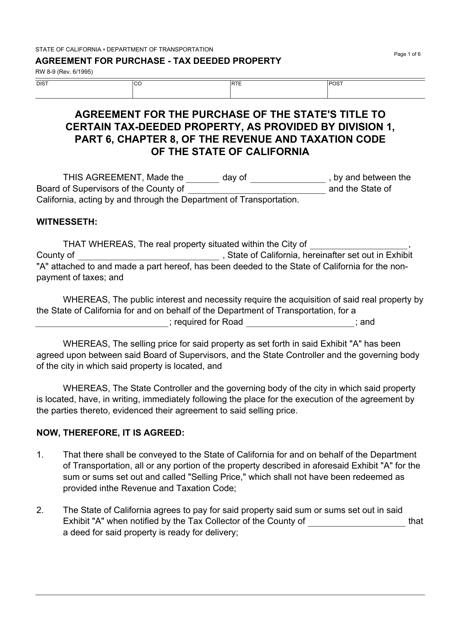

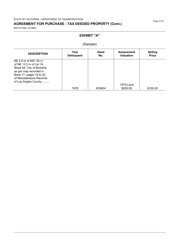

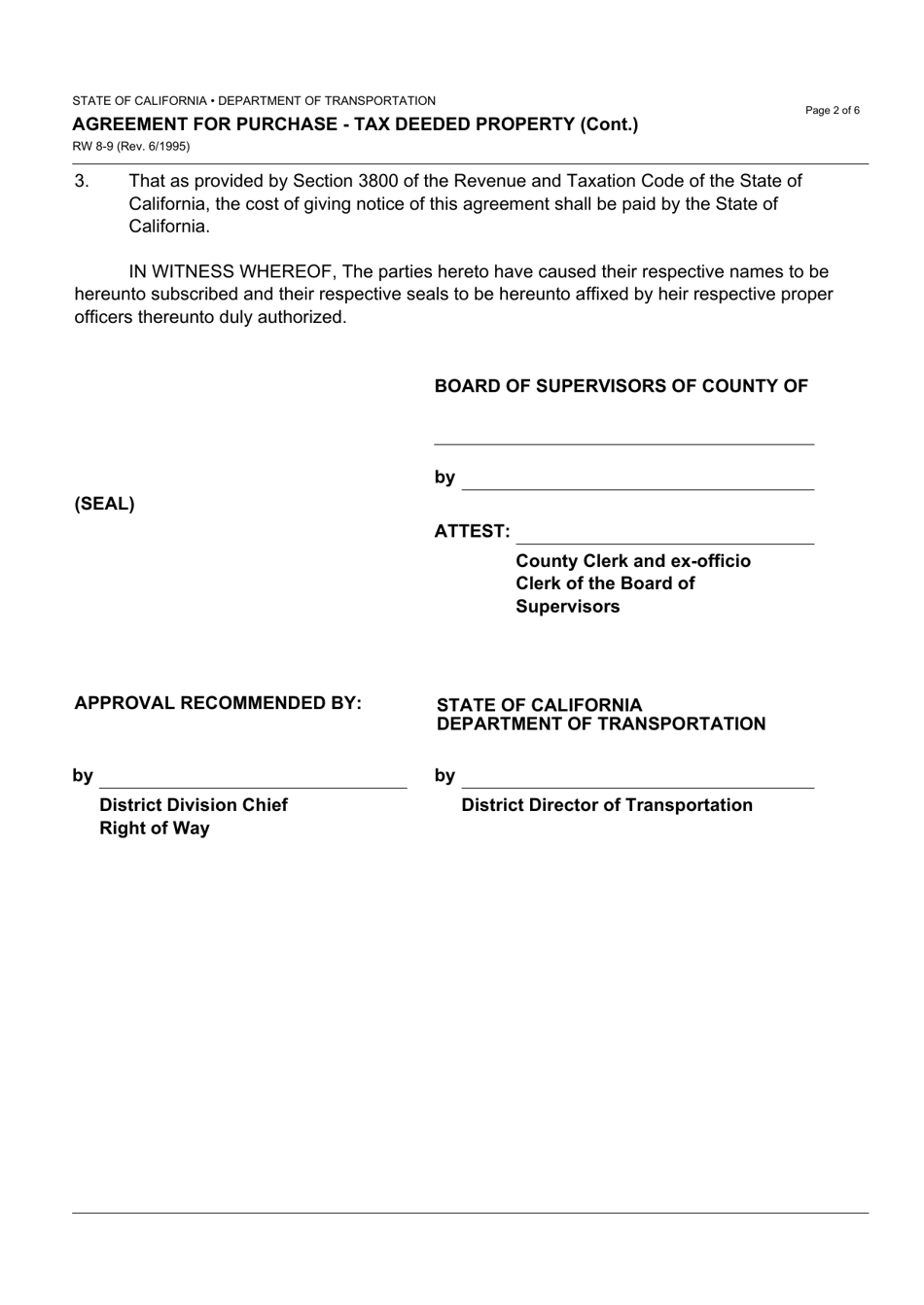

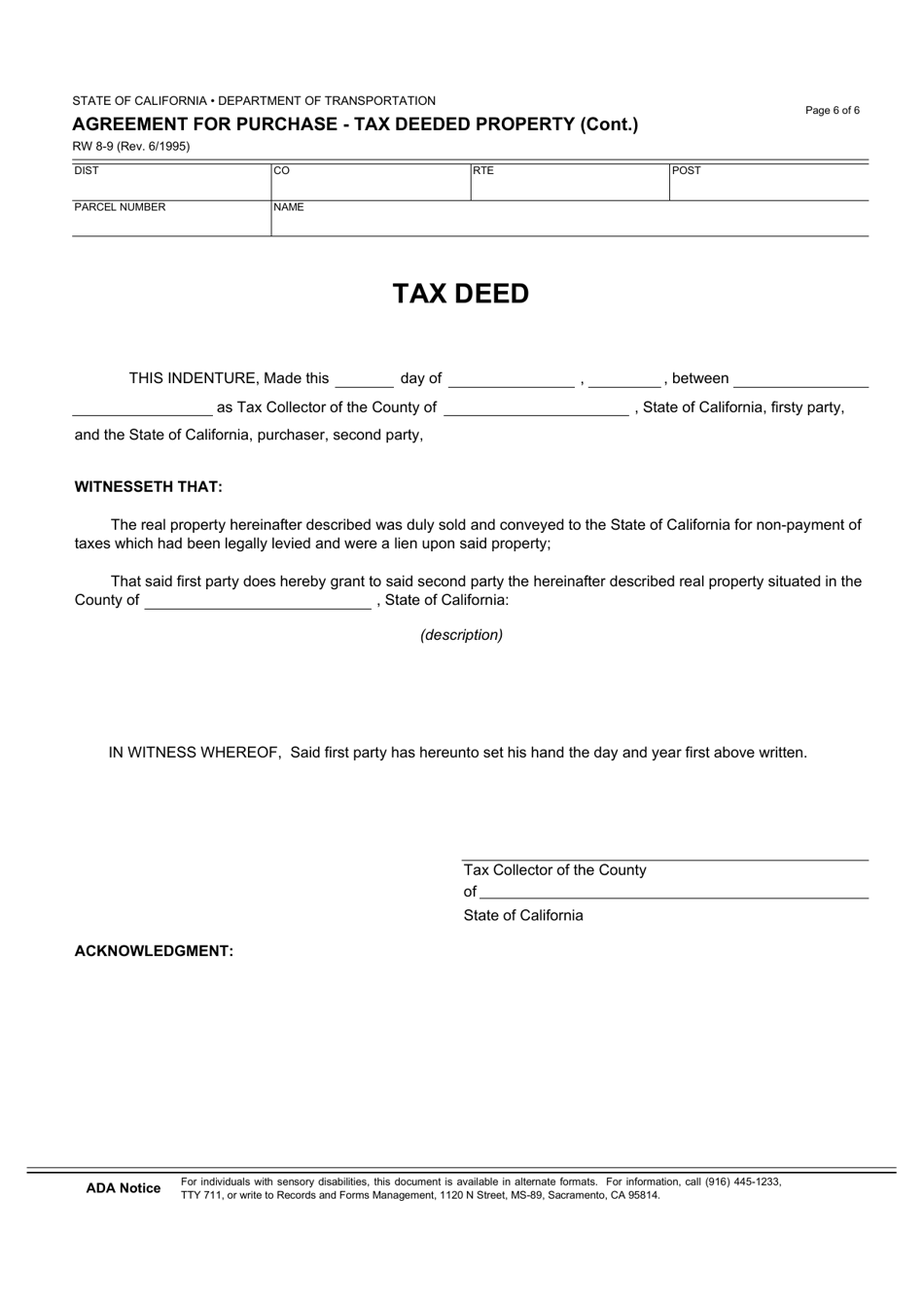

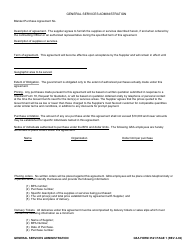

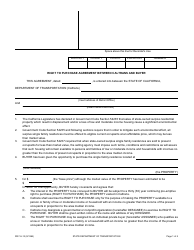

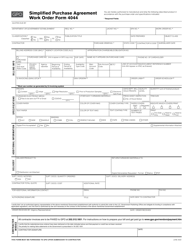

Form RW8-9 Agreement for Purchase - Tax Deeded Property - California

What Is Form RW8-9?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW8-9?

