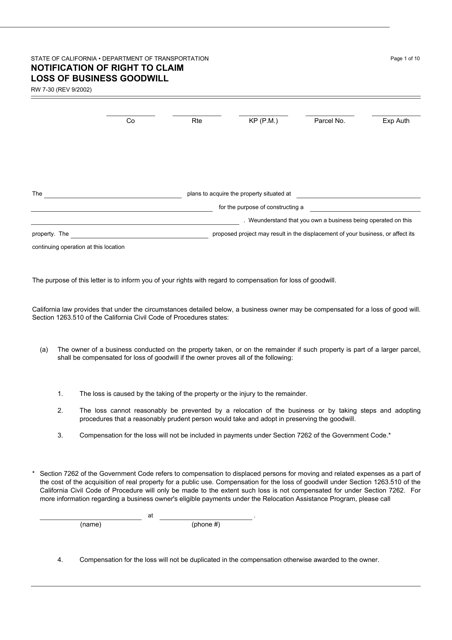

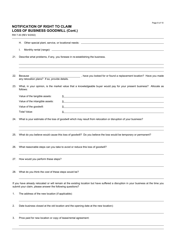

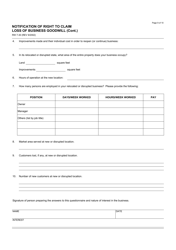

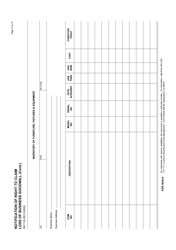

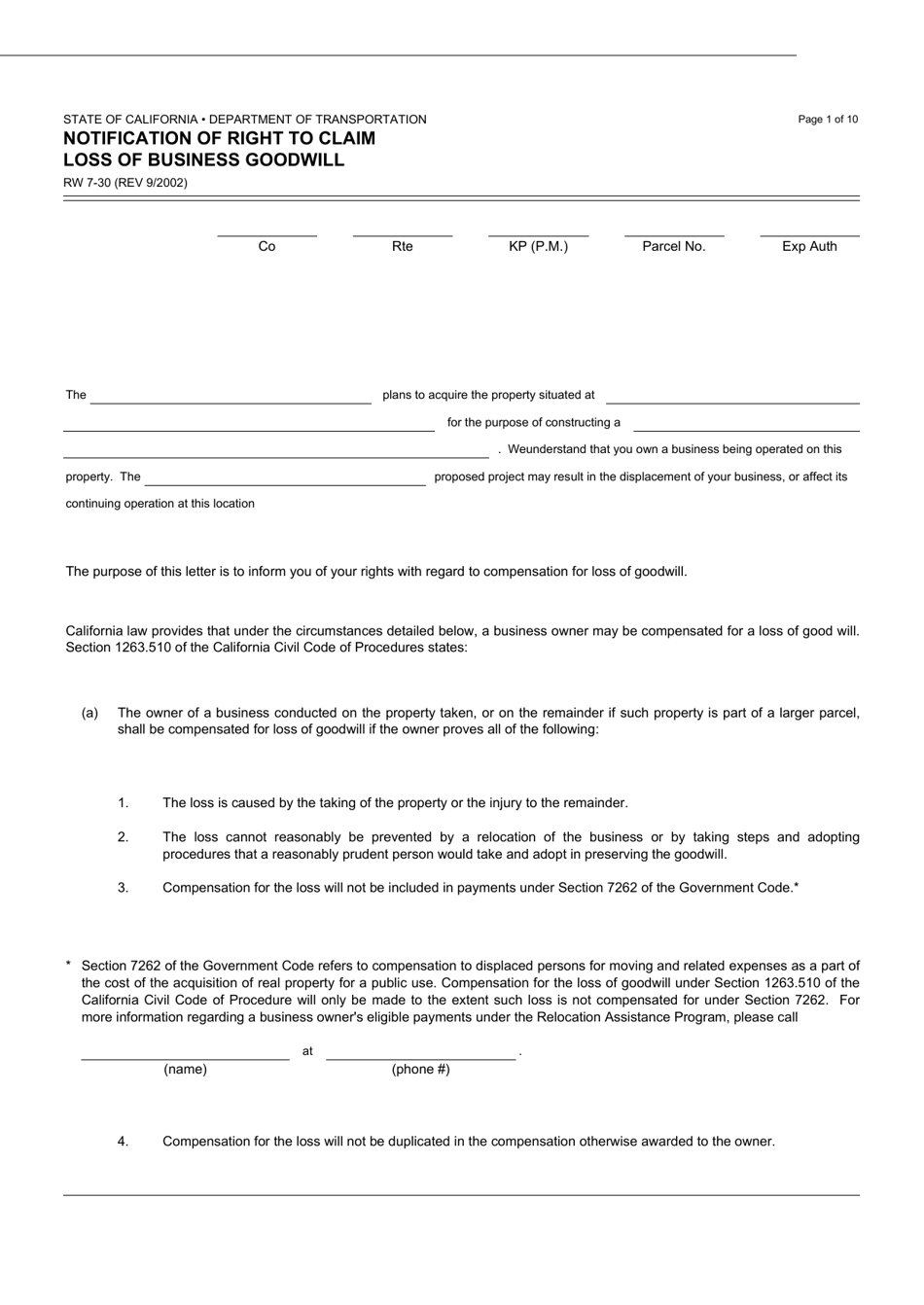

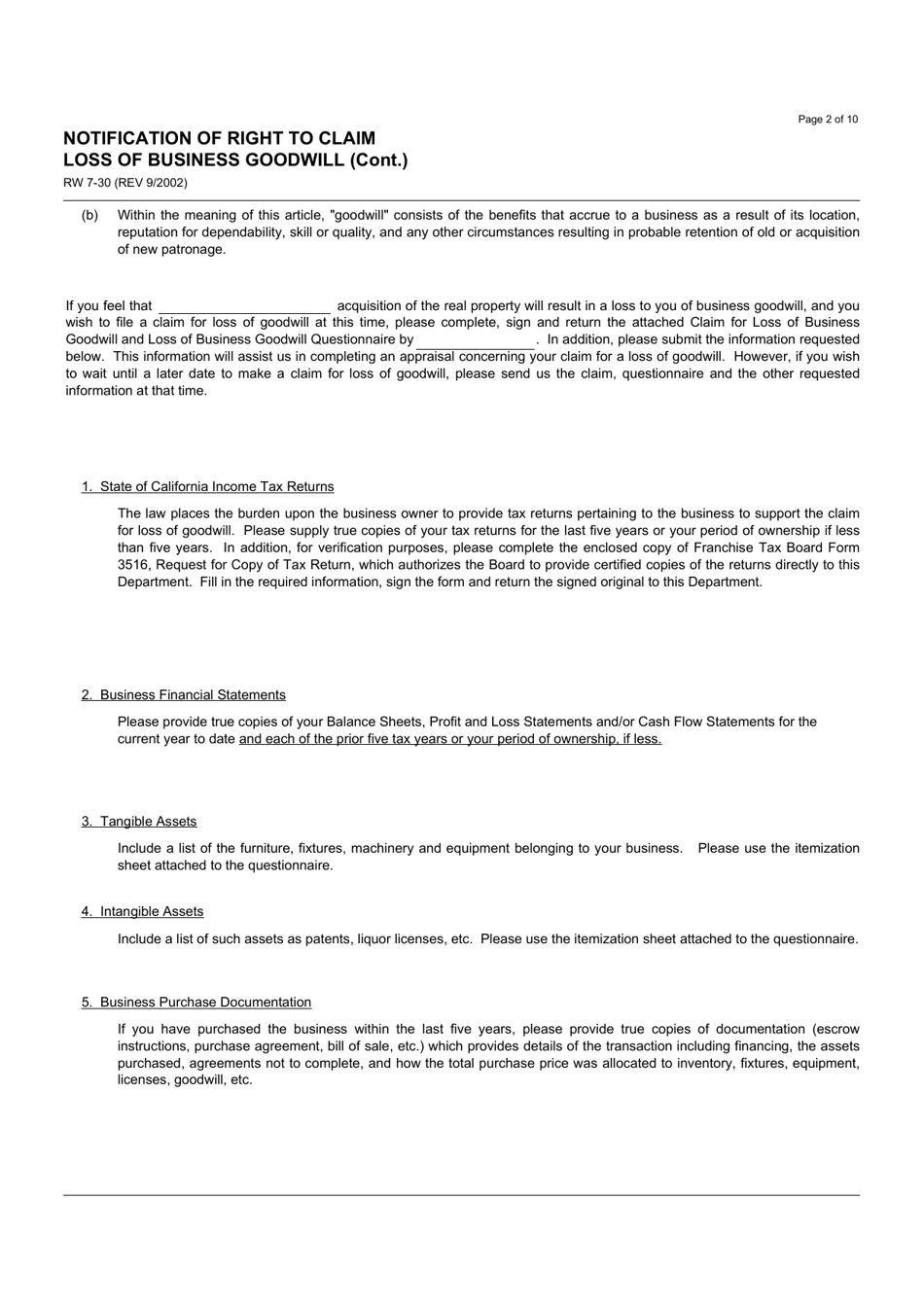

