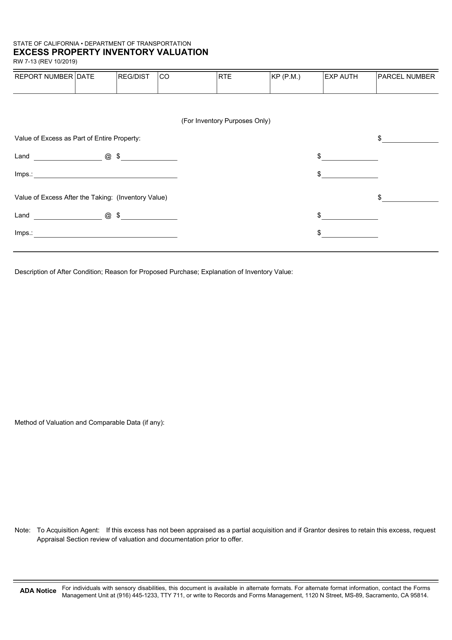

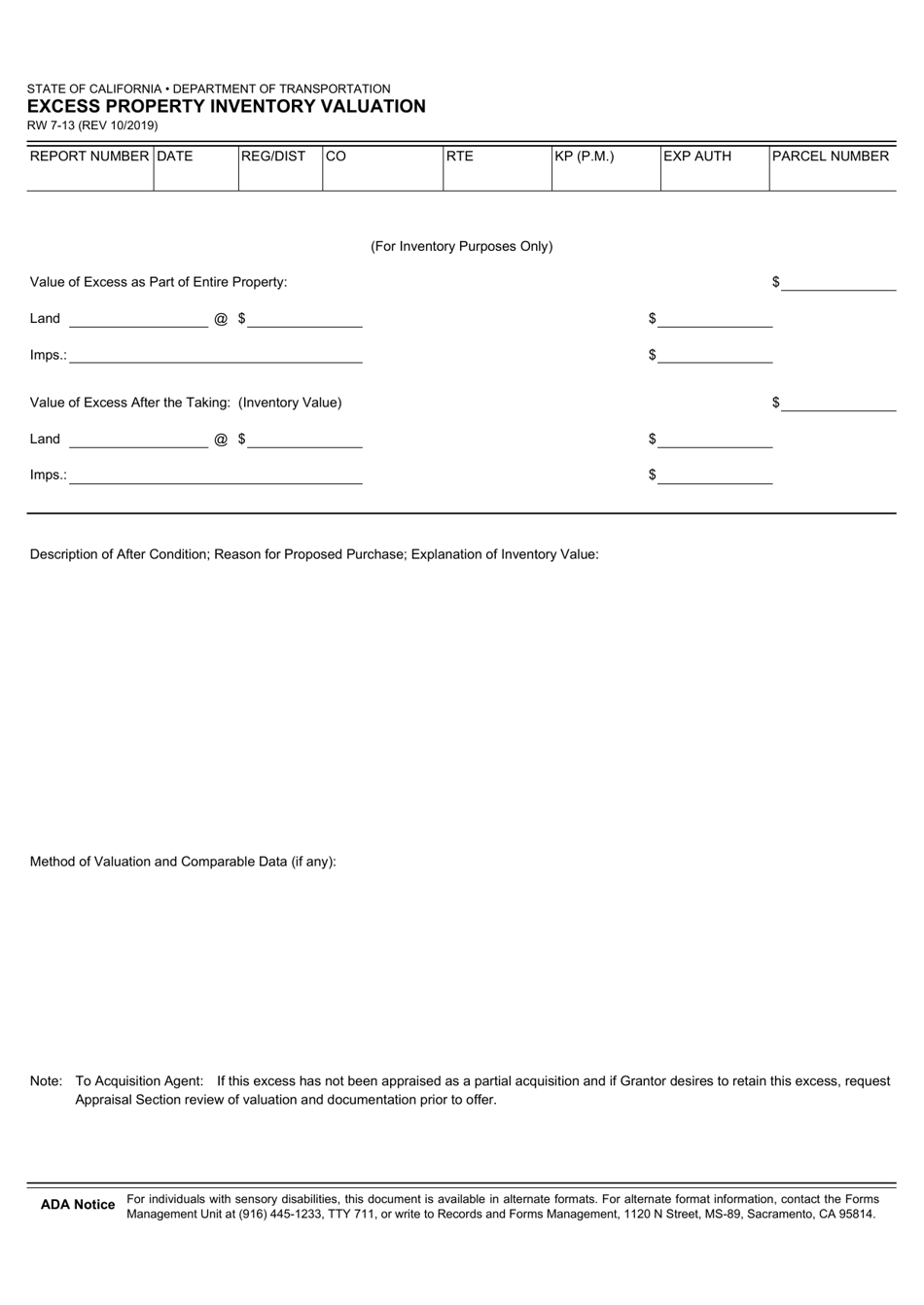

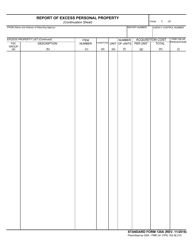

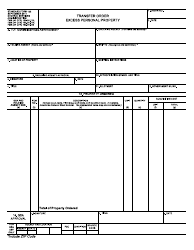

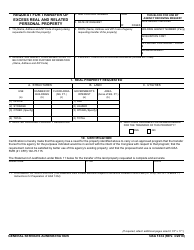

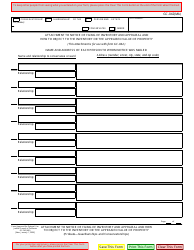

Form RW7-13 Excess Property Inventory Valuation - California

What Is Form RW7-13?

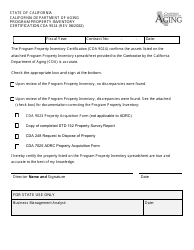

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RW7-13 form?

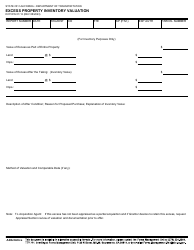

A: The RW7-13 form is a document used for the valuation of excess property inventory in California.

Q: What is excess property inventory?

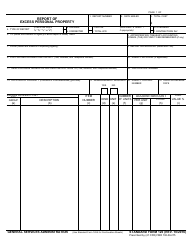

A: Excess property inventory refers to goods, equipment, or other assets that are surplus or no longer needed by a government agency or organization.

Q: What is the purpose of completing the RW7-13 form?

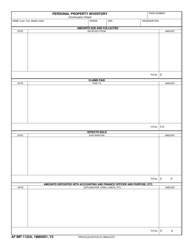

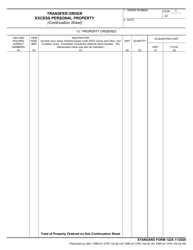

A: The purpose of completing the RW7-13 form is to provide a valuation of excess property inventory for reporting and accounting purposes.

Q: Who is required to complete the RW7-13 form?

A: Government agencies and organizations in California that have excess property inventory are generally required to complete the RW7-13 form.

Q: Are there any deadlines for submitting the RW7-13 form?

