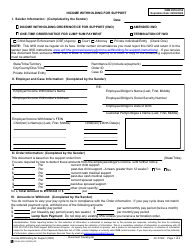

This version of the form is not currently in use and is provided for reference only. Download this version of

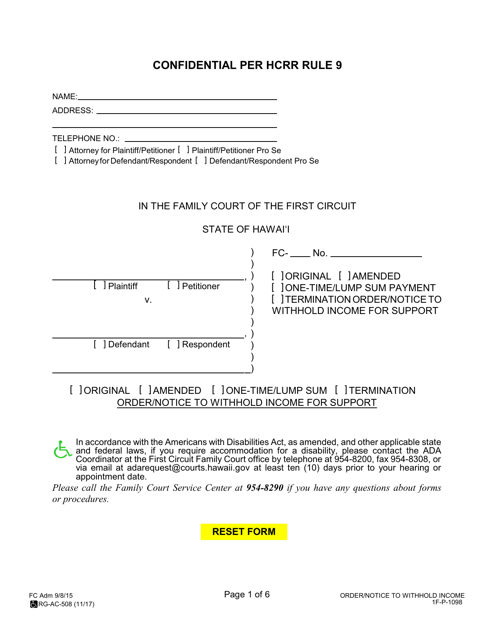

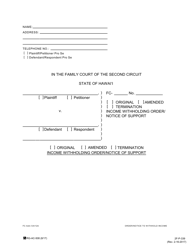

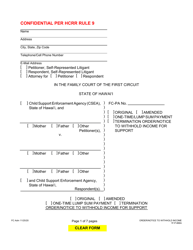

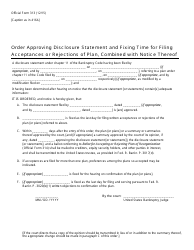

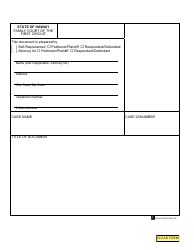

Form 1F-P-1098

for the current year.

