This version of the form is not currently in use and is provided for reference only. Download this version of

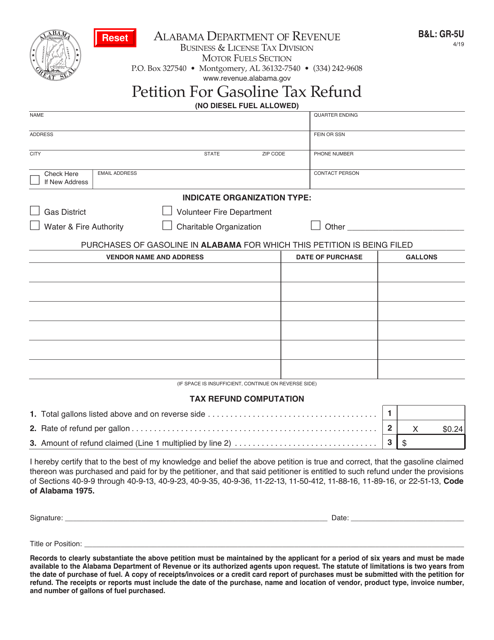

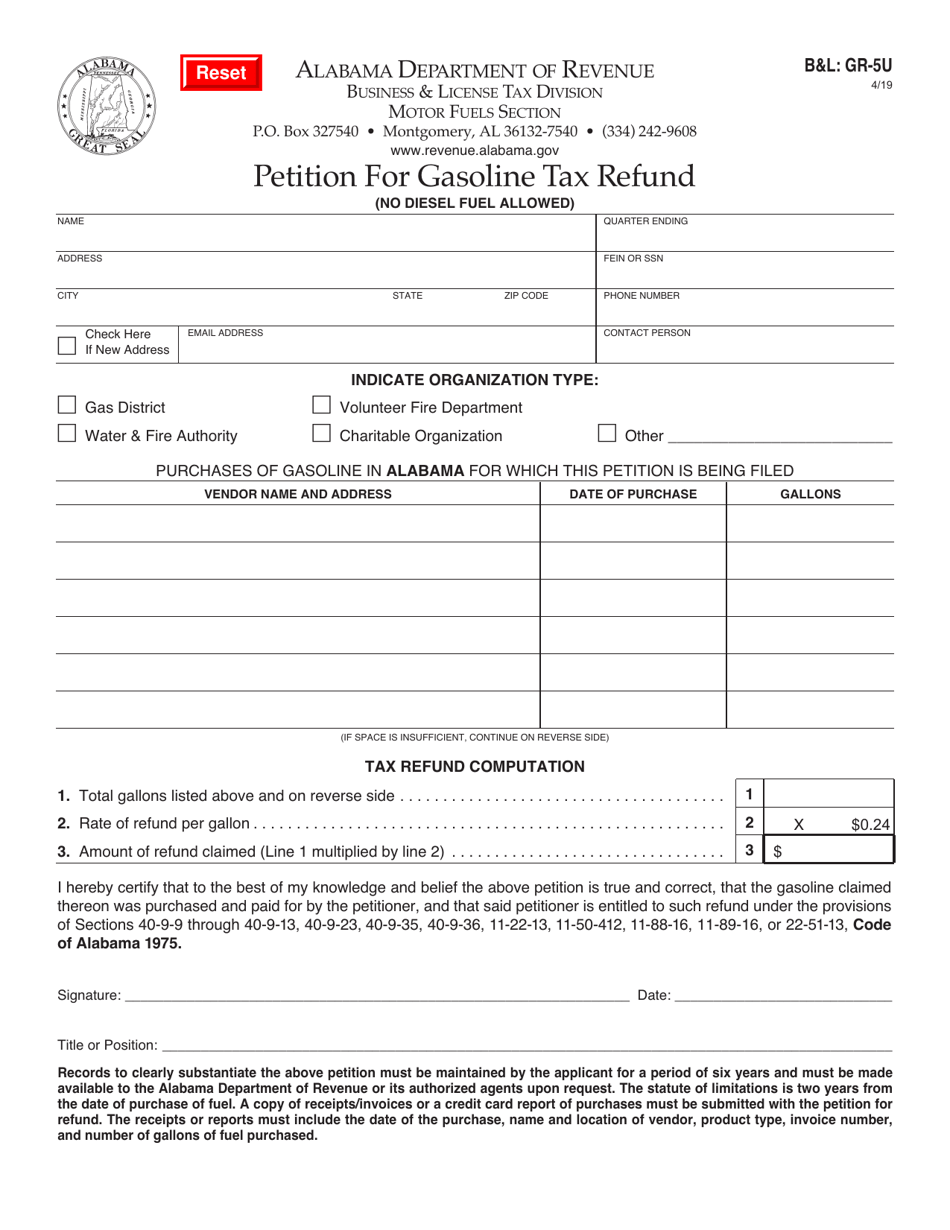

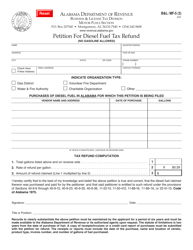

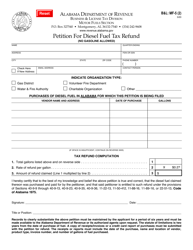

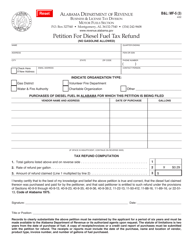

Form B&L: GR-5U

for the current year.

Form B&L: GR-5U Petition for Gasoline Tax Refund - Alabama

What Is Form B&L: GR-5U?

