This version of the form is not currently in use and is provided for reference only. Download this version of

Form DBPR CPA6

for the current year.

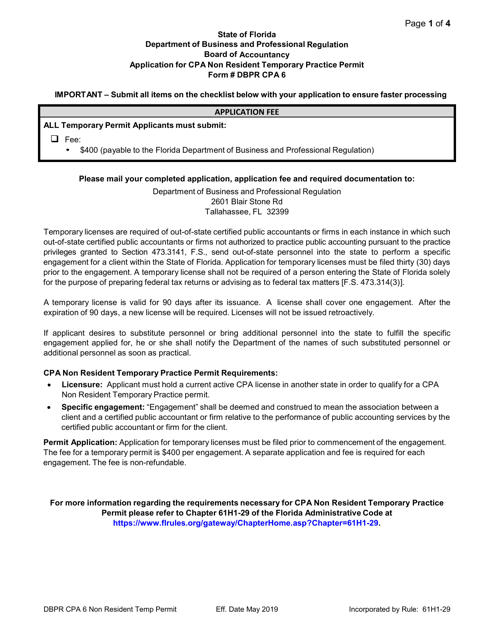

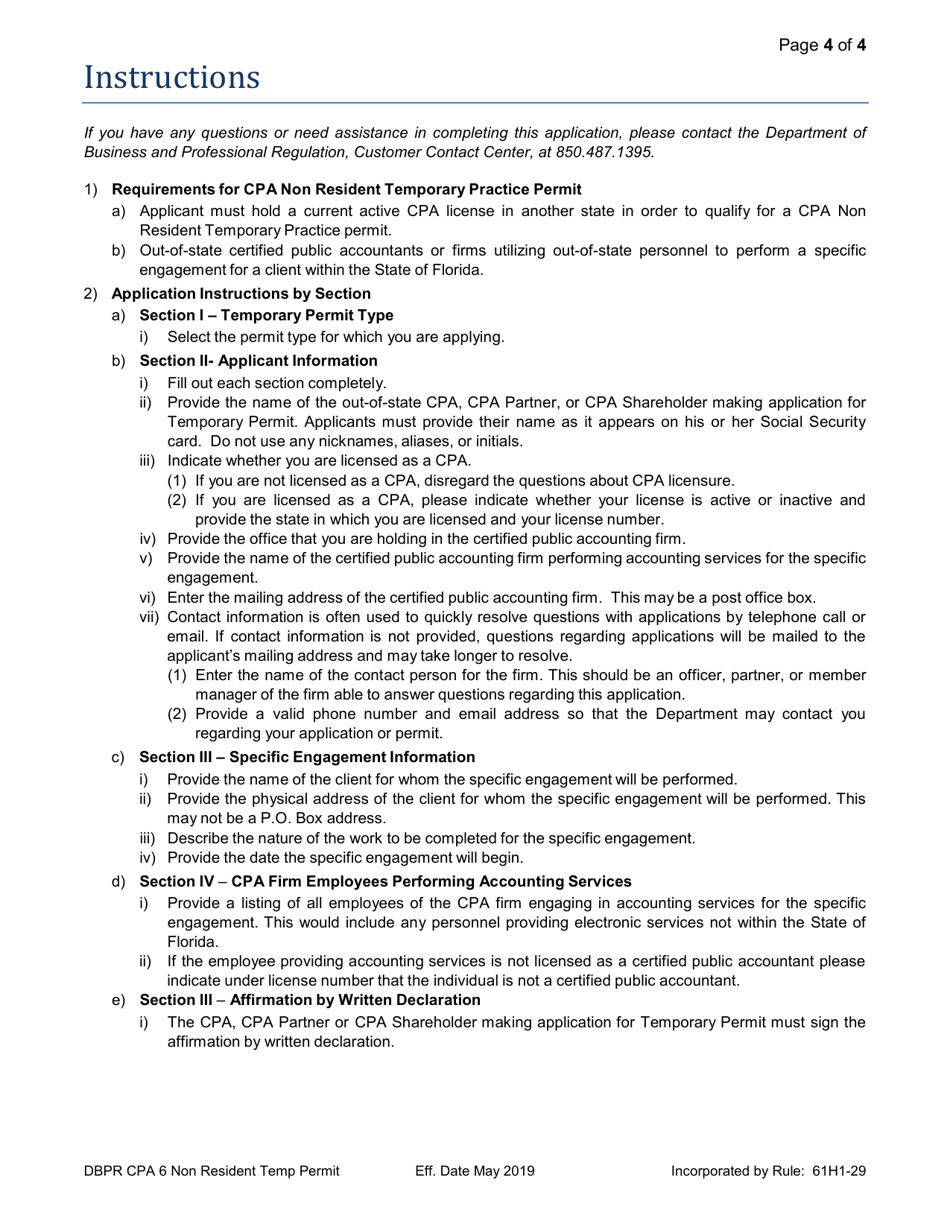

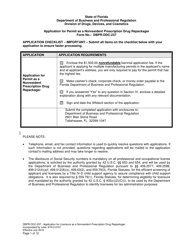

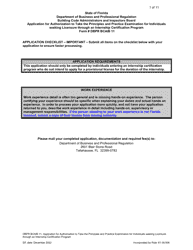

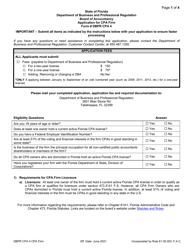

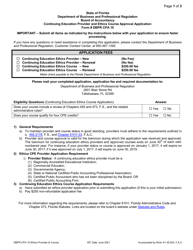

Form DBPR CPA6 Application for CPA Non Resident Temporary Practice Permit - Florida

What Is Form DBPR CPA6?

This is a legal form that was released by the Florida Department of Business & Professional Regulation - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

