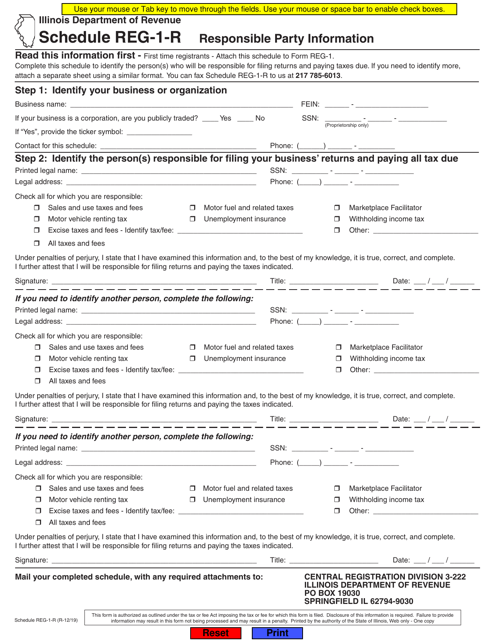

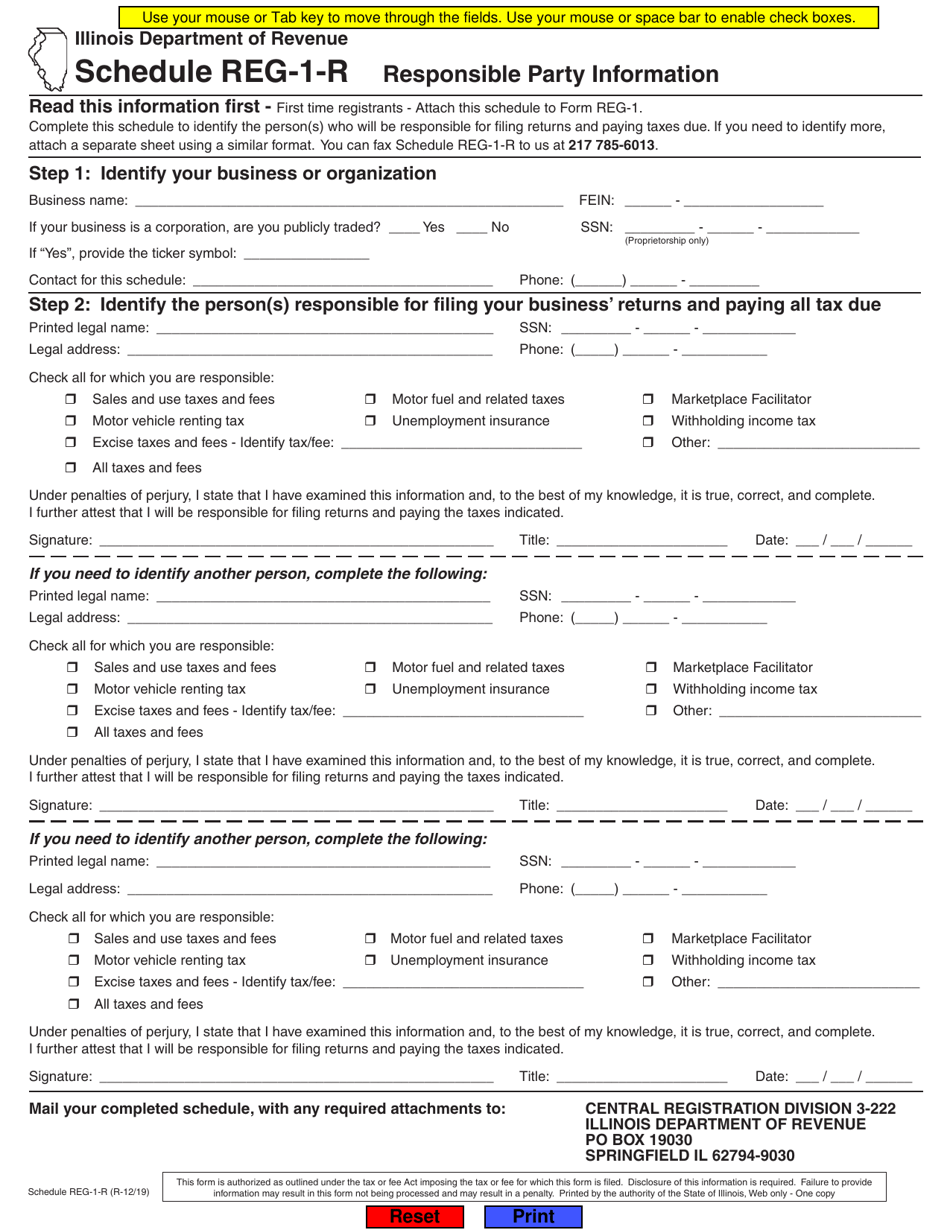

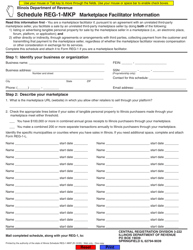

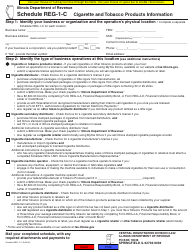

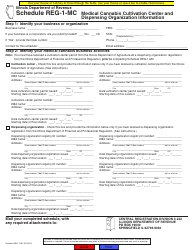

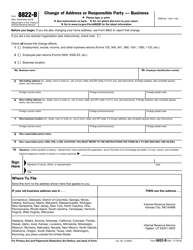

Schedule REG-1-R Responsible Party Information - Illinois

What Is Schedule REG-1-R?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REG-1-R?

A: REG-1-R is a schedule used to provide responsible party information in Illinois.

Q: What is the purpose of REG-1-R?

A: The purpose of REG-1-R is to collect information about the responsible party for tax purposes in Illinois.

Q: Who needs to complete REG-1-R?

A: Individuals or entities that are required to provide responsible party information for tax purposes in Illinois need to complete REG-1-R.

Q: Is REG-1-R mandatory?

A: Yes, REG-1-R is mandatory for individuals or entities required to provide responsible party information for tax purposes in Illinois.

Q: What information is required on REG-1-R?

A: REG-1-R requires the responsible party's name, address, social security number or federal tax identification number, and relationship to the entity.

Q: When should REG-1-R be filed?

A: REG-1-R should be filed within 60 days after the responsible party is identified.

Q: Are there any penalties for not filing REG-1-R?

A: Yes, there are penalties for not filing REG-1-R, including fines and potential denial of certain tax benefits.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule REG-1-R by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.