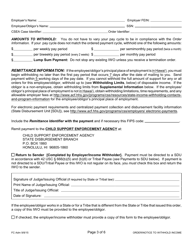

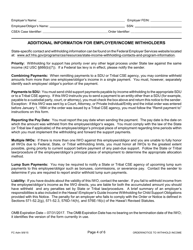

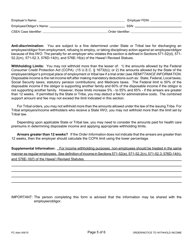

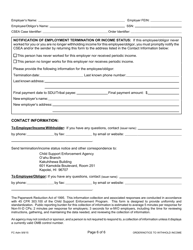

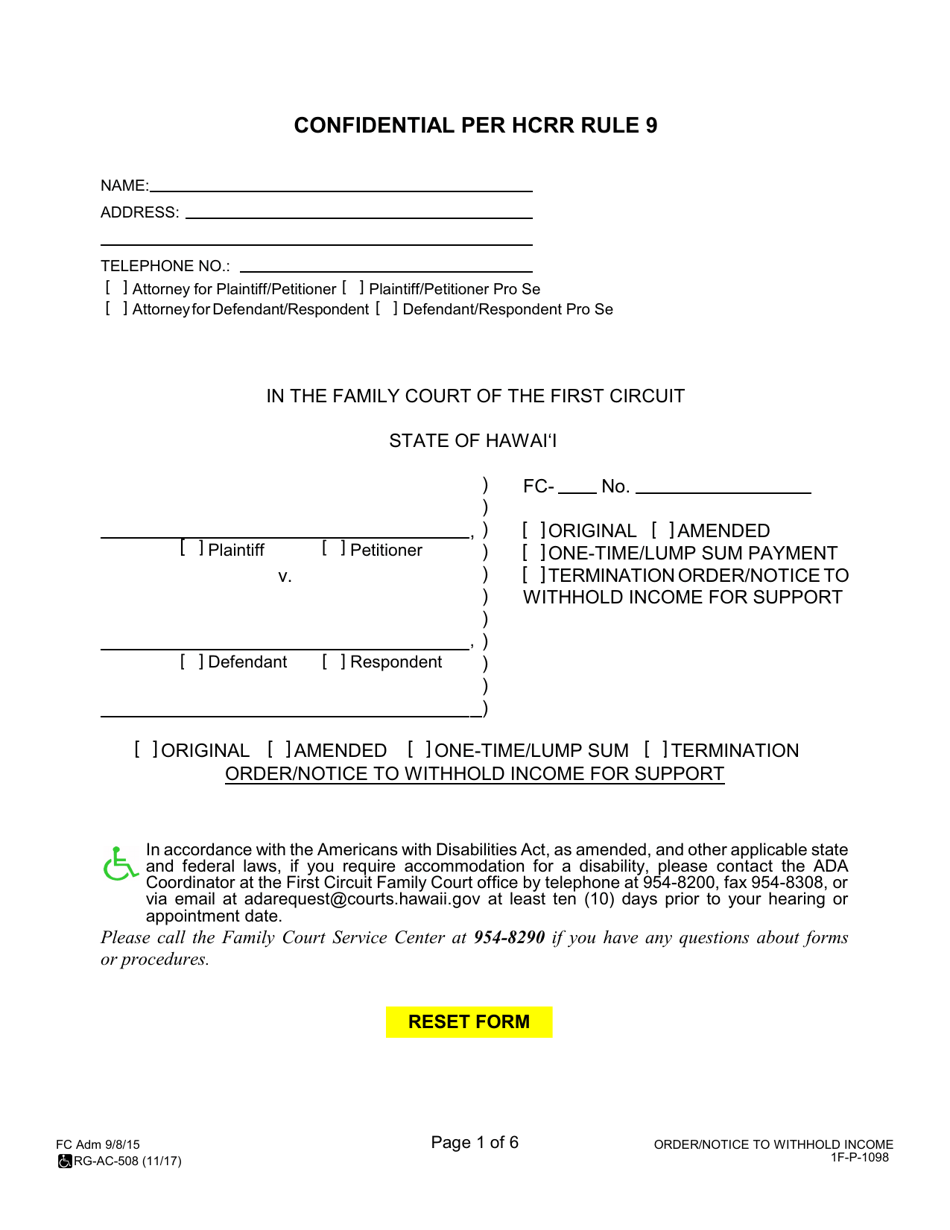

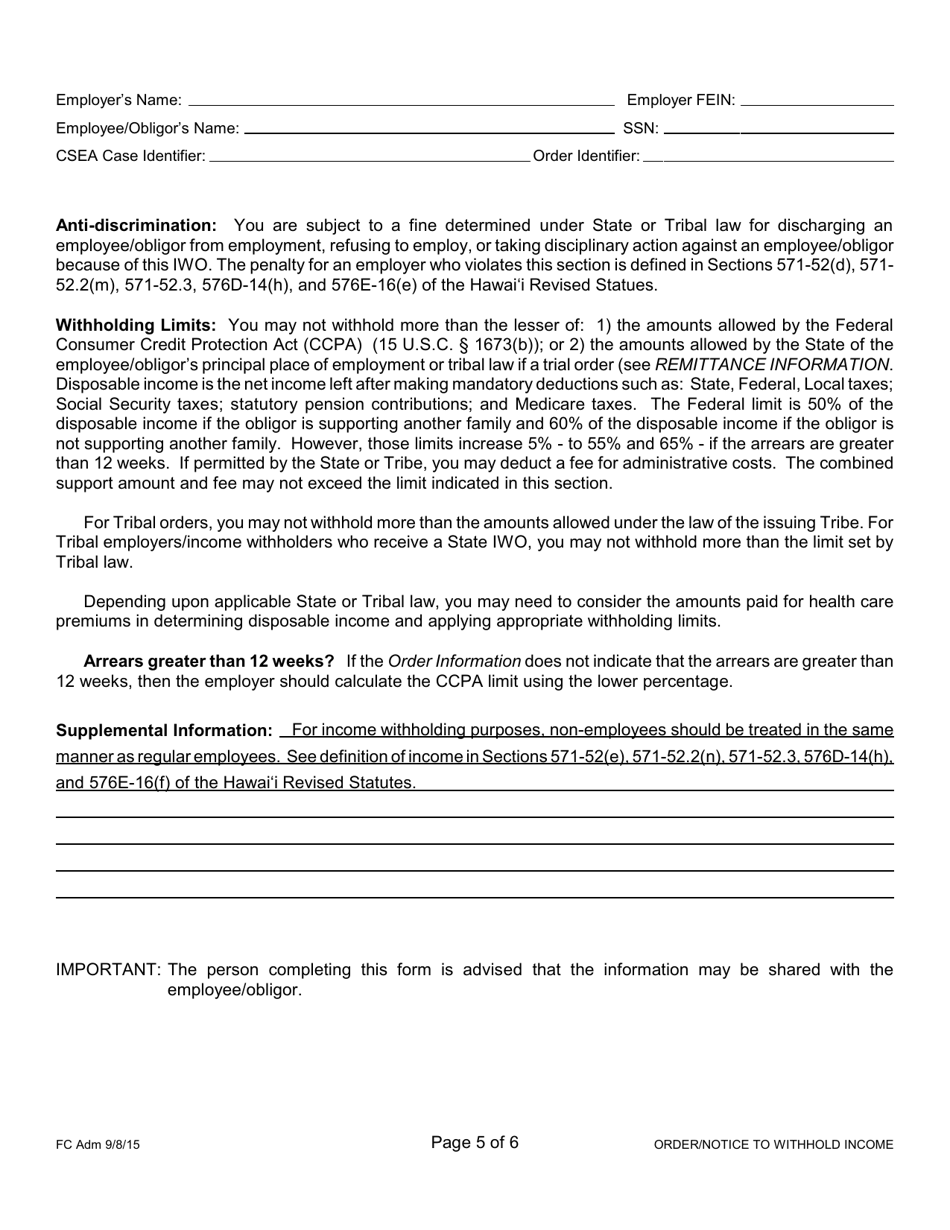

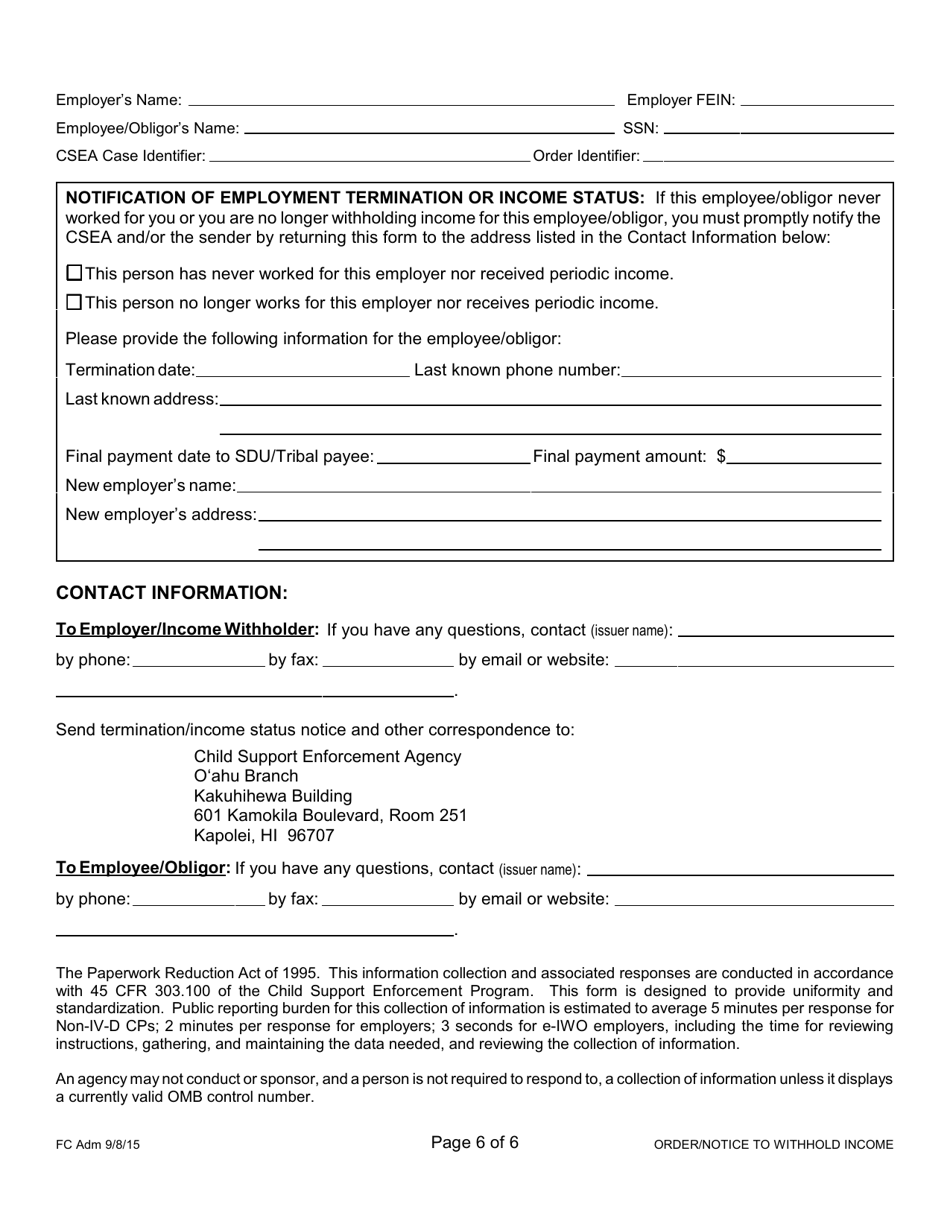

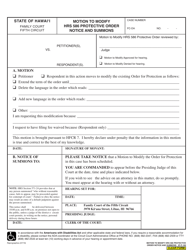

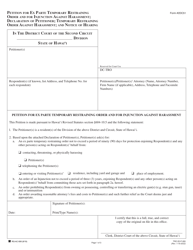

Form 1F-P-1098 Order / Notice to Withhold Income for Support - Hawaii

What Is Form 1F-P-1098?

This is a legal form that was released by the Hawaii Family Court - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1F-P-1098?

A: Form 1F-P-1098 is an Order/Notice to Withhold Income for Support document in Hawaii.

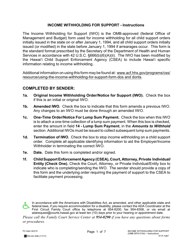

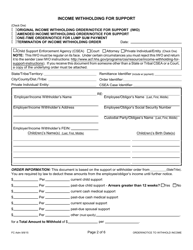

Q: What is the purpose of Form 1F-P-1098?