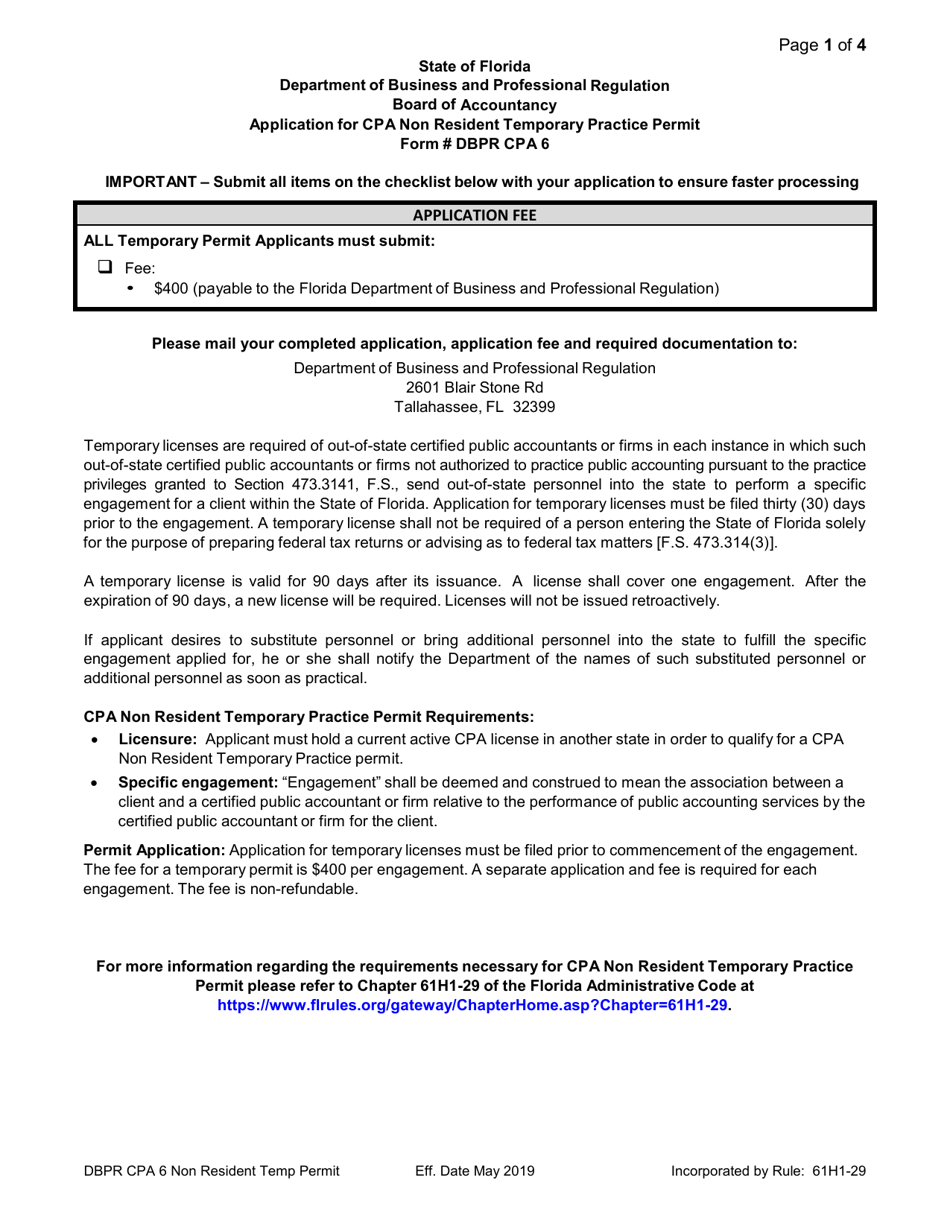

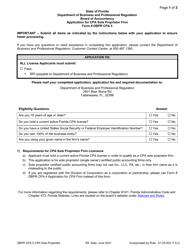

Q: What does the DBPR CPA6 Application for CPA Non Resident Temporary Practice Permit in Florida mean?

A: The DBPR CPA6 Application is used to apply for a temporary practice permit for a Certified Public Accountant (CPA) who is licensed in another state and wishes to practice in Florida temporarily.

Q: Who can use the DBPR CPA6 Application?

A: The DBPR CPA6 Application can be used by Certified Public Accountants (CPAs) who are licensed in another state and want to practice in Florida temporarily.

Q: What is a CPA Non Resident Temporary Practice Permit?

A: A CPA Non Resident Temporary Practice Permit is a permit that allows Certified Public Accountants (CPAs) licensed in another state to practice in Florida for a limited period of time.

Q: What is the purpose of a CPA Non Resident Temporary Practice Permit?

A: The purpose of a CPA Non Resident Temporary Practice Permit is to allow out-of-state CPAs to provide professional accounting services in Florida on a temporary basis.

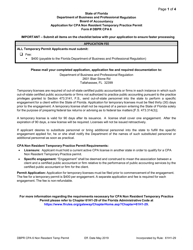

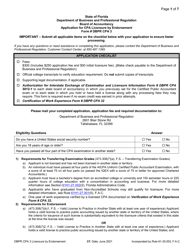

Q: How long is a CPA Non Resident Temporary Practice Permit valid for?

A: A CPA Non Resident Temporary Practice Permit is valid for a maximum period of 45 days.

