This version of the form is not currently in use and is provided for reference only. Download this version of

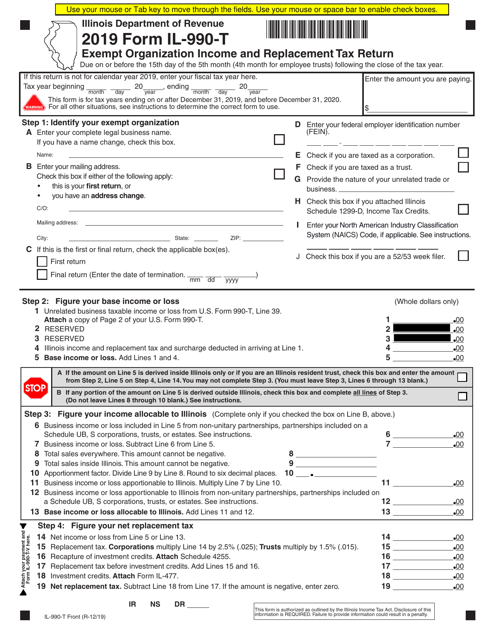

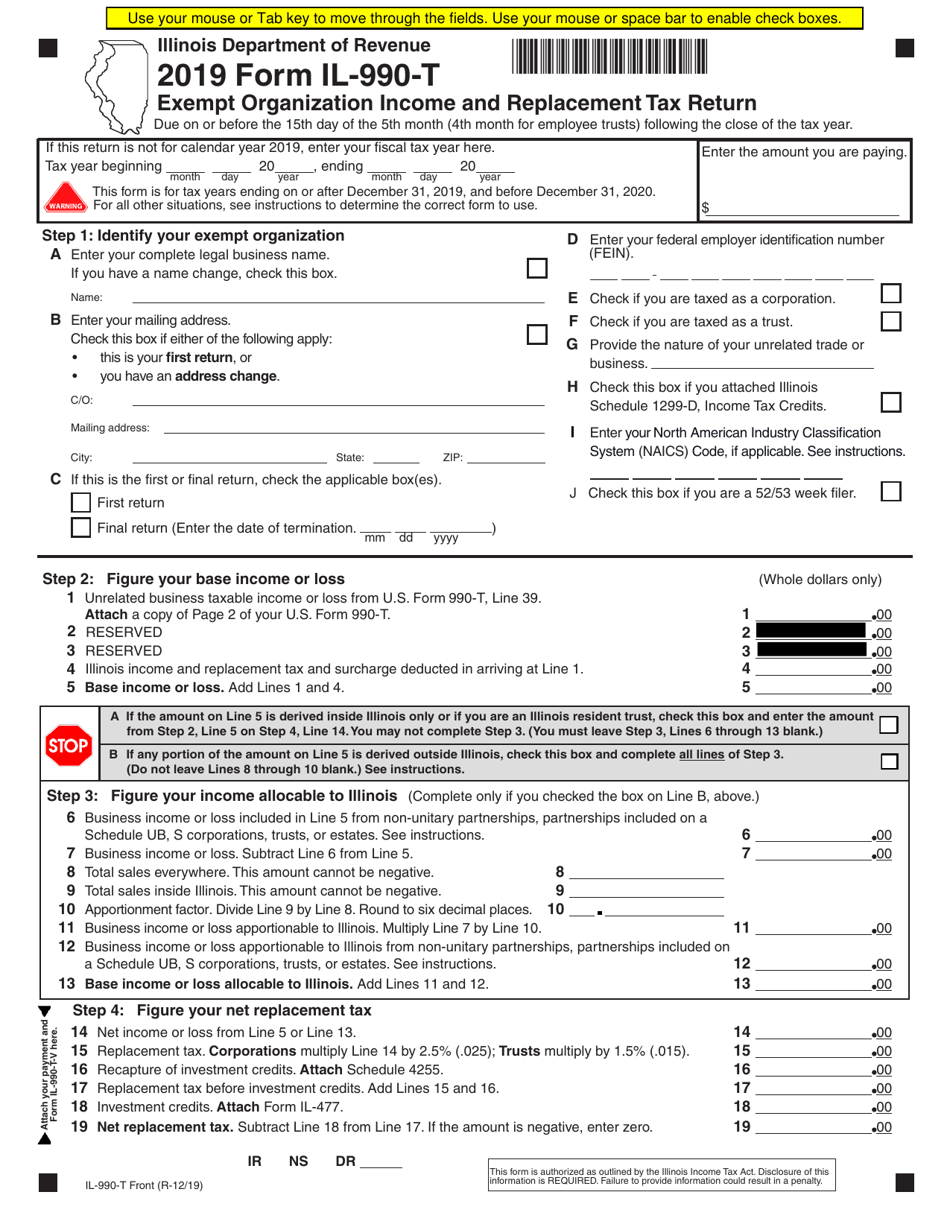

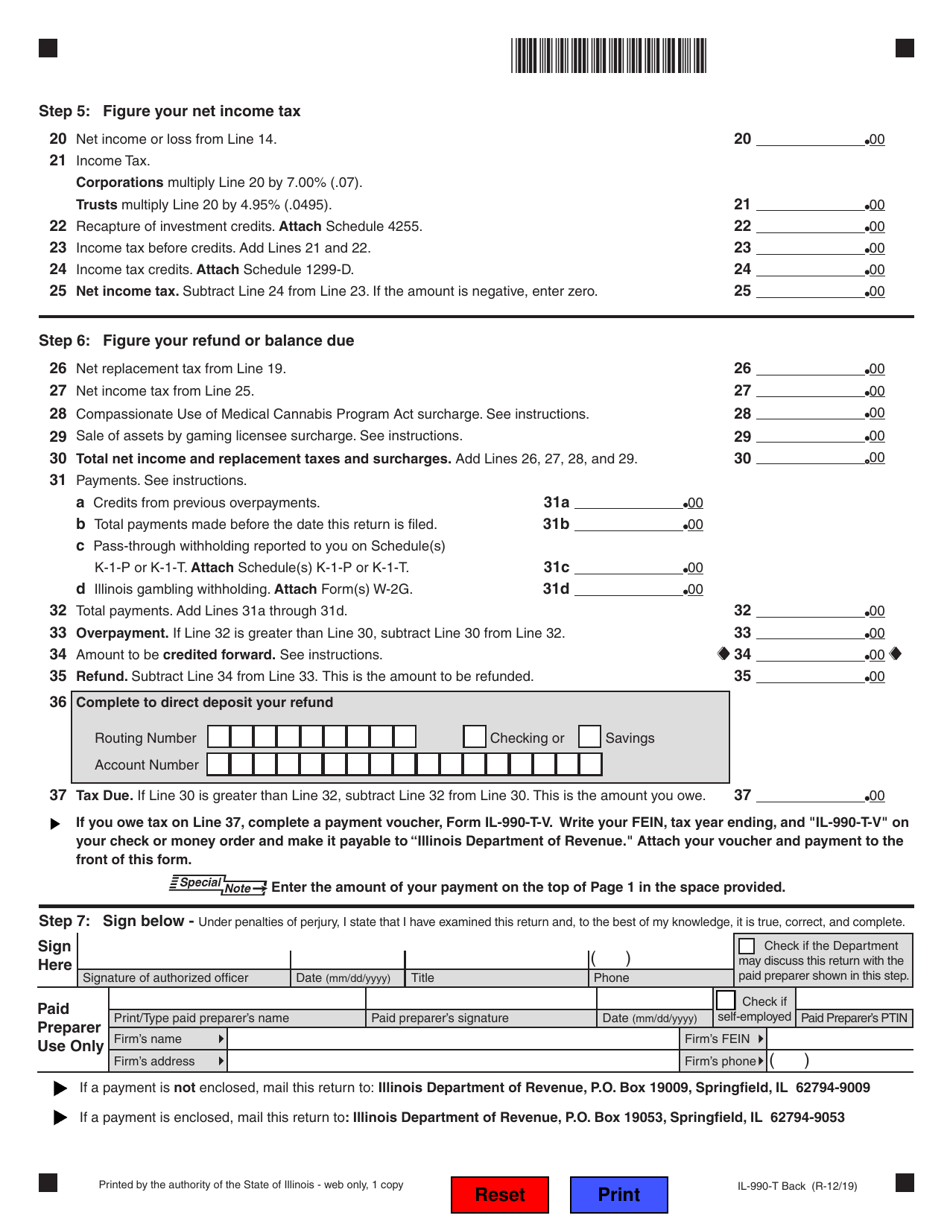

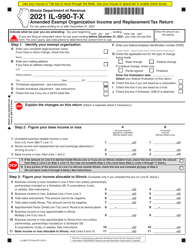

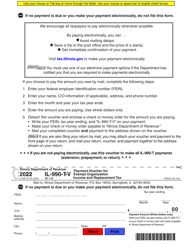

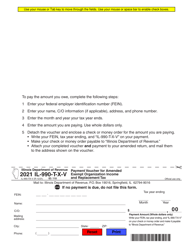

Form IL-990-T

for the current year.

Form IL-990-T Exempt Organization Income and Replacement Tax Return - Illinois

What Is Form IL-990-T?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-990-T?

A: Form IL-990-T is the Exempt Organization Income and Replacement Tax Return specifically for organizations in Illinois.

Q: Who needs to file Form IL-990-T?

A: Exempt organizations that are subject to the Income and Replacement Tax in Illinois need to file Form IL-990-T.

Q: What is the purpose of Form IL-990-T?

A: Form IL-990-T is used to calculate and report the exempt organization's income and replacement tax liability in Illinois.

Q: When is Form IL-990-T due?

A: Form IL-990-T is generally due on the 15th day of the 5th month following the end of the organization's fiscal year.

Q: Is there a fee for filing Form IL-990-T?

A: There is no fee for filing Form IL-990-T.

Q: What supporting documents need to be attached to Form IL-990-T?

A: The specific supporting documents required may vary depending on the organization's circumstances, but generally include financial statements and schedules.

Q: Can Form IL-990-T be filed electronically?

A: Yes, Form IL-990-T can be filed electronically using the Illinois Department of Revenue's e-file system.

Q: What happens if Form IL-990-T is not filed or filed late?

A: Failure to file Form IL-990-T or filing it late may result in penalties and interest charges.

Q: Are there any exemptions or deductions available on Form IL-990-T?

A: Yes, there may be exemptions and deductions available, depending on the nature of the exempt organization's activities. Consult the instructions for Form IL-990-T for more information.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.