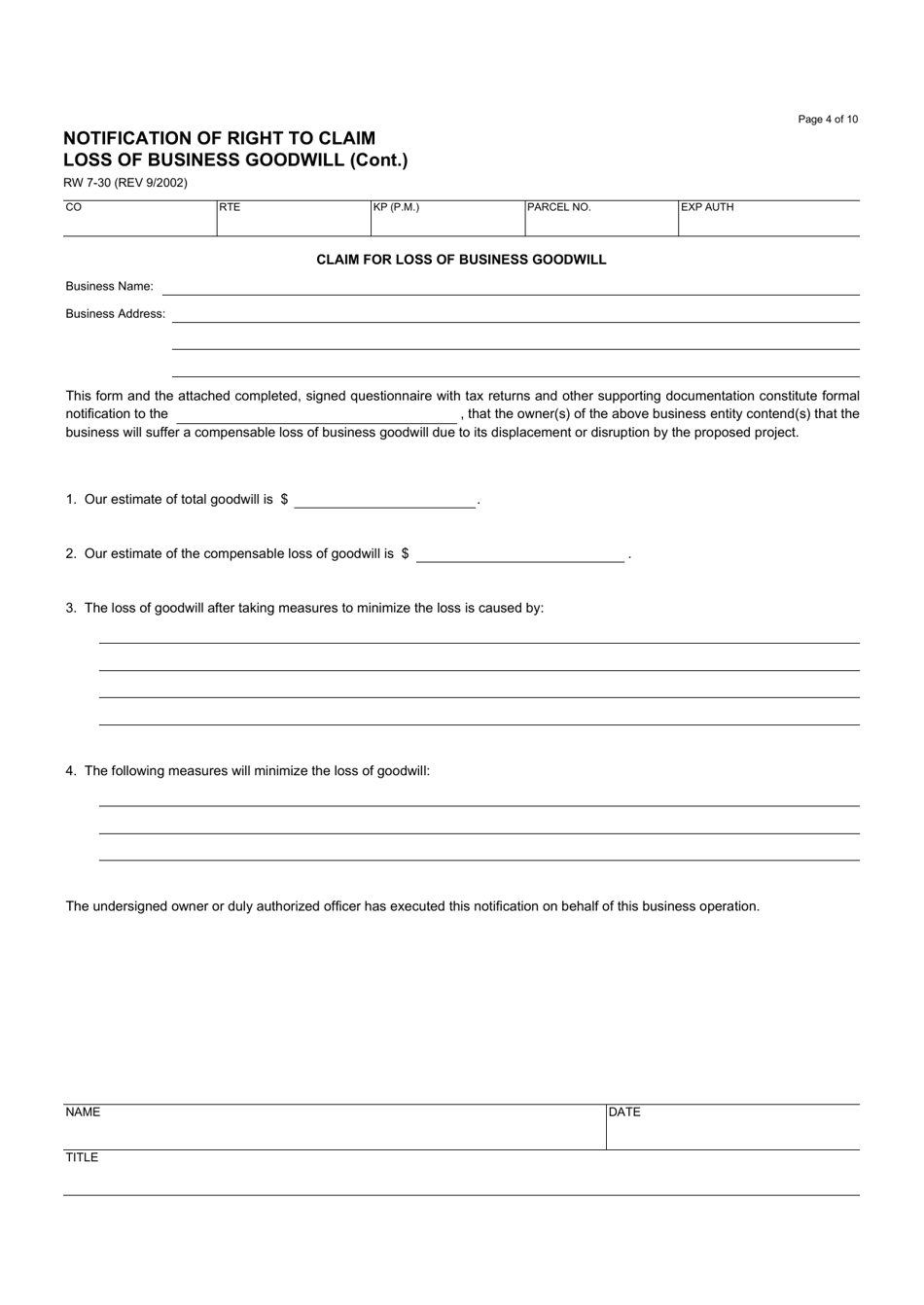

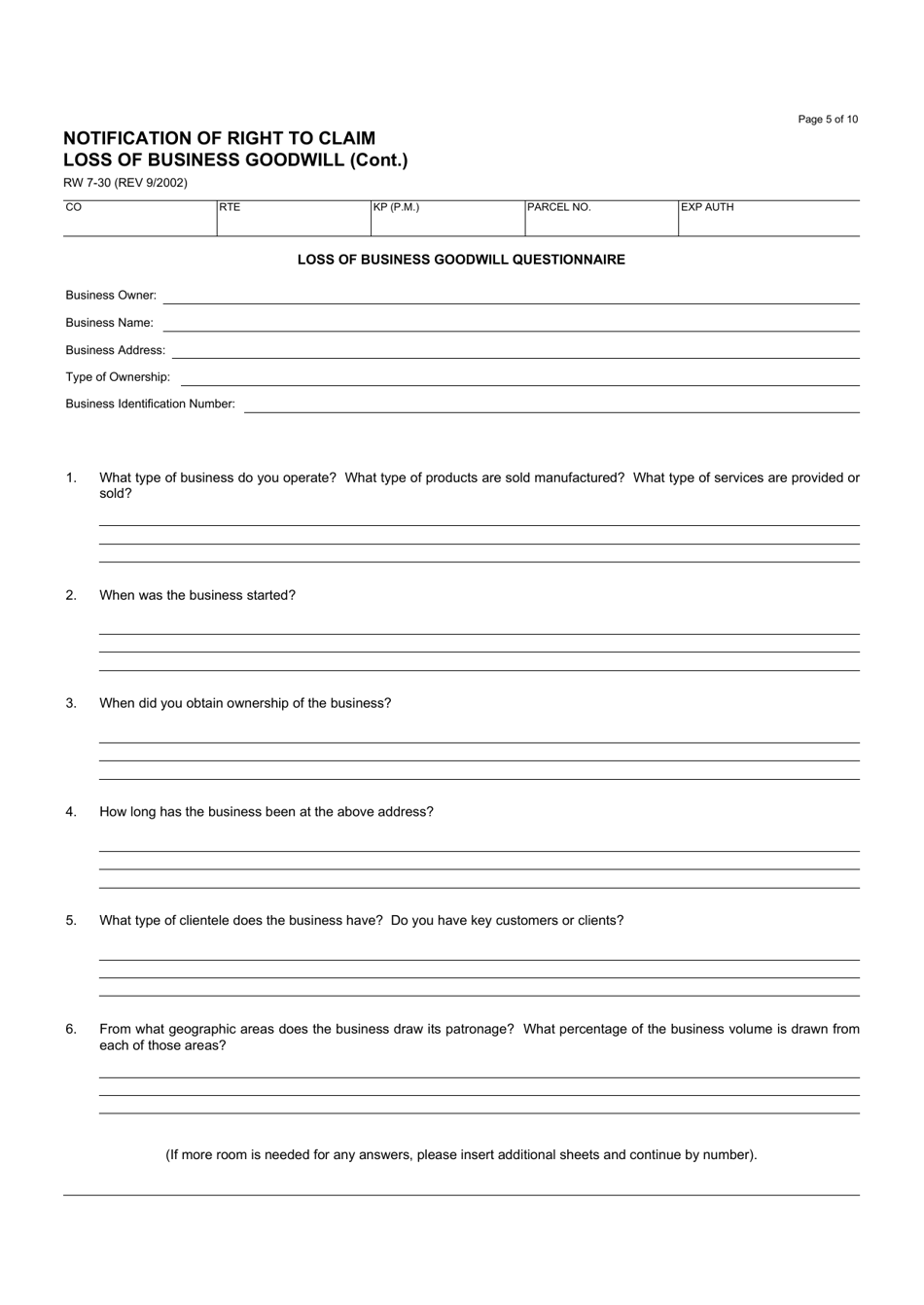

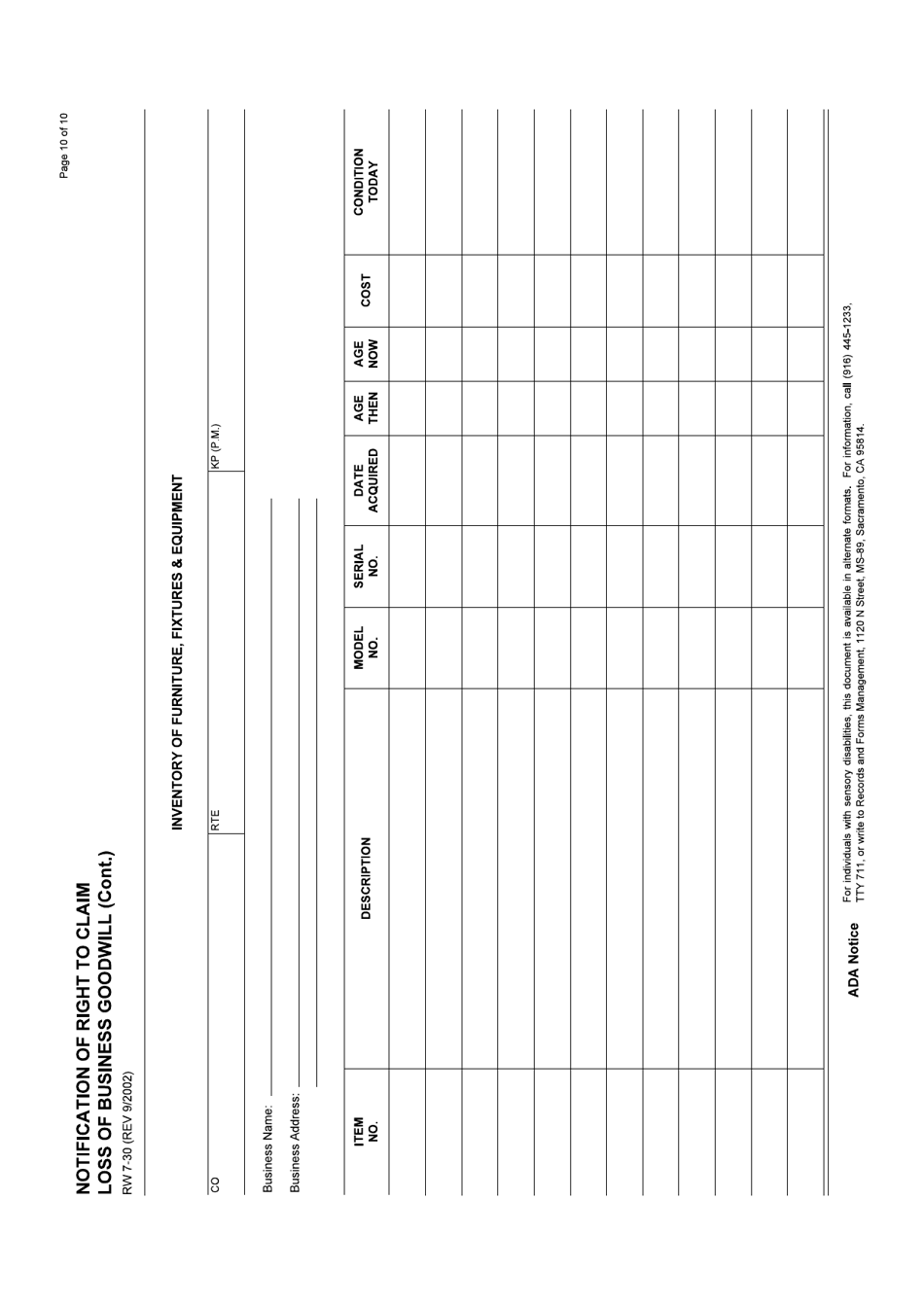

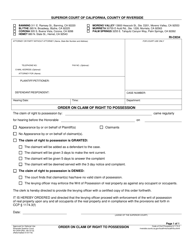

Form RW7-30 Notification of Right to Claim Loss of Business Goodwill - California

What Is Form RW7-30?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW7-30?

A: Form RW7-30 is the Notification of Right to Claim Loss of Business Goodwill in California.

Q: Who uses Form RW7-30?

A: Business owners in California who have experienced a loss of business goodwill.

Q: What is the purpose of Form RW7-30?

A: The purpose of Form RW7-30 is to notify the California Franchise Tax Board of the intent to claim a loss of business goodwill.

Q: When should I file Form RW7-30?

A: Form RW7-30 should be filed within four years from the end of the taxable year in which the loss of business goodwill occurred.

Form Details:

- Released on September 1, 2002;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW7-30 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.