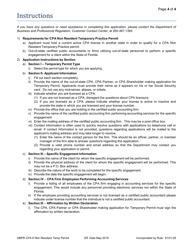

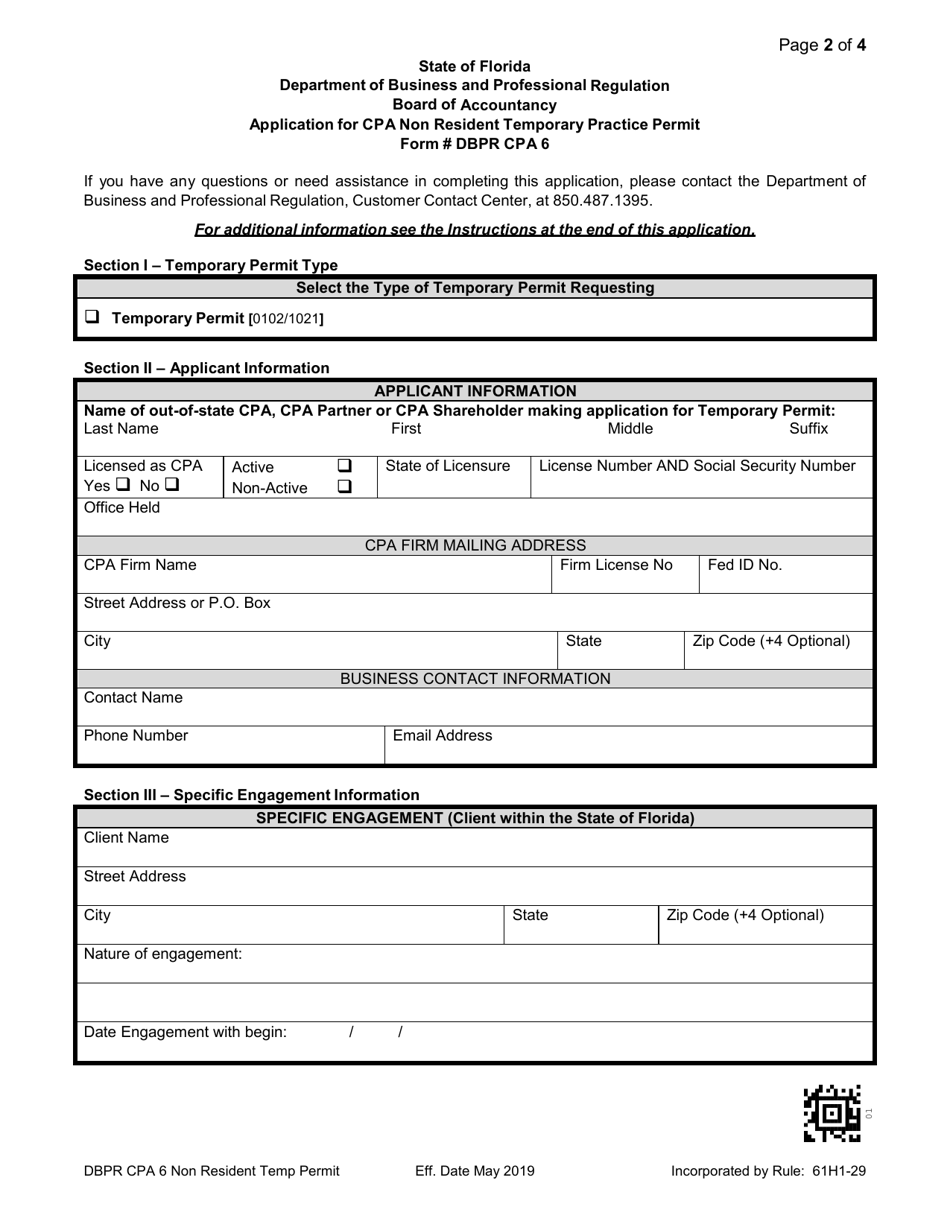

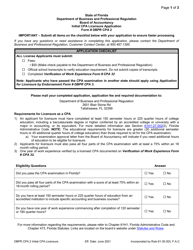

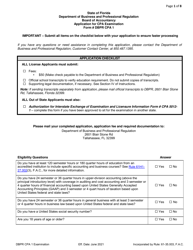

Q: What are the requirements to apply for a CPA Non Resident Temporary Practice Permit?

A: To apply for a CPA Non Resident Temporary Practice Permit, the CPA must be licensed in another state, provide evidence of good standing in that state, and pay the required application fee.

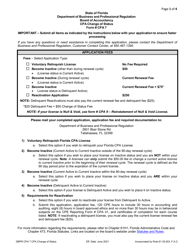

Q: Is the DBPR CPA6 Application fee refundable?

A: No, the DBPR CPA6 Application fee is non-refundable.

Q: How long does it take to process the DBPR CPA6 Application?

A: The processing time for the DBPR CPA6 Application may vary, but it typically takes a few weeks to complete.

Q: Can a CPA Non Resident Temporary Practice Permit be renewed?

A: No, a CPA Non Resident Temporary Practice Permit cannot be renewed. A new application must be submitted if the CPA wishes to continue practicing in Florida.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Florida Department of Business & Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBPR CPA6 by clicking the link below or browse more documents and templates provided by the Florida Department of Business & Professional Regulation.