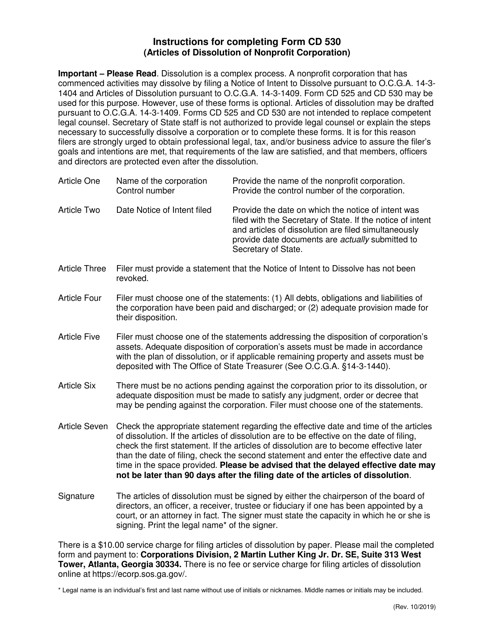

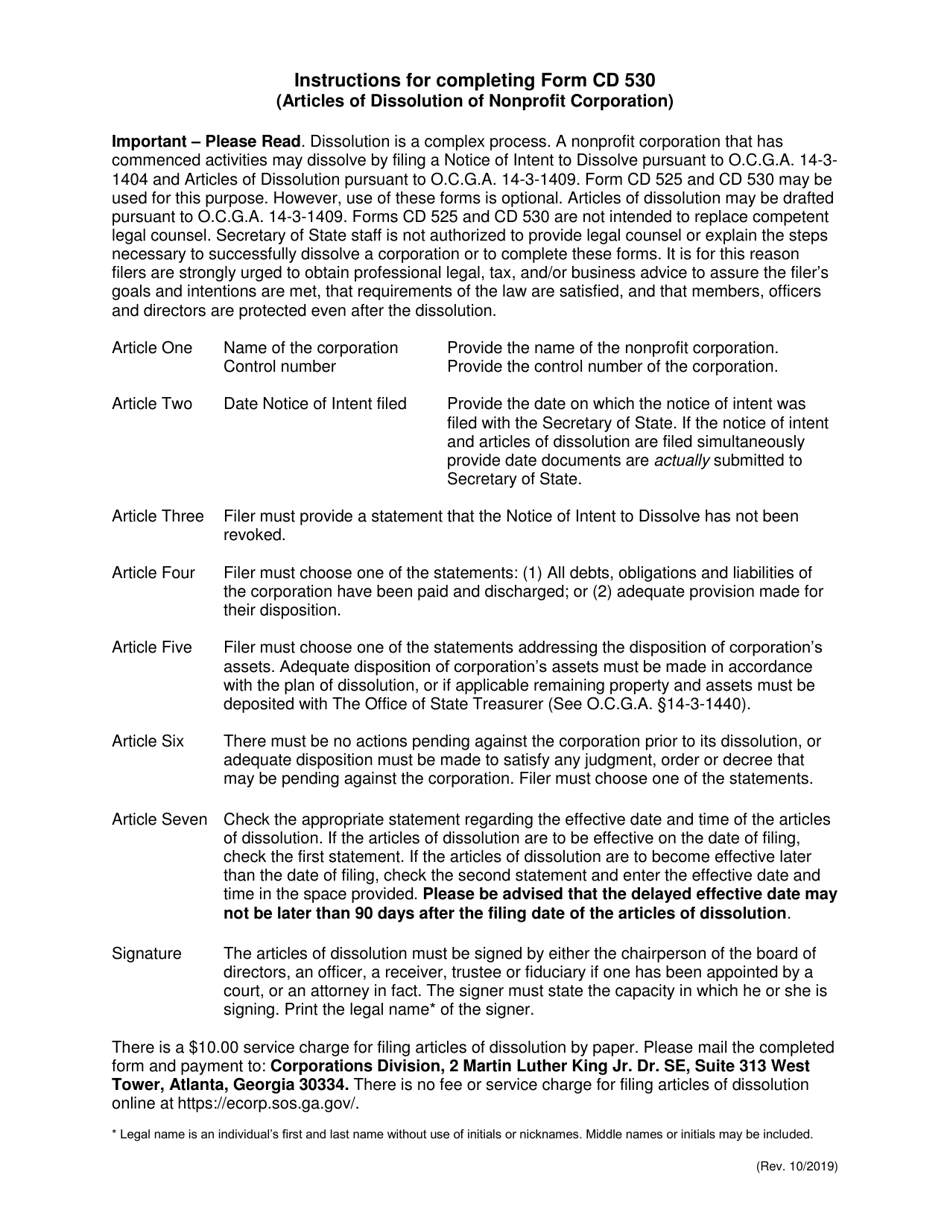

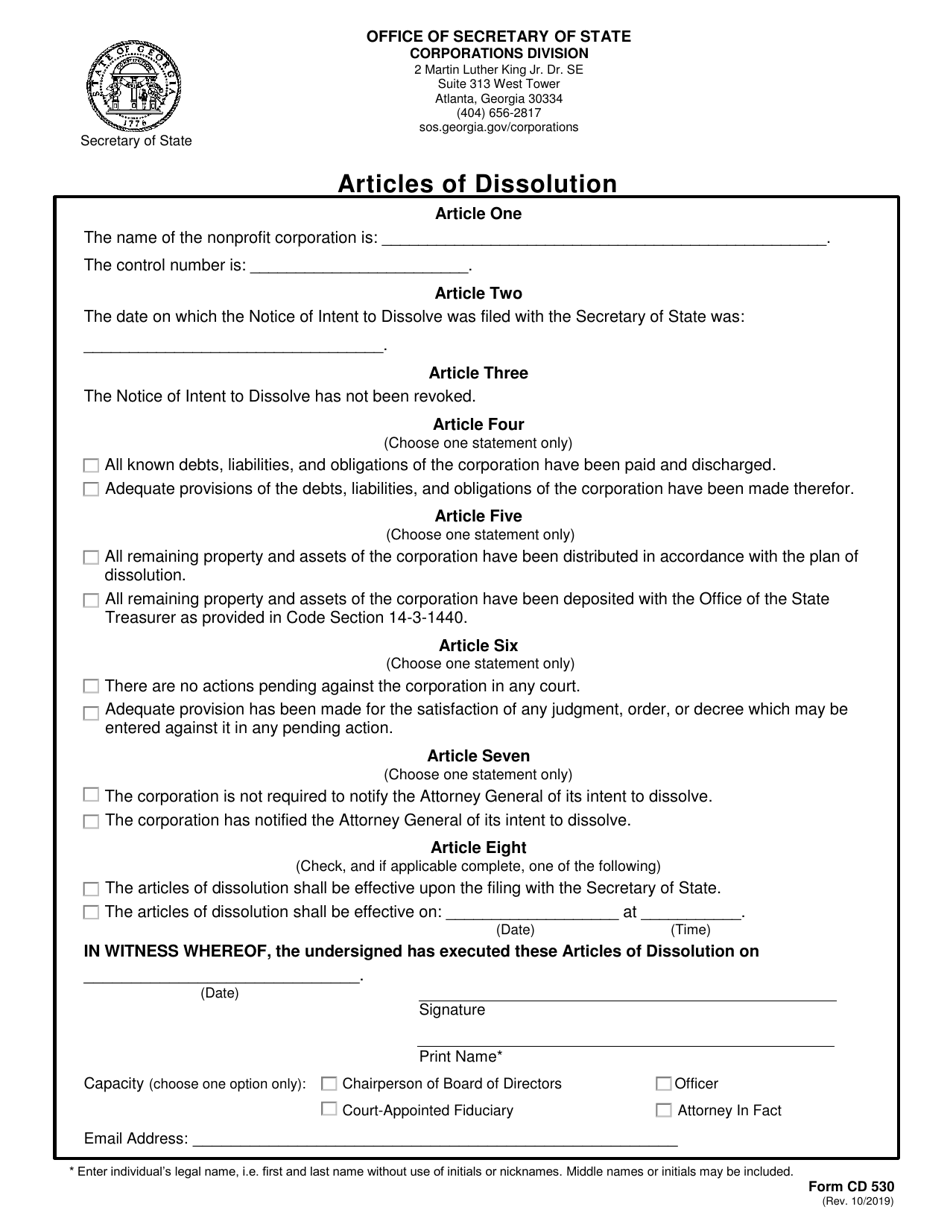

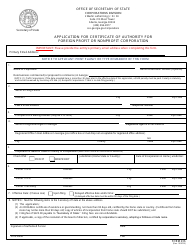

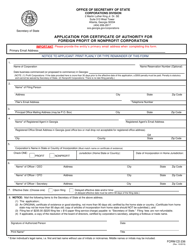

Form CD530 Articles of Dissolution of Nonprofit Corporation - Georgia (United States)

What Is Form CD530?

This is a legal form that was released by the Georgia Secretary of State - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form CD530 Articles of Dissolution of Nonprofit Corporation?

A: Form CD530 is a document used in Georgia to dissolve a nonprofit corporation.

Q: When should I use Form CD530?

A: You should use Form CD530 when you want to dissolve a nonprofit corporation in Georgia.

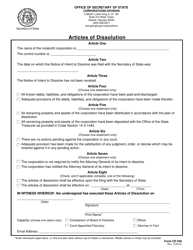

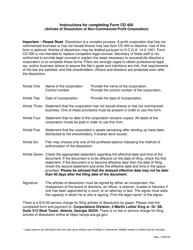

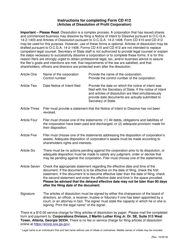

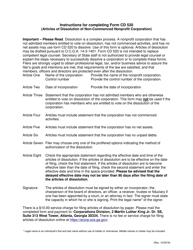

Q: What information do I need to fill out Form CD530?

A: You will need the name of the nonprofit corporation, the date of dissolution, the reason for dissolution, and the signature of an authorized officer.

Q: Are there any filing fees for Form CD530?

A: Yes, there is a filing fee of $30 for Form CD530.

Q: Do I need to notify the IRS when I file Form CD530?

A: Yes, you will need to notify the IRS separately.

Q: What happens after I submit Form CD530?

A: After submitting Form CD530, the Georgia Secretary of State will process the dissolution and update the corporation's status to 'dissolved'.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Georgia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD530 by clicking the link below or browse more documents and templates provided by the Georgia Secretary of State.