This version of the form is not currently in use and is provided for reference only. Download this version of

Form CAO GC9-3

for the current year.

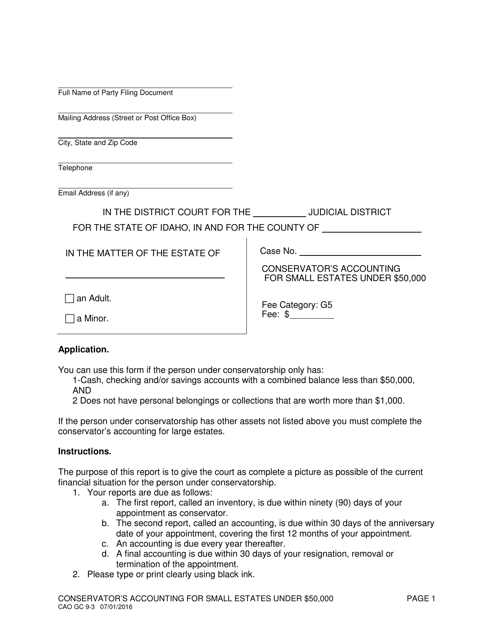

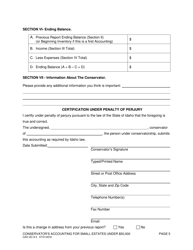

