This version of the form is not currently in use and is provided for reference only. Download this version of

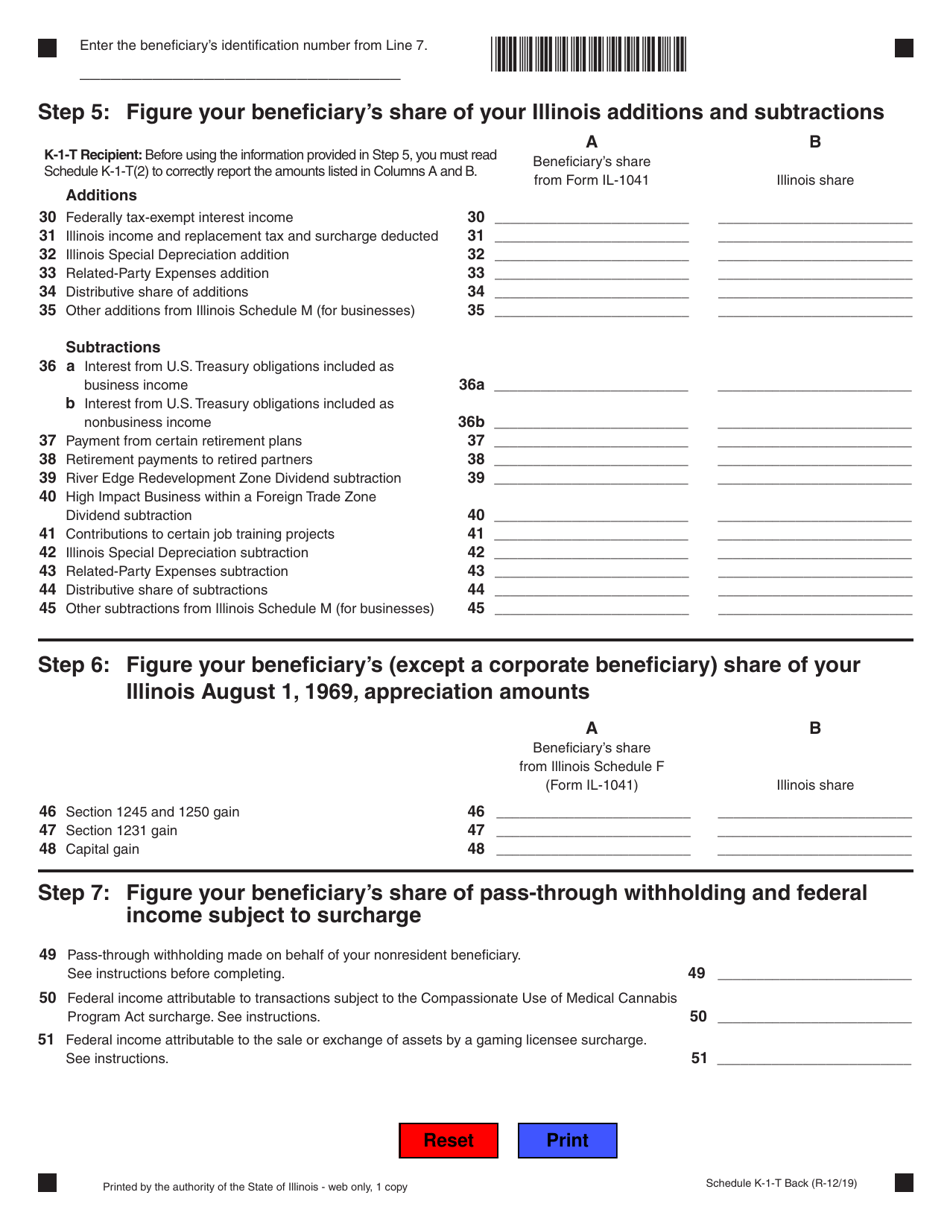

Schedule K-1-T

for the current year.

