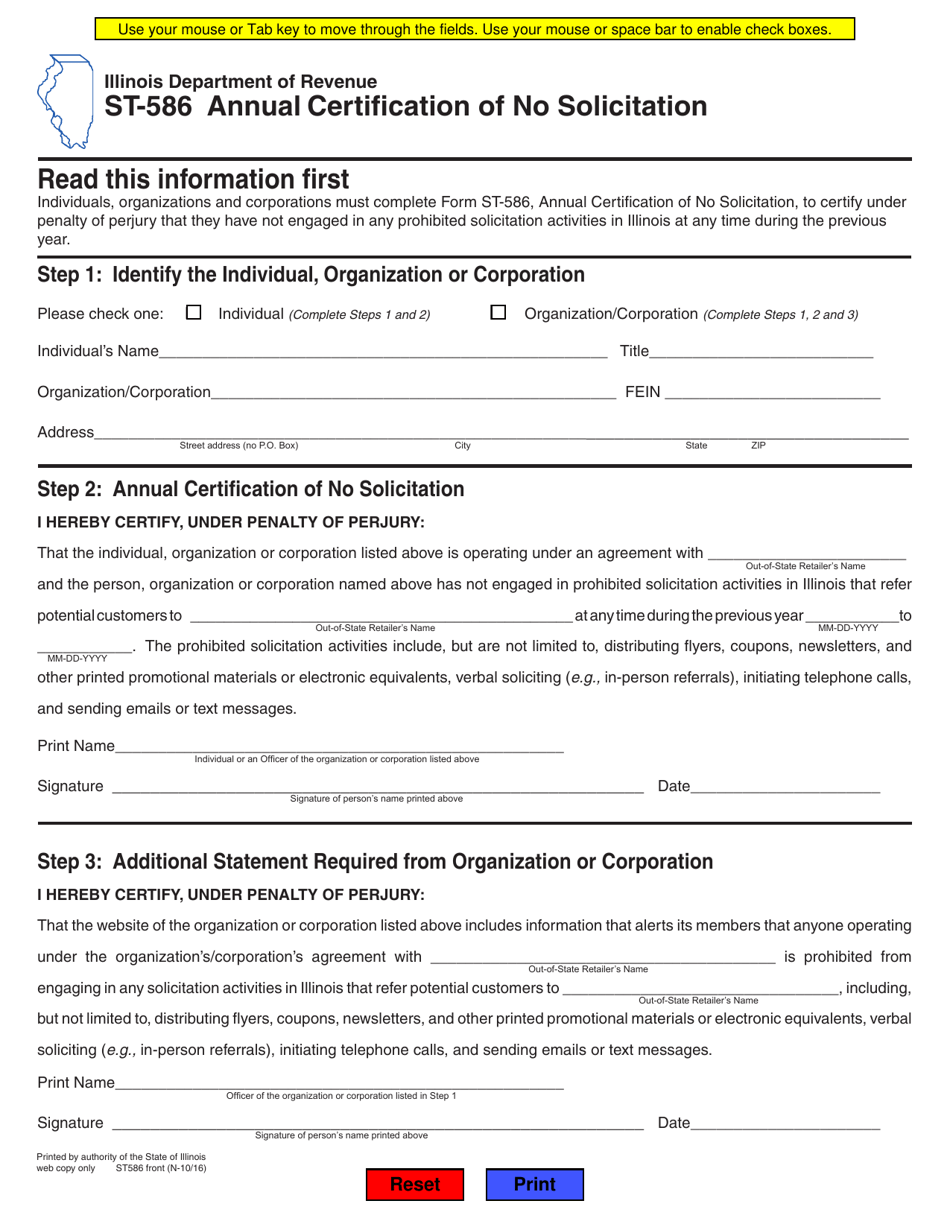

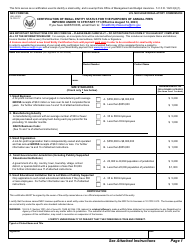

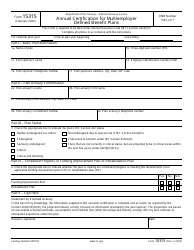

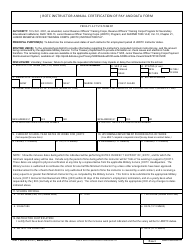

Form ST-586 Annual Certification of No Solicitation - Illinois

What Is Form ST-586?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-586?

A: Form ST-586 is the Annual Certification of No Solicitation form in Illinois.

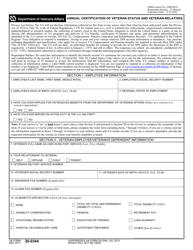

Q: What is the purpose of Form ST-586?