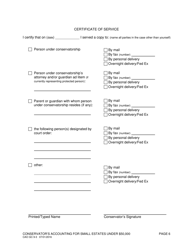

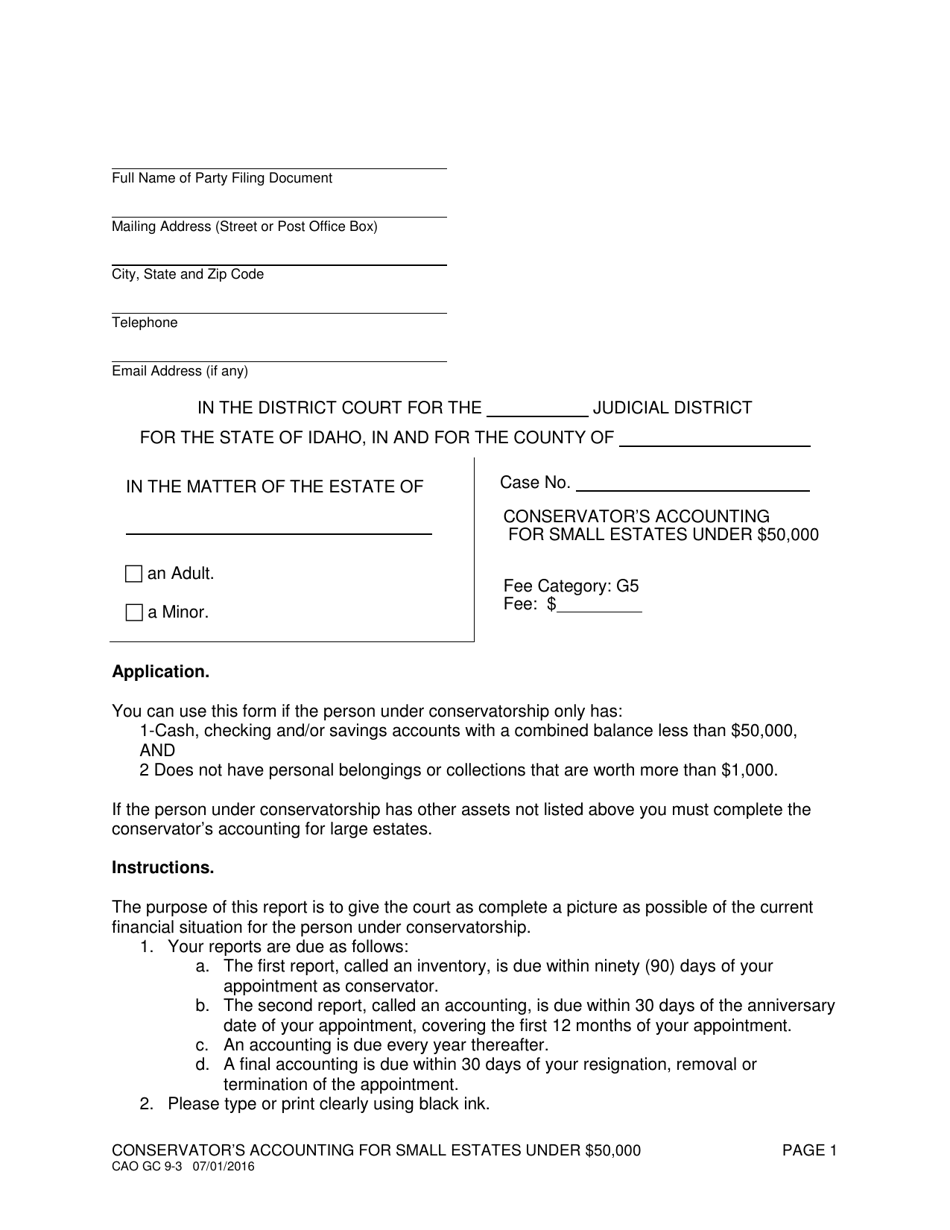

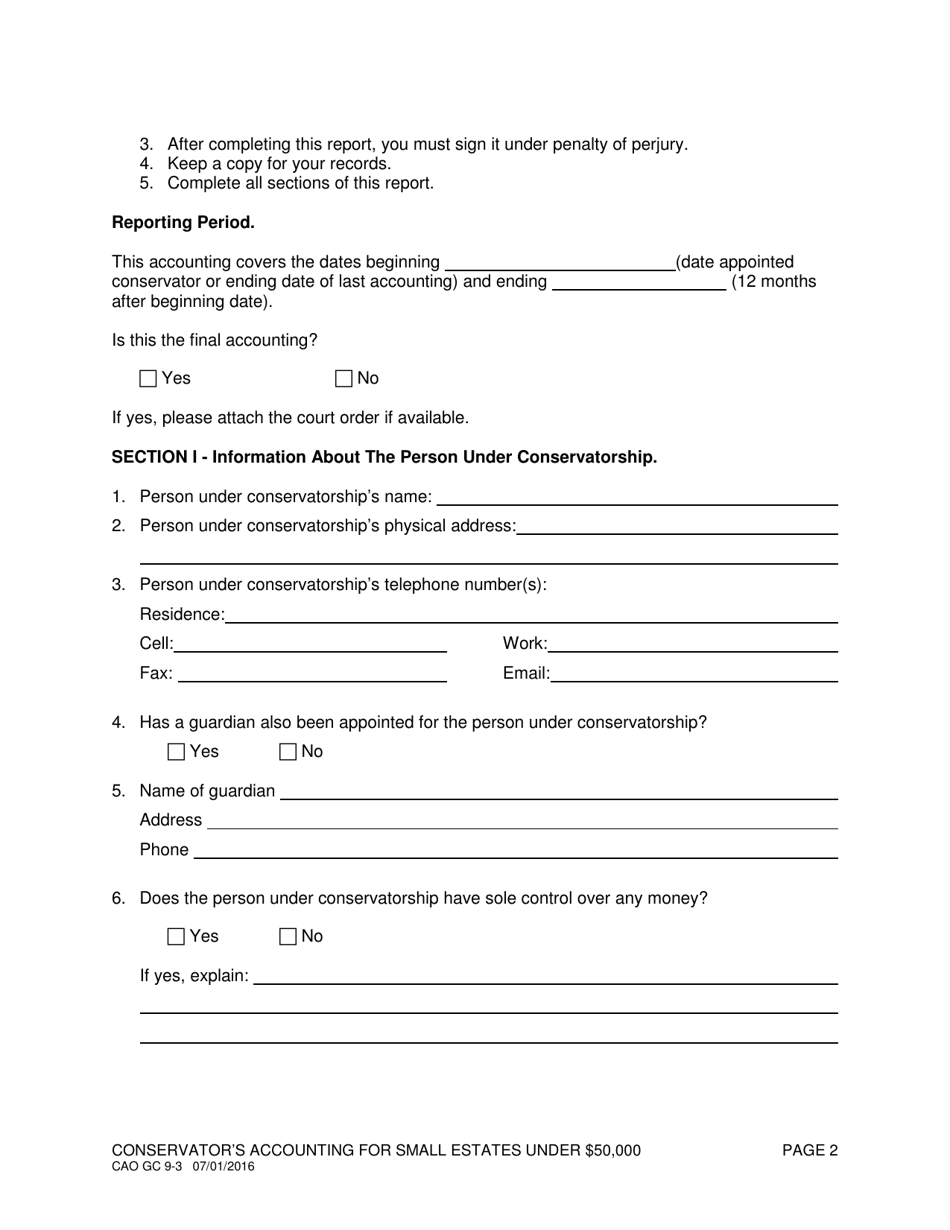

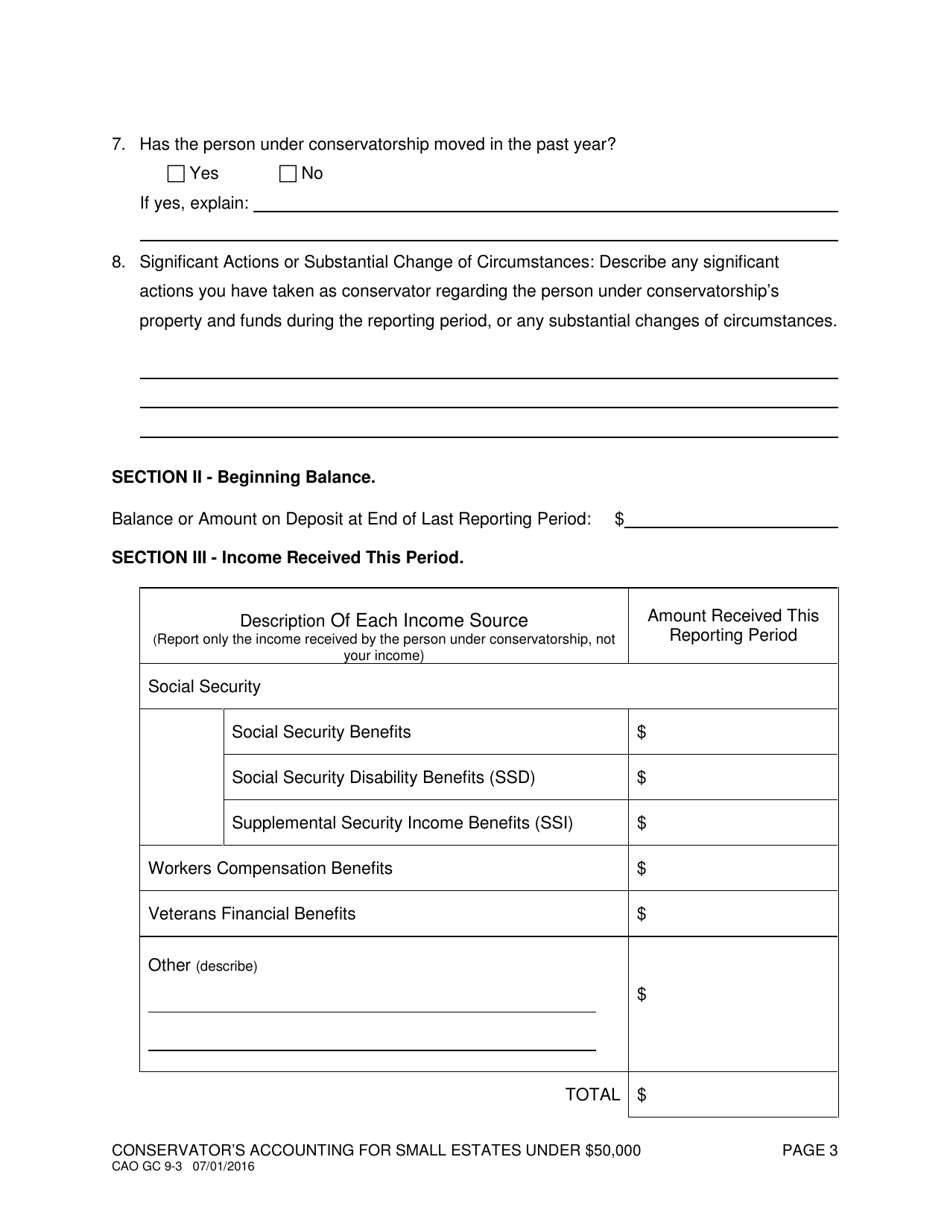

Form CAO GC9-3 Conservator's Accounting for Small Estates Under $50,000 - Idaho

What Is Form CAO GC9-3?

This is a legal form that was released by the Idaho District Courts - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAO GC9-3?

A: Form CAO GC9-3 is a document used for the conservator's accounting for small estates under $50,000 in Idaho.

