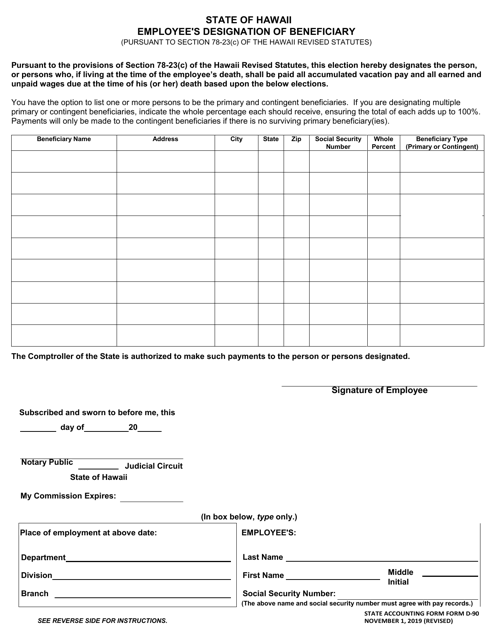

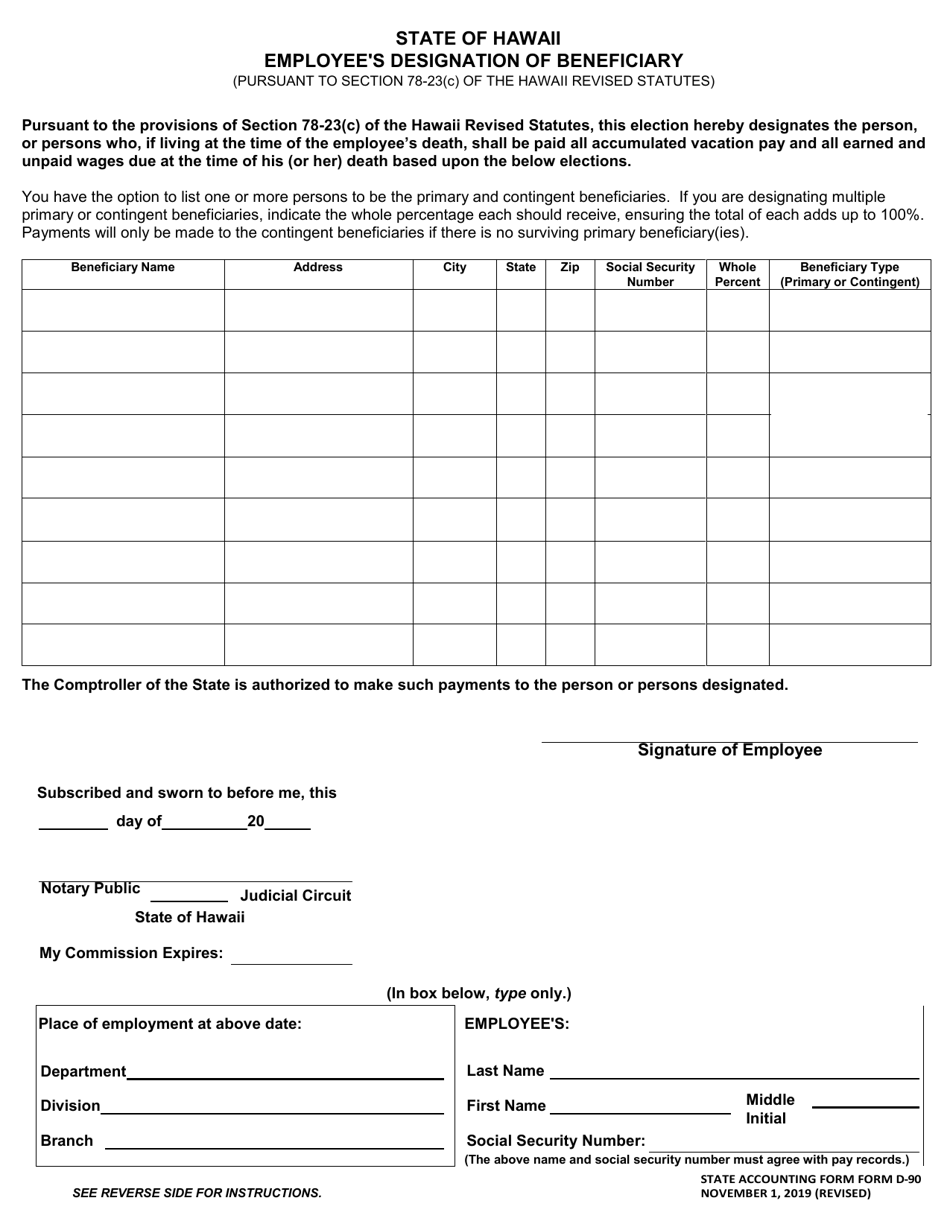

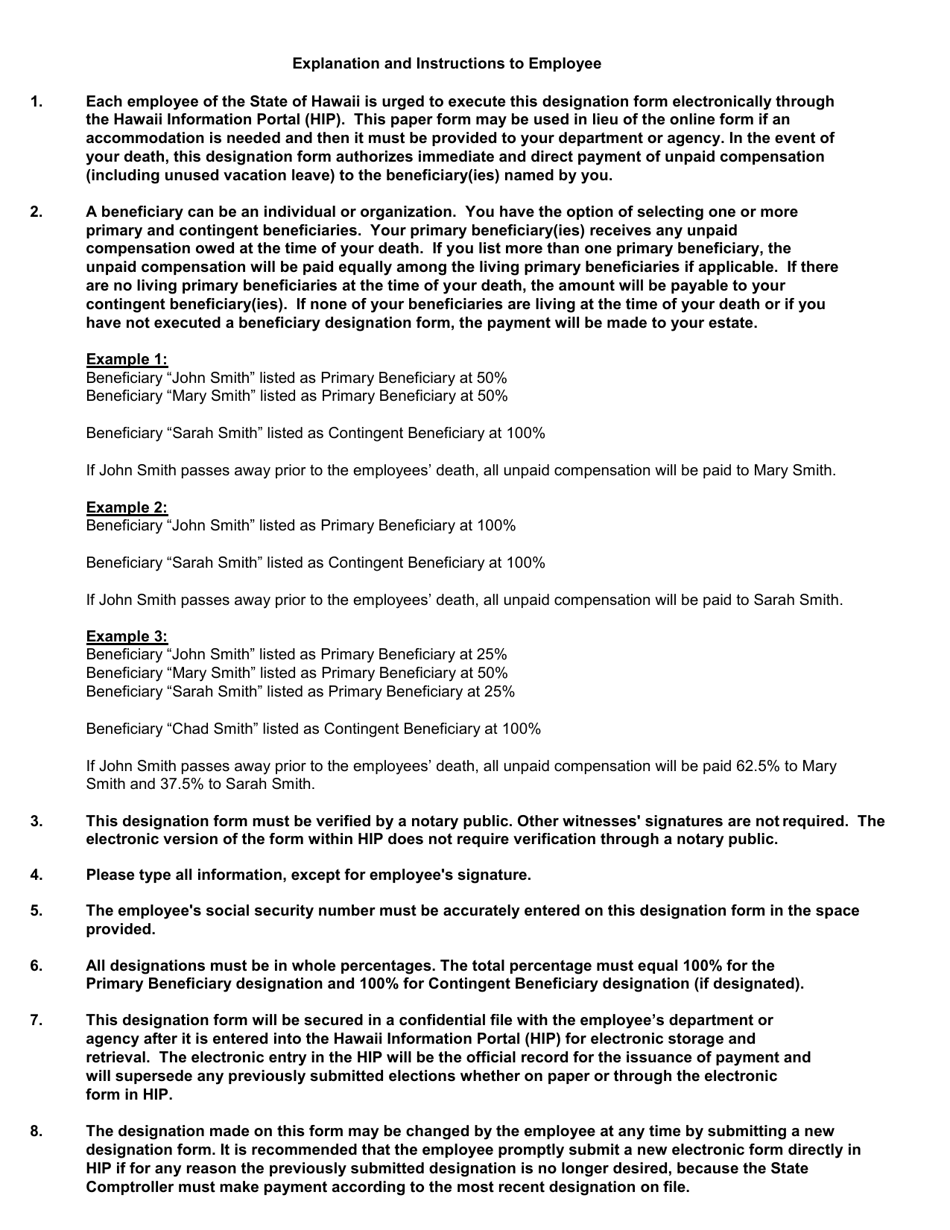

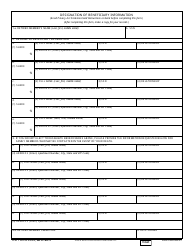

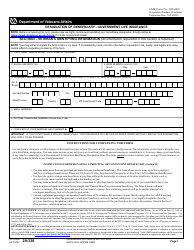

State Accounting Form D-90 Employee's Designation of Beneficiary - Hawaii

What Is State Accounting Form D-90?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-90?

A: Form D-90 is the Employee's Designation of Beneficiary form.

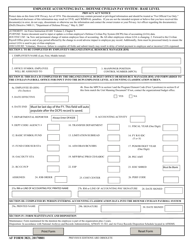

Q: Why do I need to fill out Form D-90?

A: You need to fill out Form D-90 to designate your beneficiary for employee benefits in the state of Hawaii.

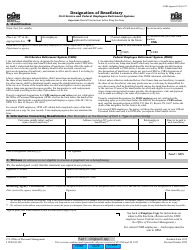

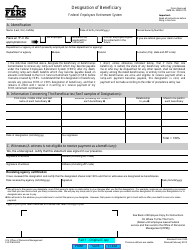

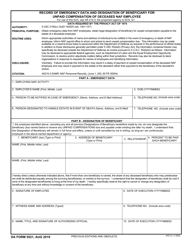

Q: What employee benefits does Form D-90 apply to?

A: Form D-90 applies to employee benefits such as life insurance and retirement plans.

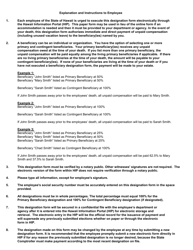

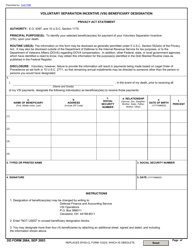

Q: Can I change my beneficiary after submitting Form D-90?

A: Yes, you can change your beneficiary by submitting a new Form D-90 to your employer or the applicable state agency.

Q: Is Form D-90 specific to Hawaii?

A: Yes, Form D-90 is specific to the state of Hawaii.

Q: Is Form D-90 mandatory?

A: Filling out Form D-90 is not mandatory, but it is recommended to ensure that your employee benefits go to your designated beneficiary.

Q: Are there any fees associated with Form D-90?

A: There are no fees associated with submitting Form D-90.

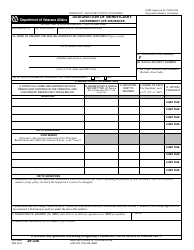

Q: Is Form D-90 confidential?

A: The information provided on Form D-90 is confidential and will only be disclosed to authorized personnel as required by law.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Accounting Form D-90 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.