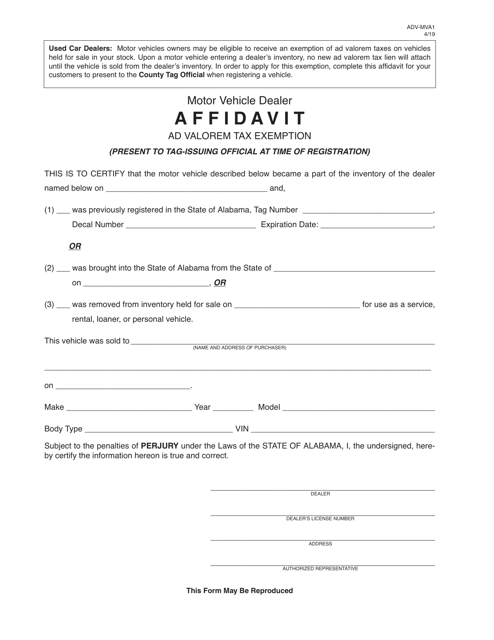

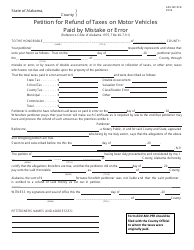

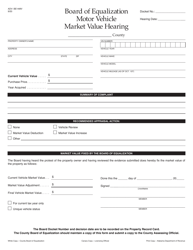

Form ADV-MVA1 Motor Vehicle Dealer Affidavit Ad Valorem Tax Exemption - Alabama

What Is Form ADV-MVA1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ADV-MVA1?

A: The Form ADV-MVA1 is a Motor Vehicle Dealer Affidavit Ad Valorem Tax Exemption form in Alabama.

Q: What is the purpose of Form ADV-MVA1?

A: The purpose of Form ADV-MVA1 is to request an ad valorem tax exemption for motor vehicles purchased by licensed motor vehicle dealers.

Q: Who can use Form ADV-MVA1?

A: Form ADV-MVA1 can be used by licensed motor vehicle dealers in Alabama.

Q: Is Form ADV-MVA1 only applicable to Alabama?

A: Yes, Form ADV-MVA1 is specifically for motor vehicle dealers in Alabama.

Q: What information is required in Form ADV-MVA1?

A: Form ADV-MVA1 requires information such as dealer information, vehicle description, and statement of retail sales tax payment.

Q: Is there a deadline for submitting Form ADV-MVA1?

A: Yes, Form ADV-MVA1 should be submitted within 20 days of taking delivery of the motor vehicle.

Q: Are there any fees associated with Form ADV-MVA1?

A: There is a $1.25 fee for each Form ADV-MVA1 submitted.

Q: Who should I contact for more information about Form ADV-MVA1?

A: For more information about Form ADV-MVA1, you can contact the Alabama Department of Revenue or the Motor Vehicle Division offices.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADV-MVA1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.