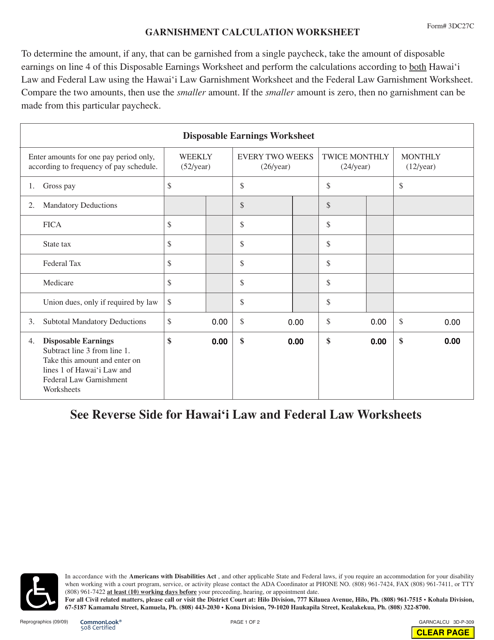

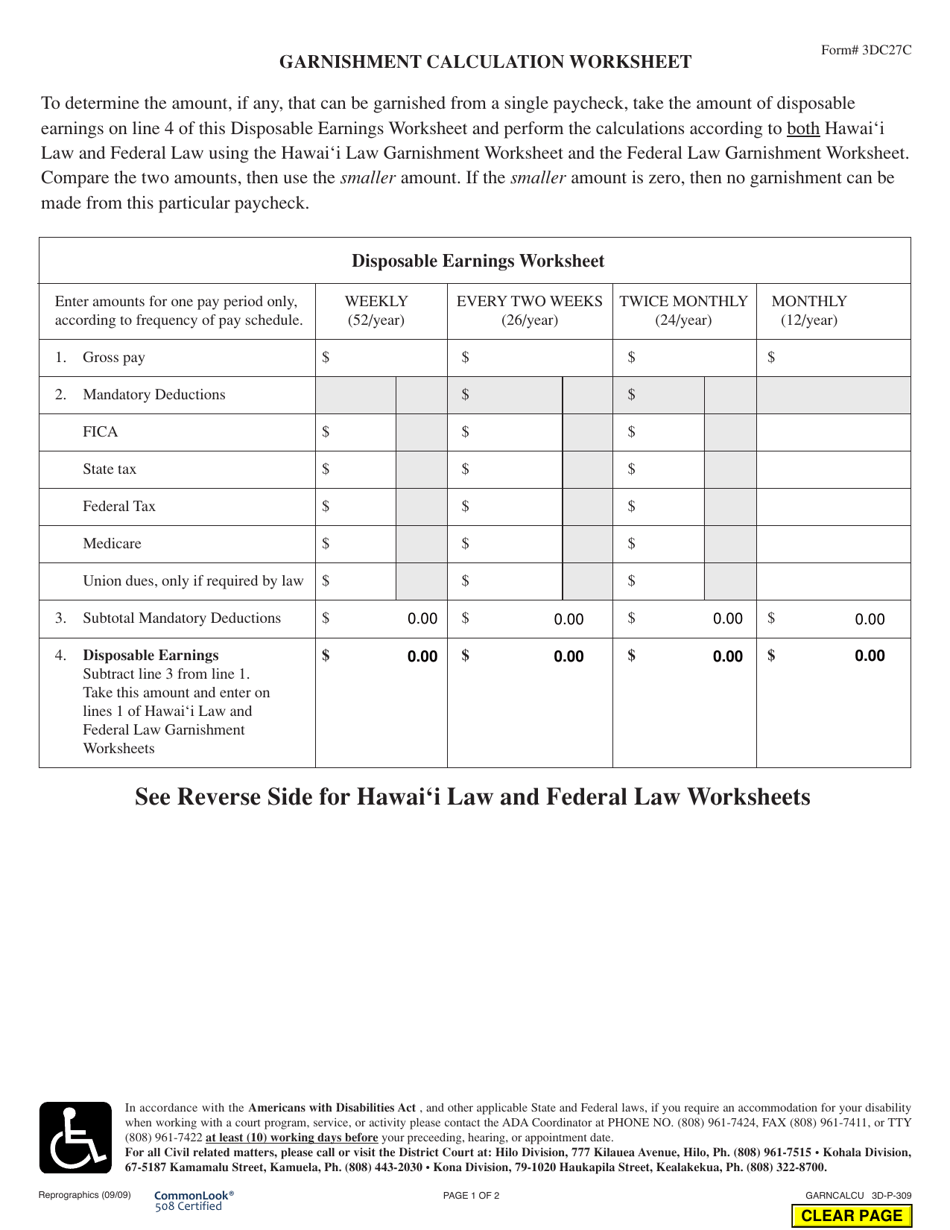

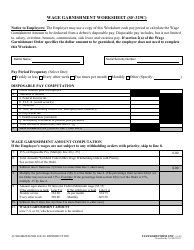

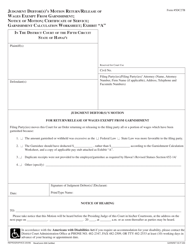

Form 3DC27C Garnishment Calculation Worksheet - Hawaii

What Is Form 3DC27C?

This is a legal form that was released by the Hawaii District Courts - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3DC27C?

A: Form 3DC27C is a Garnishment Calculation Worksheet specific to Hawaii.

Q: What is a Garnishment Calculation Worksheet?

A: A Garnishment Calculation Worksheet is a form used to calculate the amount of money that can be withheld from an individual's wages to satisfy a legal garnishment.

Q: Who uses Form 3DC27C?

A: Form 3DC27C is used by employers in Hawaii who need to calculate and withhold funds from an employee's wages due to a garnishment order.

Q: What information is needed for Form 3DC27C?

A: Form 3DC27C requires the employee's name and social security number, the type of garnishment, the amount to be withheld, and other relevant details.

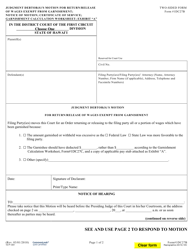

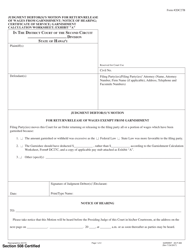

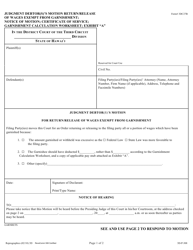

Q: Are there any exemptions to garnishment in Hawaii?

A: Yes, Hawaii law provides certain exemptions from garnishment, such as a certain percentage of income being protected. These exemptions vary depending on the individual's circumstances.

Q: How often should Form 3DC27C be filed?

A: Form 3DC27C should be filled out and processed each time an employer receives a garnishment order for an employee.

Q: What happens if an employer fails to withhold the appropriate amount?

A: If an employer fails to withhold the appropriate amount from an employee's wages as ordered by the garnishment, the employer may be subject to penalties or legal consequences.

Q: Can an employee challenge a garnishment order?

A: Yes, an employee has the right to challenge a garnishment order through the court. They can provide documentation and evidence to support their case.

Form Details:

- Released on September 1, 2009;

- The latest edition provided by the Hawaii District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3DC27C by clicking the link below or browse more documents and templates provided by the Hawaii District Courts.