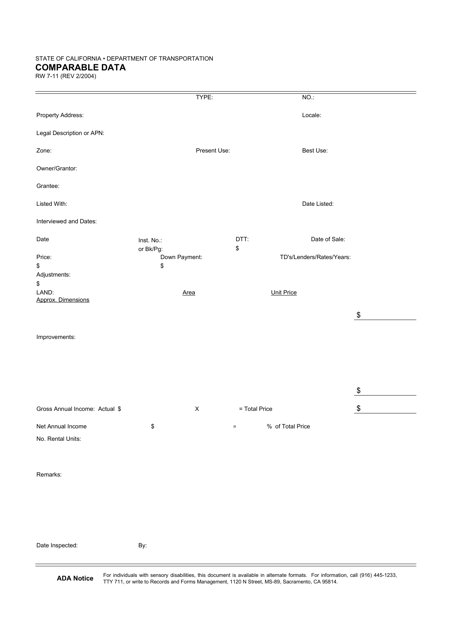

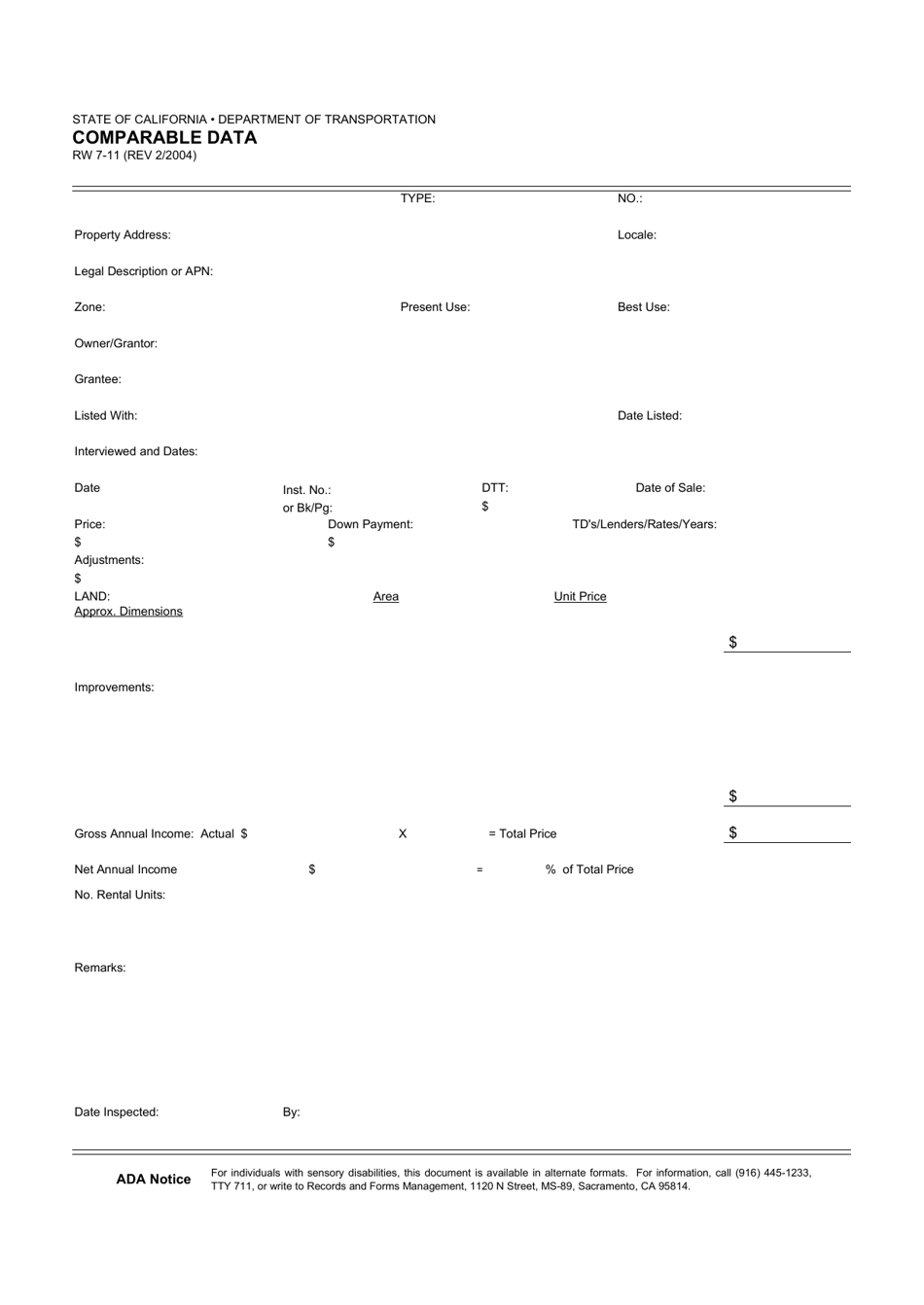

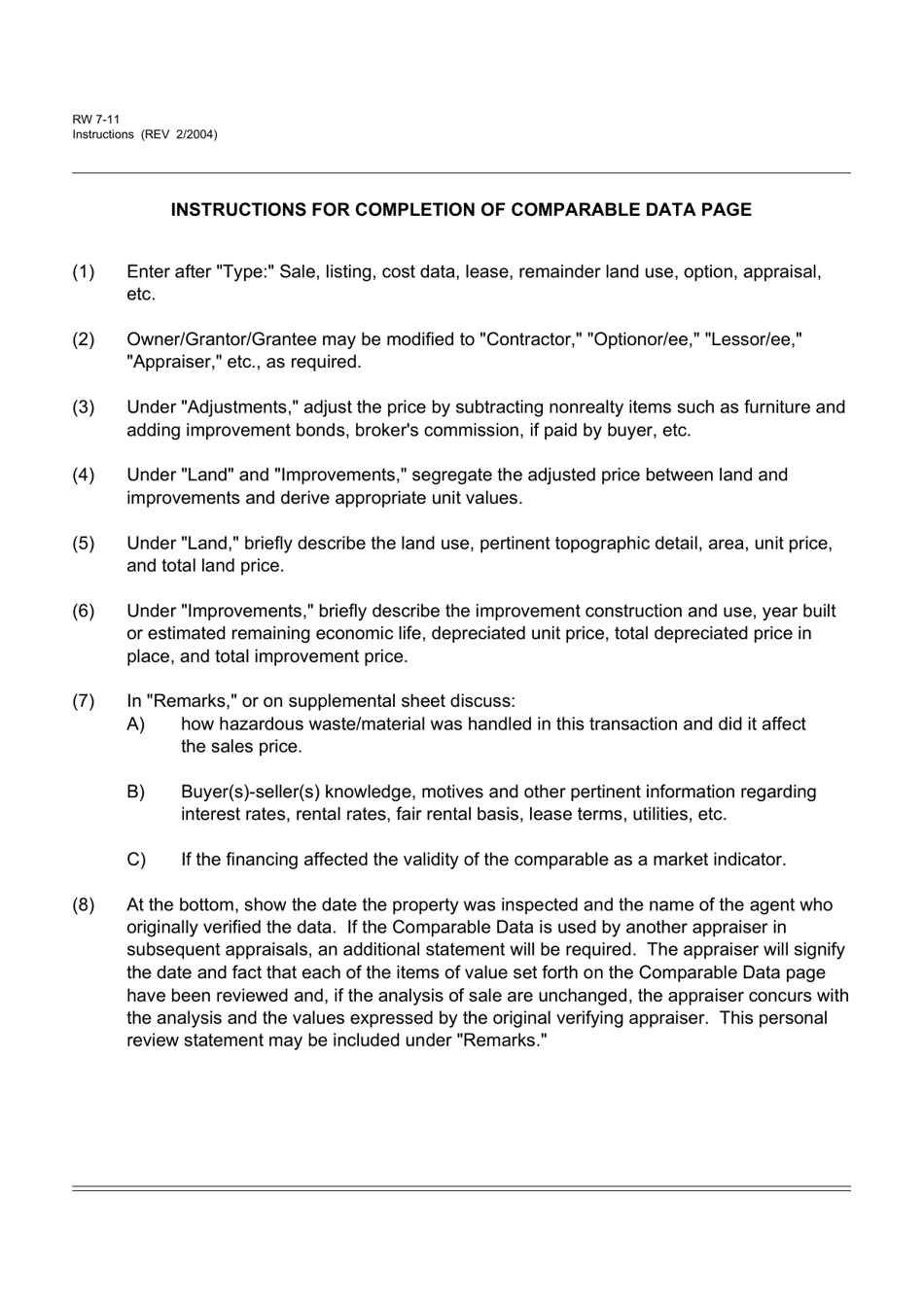

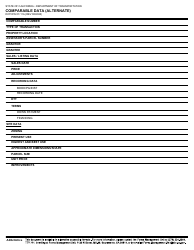

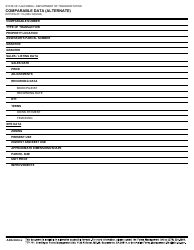

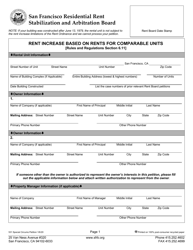

Form RW7-11 Comparable Data - California

What Is Form RW7-11?

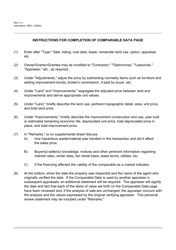

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW7-11?

A: Form RW7-11 is a document used for reporting comparable data in California.

Q: What is comparable data?

A: Comparable data refers to information about similar properties that can be used for valuation purposes.

Q: Why is Form RW7-11 used?

A: Form RW7-11 is used to provide data on comparable properties to assist in assessing property values and determining property tax assessments.

Q: Who is required to complete Form RW7-11?

A: Property owners, real estate agents, and assessors may be required to complete Form RW7-11.

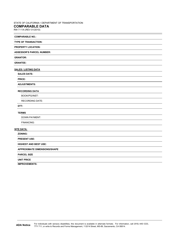

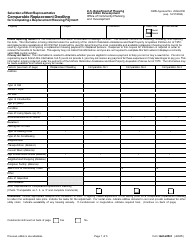

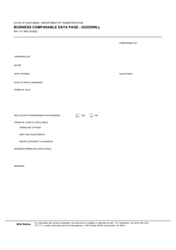

Q: What information is included in Form RW7-11?

A: Form RW7-11 includes details such as property address, sales price, and characteristics of the property.

Q: Are there any penalties for not filing Form RW7-11?

A: Penalties may vary by jurisdiction, but failure to submit Form RW7-11 as required may result in penalties or fines.

Q: How often do I need to complete Form RW7-11?

A: The frequency of completing Form RW7-11 may vary by jurisdiction, but it is usually required for specific property assessments or transactions.

Q: Can I use previous years' data on Form RW7-11?

A: Generally, it is recommended to use the most recent and relevant data when completing Form RW7-11.

Form Details:

- Released on February 1, 2004;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW7-11 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.