This version of the form is not currently in use and is provided for reference only. Download this version of

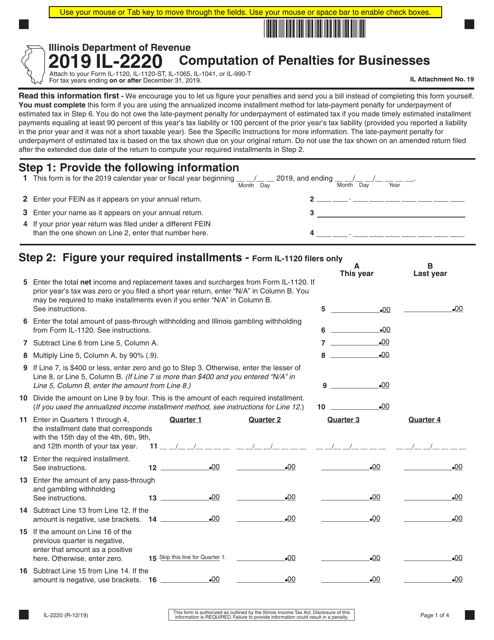

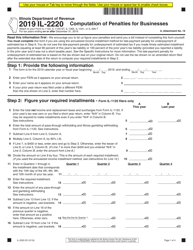

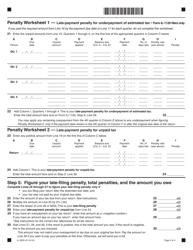

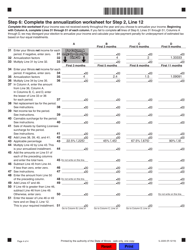

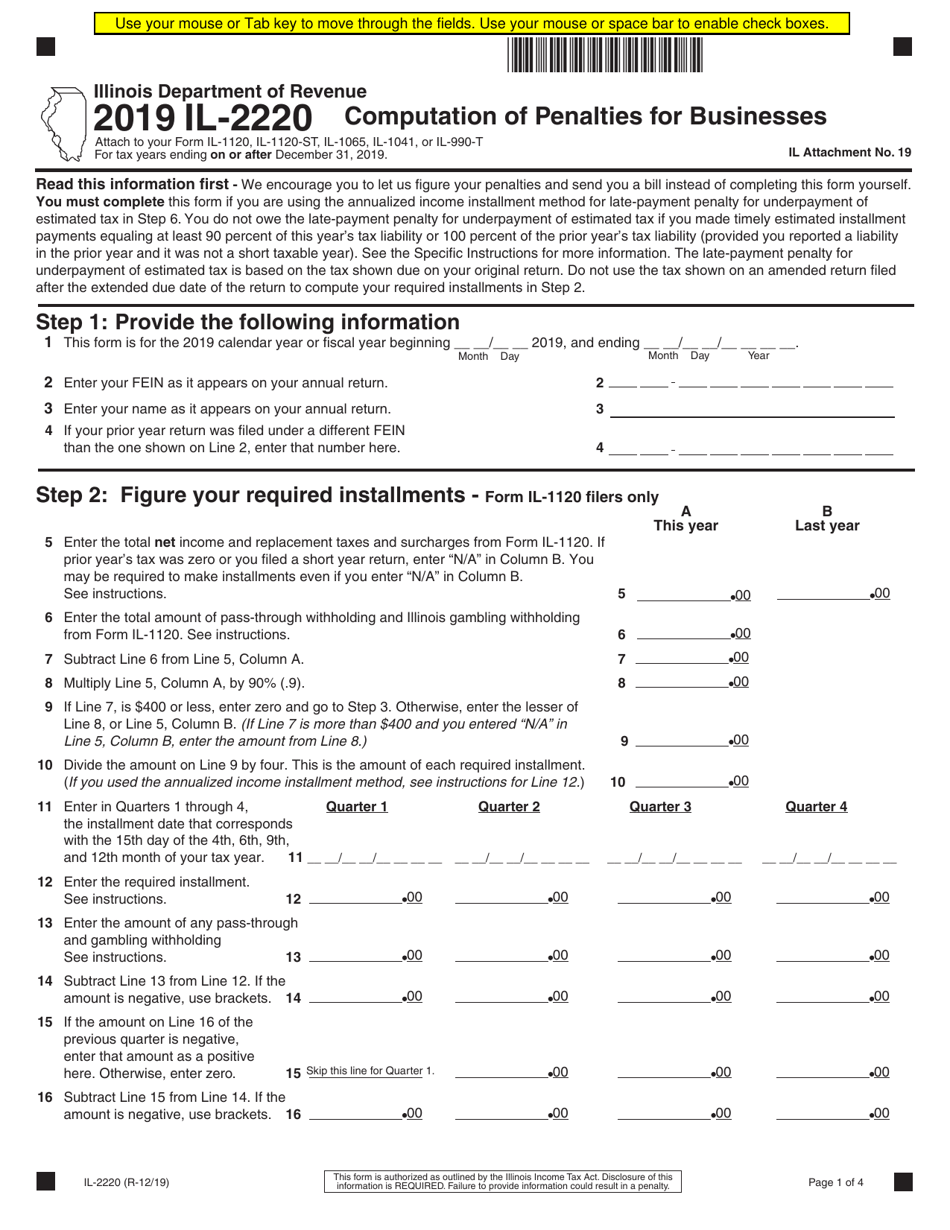

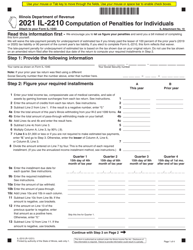

Form IL-2220

for the current year.

Form IL-2220 Computation of Penalties for Businesses - Illinois

What Is Form IL-2220?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-2220?

A: Form IL-2220 is a form used for the computation of penalties for businesses in Illinois.

Q: Who needs to file Form IL-2220?

A: Businesses in Illinois that owe certain penalties may be required to file Form IL-2220.