A: Form RW8-9 is an agreement for the purchase of a tax-deeded property in California.

Q: What is a tax-deeded property?

A: A tax-deeded property is a property that has been acquired by the government due to unpaid property taxes.

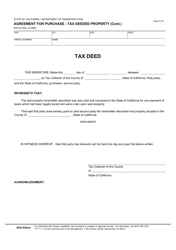

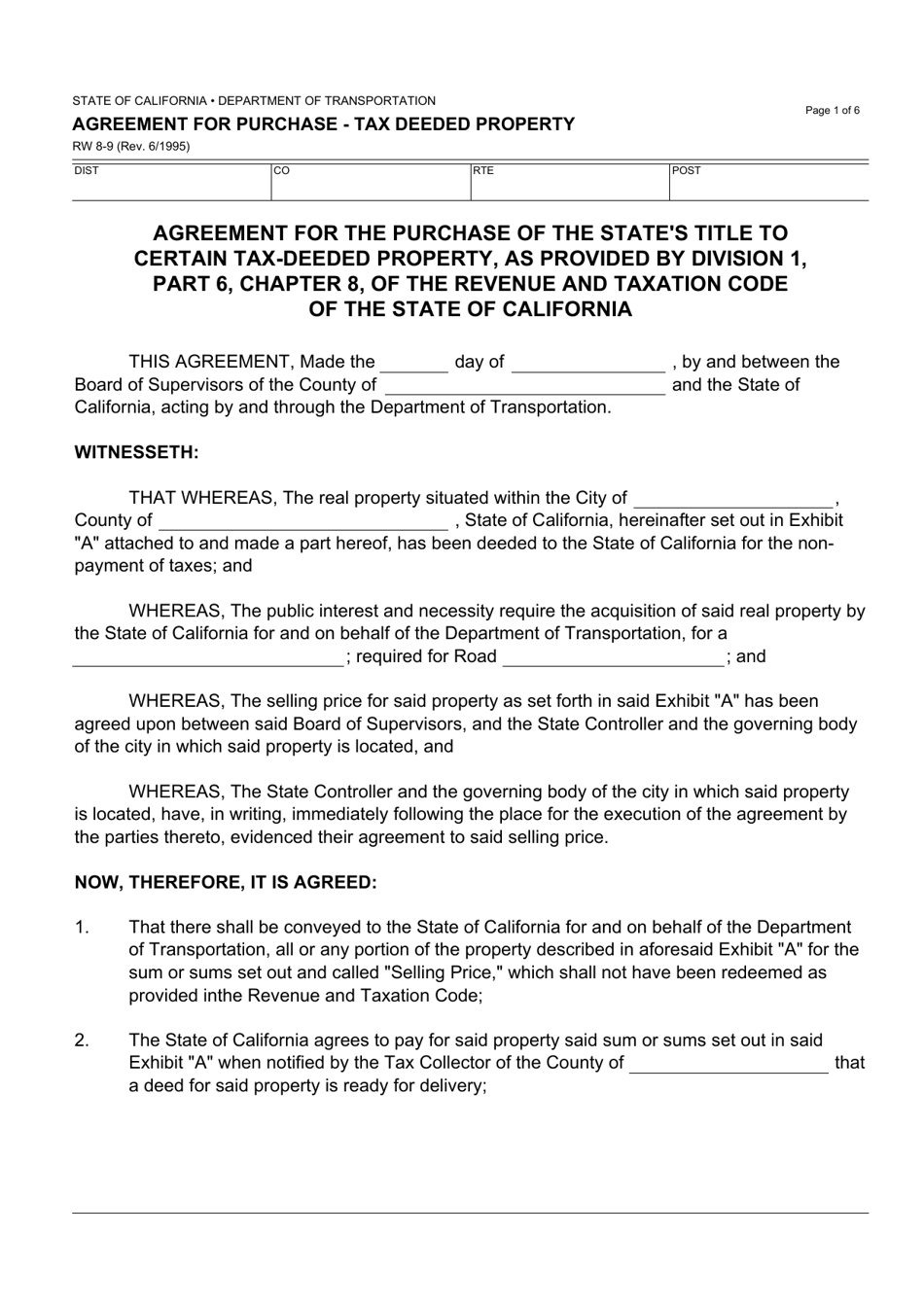

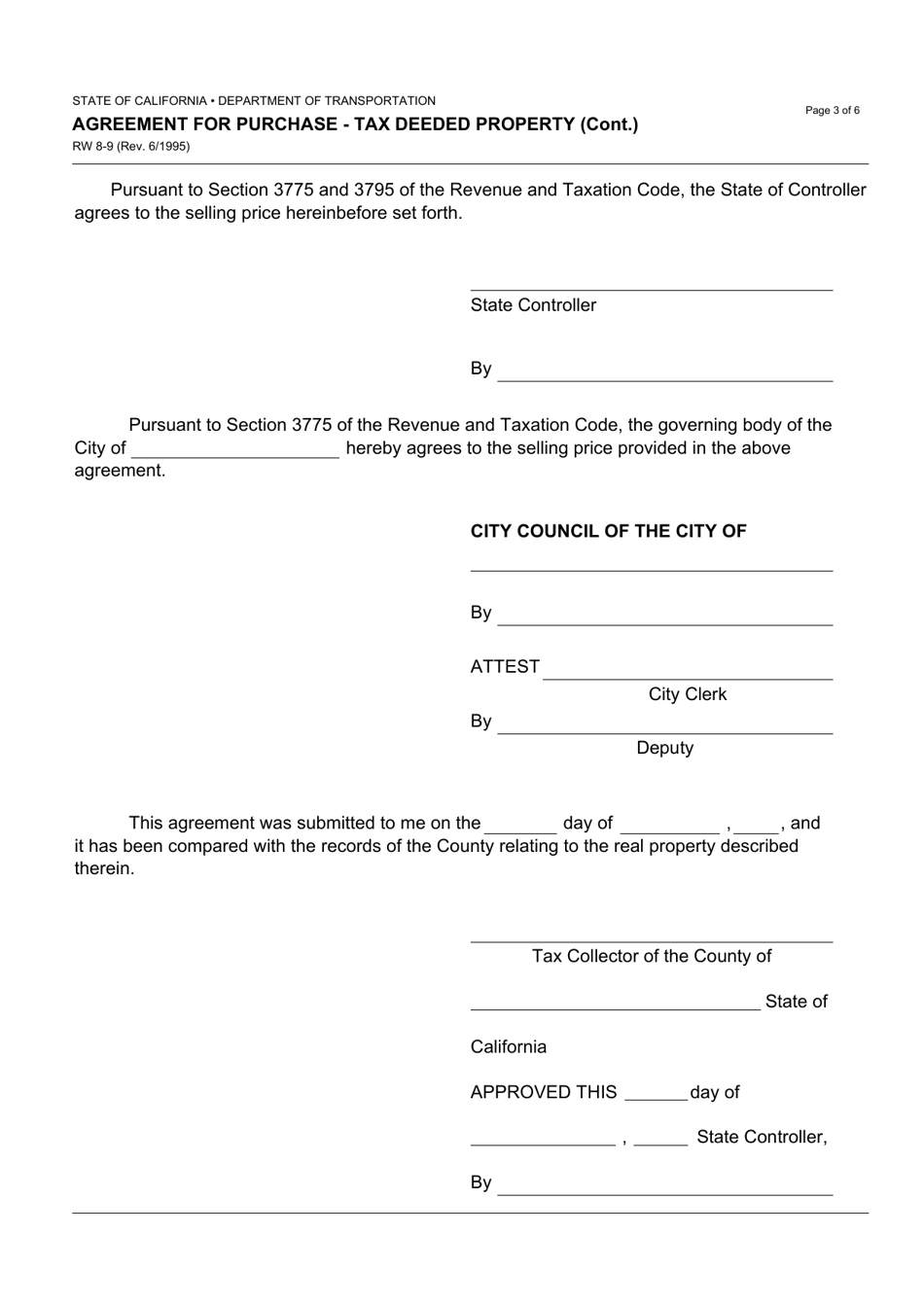

Q: What does Form RW8-9 involve?

A: Form RW8-9 involves the agreement between the buyer and the government for the purchase of a tax-deeded property.

