This version of the form is not currently in use and is provided for reference only. Download this version of

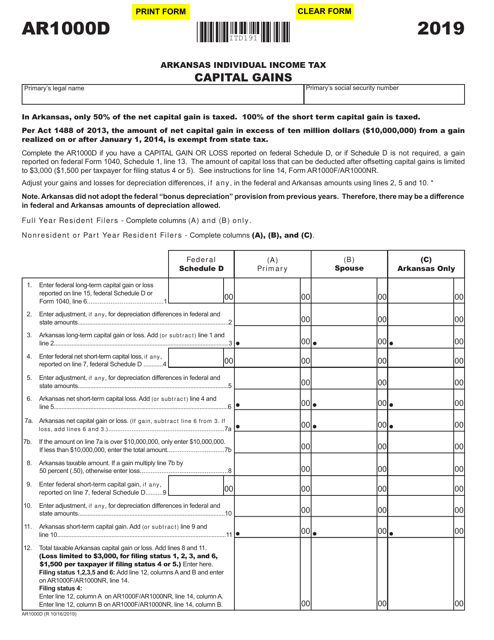

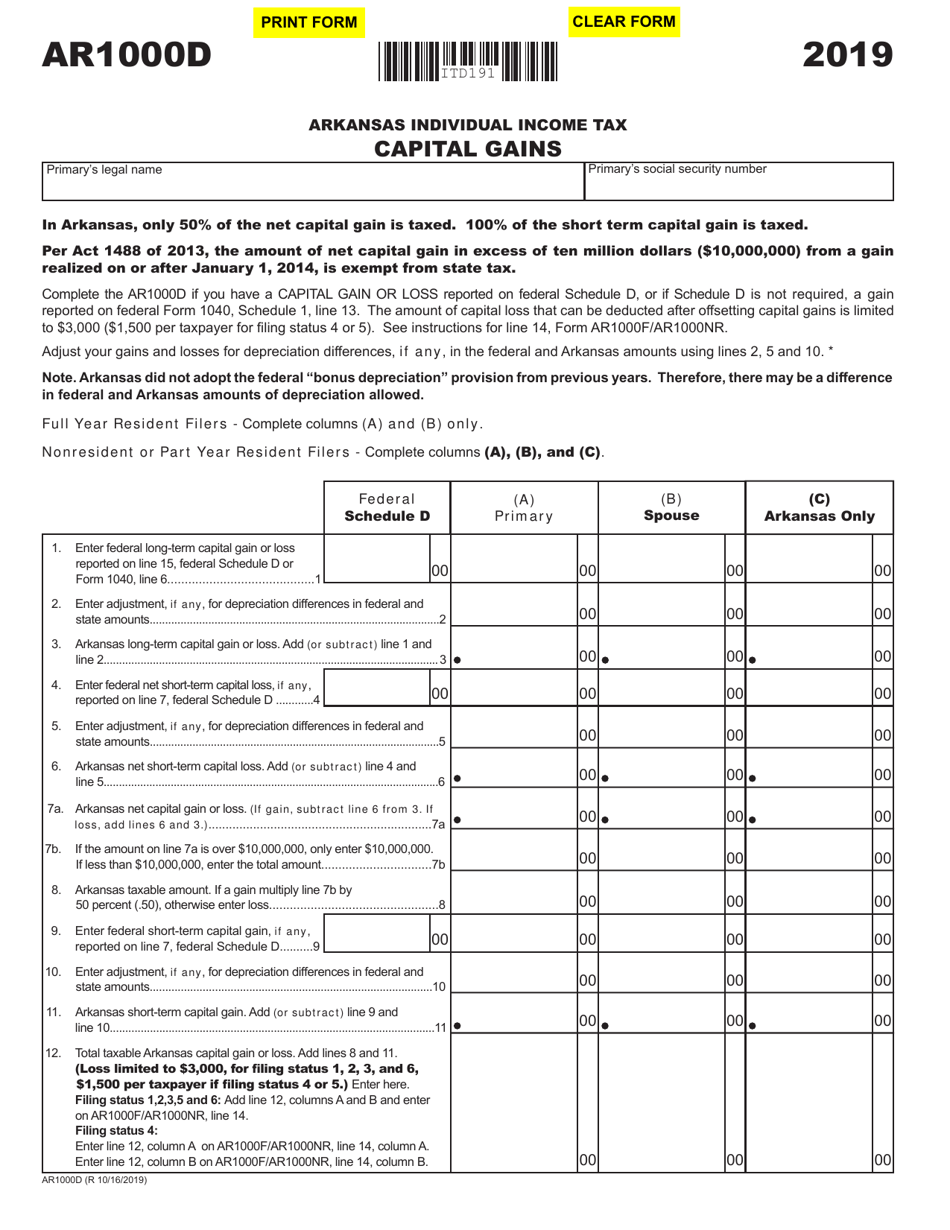

Form AR1000D

for the current year.

Form AR1000D Capital Gains - Arkansas

What Is Form AR1000D?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000D?

A: Form AR1000D is a tax form used in Arkansas to report capital gains.

Q: What are capital gains?

A: Capital gains are the profits you make from selling certain assets, such as stocks, bonds, or real estate.

Q: Who needs to file Form AR1000D?

A: Any individual or entity that had capital gains in Arkansas during the tax year needs to file Form AR1000D.

Q: What information is required on Form AR1000D?

A: Form AR1000D requires you to report information about the assets sold, the purchase and sale dates, and the gains or losses.

Q: What is the deadline for filing Form AR1000D?

A: The deadline for filing Form AR1000D in Arkansas is typically April 15th, the same as the federal tax deadline.

Form Details:

- Released on October 16, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000D by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.