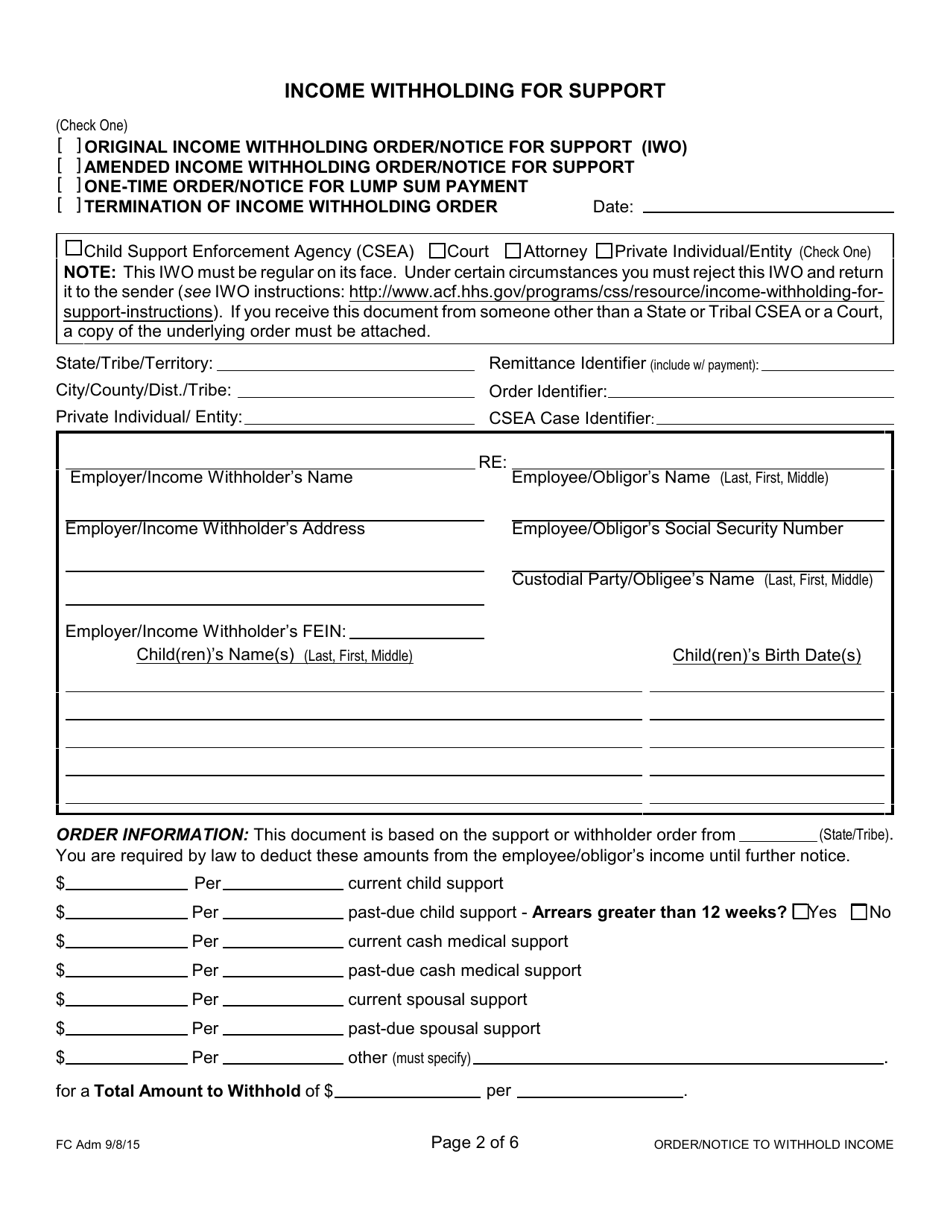

A: The purpose of Form 1F-P-1098 is to inform an employer to withhold income from an employee's paycheck for child or spousal support.

Q: Who uses Form 1F-P-1098?

A: This form is used by Hawaiian employers to comply with court-ordered obligations for child or spousal support.

Q: Is Form 1F-P-1098 specific to Hawaii?

A: Yes, Form 1F-P-1098 is specific to Hawaii and is not used in other states.

Q: Are there any fees associated with Form 1F-P-1098?

A: There are no fees associated with obtaining or filing Form 1F-P-1098.

Q: Can I modify Form 1F-P-1098?

A: No, Form 1F-P-1098 should not be modified. It should be completed as-is and submitted to the appropriate party.

