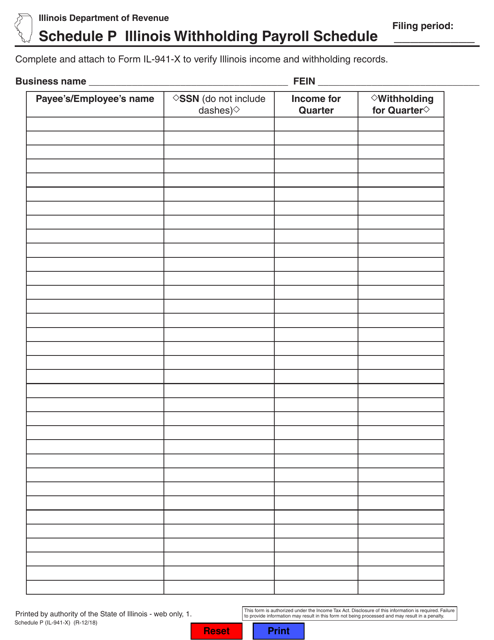

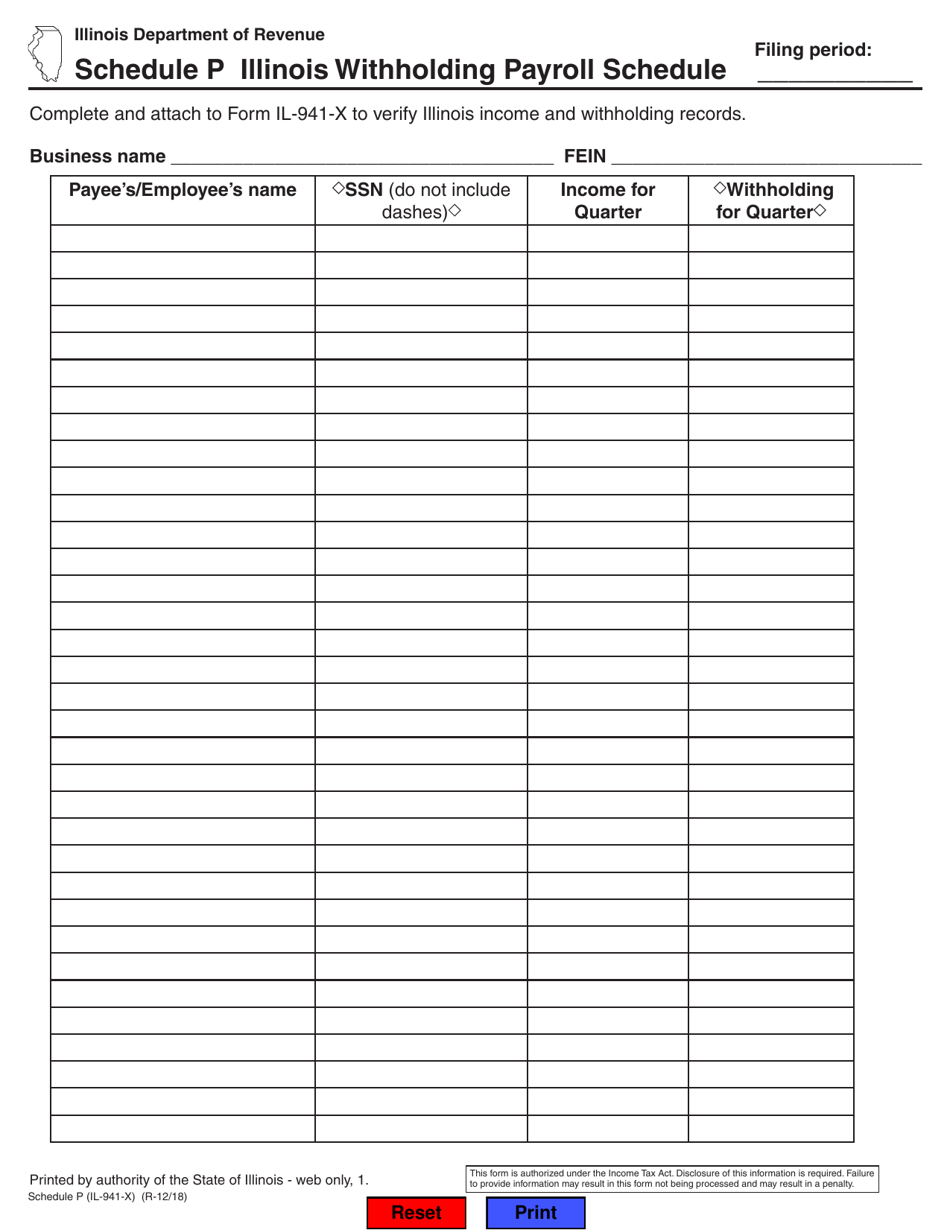

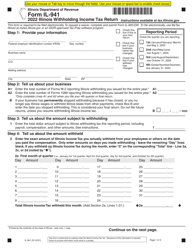

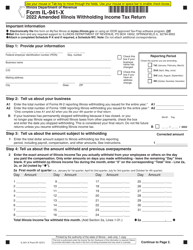

Form IL-941-X Schedule P Illinois Withholding Payroll Schedule - Illinois

What Is Form IL-941-X Schedule P?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-941-X Schedule P?

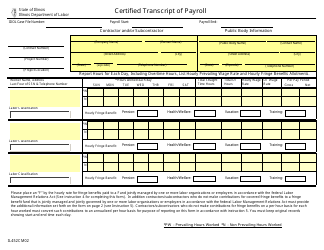

A: Form IL-941-X Schedule P is a schedule used to report Illinois withholding taxes for payroll.

Q: Who is required to file Form IL-941-X Schedule P?

A: Employers in Illinois who have employees subject to state withholding taxes are required to file Form IL-941-X Schedule P.

Q: What information is required on Form IL-941-X Schedule P?

A: Form IL-941-X Schedule P requires information such as the employer's name, address, total wages subject to withholding, and the total amount of Illinois withholding taxes withheld.

Q: When is Form IL-941-X Schedule P due?

A: Form IL-941-X Schedule P is due quarterly, on the last day of the month following the end of the quarter.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-941-X Schedule P by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.