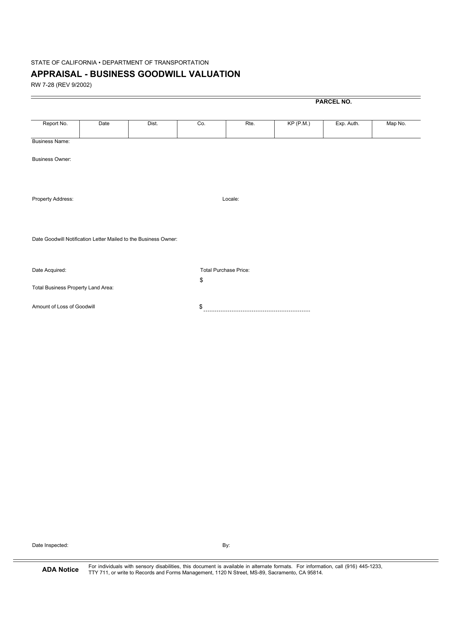

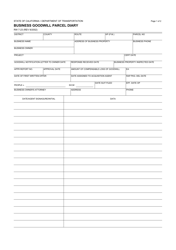

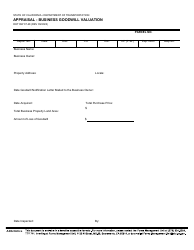

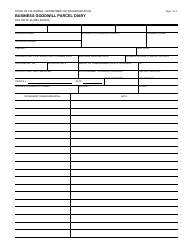

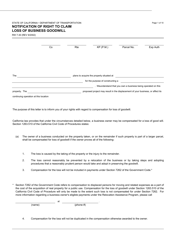

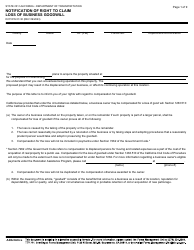

Form RW7-28 Appraisal - Business Goodwill Valuation - California

What Is Form RW7-28?

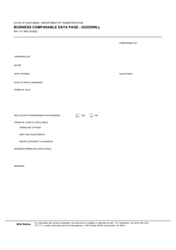

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RW7-28 Form?

A: The RW7-28 Form is an appraisal form used for valuing business goodwill in California.

Q: What is Business Goodwill?

A: Business goodwill refers to the intangible value of a business, such as reputation, customer relationships, and brand recognition.

Q: Why is Business Goodwill Valuation important?

A: Business goodwill valuation is important for various purposes, such as selling a business, determining fair market value, or calculating the value of assets.

Q: Who uses the RW7-28 Form?

A: The RW7-28 Form is typically used by appraisers, business owners, and individuals involved in the valuation of business goodwill in California.

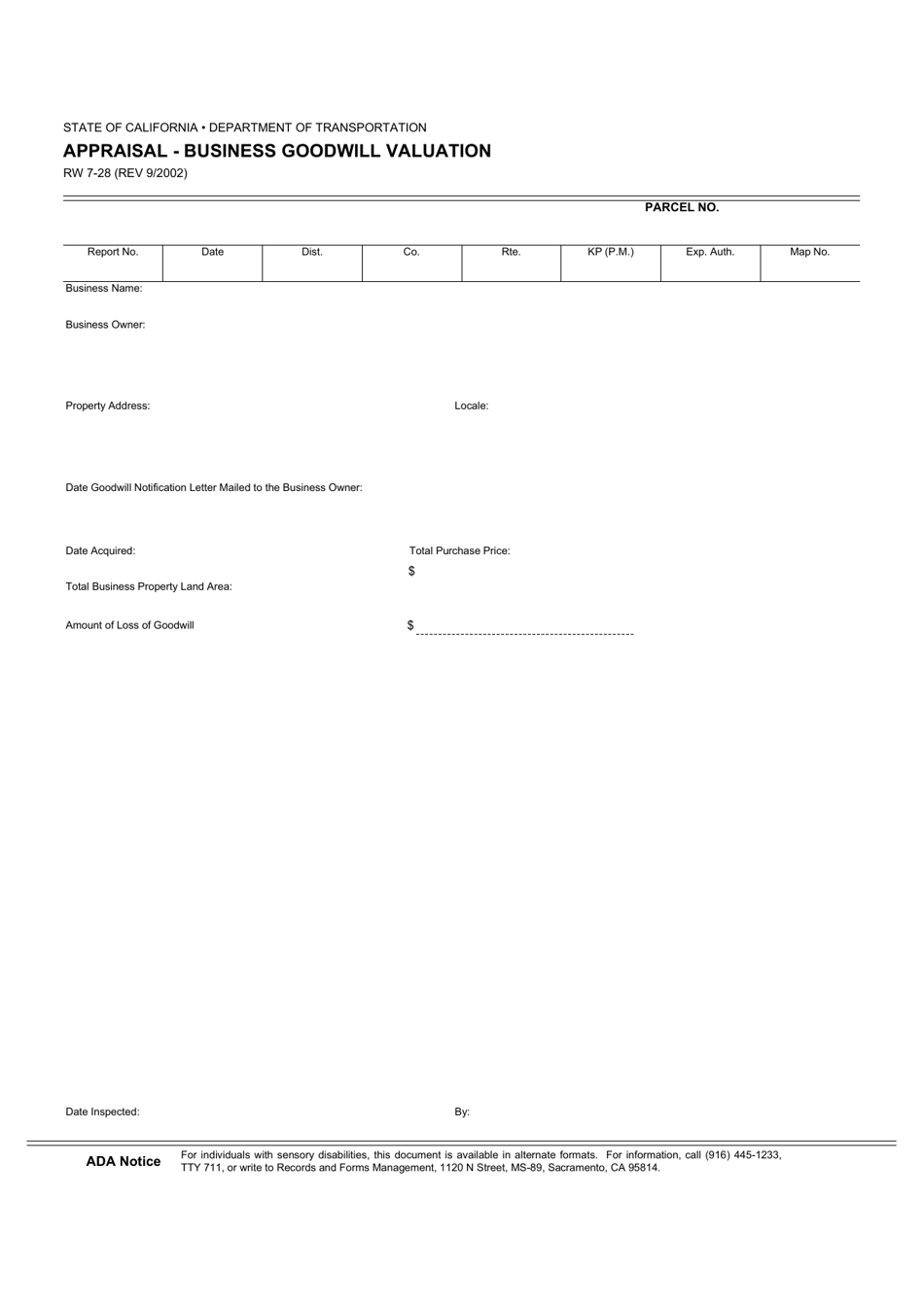

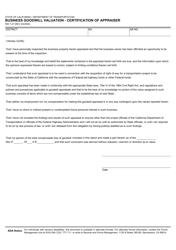

Q: How to fill out the RW7-28 Form?

A: The RW7-28 Form should be filled out with relevant information about the business, its assets, liabilities, financial performance, and other factors that contribute to its goodwill value.

Q: Are there any filing fees for the RW7-28 Form?

A: No, there are no filing fees associated with the RW7-28 Form.

Q: Can I use the RW7-28 Form outside of California?

A: The RW7-28 Form is specific to business goodwill valuation in California and may not be applicable or recognized outside of the state.

Q: What if I need assistance with filling out the RW7-28 Form?

A: If you need assistance with filling out the RW7-28 Form, you can consult a qualified appraiser or seek professional advice from a business valuation specialist.

Form Details:

- Released on September 1, 2002;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW7-28 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.