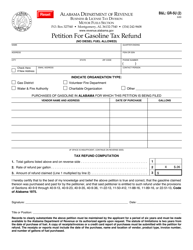

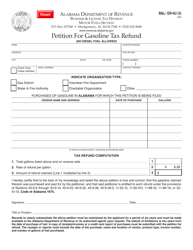

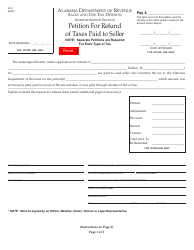

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: GR-5U?

A: Form B&L: GR-5U is a petition for gasoline tax refund in Alabama.

Q: Who can use Form B&L: GR-5U?

A: Any individual or business in Alabama who wants to request a gasoline tax refund can use Form B&L: GR-5U.

Q: What is the purpose of Form B&L: GR-5U?

A: The purpose of Form B&L: GR-5U is to request a refund for gasoline tax paid in Alabama.

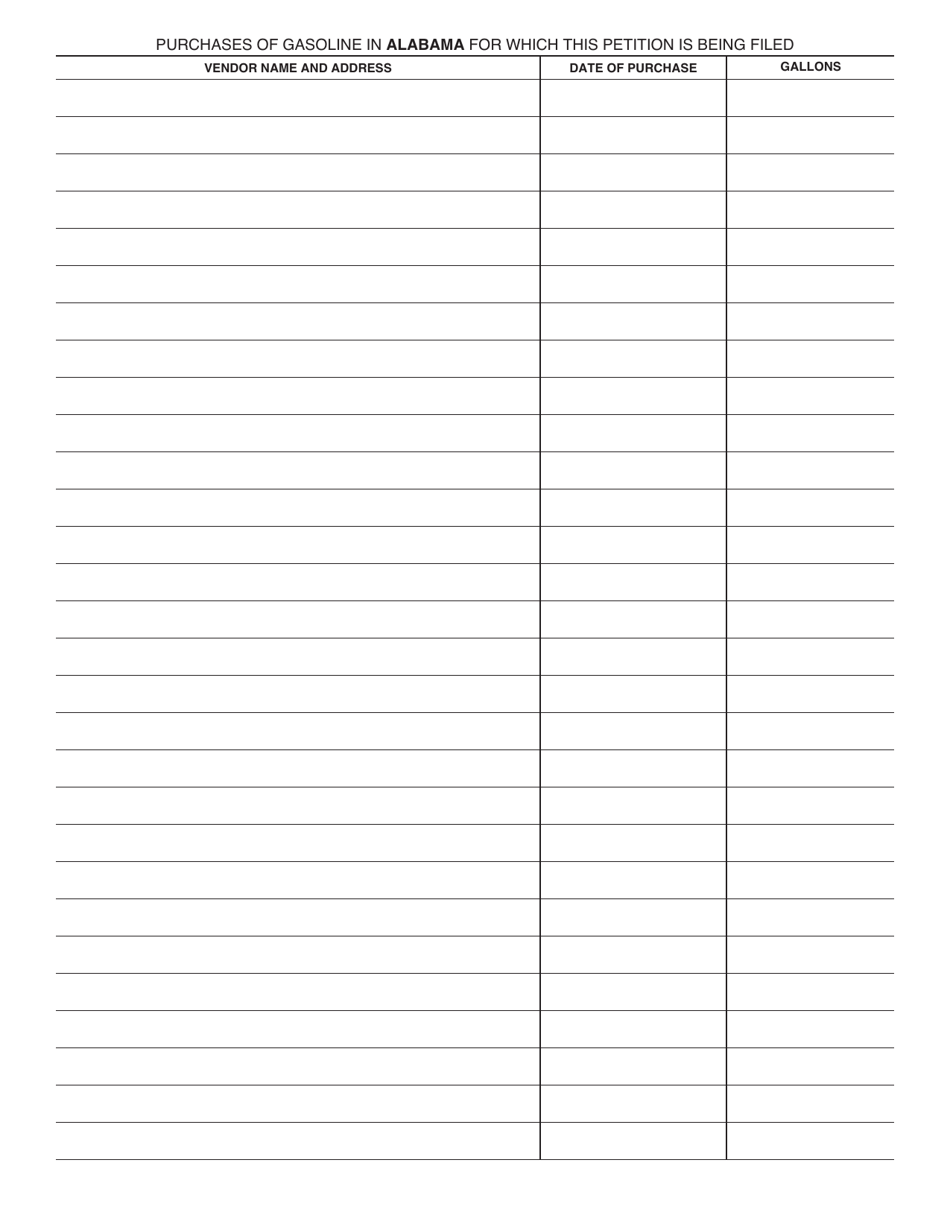

Q: What information do I need to provide on Form B&L: GR-5U?

A: You will need to provide details such as your name, address, purchase information, and the amount of gasoline tax paid.

Q: Are there any specific requirements for filing Form B&L: GR-5U?

A: Yes, you must include supporting documentation such as receipts or invoices to substantiate your gasoline tax refund claim.

Q: When should I file Form B&L: GR-5U?

A: Form B&L: GR-5U should be filed within one year from the date the gasoline tax was paid.

Q: Is there a fee to file Form B&L: GR-5U?

A: No, there is no fee to file Form B&L: GR-5U.

Q: How long does it take to process Form B&L: GR-5U?

A: Processing times may vary, but it generally takes several weeks for the Alabama Department of Revenue to review and process your gasoline tax refund request.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: GR-5U by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.