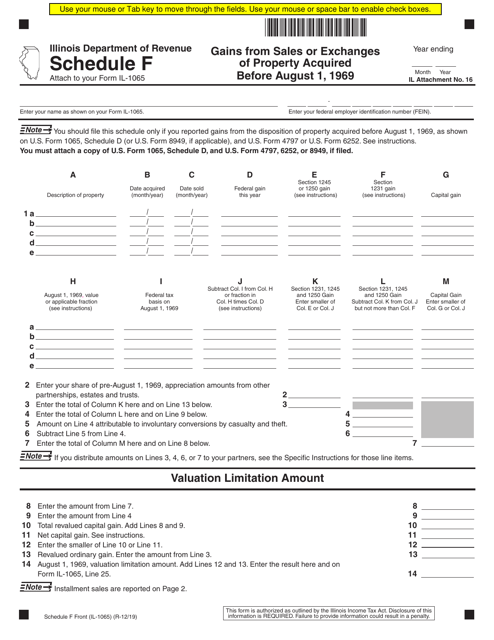

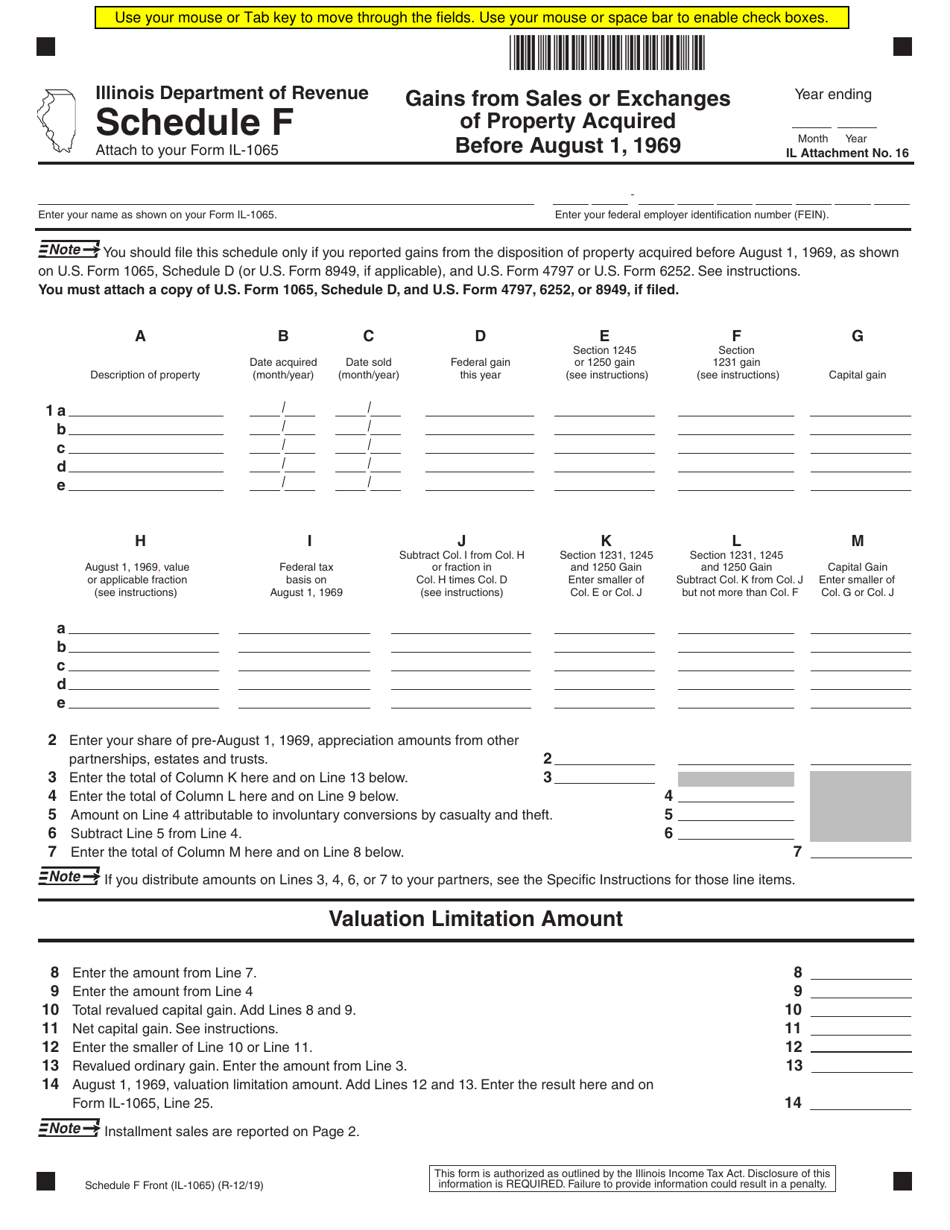

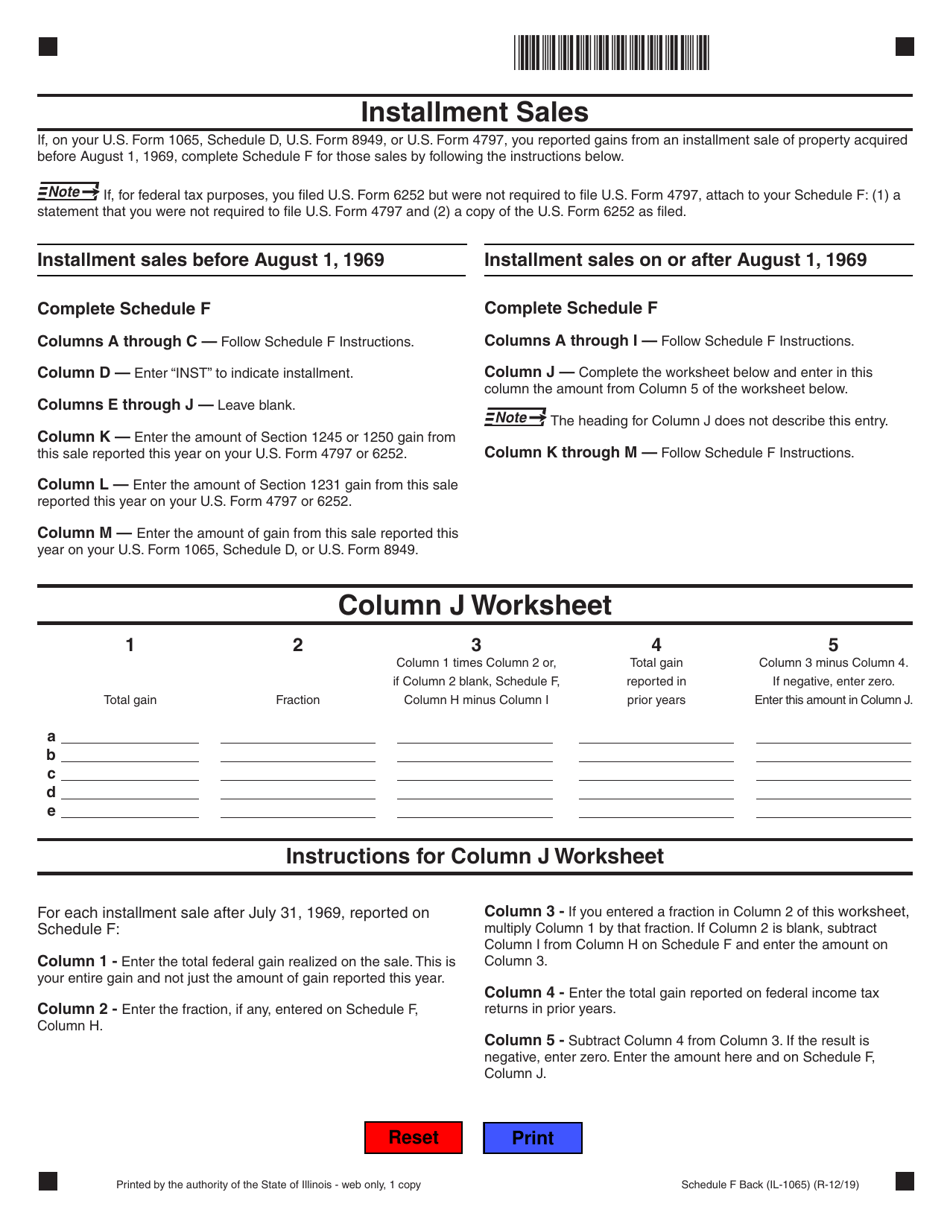

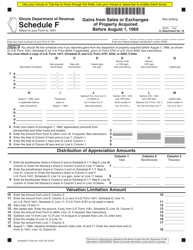

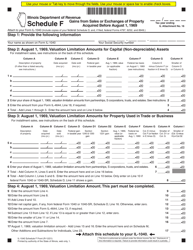

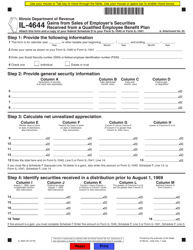

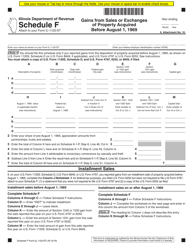

Form IL-1065 Schedule F Gains From Sales or Exchanges of Property Acquired Before August 1, 1969 - Illinois

What Is Form IL-1065 Schedule F?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1065 Schedule F?

A: Form IL-1065 Schedule F is a form used in Illinois to report gains from sales or exchanges of property acquired before August 1, 1969.

Q: What type of property does Form IL-1065 Schedule F cover?

A: Form IL-1065 Schedule F covers property acquired before August 1, 1969.

Q: What is the purpose of Form IL-1065 Schedule F?

A: The purpose of Form IL-1065 Schedule F is to report gains from the sale or exchange of property acquired before August 1, 1969.

Q: Who needs to file Form IL-1065 Schedule F?

A: Partnerships in Illinois that have gains from sales or exchanges of property acquired before August 1, 1969 need to file Form IL-1065 Schedule F.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1065 Schedule F by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.