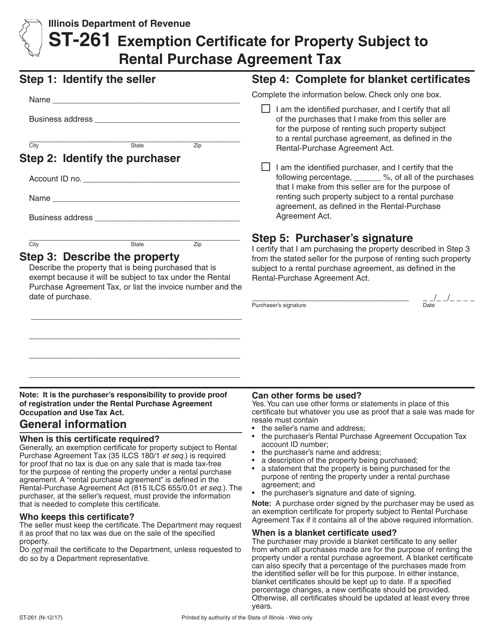

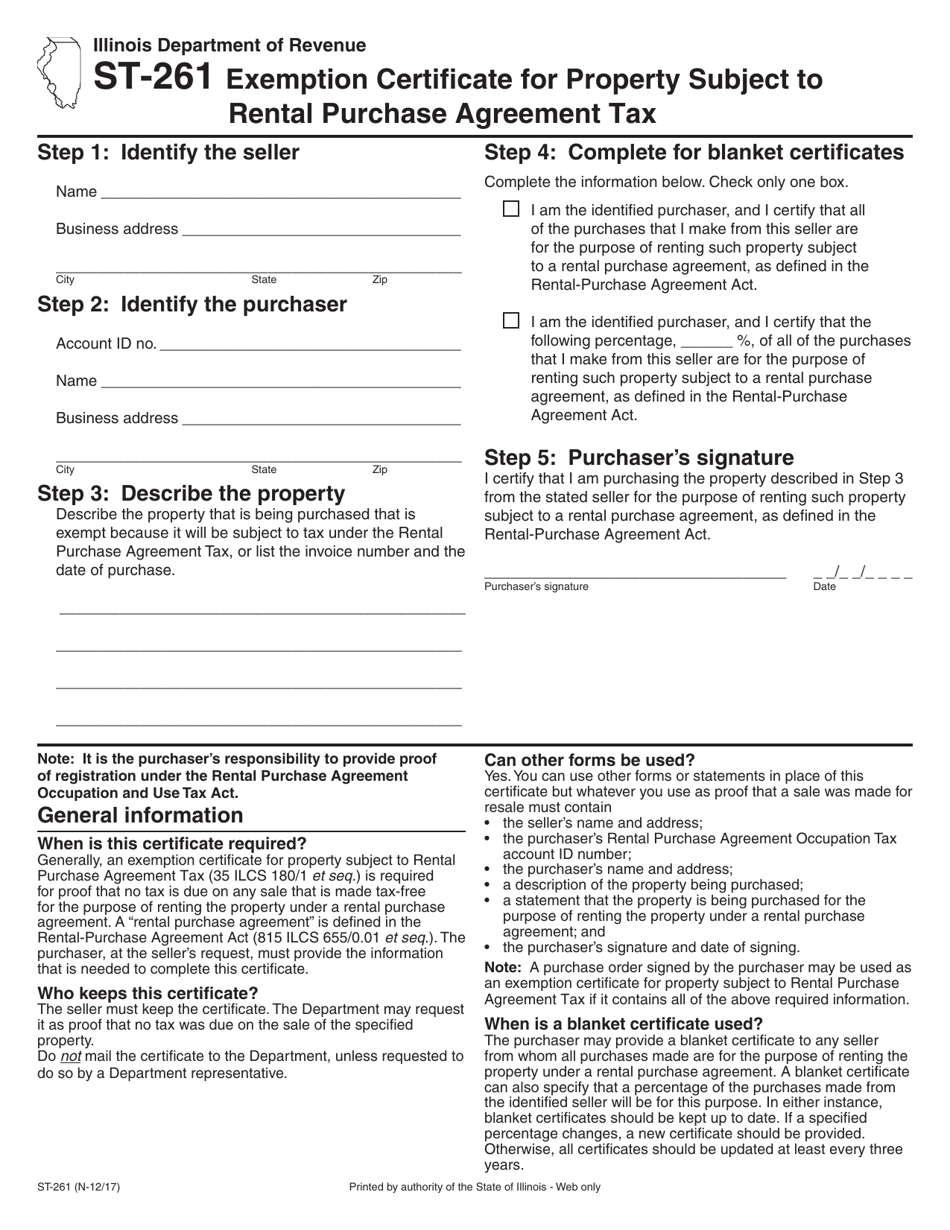

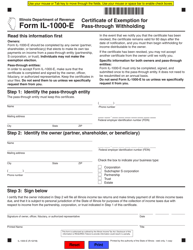

Form ST-261 Exemption Certificate for Property Subject to Rental Purchase Agreement Tax - Illinois

What Is Form ST-261?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-261?

A: Form ST-261 is the Exemption Certificate for Property Subject to Rental Purchase Agreement Tax in the state of Illinois.

Q: What is the purpose of Form ST-261?

A: The purpose of Form ST-261 is to claim exemption from the Rental Purchase Agreement Tax for specific property.

Q: Who needs to use Form ST-261?

A: Any individual or business that wants to claim exemption from the Rental Purchase Agreement Tax in Illinois needs to use Form ST-261.

Q: What is Rental Purchase Agreement Tax?

A: Rental Purchase Agreement Tax is a tax imposed on certain rental purchase agreements in Illinois.

Q: Are there any requirements or qualifications for claiming exemption?

A: Yes, there are specific requirements and qualifications for claiming exemption. Please refer to the instructions provided with Form ST-261 for more information.

Q: Is there a deadline for submitting Form ST-261?

A: Yes, there may be a deadline for submitting Form ST-261. Please refer to the instructions provided with the form or contact the Illinois Department of Revenue for more information.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-261 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.