This version of the form is not currently in use and is provided for reference only. Download this version of

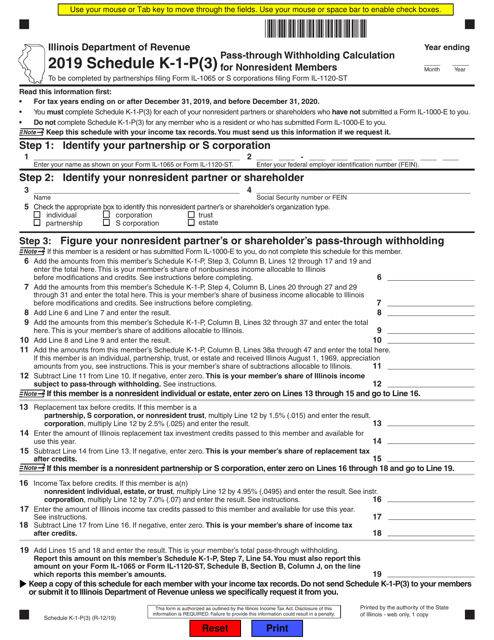

Schedule K-1-P(3)

for the current year.

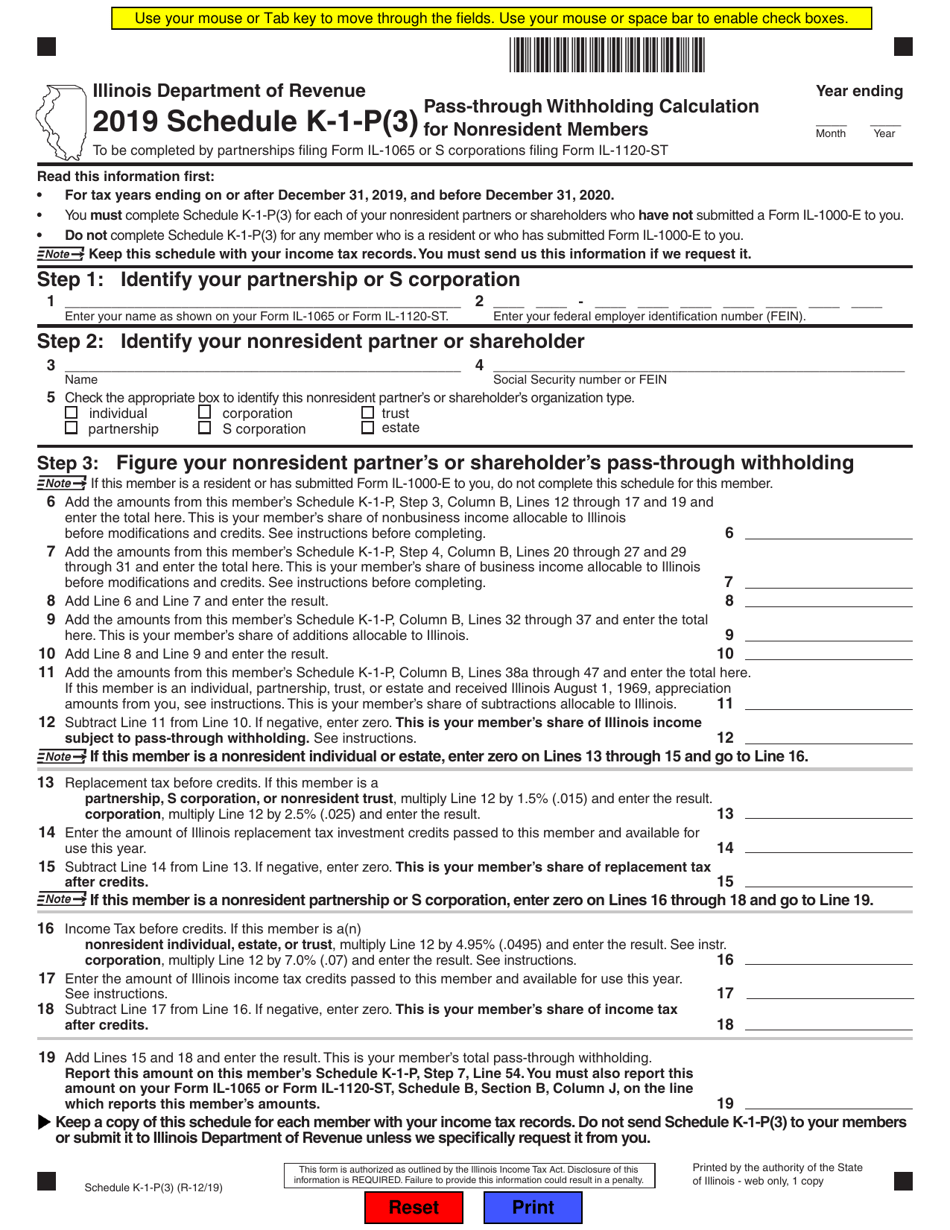

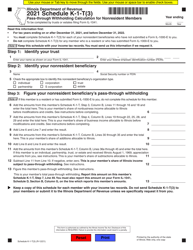

Schedule K-1-P(3) Pass-Through Withholding Calculation for Nonresident Members - Illinois

What Is Schedule K-1-P(3)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1-P(3)?

A: Schedule K-1-P(3) is a tax form used to calculate pass-through withholding for nonresident members in Illinois.

Q: Who needs to file Schedule K-1-P(3)?

A: Nonresident members of an Illinois pass-through entity who are subject to withholding need to file Schedule K-1-P(3).

Q: What is pass-through withholding?

A: Pass-through withholding is the amount of income tax that is withheld from payments made to nonresident partners or members of a pass-through entity.

Q: How is pass-through withholding calculated?

A: Pass-through withholding is calculated based on the nonresident member's distributive share of the pass-through entity's income subject to Illinois withholding.

Q: Why is pass-through withholding necessary?

A: Pass-through withholding ensures that nonresident partners or members pay their share of income taxes on income earned from Illinois sources.

Q: When is the deadline for filing Schedule K-1-P(3)?

A: The deadline for filing Schedule K-1-P(3) is generally the same as the deadline for filing the pass-through entity's income tax return, which is typically March 15th.

Q: Are there any penalties for not filing Schedule K-1-P(3)?

A: Yes, failure to file Schedule K-1-P(3) or to pay pass-through withholding can result in penalties and interest.

Q: Is pass-through withholding the same as income tax?

A: No, pass-through withholding is a type of income tax that is specifically withheld from payments made to nonresident partners or members of a pass-through entity.

Q: Can I claim a refund for pass-through withholding?

A: Yes, if the pass-through withholding amount exceeds the nonresident member's actual tax liability, they can claim a refund on their individual income tax return.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-1-P(3) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.