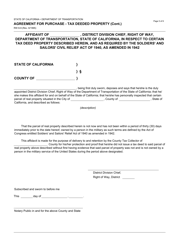

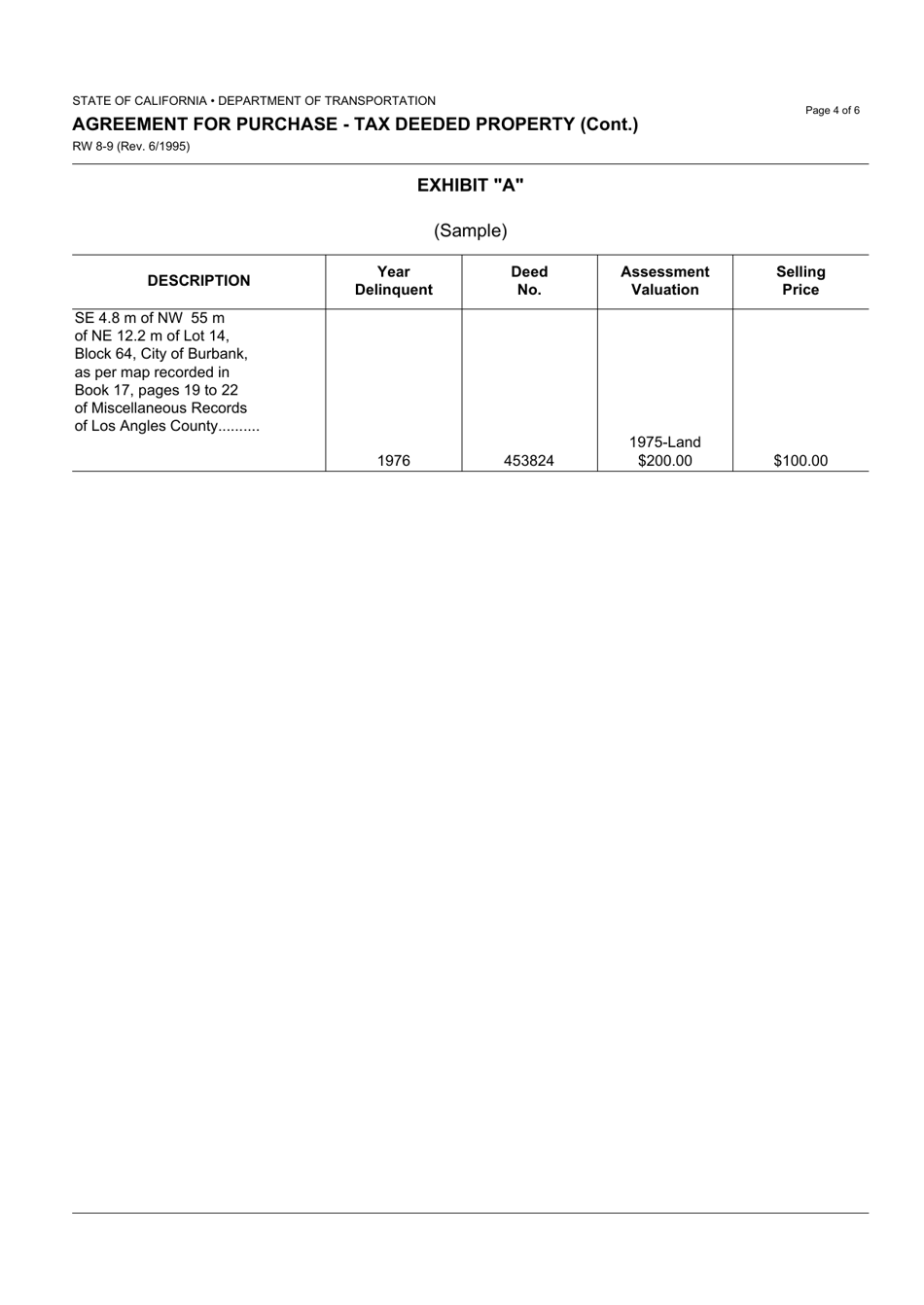

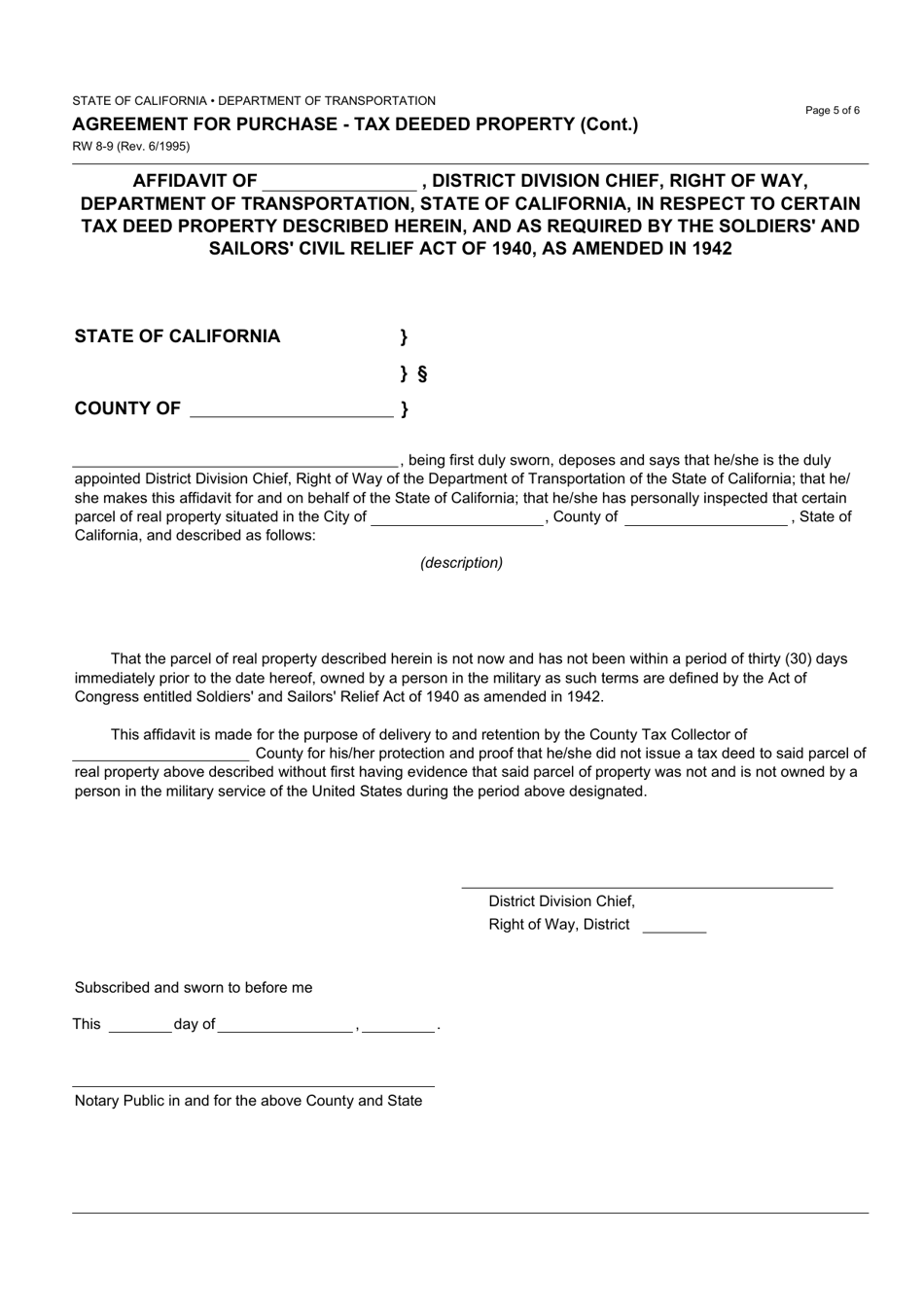

Q: What information is required in Form RW8-9?

A: Form RW8-9 requires information about the buyer, the property, and the terms of the purchase.

Q: Are there any restrictions on purchasing a tax-deeded property?

A: There may be restrictions on purchasing a tax-deeded property, such as liens or encumbrances on the property.

Q: Can I finance the purchase of a tax-deeded property?

A: Financing options for the purchase of a tax-deeded property may vary. It's recommended to consult with a financial advisor or lender.

Q: What are the risks of buying a tax-deeded property?

A: Some risks of buying a tax-deeded property include potential liens, repairs or renovations needed, and uncertain property condition.

Q: Do I need a lawyer to complete Form RW8-9?

A: While it's not required, it's recommended to consult with a lawyer to ensure the agreement is legally sound.

Q: What happens after submitting Form RW8-9?

A: After submitting Form RW8-9, the government will review the application and may accept or reject the offer to purchase the tax-deeded property.

Form Details:

- Released on June 1, 1995;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW8-9 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.