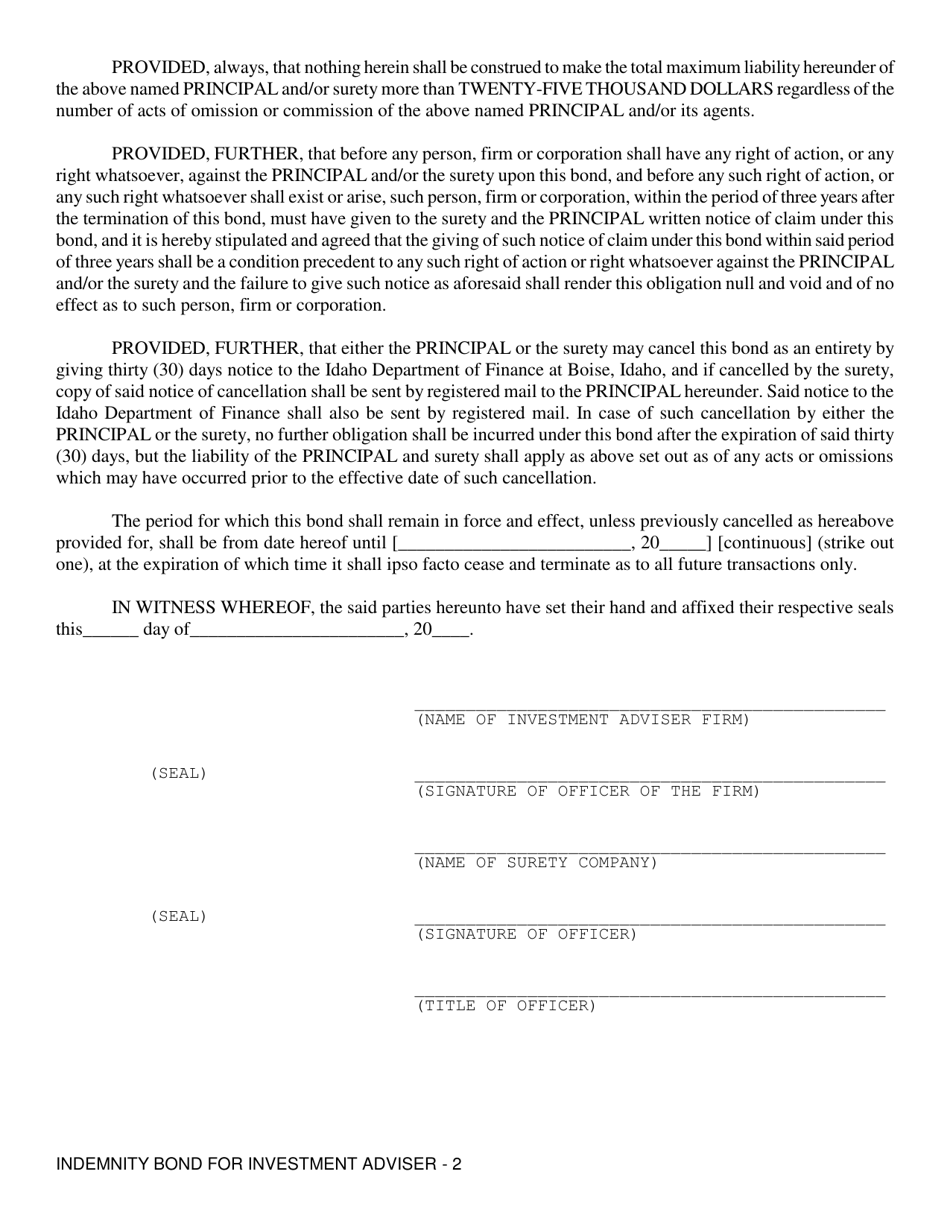

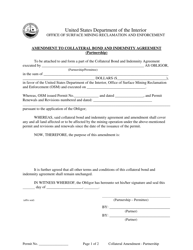

Indemnity Bond for Investment Adviser - Idaho

Indemnity Bond for Investment Adviser is a legal document that was released by the Idaho Department of Finance - a government authority operating within Idaho.

FAQ

Q: What is an indemnity bond for an investment adviser?

A: An indemnity bond for an investment adviser is a form of financial protection that may be required by the state of Idaho.

Q: Why is an indemnity bond required for an investment adviser?

A: An indemnity bond is required to protect clients and investors in case the investment adviser engages in fraudulent or unethical behavior.

Q: How does an indemnity bond work?

A: If an investment adviser is found to have committed fraud or misconduct, the indemnity bond can be used to compensate affected clients and investors.

Q: Is an indemnity bond mandatory for all investment advisers in Idaho?

A: Yes, an indemnity bond is generally required for all investment advisers operating in Idaho.

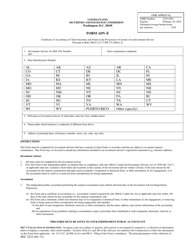

Q: How much does an indemnity bond cost?

A: The cost of an indemnity bond can vary based on factors such as the value of the assets being managed by the investment adviser and the adviser's financial history.

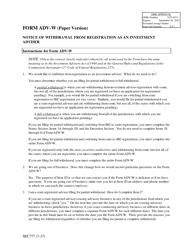

Form Details:

- The latest edition currently provided by the Idaho Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Finance.