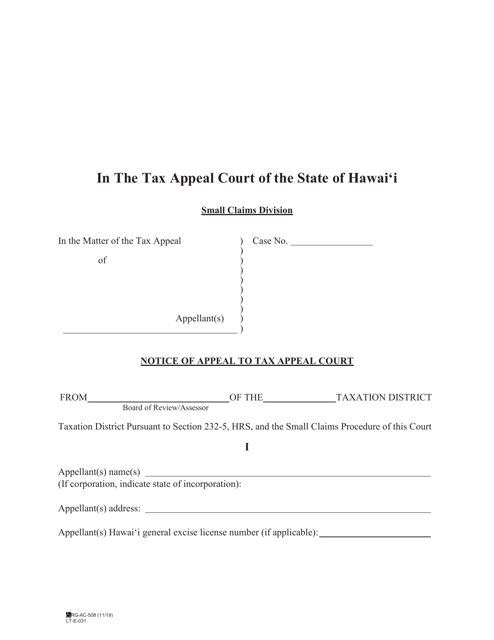

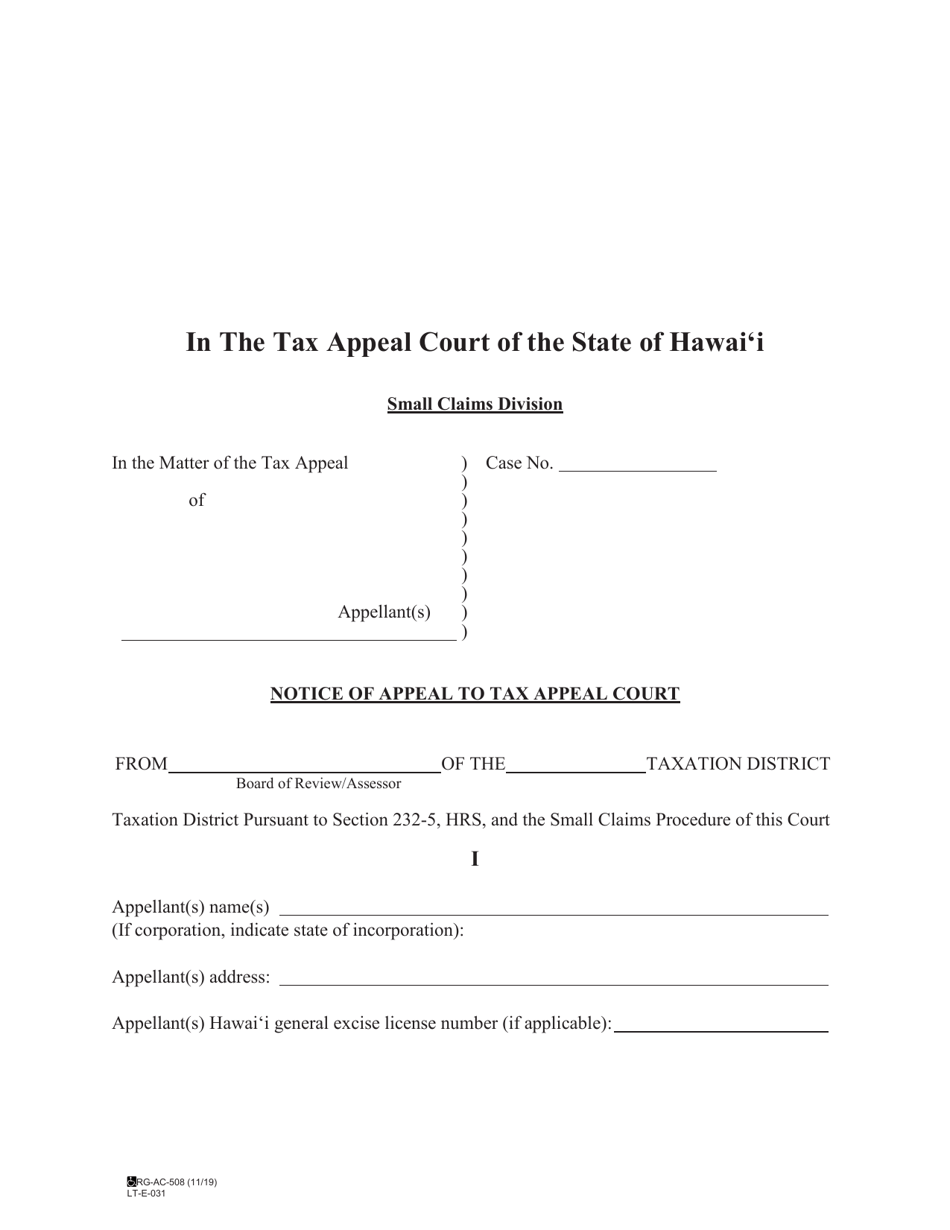

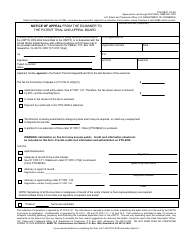

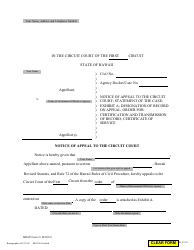

Form LTE031 Notice of Appeal to Tax Appeal Court - Hawaii

What Is Form LTE031?

