This version of the form is not currently in use and is provided for reference only. Download this version of

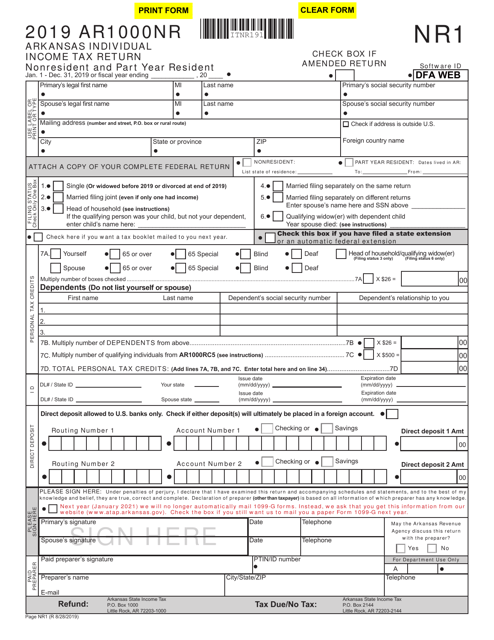

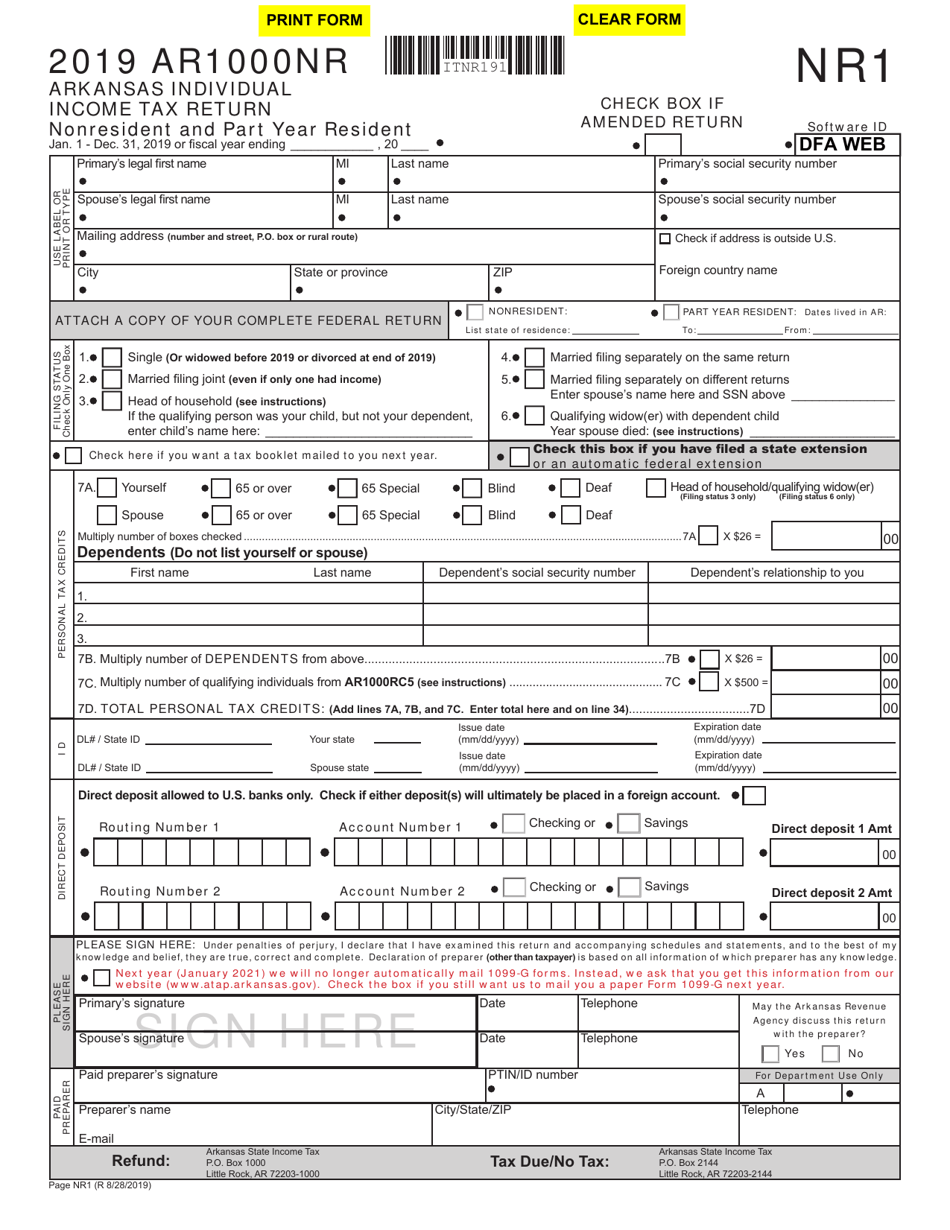

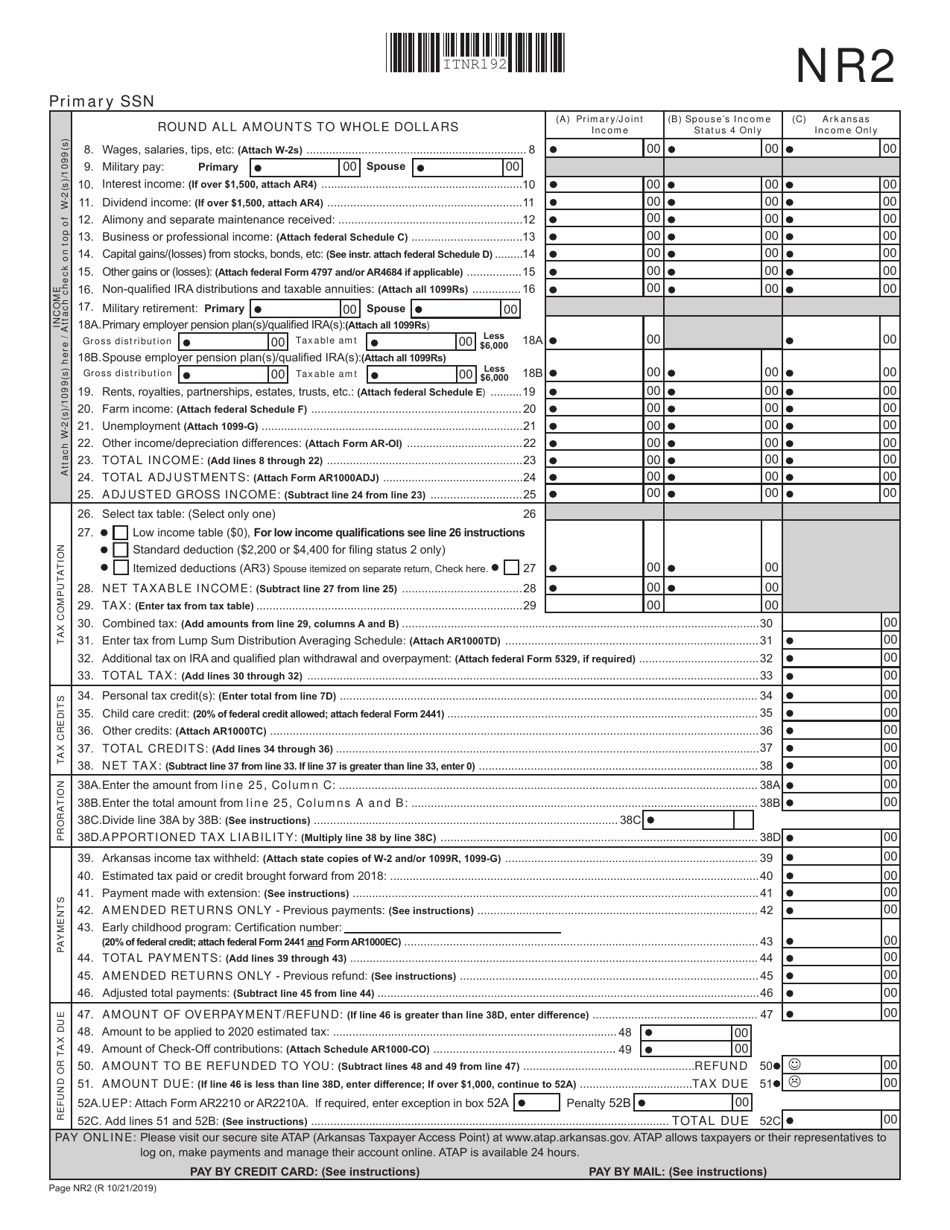

Form AR1000NR

for the current year.

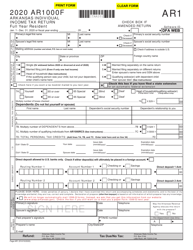

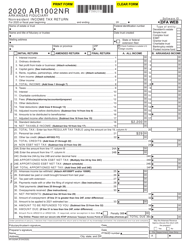

Form AR1000NR Arkansas Individual Income Tax Return - Nonresident and Part Year Resident - Arkansas

What Is Form AR1000NR?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who is required to file Form AR1000NR?

A: Nonresidents and part-year residents of Arkansas.

Q: What is the purpose of Form AR1000NR?

A: To report and pay individual income tax on income earned in Arkansas by nonresidents and part-year residents.

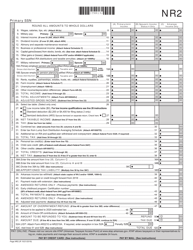

Q: What types of income should be reported on Form AR1000NR?

A: All income earned in Arkansas, including wages, salaries, self-employment income, interest, dividends, and rental income.

Q: Do nonresidents need to report income earned outside of Arkansas?

A: No, only income earned within Arkansas should be reported.

Q: Are there any deductions or credits available for nonresidents on Form AR1000NR?

A: Yes, nonresidents may be eligible for certain deductions and credits, such as the federal deduction for state taxes paid.

Q: When is the deadline for filing Form AR1000NR?

A: The deadline for filing Form AR1000NR is the same as the federal tax filing deadline, which is typically April 15th.

Q: What happens if I file Form AR1000NR late?

A: If you file Form AR1000NR late, you may be subject to penalties and interest on any unpaid tax due.

Q: Can I file Form AR1000NR electronically?

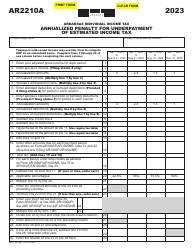

A: Yes, you can file Form AR1000NR electronically using the Arkansas Taxpayer Access Point (ATAP) system.

Q: Do I need to include any supporting documents with Form AR1000NR?

A: You may need to include copies of your federal tax return and other relevant documentation to support the information reported on Form AR1000NR.

Form Details:

- Released on August 28, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000NR by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.