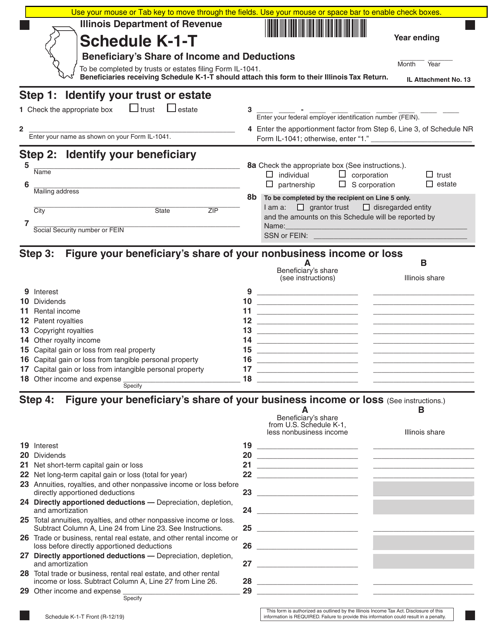

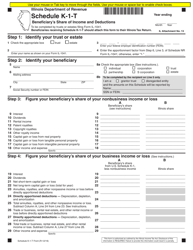

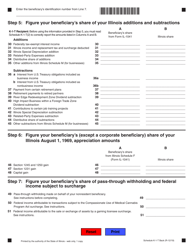

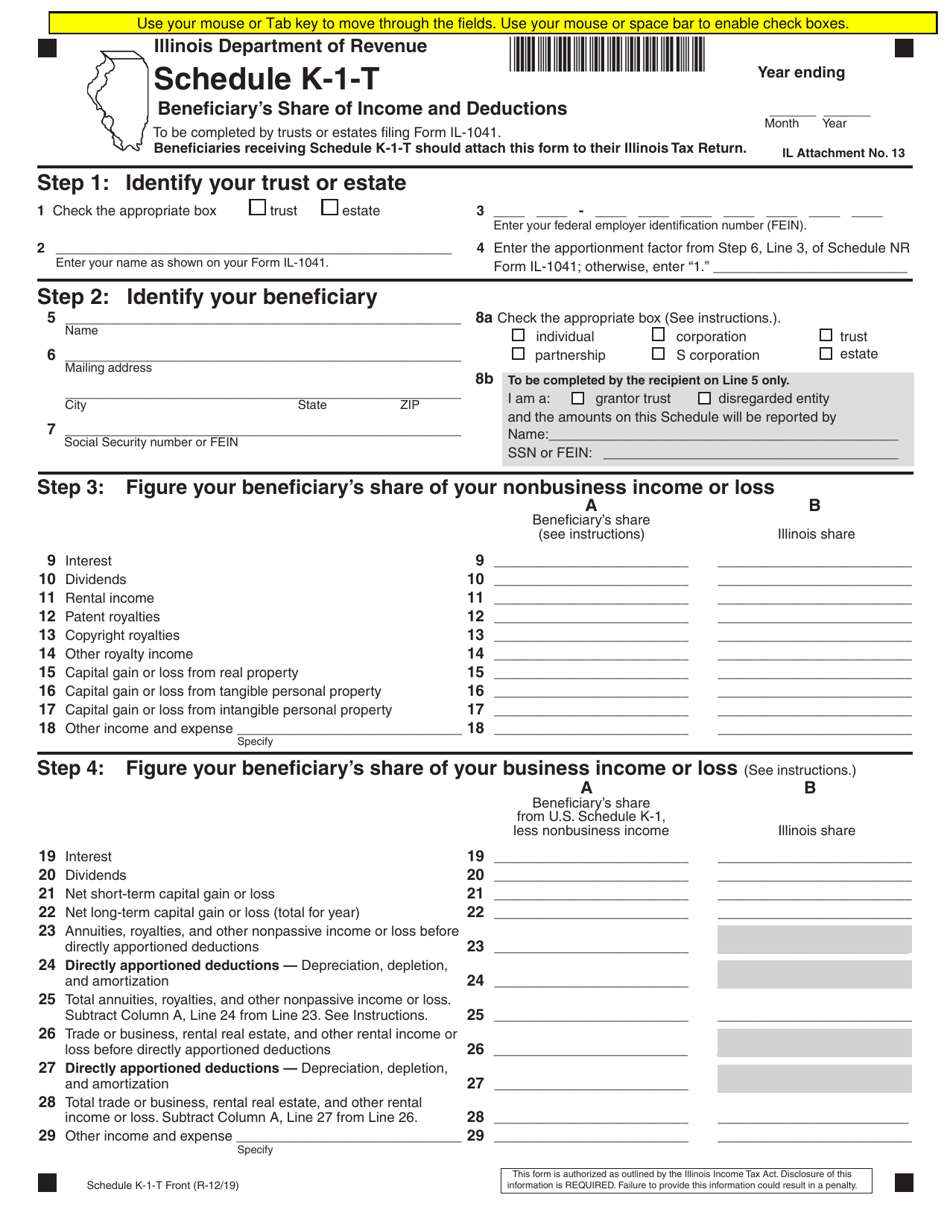

Schedule K-1-T Beneficiary's Share of Income and Deductions - Illinois

What Is Schedule K-1-T?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1-T?

A: Schedule K-1-T is a tax form used to report a beneficiary's share of income and deductions for the state of Illinois.

Q: Who is required to file Schedule K-1-T?

A: Beneficiaries of trusts or estates in Illinois may be required to file Schedule K-1-T.

Q: What information does Schedule K-1-T report?

A: Schedule K-1-T reports the beneficiary's share of income, deductions, and other relevant information from a trust or estate.

Q: Is Schedule K-1-T the same as federal Schedule K-1?

A: No, Schedule K-1-T is specifically for reporting income and deductions for the state of Illinois, while federal Schedule K-1 is for reporting income and deductions for federal tax purposes.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-1-T by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.