Q: Who uses Form CAO GC9-3?

A: This form is used by conservators who are responsible for accounting for small estates in Idaho.

Q: What is the purpose of Form CAO GC9-3?

A: The purpose of this form is to provide a detailed accounting of the conservator's actions and financial transactions regarding a small estate under $50,000 in Idaho.

Q: What is considered a small estate under $50,000?

A: In Idaho, a small estate is one with a total value of $50,000 or less.

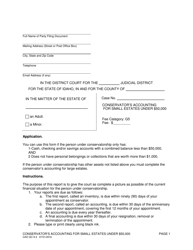

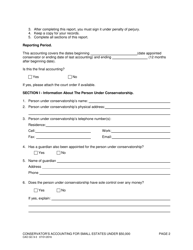

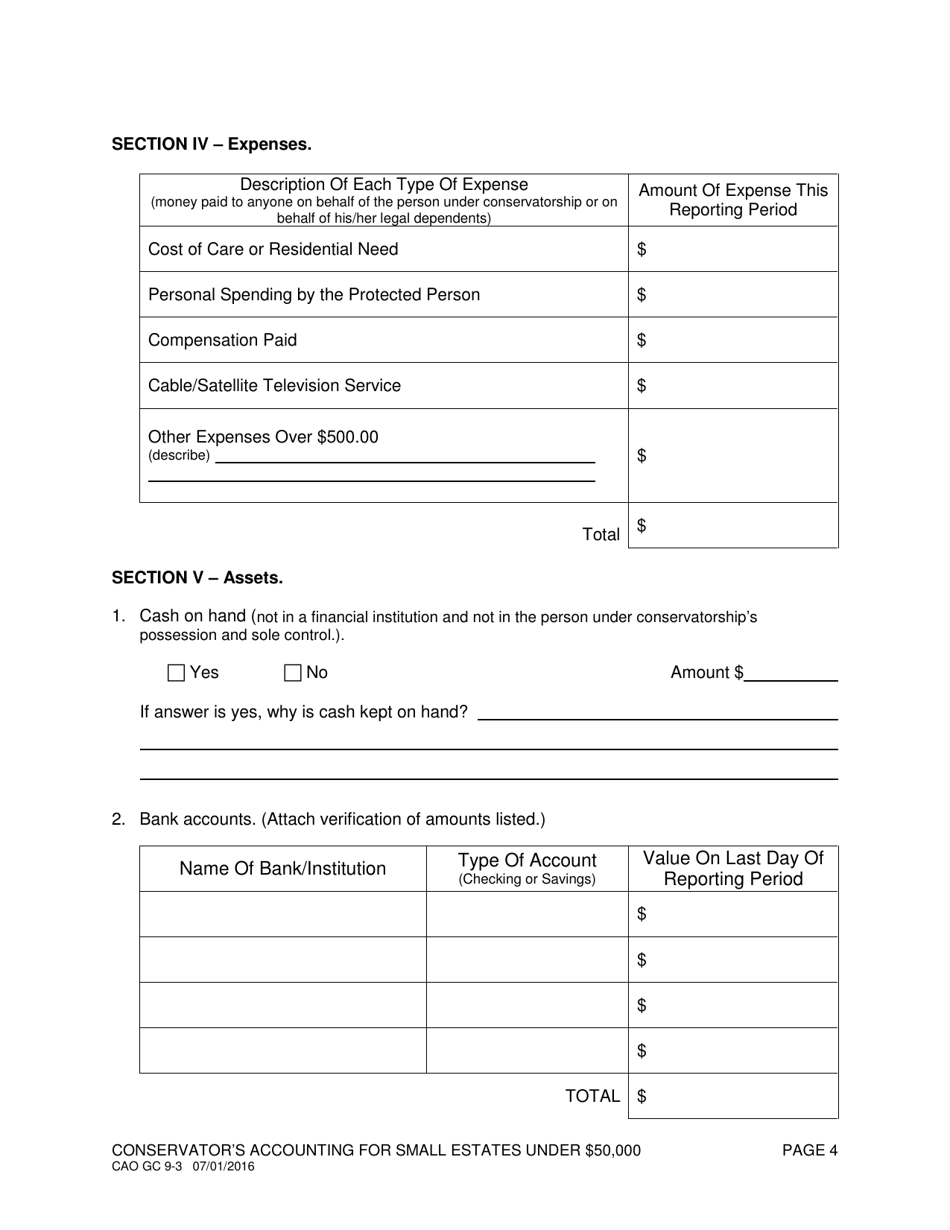

Q: What information is required in Form CAO GC9-3?

