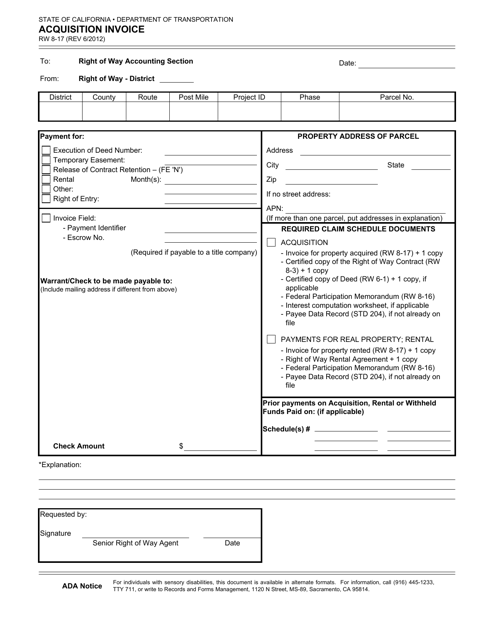

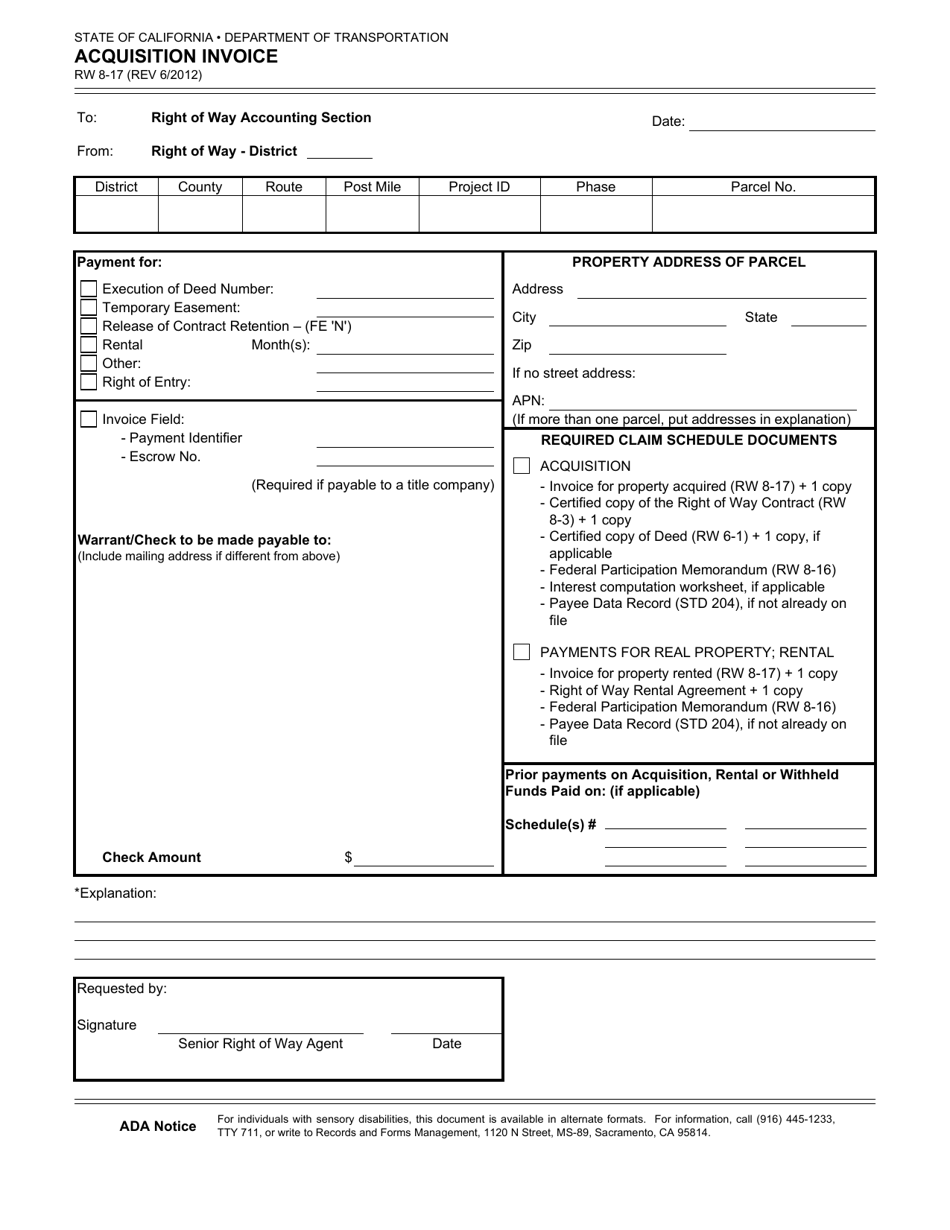

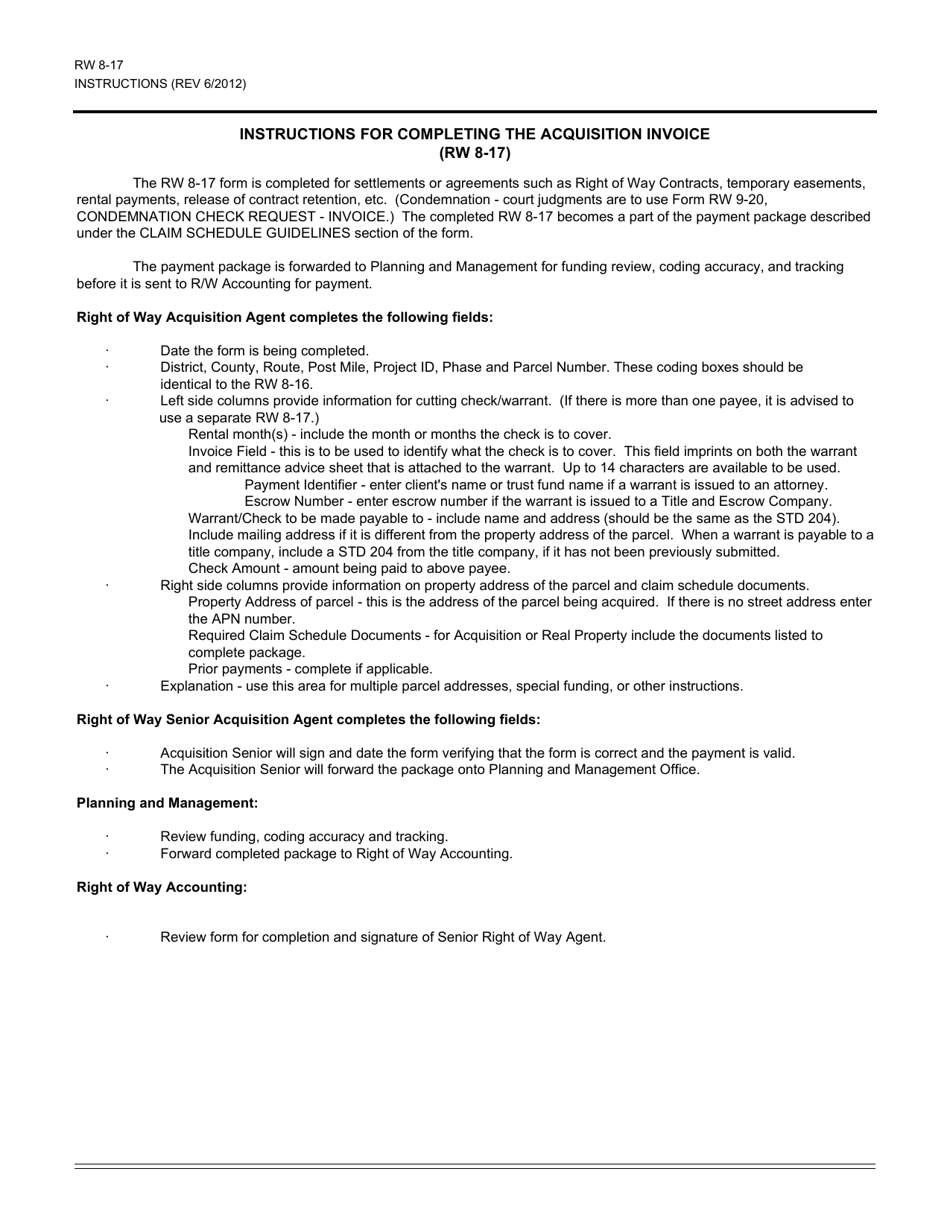

Form RW8-17 Acquisition Invoice - California

What Is Form RW8-17?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW8-17?

A: Form RW8-17 is an Acquisition Invoice used in the state of California.

Q: What is the purpose of Form RW8-17?

A: Form RW8-17 is used to record and document the acquisition of goods or services in California.

Q: Who needs to fill out Form RW8-17?

A: The party acquiring the goods or services in California needs to fill out Form RW8-17.

Q: What information is required on Form RW8-17?

A: Form RW8-17 requires information such as the name and address of the seller, a description of the goods or services acquired, the cost or value of the acquisition, and the date of the acquisition.

Q: Is Form RW8-17 only used in California?

A: Yes, Form RW8-17 is specific to the state of California and is not used in other states.

Q: Are there any filing fees for Form RW8-17?

A: No, there are no filing fees associated with Form RW8-17.

Q: When should Form RW8-17 be filed?

A: Form RW8-17 should be filed within a certain timeframe after the acquisition, according to the specific filing requirements of the California Department of Tax and Fee Administration.

Q: What are the consequences of not filing Form RW8-17?

A: Failure to file Form RW8-17 or providing false information on the form may result in penalties or fines imposed by the California Department of Tax and Fee Administration.

Q: Can Form RW8-17 be filed electronically?

A: Yes, the California Department of Tax and Fee Administration accepts electronic filing of Form RW8-17.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW8-17 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.