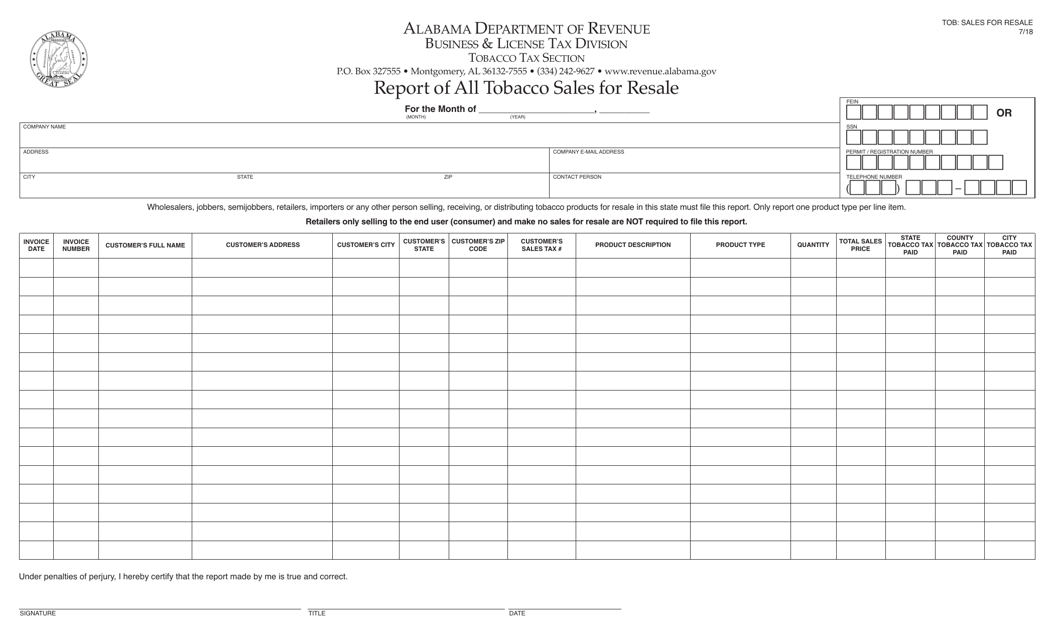

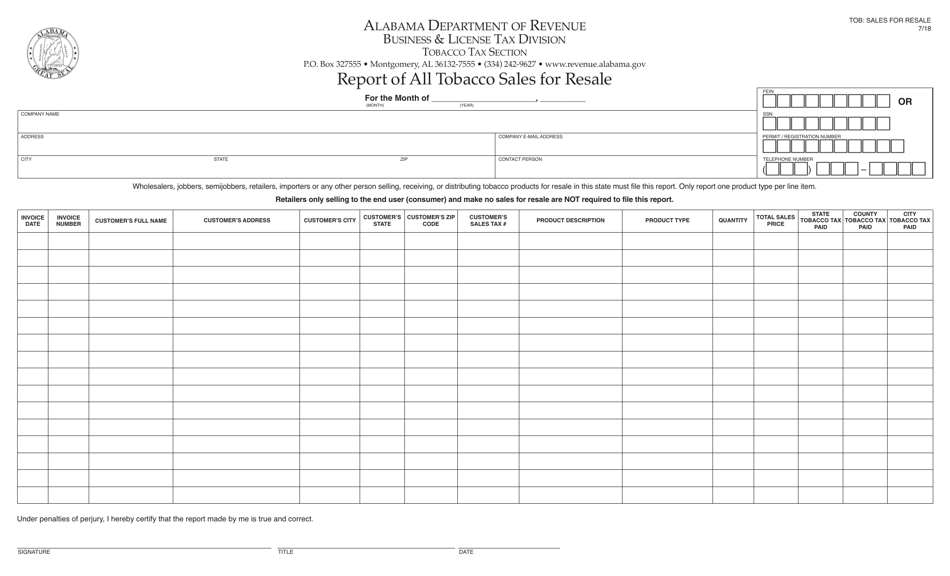

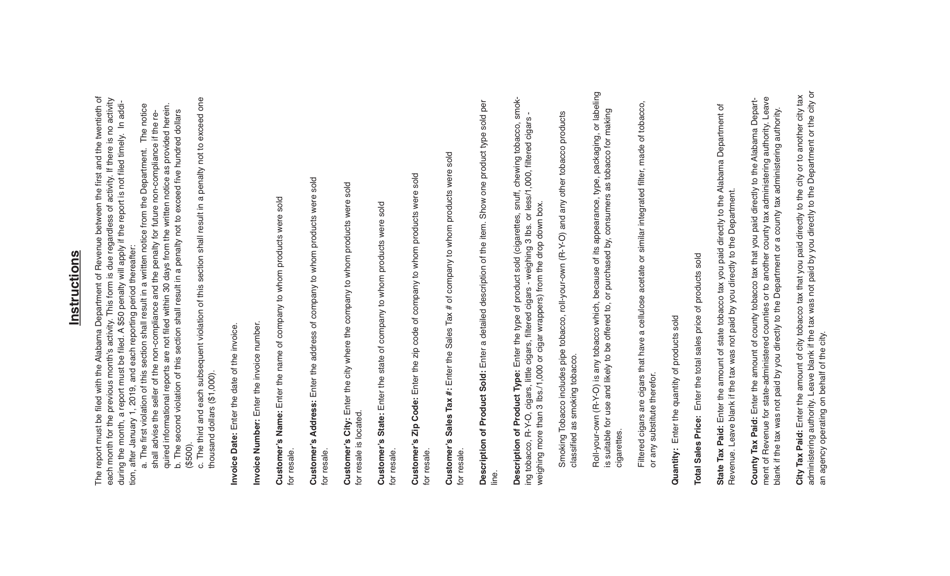

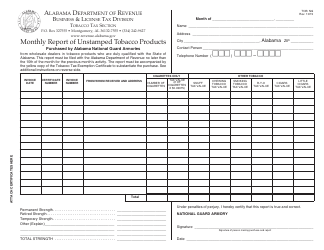

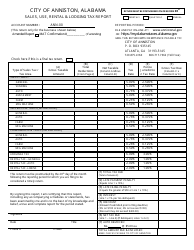

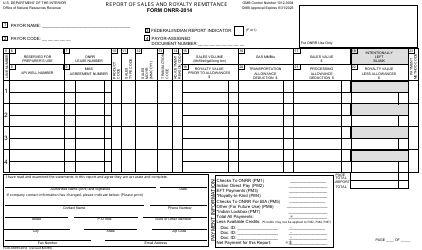

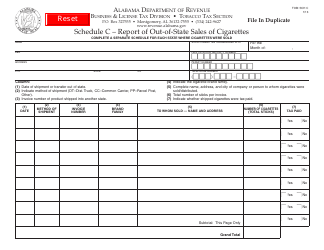

Form TOB: SALES FOR RESALE Report of All Tobacco Sales for Resale - Alabama

What Is Form TOB: SALES FOR RESALE?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TOB?

A: Form TOB is a report of all tobacco sales for resale.

Q: Who is required to file the Form TOB?

A: All tobacco retailers in Alabama are required to file the Form TOB.

Q: What information is included in the Form TOB?

A: The Form TOB includes details of all tobacco sales for resale, such as the type of tobacco products sold and the quantities.

Q: Why is the Form TOB important?

A: The Form TOB helps the Alabama authorities track and regulate tobacco sales for resale.

Q: When is the Form TOB due?

A: The Form TOB is due on a monthly basis, with the deadline usually falling on the 20th day of the following month.

Q: Are there any penalties for not filing the Form TOB?

A: Yes, failure to file the Form TOB or filing it late can result in penalties and fines.

Q: Are there any fees associated with filing the Form TOB?

A: No, there are no fees associated with filing the Form TOB.

Q: Is the information provided on the Form TOB confidential?

A: Yes, the information provided on the Form TOB is treated as confidential and is only used for tax administration purposes.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: SALES FOR RESALE by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.