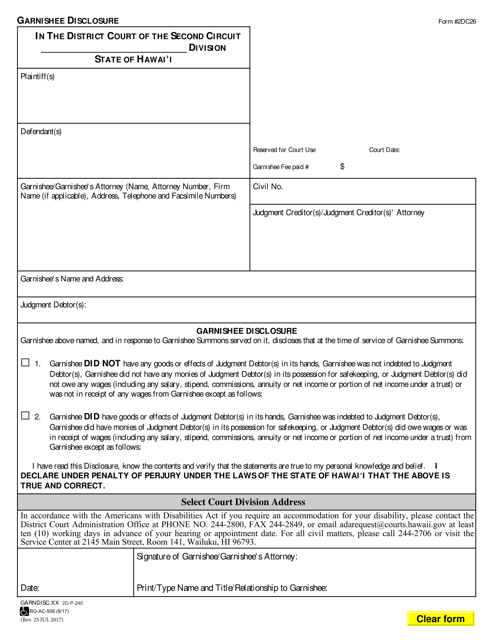

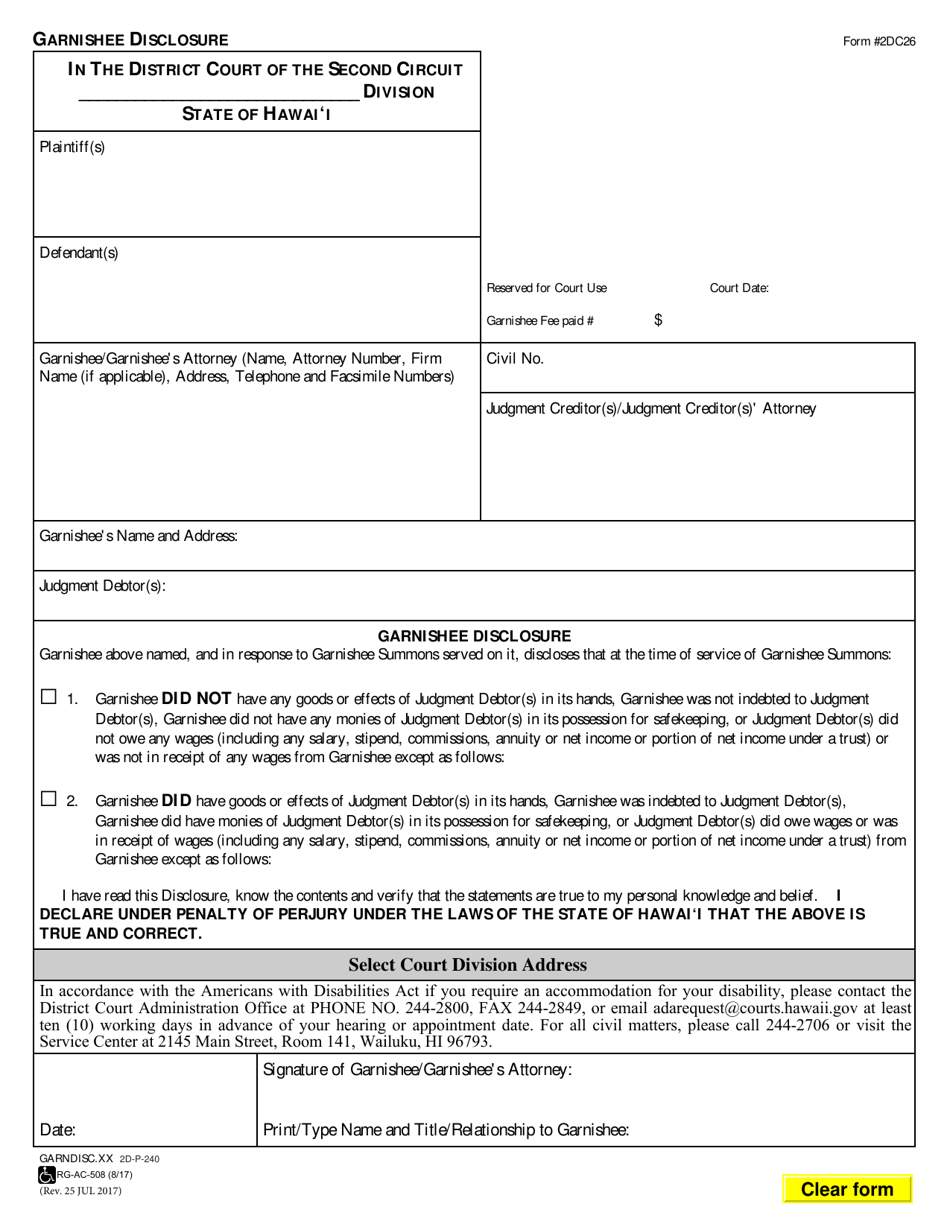

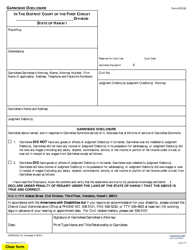

Form 2DC26 Garnishee Disclosure - Hawaii

What Is Form 2DC26?

This is a legal form that was released by the Hawaii District Courts - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 2DC26 Garnishee Disclosure?

A: The Form 2DC26 Garnishee Disclosure is a legal document used in Hawaii in the process of collecting a debt through garnishment. It is completed by the garnishee, who is the person or entity holding the debtor's funds.

Q: Who needs to complete the Form 2DC26 Garnishee Disclosure?

A: The garnishee, who may be a bank, employer, or other entity holding the debtor's funds, needs to complete the Form 2DC26 Garnishee Disclosure.

Q: What information is required in the Form 2DC26 Garnishee Disclosure?

A: The Form 2DC26 Garnishee Disclosure requires the garnishee to provide information about the debtor's account or employment, including the amount of funds held and the nature of the garnishee's relationship with the debtor.

Q: What happens after the Form 2DC26 Garnishee Disclosure is completed?

A: Once the Form 2DC26 Garnishee Disclosure is completed, it is served on the debtor and filed with the court. The court will then review the information provided and determine the appropriate amount of funds to be garnished.

Q: Can a debtor object to the information provided in the Form 2DC26 Garnishee Disclosure?

A: Yes, a debtor may have the opportunity to object to the information provided in the Form 2DC26 Garnishee Disclosure. They should consult with their legal counsel for guidance on how to proceed.

Form Details:

- Released on July 25, 2017;

- The latest edition provided by the Hawaii District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2DC26 by clicking the link below or browse more documents and templates provided by the Hawaii District Courts.