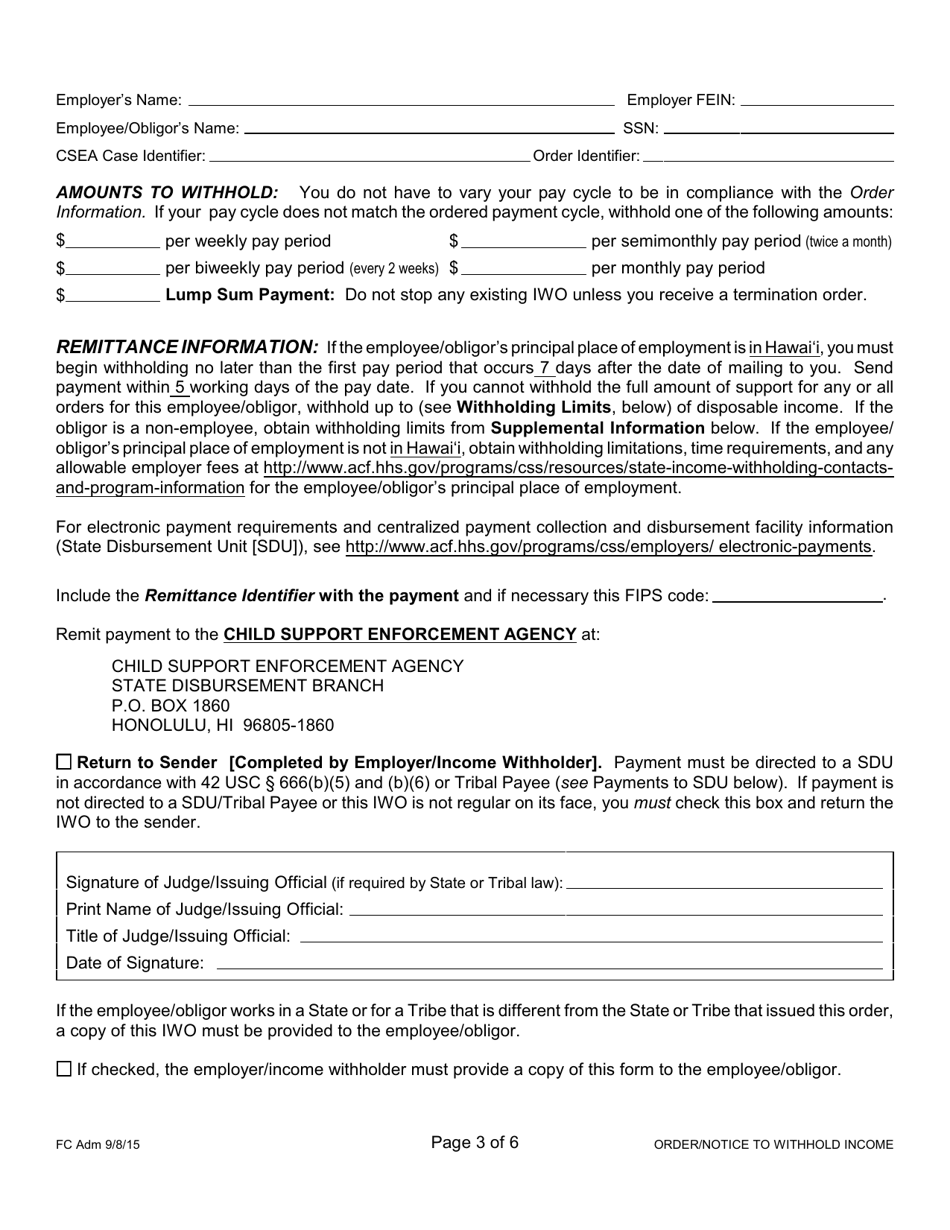

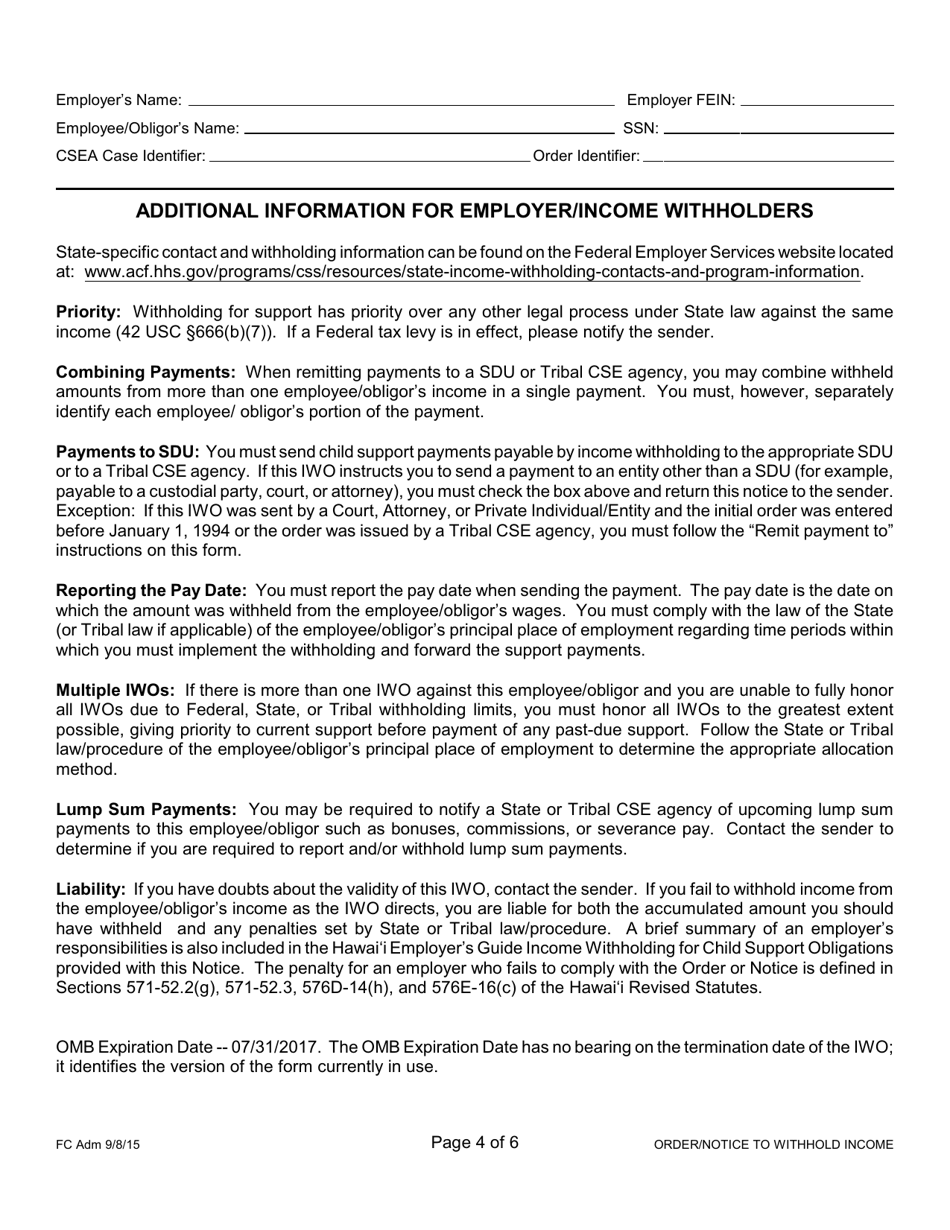

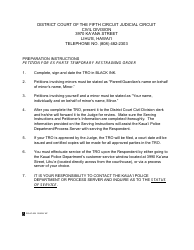

Q: What should I do if I receive Form 1F-P-1098 as an employer?

A: As an employer, if you receive Form 1F-P-1098, you should follow the instructions provided and begin withholding the specified amount from the employee's paycheck.

Q: What should I do if I receive Form 1F-P-1098 as an employee?

A: As an employee, if you receive Form 1F-P-1098, you should review the information and contact the appropriate party if you have any questions or concerns.

Q: Can I ignore or refuse to comply with Form 1F-P-1098?

A: No, it is important to comply with Form 1F-P-1098 as it is a court-ordered obligation.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Hawaii Family Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1F-P-1098 by clicking the link below or browse more documents and templates provided by the Hawaii Family Court.