A: The purpose of Form ST-586 is to certify that a taxpayer has not engaged in any solicitation activities in Illinois during the previous calendar year.

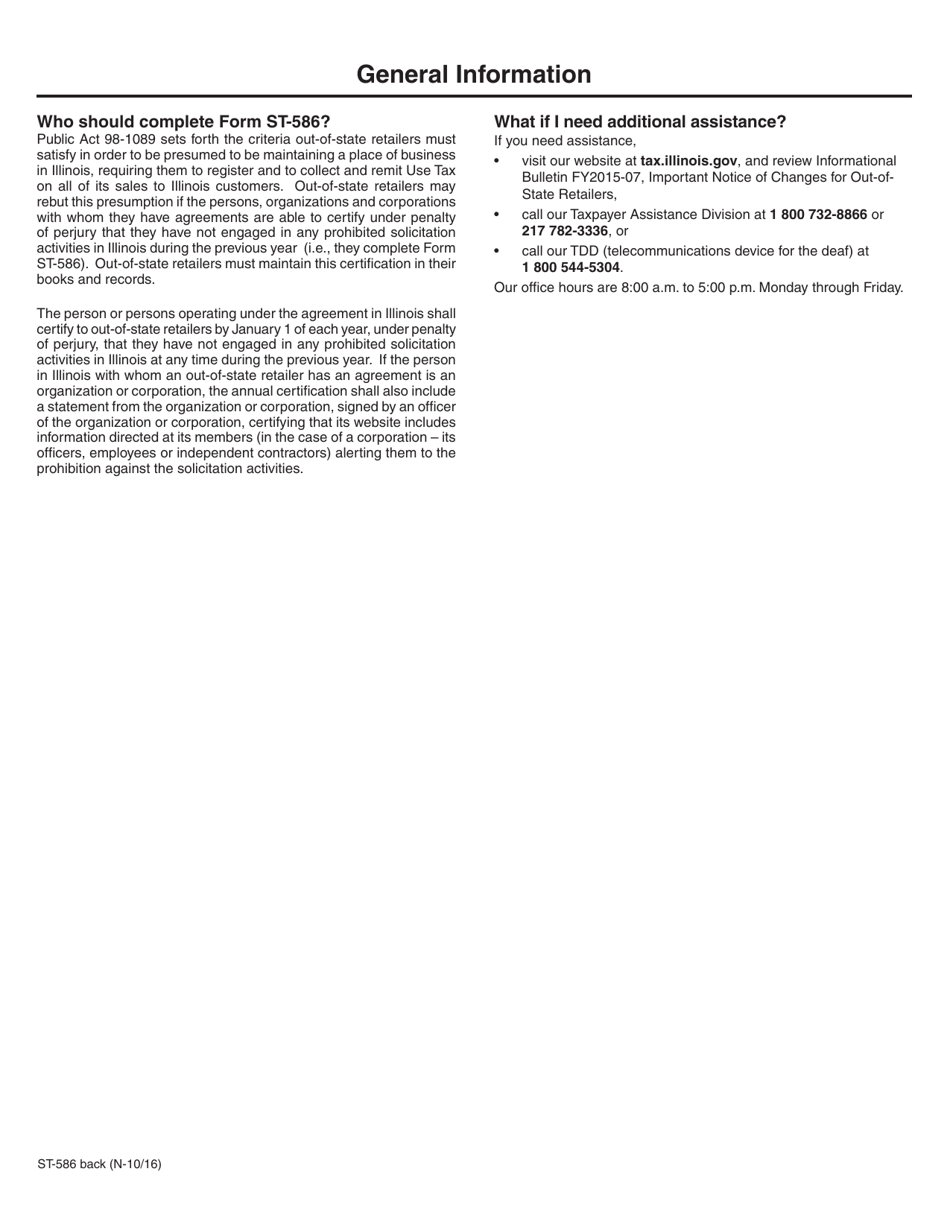

Q: Who needs to file Form ST-586?

A: Any taxpayer who did not engage in any solicitation activities in Illinois during the previous calendar year needs to file Form ST-586.

Q: When is Form ST-586 due?

A: Form ST-586 is due on or before March 1 of each year.

Q: Is there a penalty for not filing Form ST-586?

A: Yes, there is a penalty for failure to file Form ST-586. The penalty amount is determined by the Illinois Department of Revenue.

Q: Is Form ST-586 required for both individuals and businesses?

A: Yes, both individuals and businesses who did not engage in any solicitation activities in Illinois during the previous calendar year need to file Form ST-586.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-586 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.