A: Form CAO GC9-3 requires the conservator to provide information about the estate's assets, income, expenses, and any distributions made.

Q: Are there any filing fees for Form CAO GC9-3?

A: No, there are no filing fees associated with filing Form CAO GC9-3 in Idaho.

Q: Are there any deadlines for filing Form CAO GC9-3?

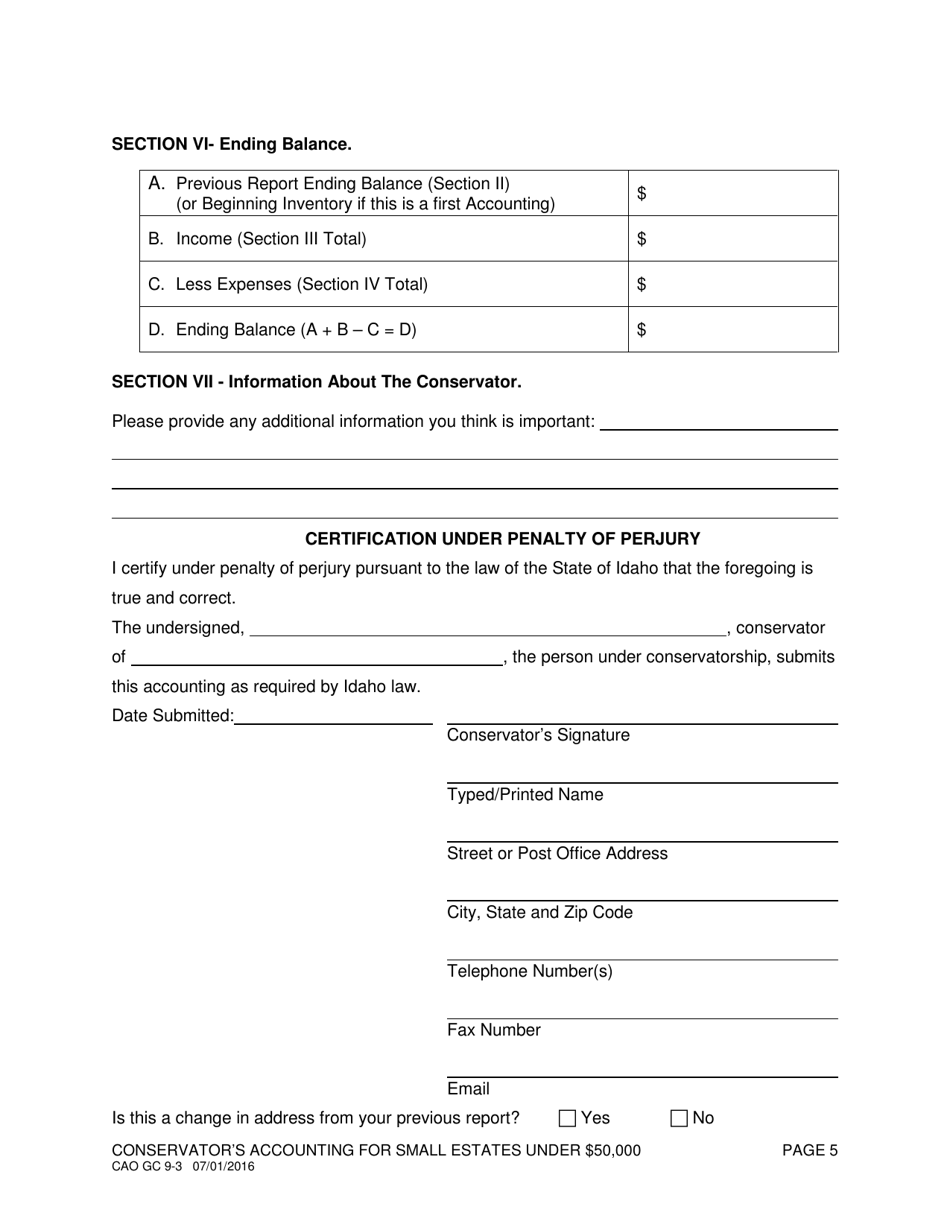

A: Yes, Form CAO GC9-3 must be filed within 90 days after the conservatorship terminates or annually if the conservatorship is ongoing.