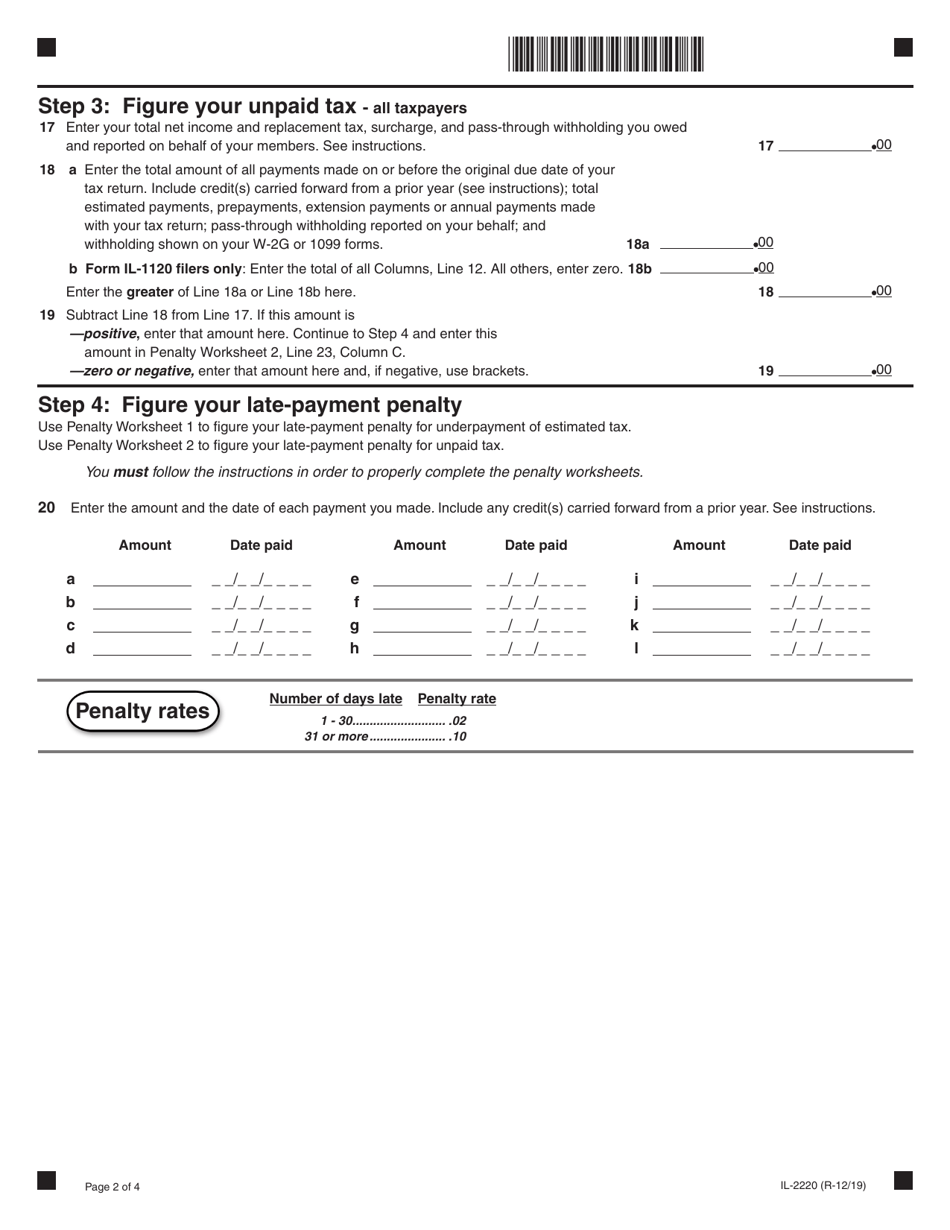

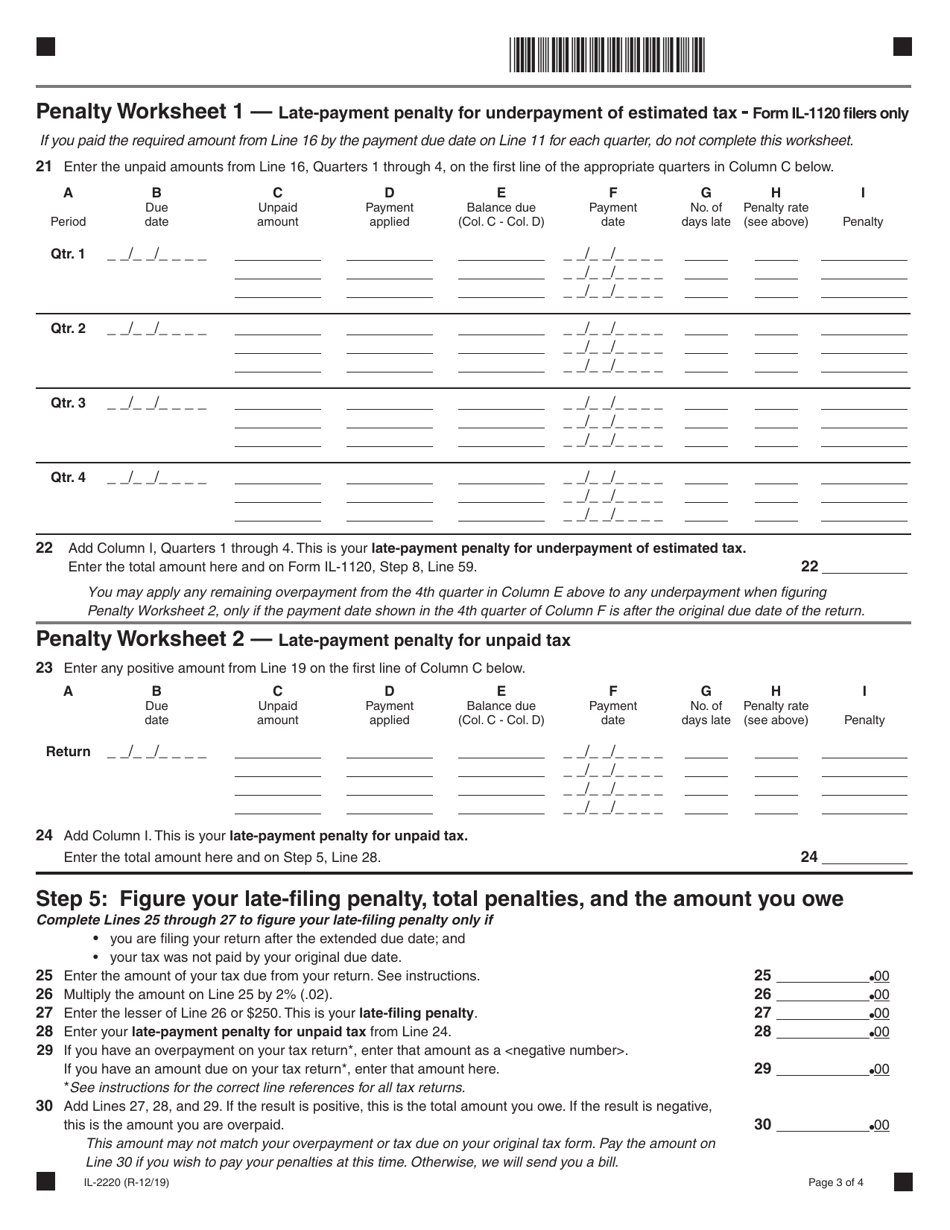

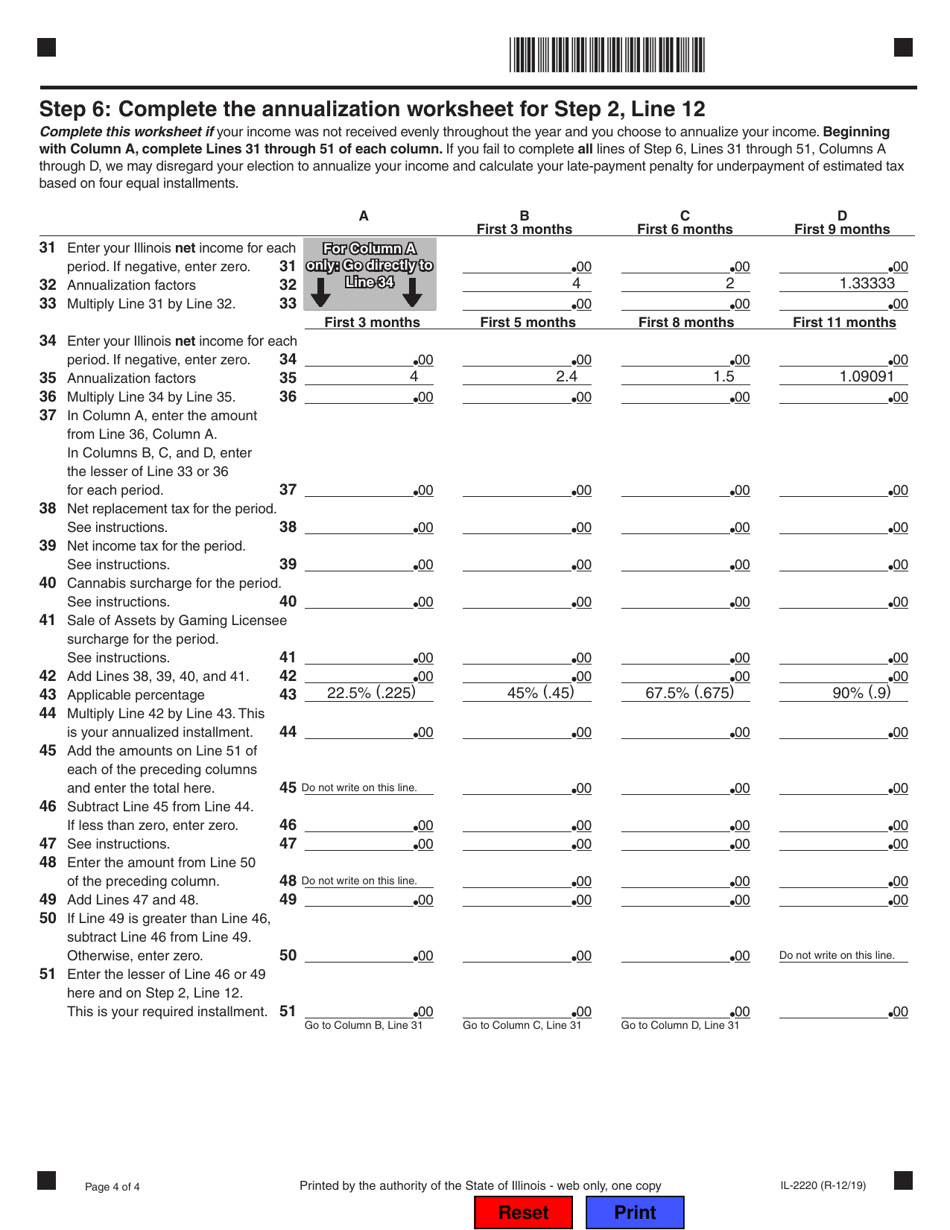

Q: What penalties does Form IL-2220 compute?

A: Form IL-2220 computes penalties for late payment of income tax, failure to file a return or pay tax, and underpayment of estimated tax.

Q: How do I fill out Form IL-2220?

A: You should follow the instructions provided with Form IL-2220 to accurately fill out the form.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2220 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.