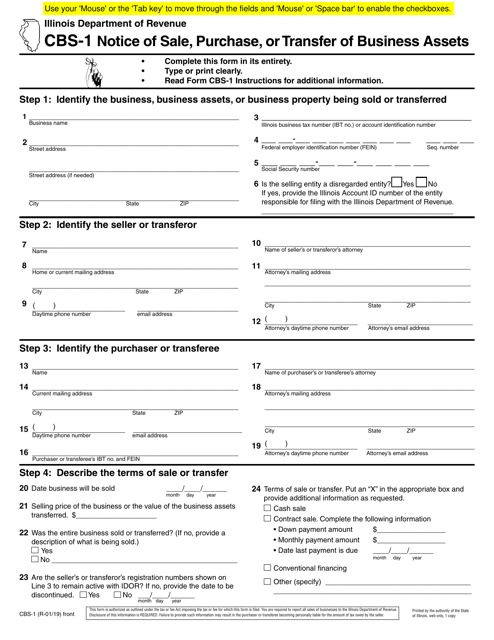

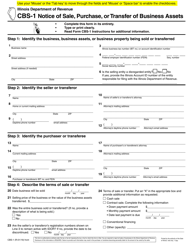

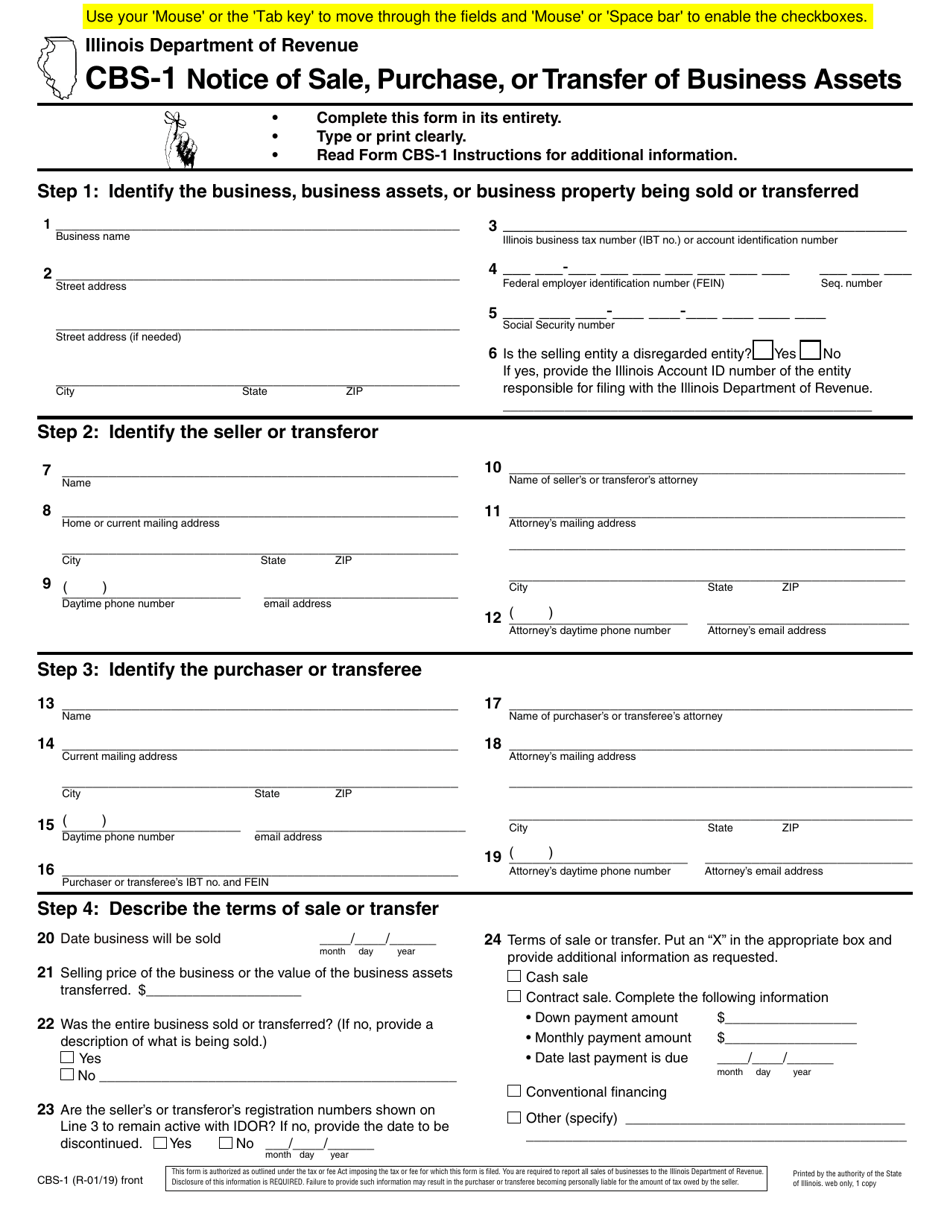

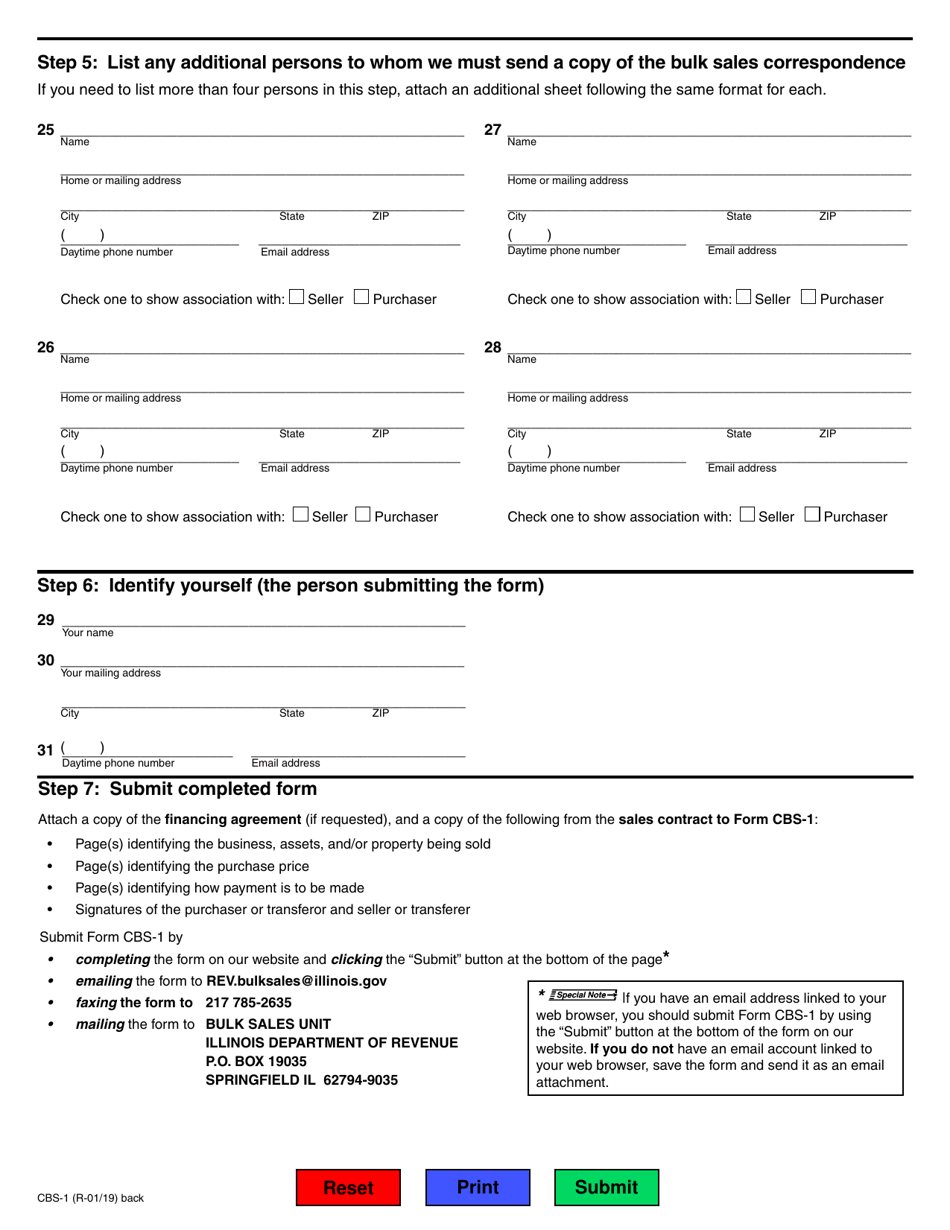

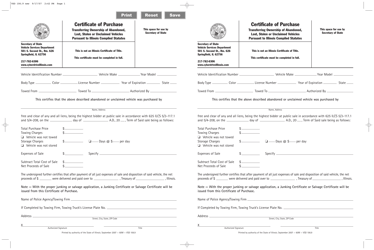

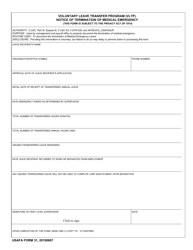

Form CBS-1 Notice of Sale, Purchase, or Transfer of Business Assets - Illinois

What Is Form CBS-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the purpose of Form CBS-1?

A: Form CBS-1 is used to notify the Illinois Department of Revenue about the sale, purchase, or transfer of business assets in the state.

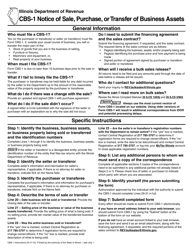

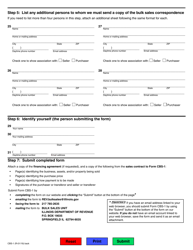

Q: Who needs to file Form CBS-1?

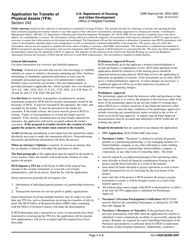

A: The buyer or transferee of the business assets is generally responsible for filing Form CBS-1 within 30 days of the transaction.

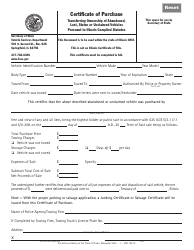

Q: What information is required on Form CBS-1?

A: The form requires details about the buyer, seller, and the transaction, including the purchase price and the type of assets involved.

Q: Are there any exemptions or exceptions to filing Form CBS-1?

A: Yes, certain transactions may be exempt from filing, such as transfers between related entities or transfers of nominal consideration.

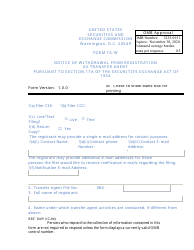

Q: Are there any penalties for not filing Form CBS-1?

A: Yes, failure to file Form CBS-1 or filing it late may result in penalties imposed by the Illinois Department of Revenue.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBS-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.