This is a legal form that was released by the Hawaii Tax Appeal Court - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LTE031?

A: Form LTE031 is the Notice of Appeal to Tax Appeal Court in Hawaii.

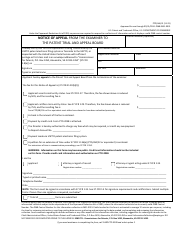

Q: When should I use Form LTE031?

A: You should use Form LTE031 when you want to appeal a decision made by the Department of Taxation in Hawaii.

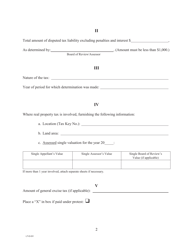

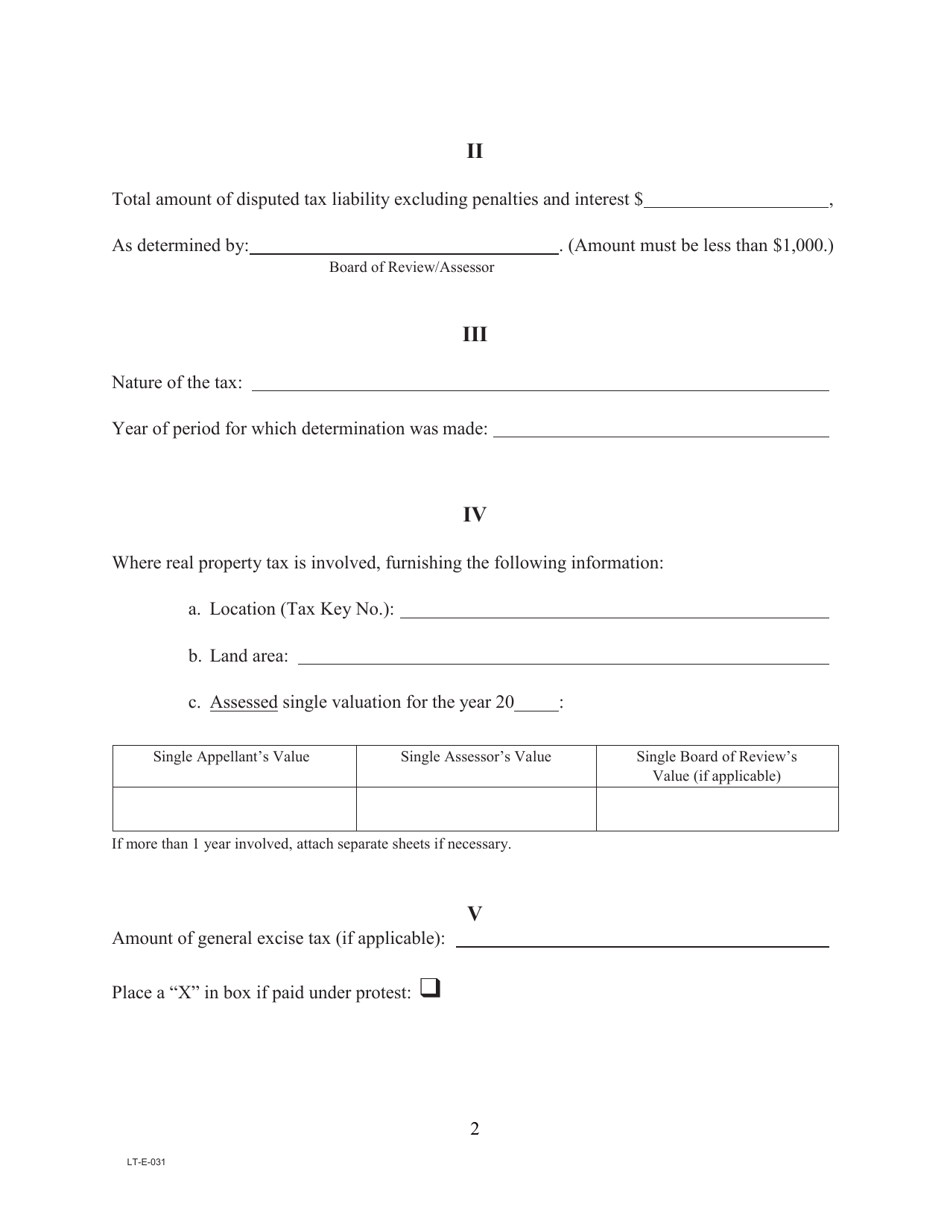

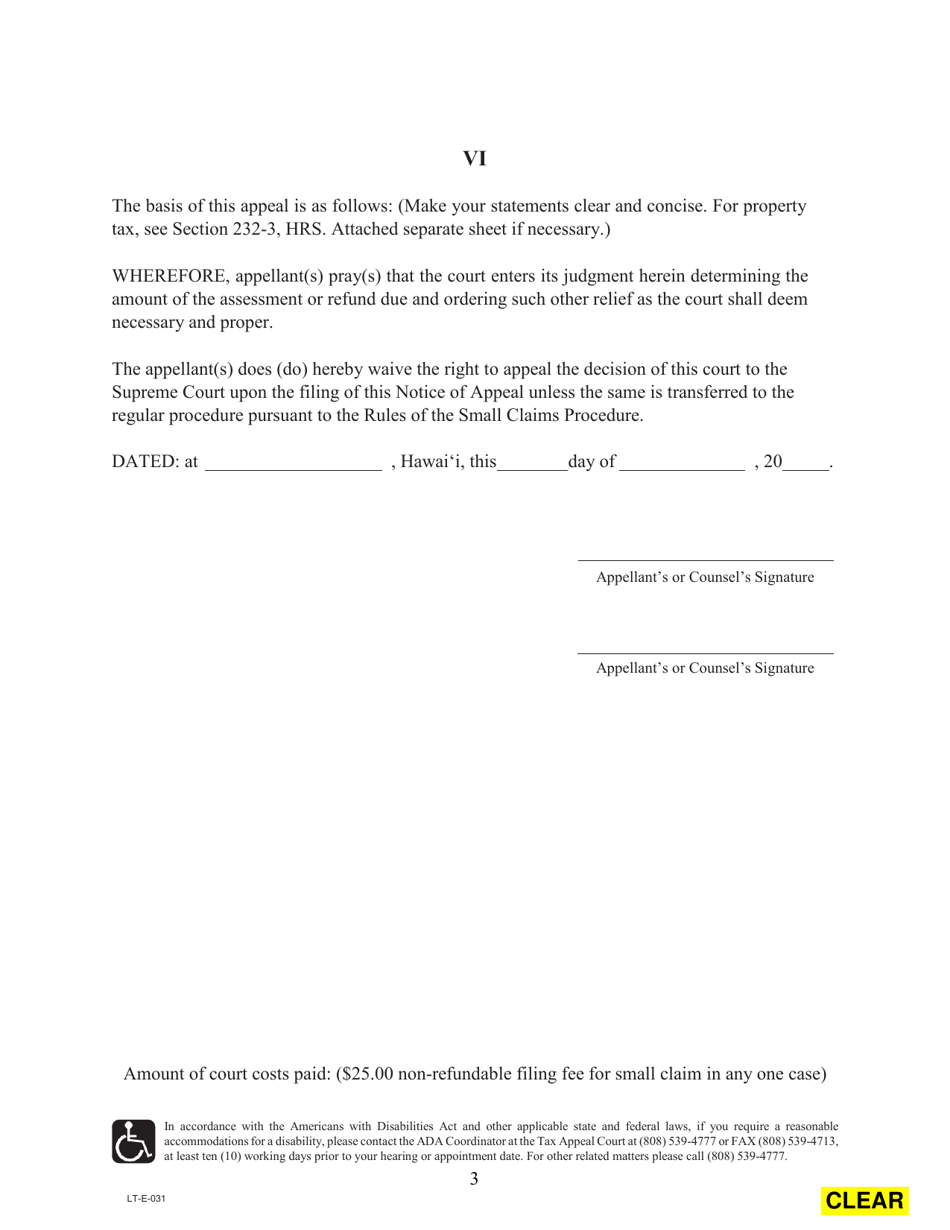

Q: What information is required in Form LTE031?

A: Form LTE031 requires information such as your name, address, the tax year or period involved, the tax type or category, and the grounds for your appeal.

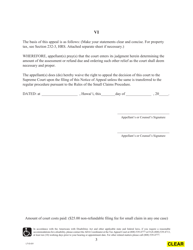

Q: How do I file Form LTE031?

A: After completing and signing Form LTE031, you must file it with the Tax Appeal Court in Hawaii. You may submit it in person or by mail.

Q: Is there a deadline for filing Form LTE031?

A: Yes, there is a deadline for filing Form LTE031. The appeal must generally be filed within 30 days of the final decision by the Department of Taxation.

Q: What happens after I file Form LTE031?

A: After you file Form LTE031, the Tax Appeal Court will review your appeal and schedule a hearing. You will be notified of the hearing date and any further instructions.

Q: Can I seek legal representation for my appeal?

A: Yes, you have the right to seek legal representation for your appeal. You may choose to hire an attorney to assist you throughout the appeals process.

Q: What should I do if I need help filling out Form LTE031?

A: If you need assistance with filling out Form LTE031, you may consider consulting with a tax professional or seeking guidance from the Tax Appeal Court.

Q: Can I appeal the decision of the Tax Appeal Court?

A: Yes, if you are not satisfied with the decision of the Tax Appeal Court, you may have the option to further appeal to the Hawaii State Supreme Court, depending on the circumstances.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Hawaii Tax Appeal Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LTE031 by clicking the link below or browse more documents and templates provided by the Hawaii Tax Appeal Court.