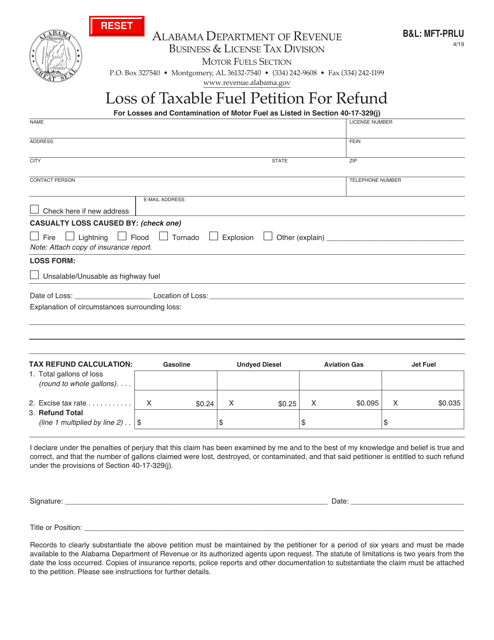

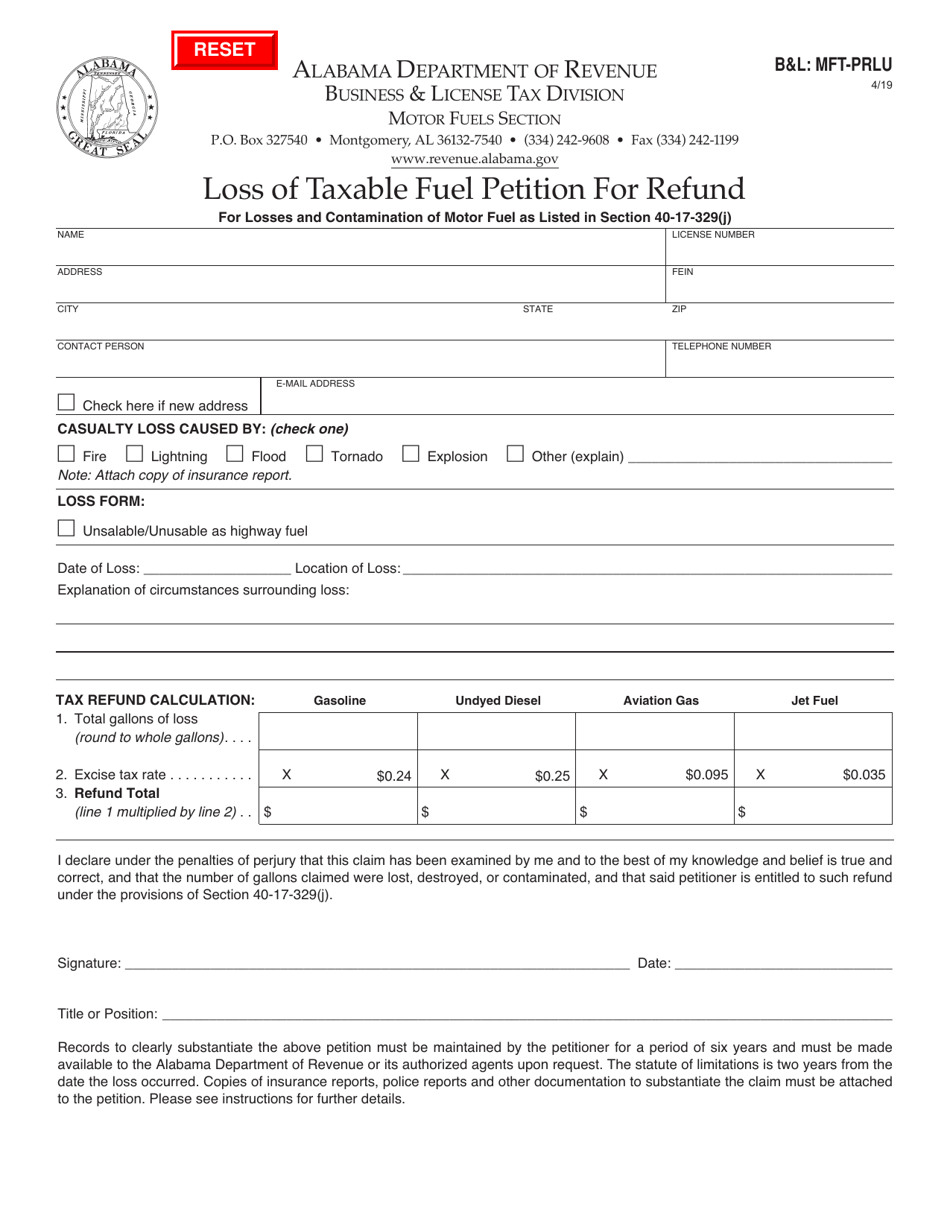

This version of the form is not currently in use and is provided for reference only. Download this version of

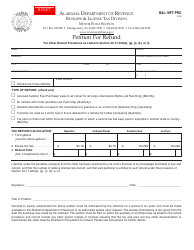

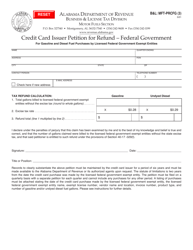

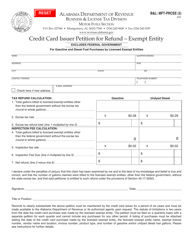

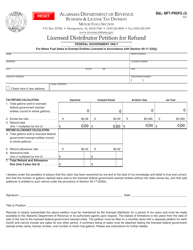

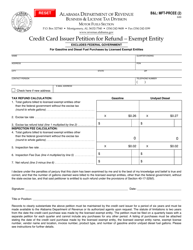

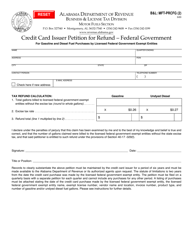

Form B&L: MFT-PRLU

for the current year.

Form B&L: MFT-PRLU Loss of Taxable Fuel Petition for Refund - Alabama

What Is Form B&L: MFT-PRLU?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a MFT-PRLU Loss of Taxable Fuel Petition for Refund?

A: The MFT-PRLU Loss of Taxable Fuel Petition for Refund is a form used in Alabama to request a refund for lost taxable fuel.

Q: Who can use the MFT-PRLU Loss of Taxable Fuel Petition for Refund?

A: This form can be used by individuals or businesses that have experienced a loss of taxable fuel in Alabama.

Q: What is considered a loss of taxable fuel?

A: A loss of taxable fuel can include spills, leaks, or theft of fuel that has already been taxed.

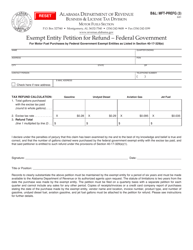

Q: What information is needed to complete the form?

A: You will need to provide details about the loss of fuel, including the quantity lost, the reason for the loss, and any supporting documentation.

Q: How do I submit the MFT-PRLU Loss of Taxable Fuel Petition for Refund?

A: The completed form should be mailed to the Alabama Department of Revenue along with any required attachments or supporting documentation.

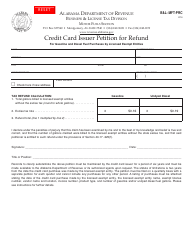

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-PRLU by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.