This version of the form is not currently in use and is provided for reference only. Download this version of

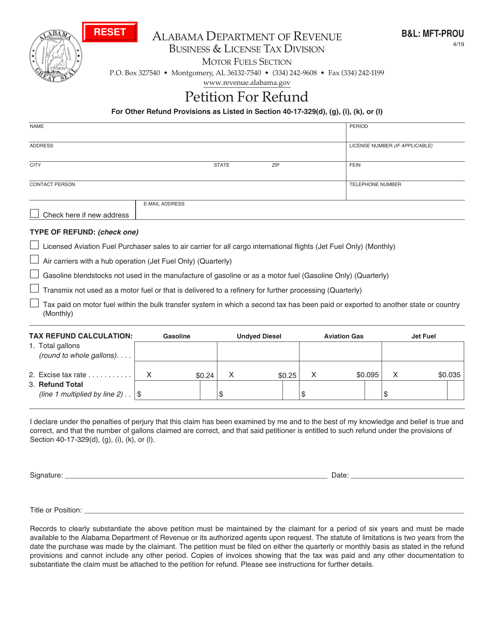

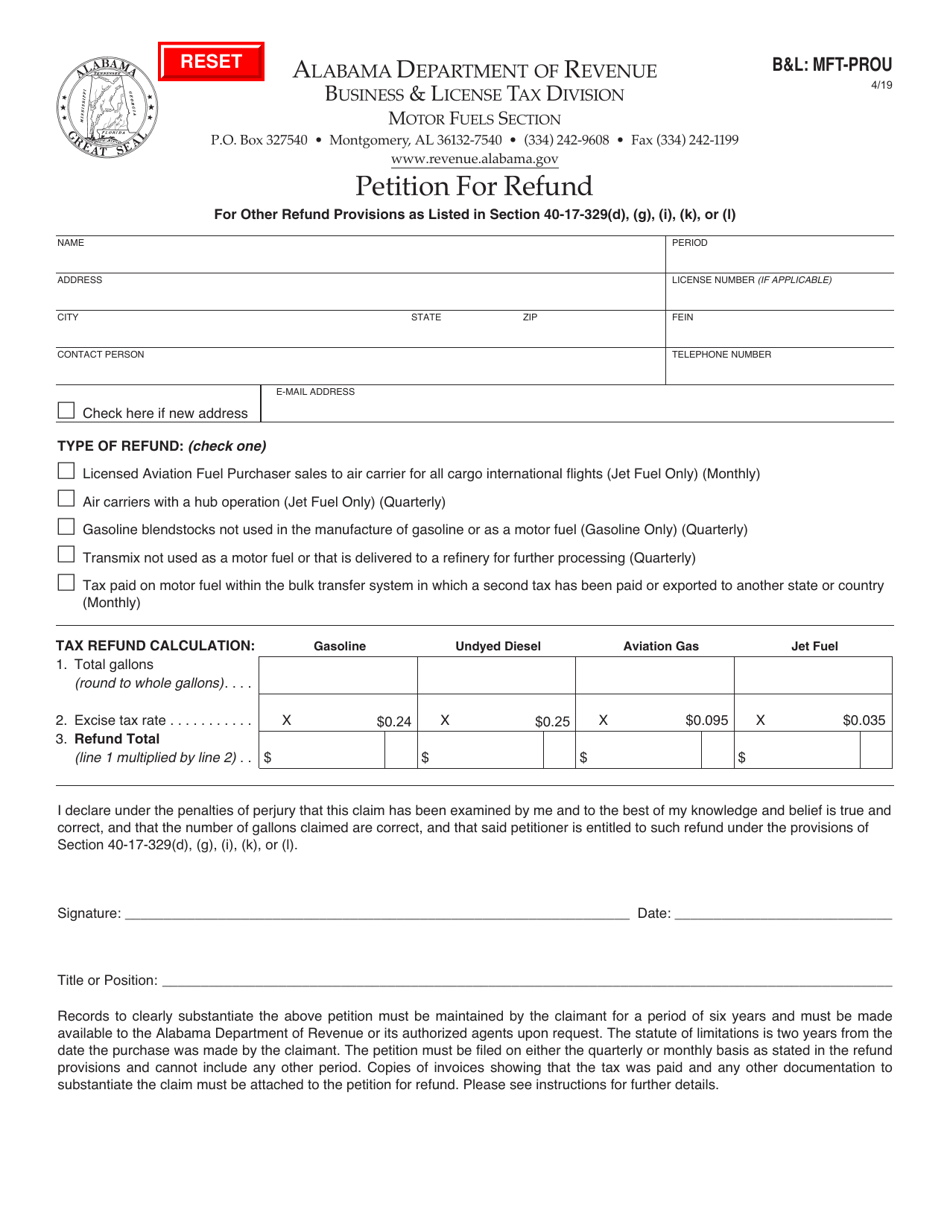

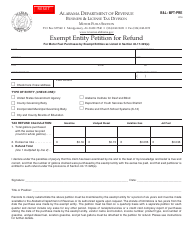

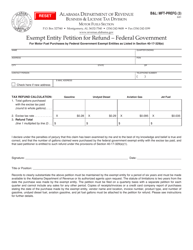

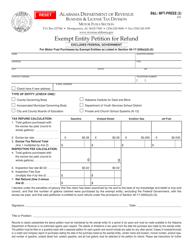

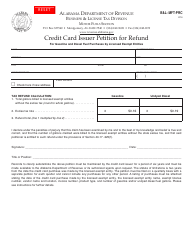

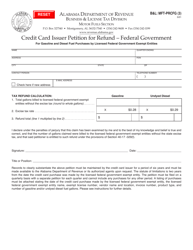

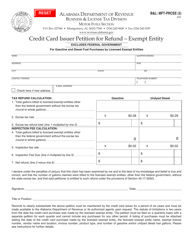

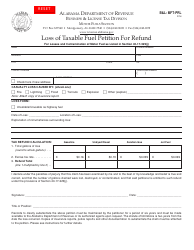

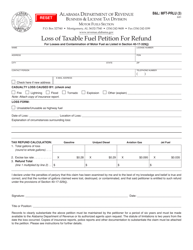

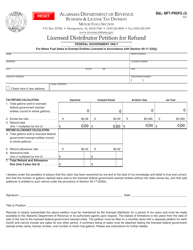

Form B&L: MFT-PROU

for the current year.

Form B&L: MFT-PROU Petition for Refund - Alabama

What Is Form B&L: MFT-PROU?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B&L: MFT-PROU?

A: Form B&L: MFT-PROU refers to the Petition for Refund in Alabama.

Q: What is the purpose of Form B&L: MFT-PROU?

A: Form B&L: MFT-PROU is used to request a refund of taxes paid in Alabama.

Q: Who should use Form B&L: MFT-PROU?

A: Individuals or businesses who have overpaid taxes in Alabama can use Form B&L: MFT-PROU to request a refund.

Q: What information is required on Form B&L: MFT-PROU?

A: Form B&L: MFT-PROU requires the taxpayer to provide their personal or business information, including the amount of the refund being requested, and supporting documentation.

Q: Are there any deadlines for filing Form B&L: MFT-PROU?

A: Yes, Form B&L: MFT-PROU must be filed within the statute of limitations for refund claims in Alabama.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFT-PROU by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.