A: Specific deadlines for submitting the RW7-13 form may vary depending on the agency or organization, so it is important to check with the appropriate authority for the deadline.

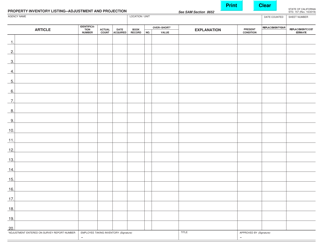

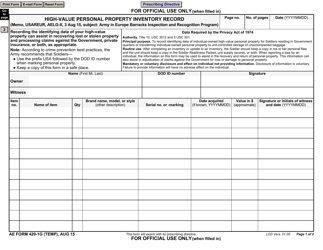

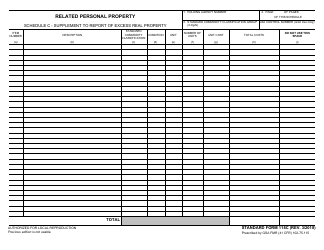

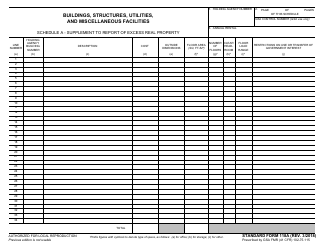

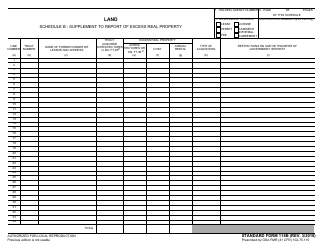

Q: What information is required on the RW7-13 form?

A: The RW7-13 form typically requires information such as the description of the property, acquisition cost, condition, location, and other relevant details.

Q: Is there a fee for filing the RW7-13 form?

A: There may be a fee associated with filing the RW7-13 form, which can vary depending on the agency or organization. It is advisable to check the specific requirements and fee structure.

Q: Can the valuation provided on the RW7-13 form be appealed?

A: Yes, in some cases, the valuation provided on the RW7-13 form can be appealed through the appropriate appeals process. It is necessary to follow the guidelines and procedures outlined by the agency or organization.

Q: What happens to the excess property inventory after completing the RW7-13 form?

A: After completing the RW7-13 form, the excess property inventory may be disposed of or sold, depending on the policies and procedures of the agency or organization.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW7-13 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.