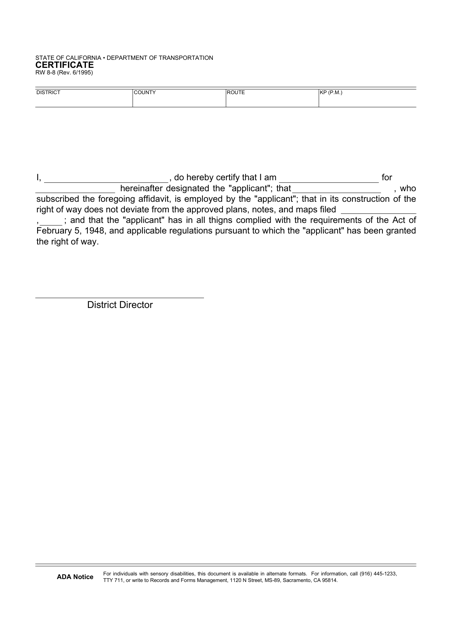

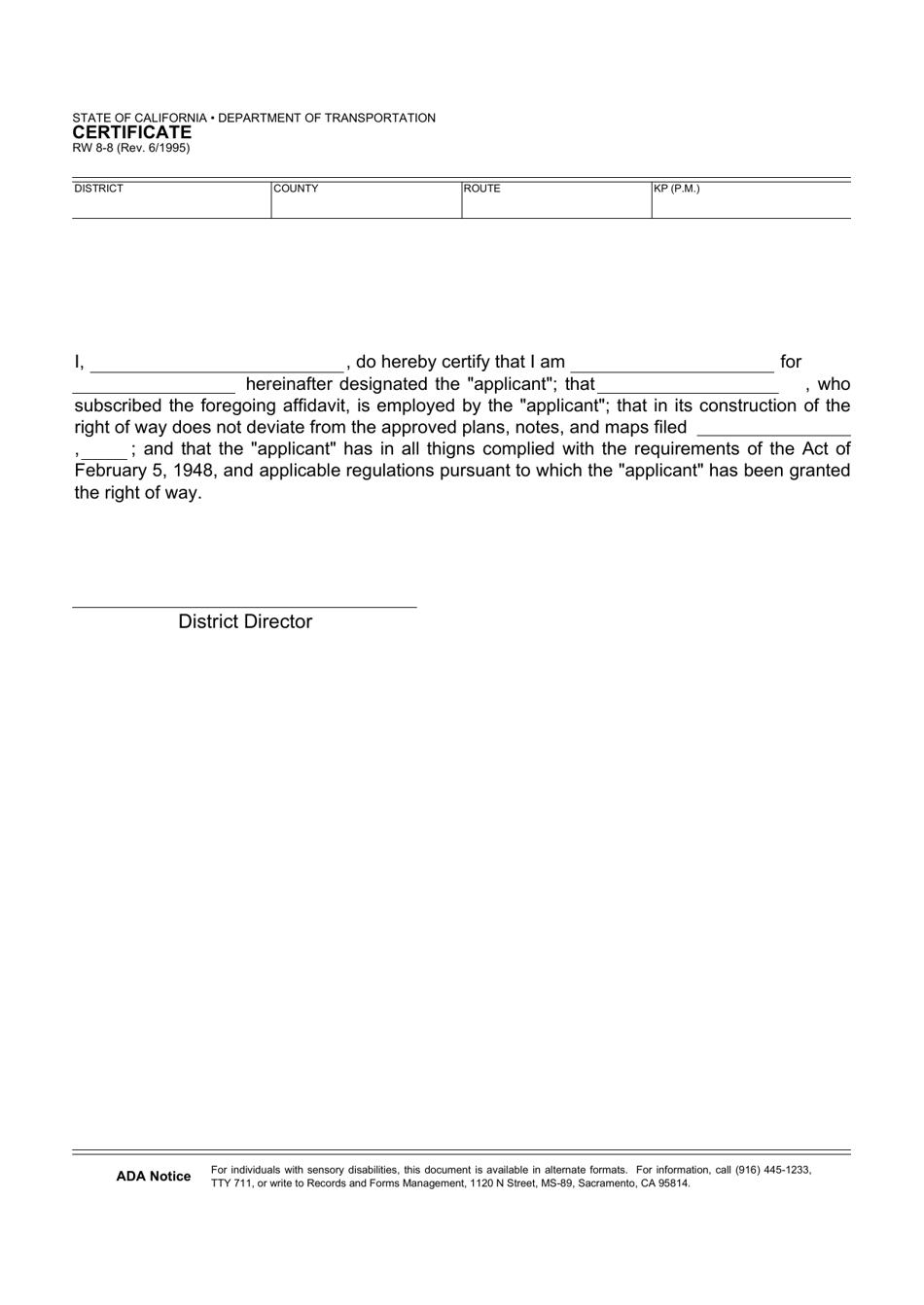

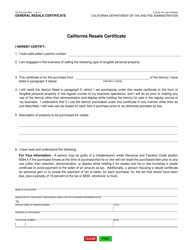

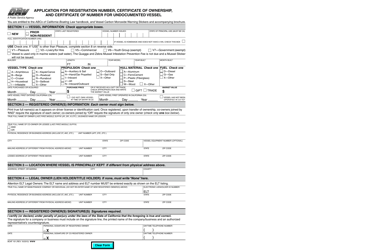

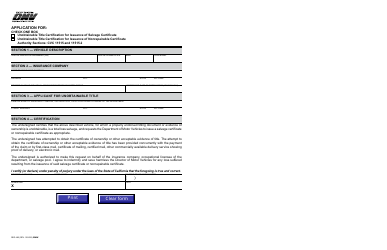

Form RW8-8 Certificate - California

What Is Form RW8-8?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form RW8-8 Certificate?

A: Form RW8-8 Certificate is a document used in California to report state income tax withheld from compensation paid to nonresident individuals.

Q: Who needs to file a Form RW8-8 Certificate?

A: Employers in California who have withheld state income tax from compensation paid to nonresident individuals need to file a Form RW8-8 Certificate.

Q: What information is required on a Form RW8-8 Certificate?

A: The Form RW8-8 Certificate requires information such as the employer's name, address, and identification number, as well as the nonresident individual's name, address, and social security number or individual taxpayer identification number.

Q: When is the deadline to file a Form RW8-8 Certificate?

A: The Form RW8-8 Certificate must be filed by January 31 of the year following the calendar year in which the compensation was paid.

Form Details:

- Released on June 1, 1995;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW8-8 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.