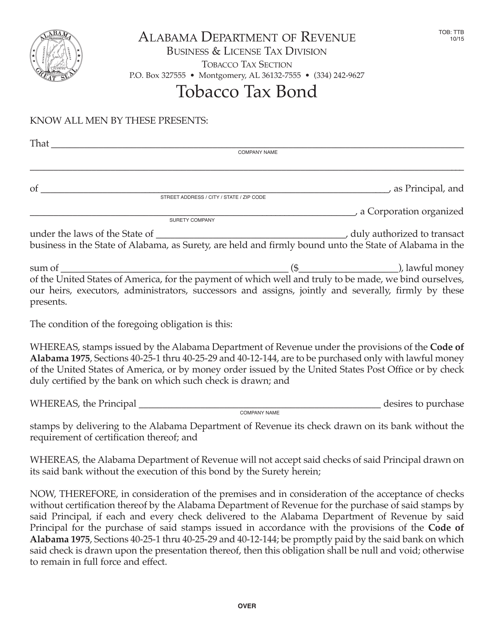

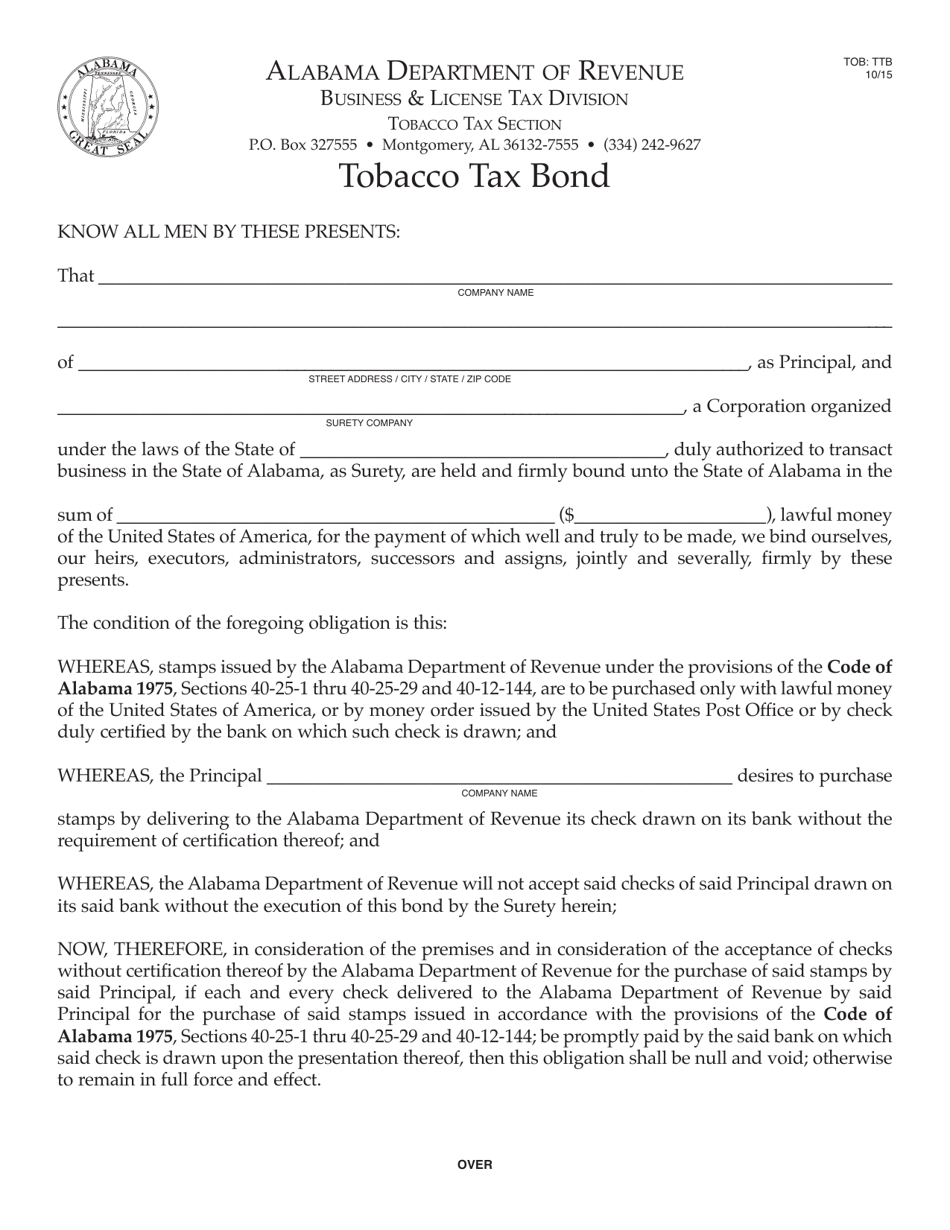

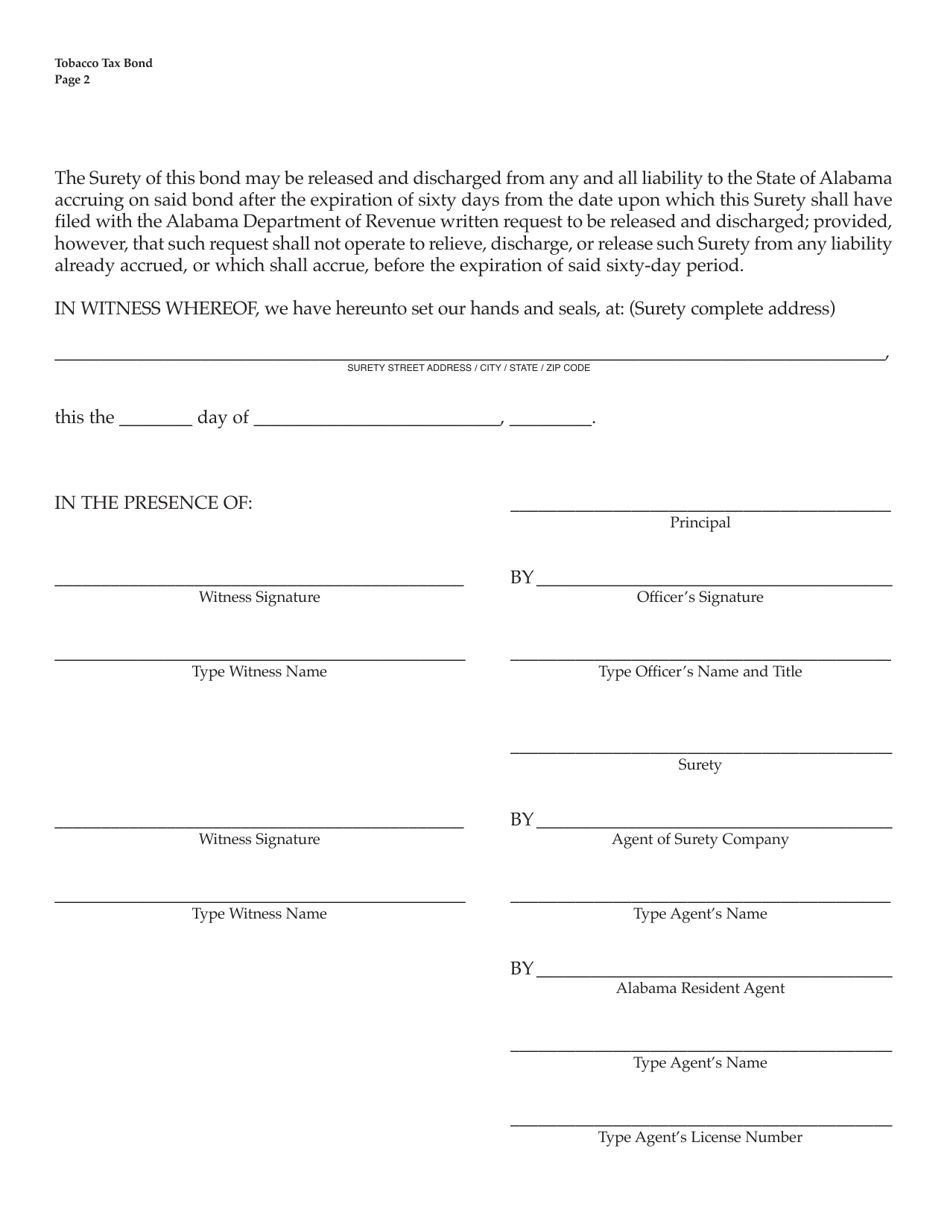

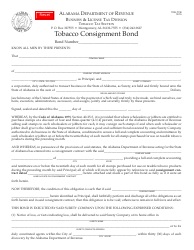

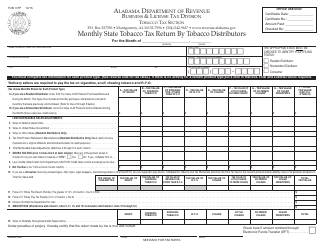

Form TOB: TTB Tobacco Tax Bond - Alabama

What Is Form TOB: TTB?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

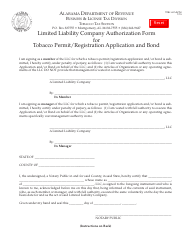

Q: What is a Form TOB?

A: Form TOB stands for TTB Tobacco Tax Bond.

Q: What is a TTB Tobacco Tax Bond?

A: A TTB Tobacco Tax Bond is a type of surety bond required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for businesses engaged in the manufacturing, distribution, or importation of tobacco products.

Q: What is the purpose of a TTB Tobacco Tax Bond?

A: The purpose of a TTB Tobacco Tax Bond is to ensure that businesses comply with federal laws and regulations regarding the payment of tobacco taxes.

Q: Who needs to obtain a TTB Tobacco Tax Bond?

A: Businesses engaged in the manufacturing, distribution, or importation of tobacco products need to obtain a TTB Tobacco Tax Bond.

Q: Is a TTB Tobacco Tax Bond required in Alabama?

A: Yes, a TTB Tobacco Tax Bond is required in Alabama.

Q: How much does a TTB Tobacco Tax Bond cost?

A: The cost of a TTB Tobacco Tax Bond varies depending on factors such as the bond amount and the applicant's creditworthiness.

Q: How long does a TTB Tobacco Tax Bond need to be maintained?

A: A TTB Tobacco Tax Bond needs to be maintained for as long as the business engages in the manufacturing, distribution, or importation of tobacco products.

Q: What happens if a business fails to comply with tobacco tax obligations?

A: If a business fails to comply with tobacco tax obligations, the TTB may make a claim against the bond, and the business may be subject to penalties or other enforcement actions.

Q: Can a business with bad credit still obtain a TTB Tobacco Tax Bond?

A: Yes, businesses with bad credit may still be able to obtain a TTB Tobacco Tax Bond, but the cost of the bond may be higher.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TOB: TTB by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.