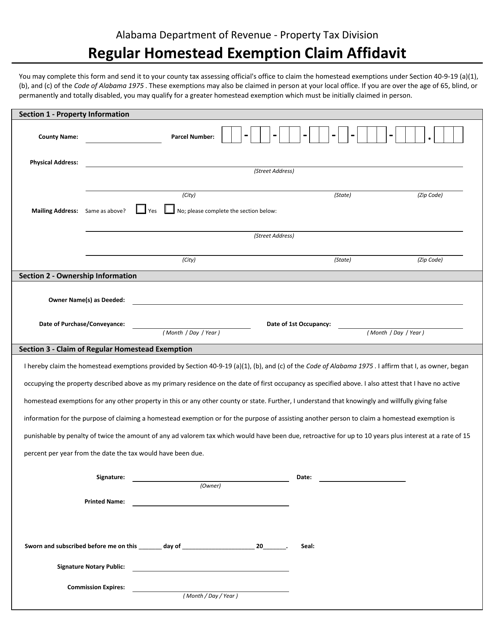

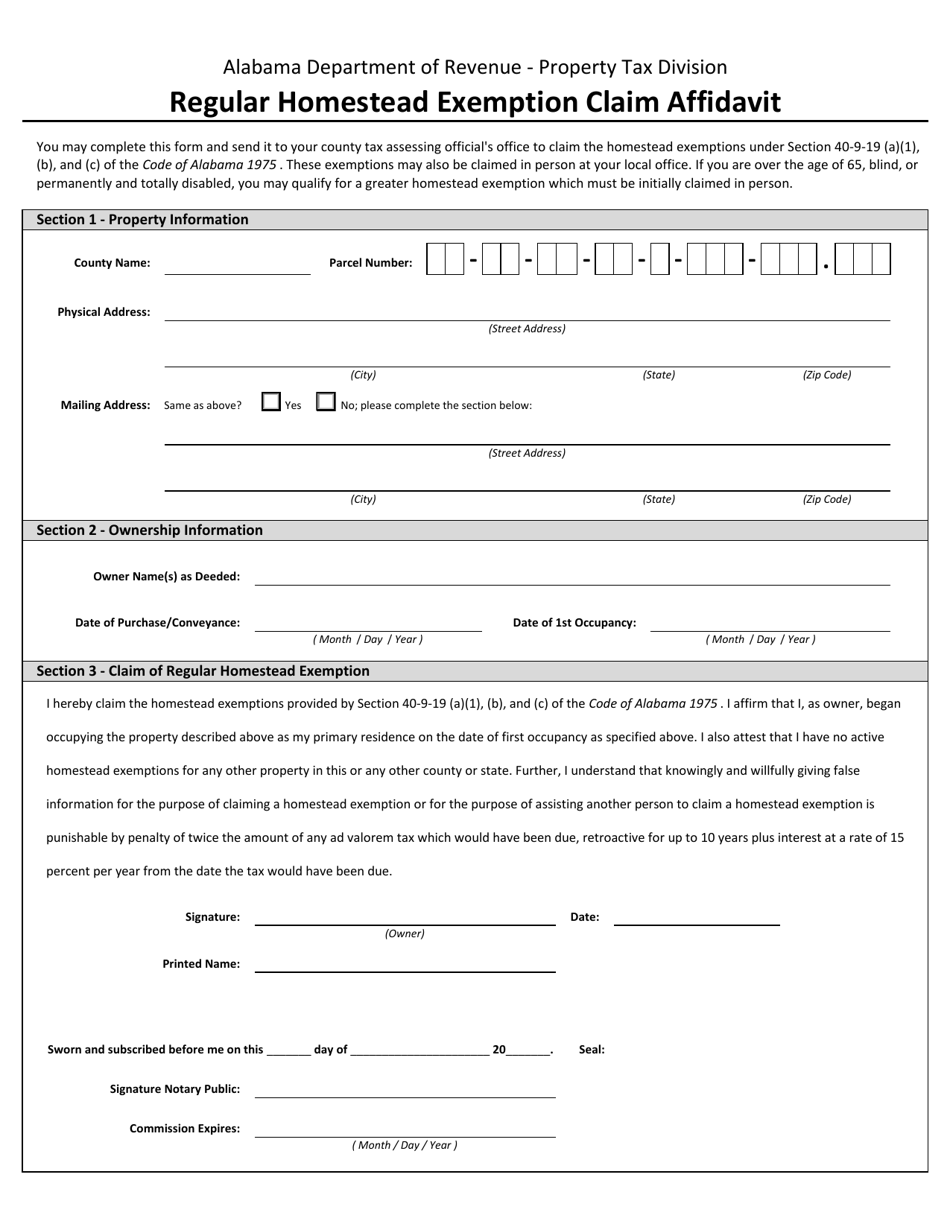

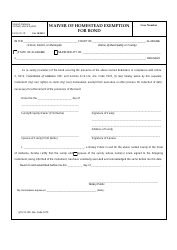

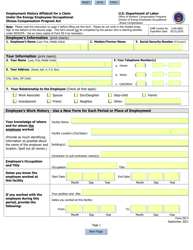

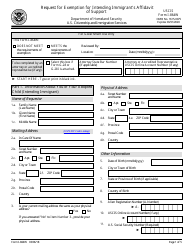

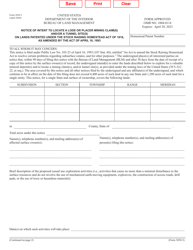

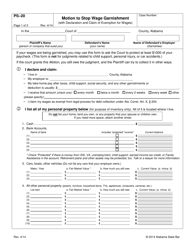

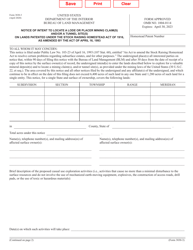

Regular Homestead Exemption Claim Affidavit - Alabama

Regular Homestead Exemption Claim Affidavit is a legal document that was released by the Alabama Department of Revenue - a government authority operating within Alabama.

FAQ

Q: What is a Regular Homestead Exemption?

A: Regular Homestead Exemption is a property tax exemption provided to homeowners to reduce the amount of property taxes they owe.

Q: Who is eligible for the Regular Homestead Exemption in Alabama?

A: To be eligible for the Regular Homestead Exemption in Alabama, you must own and occupy the property as your primary residence on October 1st of the tax year.

Q: How much is the Regular Homestead Exemption in Alabama?

A: The Regular Homestead Exemption in Alabama provides a $4,000 reduction in the assessed value of your primary residence for property tax purposes.

Q: How do I apply for the Regular Homestead Exemption in Alabama?

A: To apply for the Regular Homestead Exemption in Alabama, you must complete and file a Homestead Exemption Claim Affidavit with your county's tax assessor's office.

Q: Is there an application deadline for the Regular Homestead Exemption in Alabama?

A: Yes, the application deadline for the Regular Homestead Exemption in Alabama is December 31st of the tax year.

Q: Can I receive the Regular Homestead Exemption if I rent out a portion of my property?

A: No, you are only eligible for the Regular Homestead Exemption in Alabama if you own and occupy the property as your primary residence.

Q: Do I need to reapply for the Regular Homestead Exemption every year?

A: No, in Alabama, once you are approved for the Regular Homestead Exemption, you do not need to reapply as long as you continue to meet the eligibility requirements.

Q: What documents do I need to include with my Homestead Exemption Claim Affidavit?

A: You may need to include documents such as a copy of your driver's license, proof of ownership, and proof of residency with your Homestead Exemption Claim Affidavit.

Q: What are the benefits of the Regular Homestead Exemption in Alabama?

A: The benefits of the Regular Homestead Exemption in Alabama include a reduction in property taxes, which can help homeowners save money on their annual tax bill.

Q: Can I claim the Regular Homestead Exemption if I am a non-resident of Alabama?

A: No, the Regular Homestead Exemption in Alabama is only available to residents who own and occupy the property as their primary residence.

Form Details:

- The latest edition currently provided by the Alabama Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.