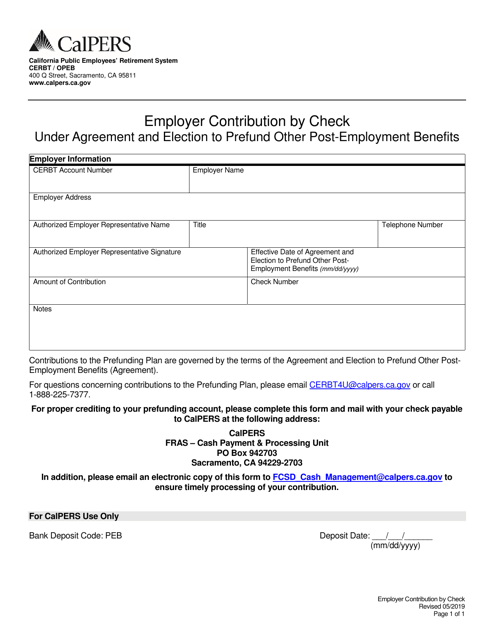

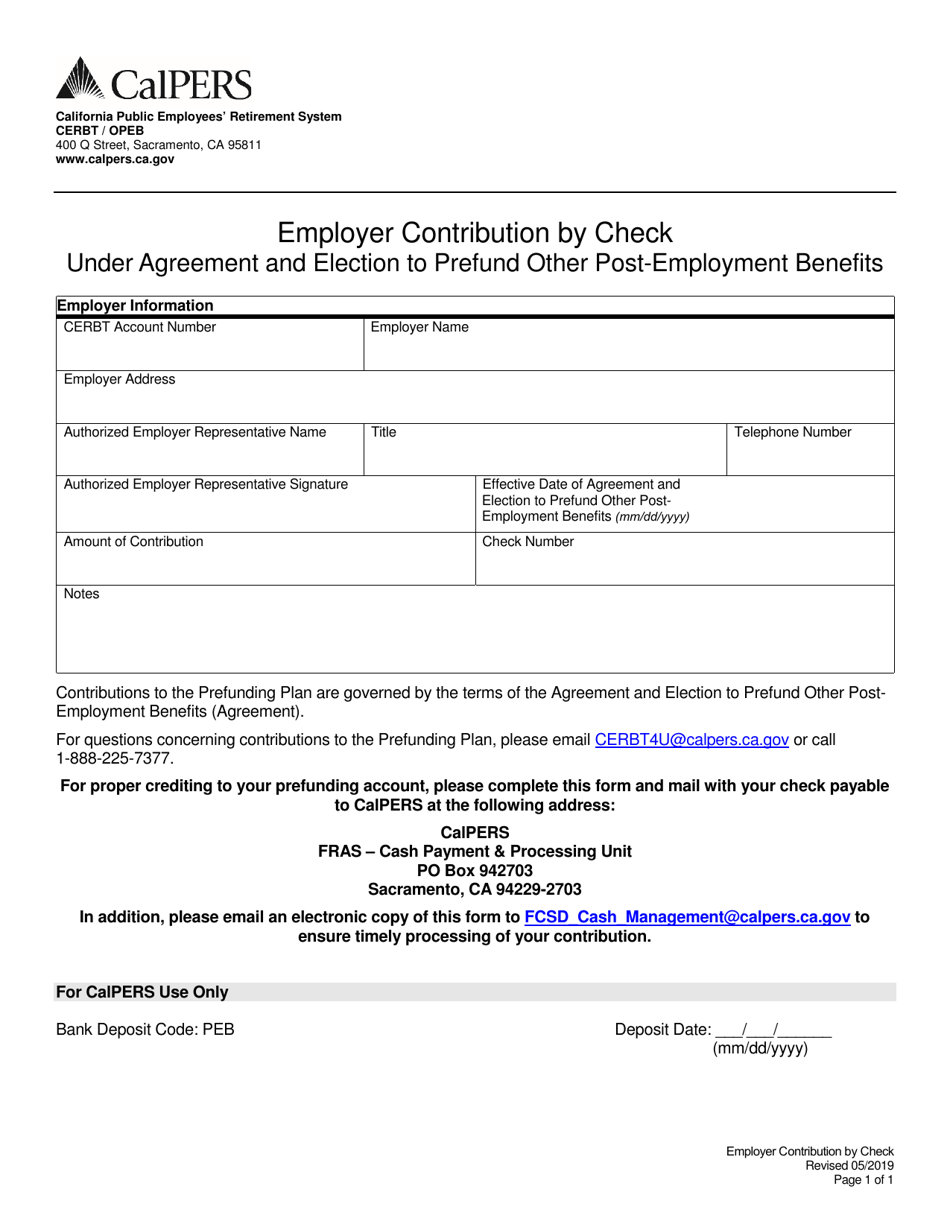

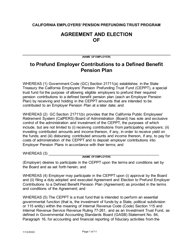

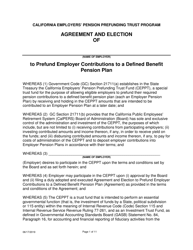

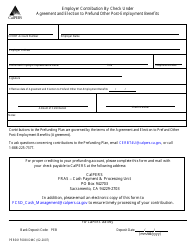

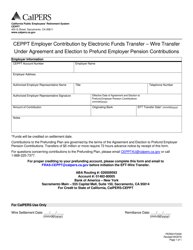

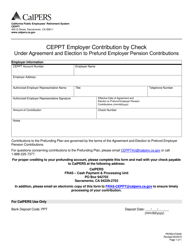

Employer Contribution by Check Under Agreement and Election to Prefund Other Post-employment Benefits - California

Employer Contribution by Check Under Agreement and Election to Prefund Other Post-employment Benefits is a legal document that was released by the California Public Employees' Retirement System - a government authority operating within California.

FAQ

Q: What is an employer contribution by check under agreement?

A: It is an agreed-upon amount that an employer contributes by check towards certain benefits.

Q: What are post-employment benefits?

A: Post-employment benefits refer to benefits provided to employees after their employment has ended, such as retirement benefits or healthcare coverage.

Q: What is an election to prefund other post-employment benefits?

A: It is the act of choosing to set aside funds in advance to cover future post-employment benefits, ensuring the availability of funds when needed.

Q: Why would an employer choose to prefund post-employment benefits?

A: Prefunding post-employment benefits can help an employer ensure financial stability and fulfill their obligations to provide these benefits in the future.

Q: Is employer contribution by check under agreement mandatory in California?

A: No, it is not mandatory. It is a voluntary agreement between an employer and their employees.

Q: Can an employer decide not to prefund post-employment benefits?

A: Yes, an employer can choose not to prefund post-employment benefits, but it may carry financial risks and potential challenges in meeting future obligations.

Q: Are there any legal requirements for employer contributions towards post-employment benefits in California?

A: There are specific legal requirements regarding post-employment benefits in California, but the exact obligations depend on various factors such as the type of benefits and the size of the employer.

Q: Do all employers in California offer post-employment benefits?

A: No, not all employers in California are required to offer post-employment benefits. The provision of such benefits varies based on factors such as the size and nature of the employer.

Q: Can employees negotiate the amount of employer contribution for post-employment benefits?

A: Yes, employees can negotiate the amount of employer contribution for post-employment benefits, but it ultimately depends on the agreement reached between the employer and the employees.

Q: How does employer contribution by check impact employees?

A: Employer contribution by check can help employees by providing additional financial security and stability in the form of post-employment benefits.

Form Details:

- Released on May 1, 2019;

- The latest edition currently provided by the California Public Employees' Retirement System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.