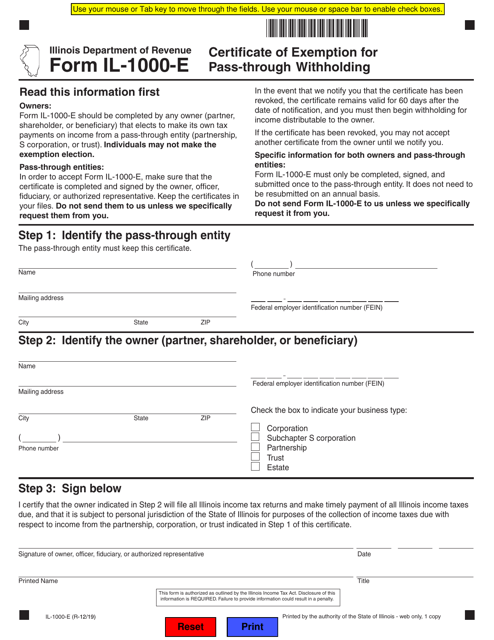

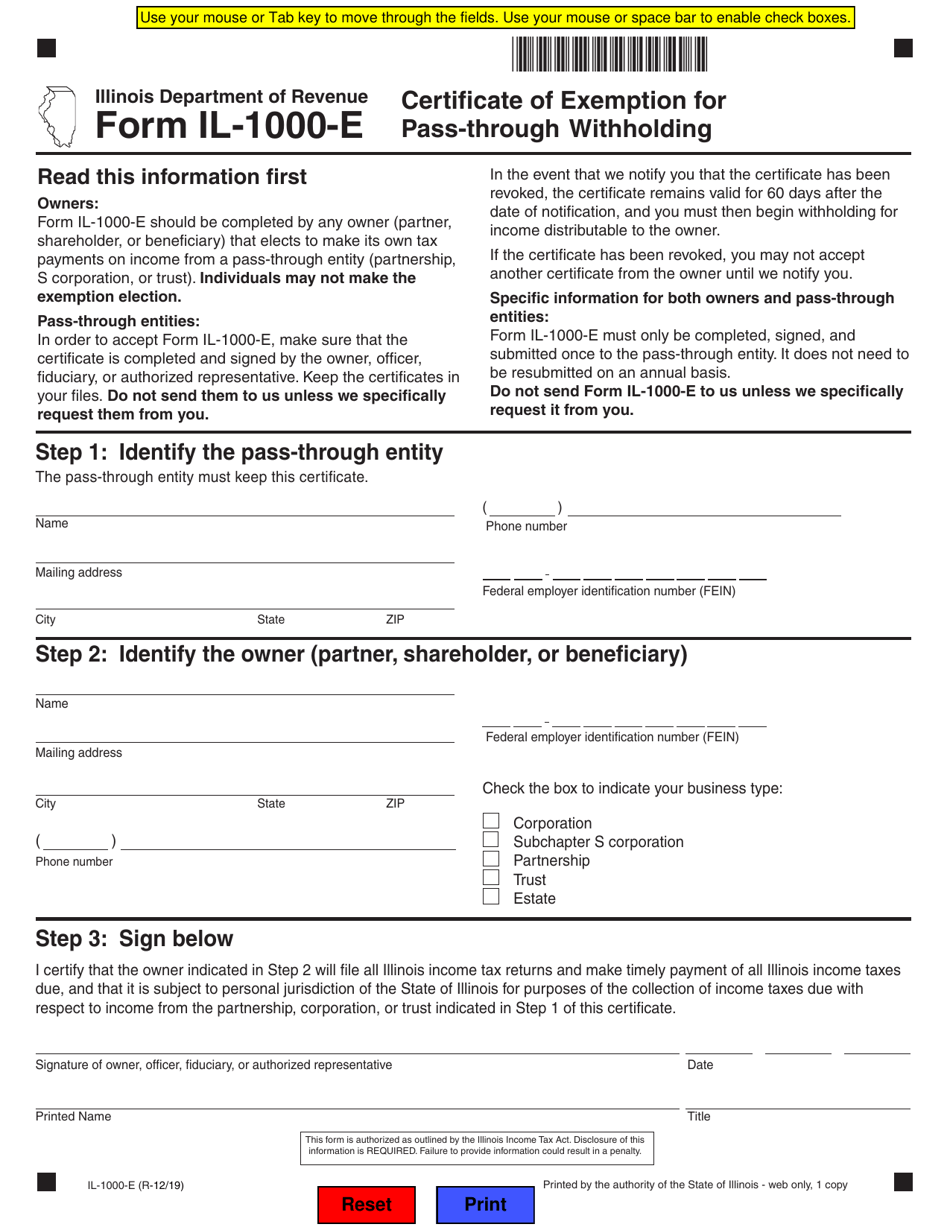

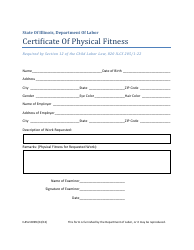

Form IL-1000-E Certificate of Exemption for Pass-Through Withholding - Illinois

What Is Form IL-1000-E?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1000-E?

A: Form IL-1000-E is a Certificate of Exemption for Pass-Through Withholding in Illinois.

Q: Who uses Form IL-1000-E?

A: Form IL-1000-E is used by individuals and businesses who are claiming an exemption from the pass-through withholding requirements in Illinois.

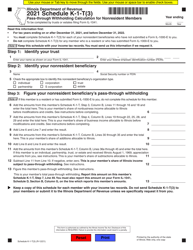

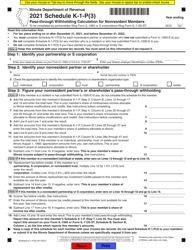

Q: What is pass-through withholding?

A: Pass-through withholding is when income earned by a pass-through entity, such as a partnership or S corporation, is subject to withholding tax before it is distributed to the owners or partners.

Q: How can I claim an exemption from pass-through withholding?

A: To claim an exemption from pass-through withholding, you must complete and submit Form IL-1000-E to the Illinois Department of Revenue.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1000-E by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.