Q: Can Form CAO GC9-3 be filed electronically?

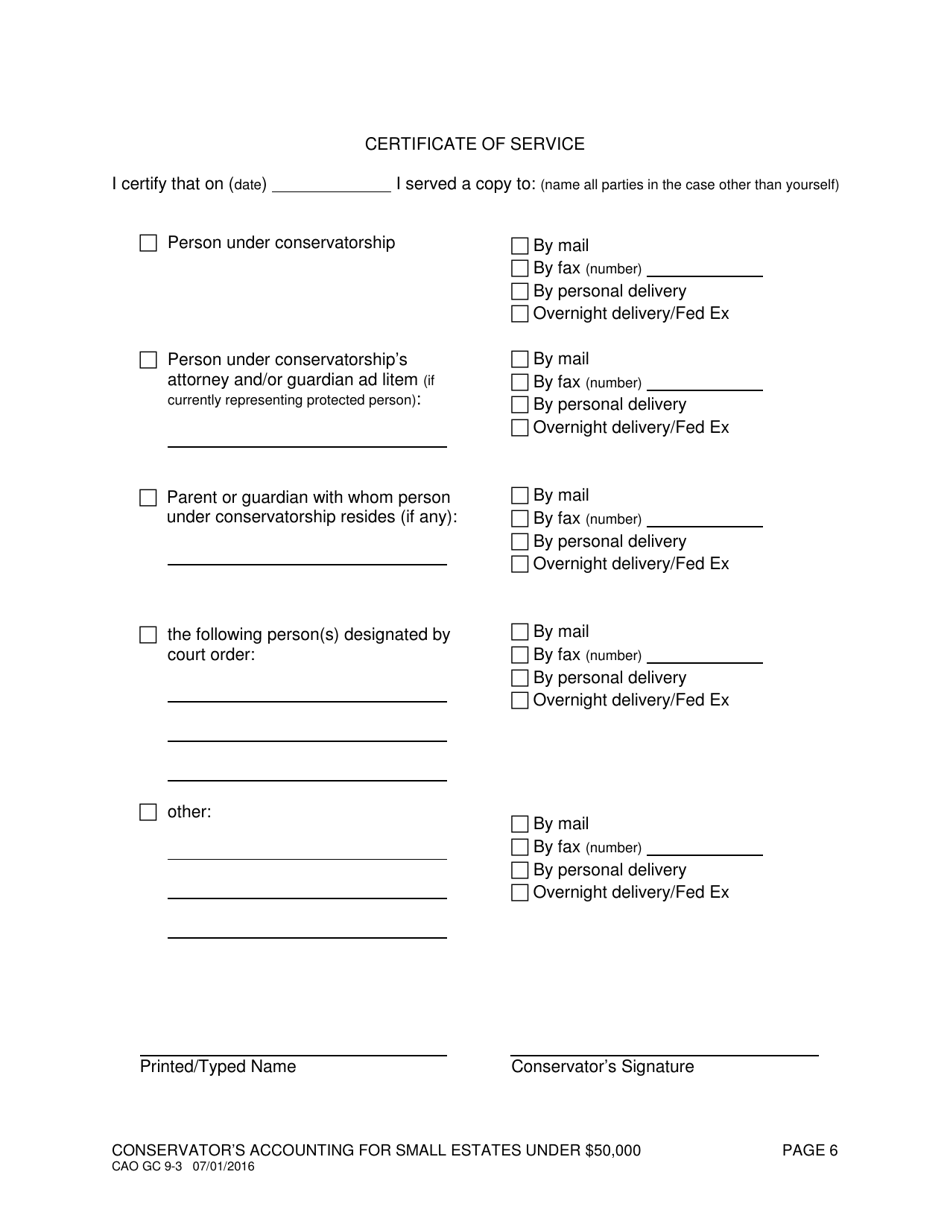

A: No, Form CAO GC9-3 cannot be filed electronically in Idaho. It must be filed in person or by mail.

Q: What happens if Form CAO GC9-3 is not filed?

A: Failure to file Form CAO GC9-3 or provide an accounting may result in penalties, fees, or removal of the conservator.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Idaho District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAO GC9-3 by clicking the link below or browse more documents and templates provided by the Idaho District Courts.