This version of the form is not currently in use and is provided for reference only. Download this version of

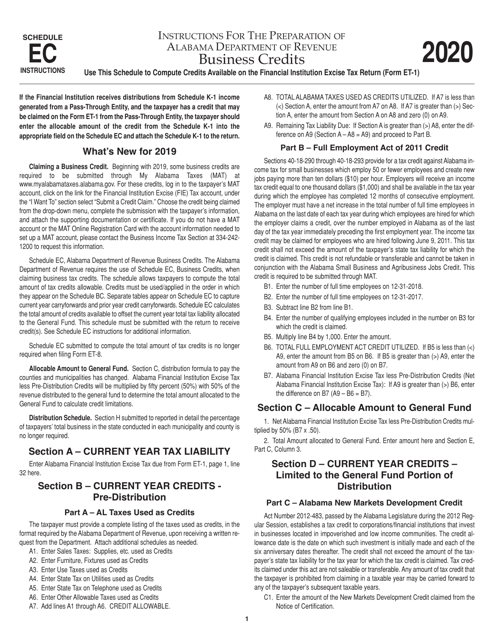

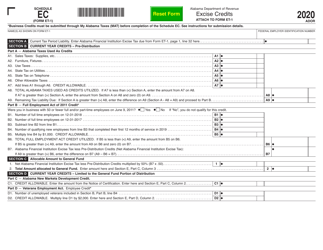

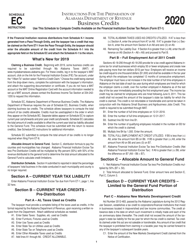

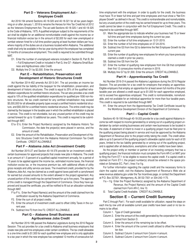

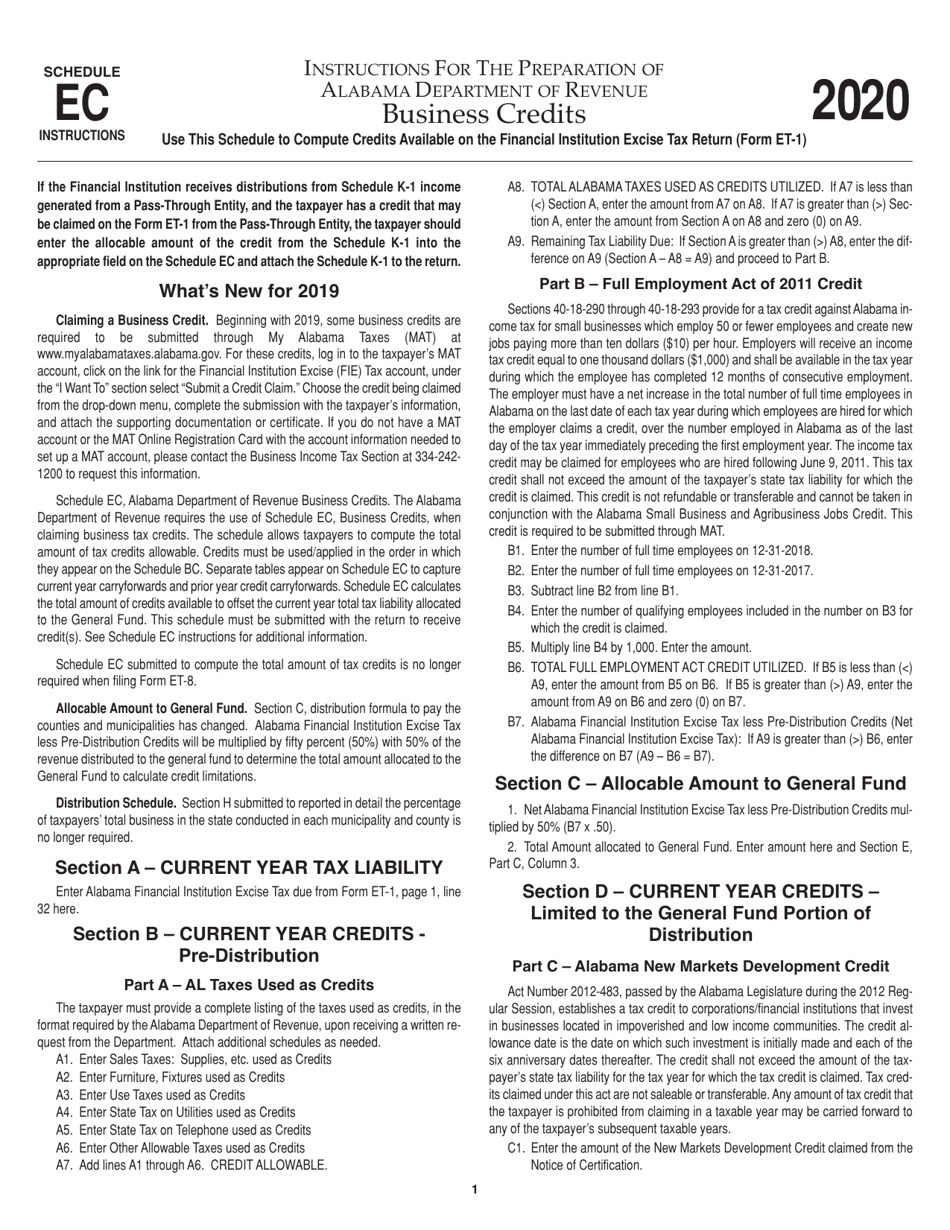

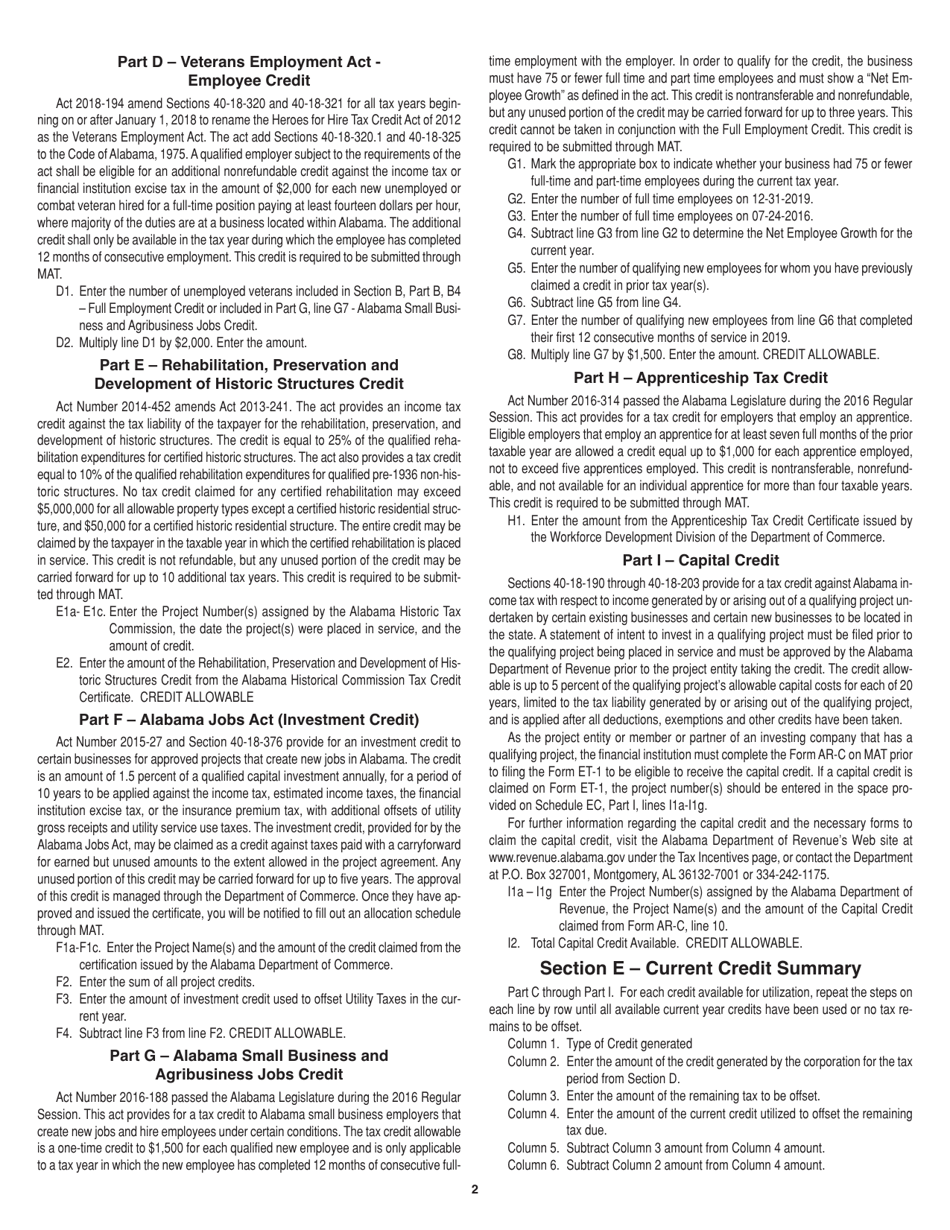

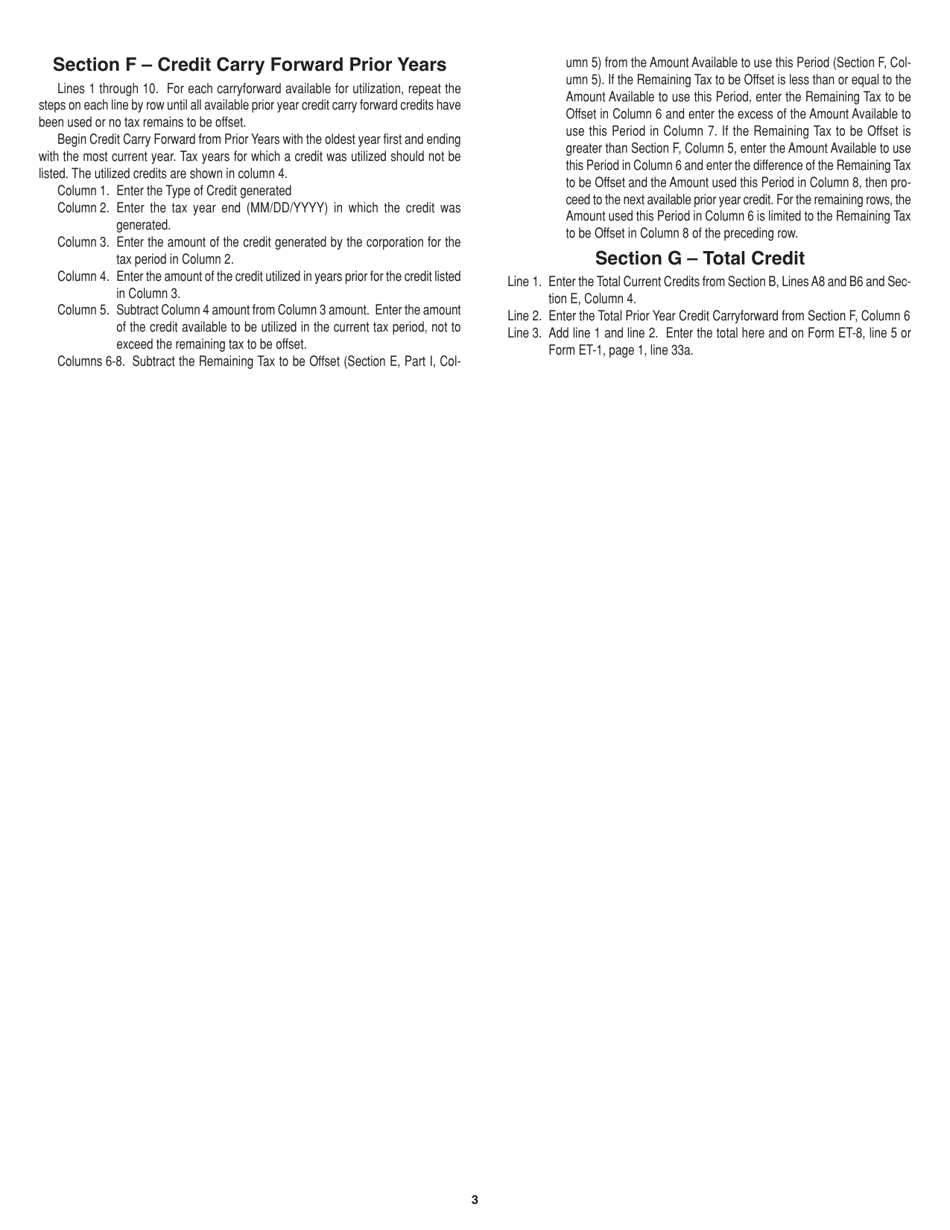

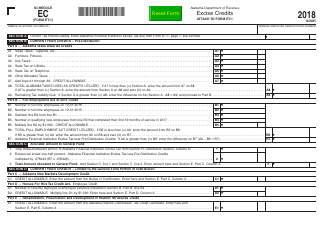

Instructions for Form ET-1 Schedule EC

for the current year.

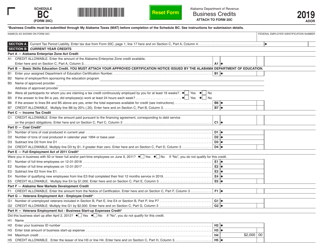

Instructions for Form ET-1 Schedule EC Business Credits - Alabama

This document contains official instructions for Form ET-1 Schedule EC, Business Credits - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form ET-1 Schedule EC is available for download through this link.

FAQ

Q: What is Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC is a schedule that reports business credits for Alabama.

Q: Who needs to file Form ET-1 Schedule EC?

A: Businesses in Alabama that have eligible business credits need to file Form ET-1 Schedule EC.

Q: What are business credits?

A: Business credits are incentives provided to businesses by the government as a way to encourage certain activities or investments.

Q: What type of credits are reported on Form ET-1 Schedule EC?

A: Form ET-1 Schedule EC reports credits such as the Rural Jobs Credit, Aerospace Revitalization Credit, and Film Rebate Credit.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.